How to Text Chase Bank for Your Balance

Chase Text Banking lets you check your balance with a simple text. Find out how to sign up for this convenient service below.

Chase makes it easy to access your account from any mobile phone that can send and receive texts. You can check your account balance, transaction history, payment date and more.

Just text 24273 (Chase) and they'll text back your account balance. Here's how to get started.

How to Set Up Chase Text Banking

Follow the instructions below to receive banking text notifications from Chase.

|

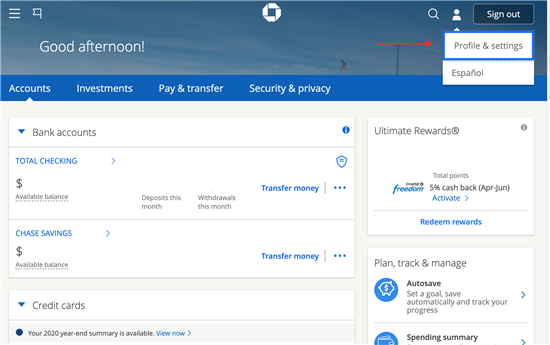

| Screenshot of Chase |

- Sign into Chase.com and go to Profile and Settings (upper right corner)

- Go to Alerts and choose Text Banking from dropdown options

- Add and confirm your mobile number

- Submit your activation code and click "Activate"

You only need to input the confirmation code one time as a security measure. This ensures that you're able to access your account via text.

It's that simple. You're now enrolled in Chase Text Banking. Next, they'll send you an email to confirm you've activated Chase Mobile and a text with a list of Chase Mobile commands.

Chase Bank Text Commands

Text 24273 with any of these commands to manage your Chase account on the go. Keep in mind that you can always opt-out of the service by texting "Stop."

- BAL=balance

- HIST=history

- COMMAND=info

- Reply HELP for Help

Check out the Chase Mobile Banking App

The Chase Mobile App offers much more features than Chase Text Banking. With the mobile app, you basically never need to visit a physical branch or ATM. Here's what you can do:

- Check your balance

- Deposit checks

- Withdraw cash

- Make transfers between accounts

- Pay bills

- Zelle® transfers between different financial accounts

- See spending summary

- Check credit score

To use the Chase Mobile App, you need a Chase checking or savings account, or credit card. If you do not already have a checking account, view the latest Chase promotions for new customers.

Bottom Line

Chase Text Banking is a helpful way to receive up-to-date information on your bank account - and you don't need a smartphone.

To perform more financial transactions, download the Chase Mobile App. You can see activity, pay bills, deposit checks and other tasks.

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 1/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

U.S. Bank Business Essentials - $400 Bonus

Promo code Q4AFL25 MUST be used when opening a U.S. Bank Business Essentials®, or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

Earn your $400 Business Checking bonus by opening a new U.S. Bank Business Essentials account between 10/01/2025 and 1/14/2026. You must make deposit(s) of at least $5,000 in new money within 30 days of account opening and thereafter maintain a daily balance of at least $5,000 until the 60th day after account opening. You must also complete 5 qualifying transactions within 60 days of account opening.

Qualifying transactions include debit card purchases, ACH credits, Wire Transfer credits and debits, Zelle credits and debits, U.S. Bank Mobile Check Deposit or Bill Pay or payment received via U.S. Bank Payment Solutions. Other transactions such as (but not limited to) other Person to Person payments, transfers to credit card or transfers between U.S. Bank accounts are not eligible.

New money is considered money that is new to U.S. Bank. Funds must come from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees (e.g., monthly maintenance, paper statement fee, etc.) could reduce the qualifying daily balance, therefore you must make deposit(s) to cover the fees to maintain the daily balance during the qualifying period to be awarded the bonus. Refer to the Business Pricing Information or Business Essentials Pricing Information Document for a list of fees.

Bonus will be deposited into your new eligible U.S. Bank Business Checking account within 30 days following the last calendar day of the month you complete all of the offer requirements, as long as the account is open and has a positive available balance.

Offer may not be combined with any other business checking account bonus offers. Existing customers (businesses) with a business checking account or customers (businesses) who had an account in the last 12 months, do not qualify.

All regular account-opening procedures apply. For a comprehensive list of checking account pricing, terms and policies, reference your Business Pricing Information or Business Essentials Pricing Information and YDAA disclosure. These documents can be obtained by contacting a U.S. Bank branch or calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice. Member FDIC

CIT Bank Platinum Savings - $300 Bonus

- Qualify for a $300 cash bonus with a minimum deposit of $50,000

- This limited time offer to qualify for a $225 cash bonus with a minimum deposit of $25,000 or a $300 bonus with a minimum deposit of $50,000 is available to New and Existing Customers who meet the Platinum Savings promotion criteria. The Promotion begins on September 23, 2025 and can end at any time without notice.

Free Business Checking - Earn $500 Bonus

To earn the $500 bonus, customers must apply for a Bluevine Business Checking account anytime between now and 01/31/2026 using the referral code CD500.

After opening your account, deposit a total of $5,000 within the first 30 days. After 30 days, maintain a minimum daily balance of $5,000 while also completing at least one of the following eligibility requirements every 30 days for 90 days:

- Deposit at least $5,000 from eligible merchant services to your Bluevine account OR

- Make at least $5,000 of outbound payroll payments from your Bluevine account using eligible payroll providers OR

- Spend at least $2,000 on eligible transactions with your Bluevine Business Debit Mastercard® and/or Bluevine Business Cashback Mastercard®

Banking services provided by Coastal Community Bank, Member FDIC

Amber Kong is a content specialist at CreditDonkey, a bank comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|

Compare: