CIT Bank Review

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

CIT Bank offers a high interest rate. But how reliable is this online bank? Read this review to find out if what you heard is true.

| |||

CIT Bank Platinum Savings - 3.75% APY | |||

Overall Score | 4.4 | ||

Savings | 5.0 | ||

Checking | 4.5 | ||

Money Market | 4.5 | ||

Mobile App | 4.0 | ||

Customer Service | 4.0 | ||

Pros and Cons

- High savings APY

- No monthly fees

- Low opening deposits

- No check writing

Bottom Line

Solid online bank with excellent rates and no monthly fees

If you're looking for high interest on your savings, CIT Bank is worth a look. CIT's savings accounts and CDs offer some of the highest interest rates on the market. And they all have no monthly fees.

As an online bank, it has fewer overhead costs. In return, it passes along the savings to customers in the form of higher APYs.

Though it's a digital bank, CIT Bank is totally safe. Your savings are protected by FDIC insurance just like traditional banks.

In this review, you'll learn how CIT Bank's Savings Accounts, CD Rates, and Money Market Accounts can help grow your savings faster.

Shortcut: Most people have a regular savings account with very low interest. That's a big mistake. You could earn more for your money with

About CIT Bank

Who is CIT Bank owned by?

CIT Bank is a division of First Citizens Bank. Headquartered in North Carolina, First Citizens has over 500 branches in 23 states. It's one of the largest family-controlled banks in the US with over $200 billion in total assets.

Though First Citizens is a brick-and-mortar bank, CIT Bank is online-only. But CIT Bank customers can now enjoy greater banking convenience from any First Citizens Bank location, through digital banking, by ATM, and by telephone. You can also access products and services offered by First Citizens.

CIT Bank is fully FDIC insured[1] up to $250,000. This is for combined deposits held between First Citizens Bank and CIT Bank.

What CIT Offers

|

CIT Bank offers a variety of accounts to cover your basic banking needs. It's popular for its high-yield savings products with better rates than many other online banks.

CIT Bank Promotions | FDIC National Average | |

|---|---|---|

Benefits and Features | ||

| Savings | Platinum Savings: 3.75% APY with a balance of $5,000 or more Savings Connect: 3.65% APY Savings Builder up to 1.00% APY with $25,000+ balance or $100 monthly deposit | |

| Checking | ||

| Money Market | ||

CIT Bank: For complete list of account details and fees, see our Personal Account disclosures. FDIC National Average: National deposit rate information as of January 20, 2026 | ||

Take a look at their account types to find the right one for you.

Platinum Savings

CIT Bank's Platinum Savings account is the newest and highest-interest savings product from CIT Bank, and there's no monthly fee.

You earn 3.75% APY with a balance of $5,000 or more. The minimum to open is only $100, but in order to receive top-tier APY, you need to maintain a $5,000 daily balance.

Platinum Savings account is best if you can keep at least $5,000 in your savings. If your daily balance is less than $5,000, your account will still earn APY, but it will drop to 0.25%.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Savings Connect

CIT Bank's Savings Connect account offers a competitive rate with fewer restrictions, and you won't have to worry about keeping a certain balance to get the highest APY.

You earn 3.65% APY on your entire balance. The minimum to open is only $100 and there's no balance requirement after that.

This is one of the highest savings interest rates currently being offered in the nation. It's a great place to park your emergency fund and increase your savings. There's no downside since there's no monthly fee or minimums.

CIT Bank Savings Connect - 3.65% APY

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Use this calculator to see how much interest you can earn with 3.65% APY.

Savings Builder

CIT Savings Builder account is meant to encourage active saving. You get rewarded with a higher APY by either actively saving or keeping a high balance.

You can earn 1.00% APY if you do one of the following:

- Keep a balance of $25,000+, OR

- Open an account with $100, and deposit at least $100 per month

If you don't meet the requirements, you'll still earn their base tier APY that month. Once you meet the requirements again, your rate will go back up to 1.00%.[2]

The Savings Builder account limits you to 6 pre-authorized or electronic withdrawals or transfers per statement cycle, though mailed withdrawal requests or check requests made by phone are not counted toward this limit.

Compare Savings Accounts

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

High-Yield Savings Premier - 3.80% APY

- No account fees

- Option to open individual or joint account

- FDIC insured up to $250,000 per depositor

- Only $500 minimum opening deposit

High Yield Savings Account - 3.86% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- FDIC insured

Money Market

The CIT Bank Money Market account offers the same interest rate for every balance. You'll earn 1.55% APY no matter how much you have in your account. You will need a minimum of $100 to open the account.

Once the account is open, there are no monthly service fees. Like the Savings Builder, you're limited to 6 withdrawals per month. If you can't commit to saving a certain amount each month, this could be a great option.

Certificates of Deposit (CDs)

CIT Bank also offers competitive rates on their term CDs. The minimum deposit for all term CDs is $1,000. And there are no account fees.

Terms are available from six months to five years. Your rate is locked in for the entire duration. Even if interest rates go down later, you'll still earn the high interest until the end of your term.

CDs auto-renew for the same term once they mature, except for 13-month and 18-month CDs. 13-month CDs renew as 1-year CDs, and 18-month CDs become 2-year CDs.

CIT Bank Term CDs - Up to 3.75% APY

- Up to 3.75% APY

- $1,000 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

| Term | CD Rates |

|---|---|

| 6 Month | 3.75% APY |

| 1 Year | 0.30% APY |

| 13 Month | 3.25% APY |

| 18 Month | 2.75% APY |

| 2 Year | 0.40% APY |

| 3 Year | 0.40% APY |

| 4 Year | 0.50% APY |

| 5 Year | 0.50% APY |

The information for CIT Bank Term CDs have been collected independently by CreditDonkey. The details on this page have not been reviewed or provided by the bank.

CDs require you to lock your savings for a set period of time. Typically, withdrawing money from a CD before maturity will incur a withdrawal penalty.

It depends on the term of your CD. Here are CIT Bank's early withdrawal penalties:

- Up to 1 year: 3 months' simple interest on the amount withdrawn

- From 1-3 years: 6 months' simple interest on the amount withdrawn

- Over 3 years: 12 months' simple interest on the amount withdrawn

Note that CDs are not available as IRA or trust accounts. However, they are available as custodial accounts.

No-Penalty CD

If you're nervous about committing your money for a period of time, CIT Bank offers a unique No-Penalty CD.

If something comes up and you suddenly need your money, you can withdraw your full balance with no penalty (starting from 7 days after account funding).

This gives you flexibility and peace of mind knowing your money is still available if you need it. At the same time, you can enjoy the higher locked-in interest rate.

This no-penalty CD product has one fixed term of 11 months. The minimum deposit is also only $1,000.

CIT Bank No Penalty CD - 3.75% APY

- Option to withdraw full balance and interest after 7 days of CD funding date

- $1,000 minimum to open an account

- 11 months

- No monthly maintenance fee

- Member FDIC

Compare CD Rates

High-Yield CD Rates - Up to 4.00% APY

- No fees

- $1 minimum deposit

- FDIC insured

| Term | CD Rates |

|---|---|

| 3 Month | 4.00% APY |

| 4 Month | 3.50% APY |

| 5 Month | 3.40% APY |

| 6 Month | 3.50% APY |

| 9 Month | 3.40% APY |

| 12 Month | 3.30% APY |

CD Rates - Up to 3.75% APY

- $500 minimum opening deposit

- FDIC insured

| Term | CD Rates |

|---|---|

| 6 Month | 3.75% APY |

| 12 Month | 3.00% APY |

| 24 Month | 3.35% APY |

| 36 Month | 3.25% APY |

| 60 Month | 3.00% APY |

High-Yield CD - Up to $1,500 Bonus

- Select a savings offer and sign up: Choose and fund at least one high-yield savings account or CD on the Raisin platform to get started. Be sure to enter bonus code HEADSTART during sign-up to be eligible for a cash bonus.

- Deposit funds: The more you save, the more you can earn. Make a qualifying deposit(s) within 14 days of opening your account to set your bonus tier.

- Maintain your deposit(s): Maintain your deposit(s) for 90 days from your first deposit date to earn your bonus.

| Deposit | Cash Bonus |

|---|---|

| $10,000 - $24,999 | $70 |

| $25,000 - $49,999 | $175 |

| $50,000 - $99,999 | $350 |

| $100,000 - $199,999 | $750 |

| $200,000 or more | $1,500 |

Home Loans

CIT offers mortgage and refinance options with both fixed and adjustable rates, giving borrowers flexibility to find a loan that fits their needs. Their programs include a variety of terms designed to accommodate different financial situations.

Because rates and offerings can vary, it's best to contact the bank directly to see what's currently available and determine which option is the best fit for you.

Pros & Cons of CIT

|

Pros:

- Higher interest rates than traditional banks

- No monthly maintenance fees on standard accounts

- Low opening deposits ($100 for checking & savings accounts and $1,000 for CDs)

- Minimal one-time fees

- Up to $30 monthly in ATM fee reimbursements

- Remote check deposits

- 24/7 mobile banking on iOS and Android

| For | Account |

|---|---|

| Saving money for emergencies & short term goals | Savings Connect |

| Growing money you might need in the future | Other CDs |

| Earning high interest and can maintain $5k | Platinum Savings |

Cons:

- No check writing from the checking account

- May experience long wait times on phone calls

- Can't build credit since no credit cards are offered

If you need access to lots of physical locations, we recommend a Chase checking account. Chase has more than 5,000 branches and more than 15,000 ATMs nationwide.

Fees and Charges

There are no monthly fees with a CIT savings account. CIT waives many common banking fees you might run into at a traditional bank. All deposit accounts have no:

- Fee to open account

- Maintenance fees

- Account closing fee

- Fees for incoming wire transfer

- Mailed check fees

- No online transfer fees

That said, it's not entirely fee-free. Here are some fees you might encounter:[4]

- $10 outgoing wire transfer fee for domestic only - minimum $1,000 ($0 for accounts $25,000+)

- $30 Bill Pay stop payment

- $10 debit card replacement (1 free card per year)

- 1% of transaction amount for international ATM withdrawals

Is CIT Bank trustworthy?

|

Yes, CIT Bank is a legitimate bank with the same rules and regulations as traditional banks. CIT is owned by First Citizens Bank, which has over 120 years of history. Your funds are FDIC insured (FDIC# 11063) up to $250,000 per depositor, per ownership category in the event that CIT Bank fails.

CIT also uses layers of security to make sure your personal information is safe. It has anti-virus protection, firewalls, 128-bit Secure Socket Layer encryption, and more.

Is Online Banking Right for You?

Do you already do everything online? Or do you prefer to deal with your money in person? If you're part of the first group, online banking has some great perks:

- Higher interest rates than traditional banks

- No or low monthly fees and balance requirements

- Convenient 24/7 online account management

- Easy to open an account online

However, you have to be comfortable with doing everything purely online. Some downsides include:

- No physical branches

- No personal relationships with your banker

- Limited services available

- More hassle to transfer funds

- More limited withdrawals (for example, you can't withdraw crisp $100 notes)

CIT Bank Common Complaints

You can't please everyone, especially if you're a bank. Here are some common complaints from CIT Bank customers.

Customer Service

You can only reach customer support by phone call or email. Customers report long wait times when they phone in with issues.

Hold Times on Incoming Funds

An ACH transfer may be held for up to 5 business days. Checks deposited to your account may be held for 7 business days.

Electronic Transfers May Take a Few Days

If you need to transfer funds to an external account, it won't be available immediately. Make sure you give yourself plenty of time to initiate the transfer.

Mon - Fri: 9 am - 9 pm ET

Sat: 10 am - 6 pm ET

Sunday: Closed

Home Loans Division (800-217-6629): Monday-Friday, 9 am - 8 pm (PT)

Or, you can access your account online and by Automated Telephone Banking 24/7.

How to Open a CIT Bank Account

|

All CIT accounts must be opened online. Here's how to use its online system.

- Start here to open a new account. You must be a U.S. citizen or a permanent resident and provide the following info:

- Social Security number

- Driver's license or other valid state ID

- Primary home address

- Valid email address

- Valid phone number

- Social Security number

- Fund your new account with one of these methods:

- Transfer funds electronically from an external checking or savings account. CIT's Routing/Transit number is 124084834.

- Mail a check to CIT Bank, N.A. Attn: Deposit Services, P.O. Box 7056, Pasadena, CA 91109-9699

- Wire funds to your new account

- Verify your micro-deposits. CIT will make two "test" micro-deposits to your funding account. Within 3 business days, you'll get an email asking you to verify the amounts. As soon as you have verified, your transaction will be processed.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

CIT Bank Savings Connect - 3.65% APY

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

CIT Savings Builder - 1.00% APY

Earn up to 1.00% APY. Here's how it works: Maintain a minimum balance of $25k OR make at least a $100 minimum deposit every month. Member FDIC

The information for Savings Builder has been collected independently by CreditDonkey. The details on this page have not been reviewed or provided by the bank.

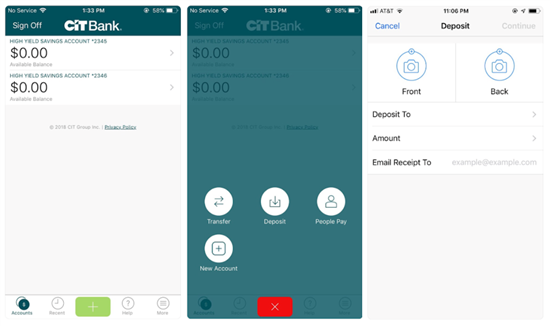

CIT Bank Mobile App

|

CIT offers a mobile app for both iOS and Android, so you can bank on the go from anywhere.

On the mobile app, you can:

- Log in via fingerprint or password

- Transfer funds between CIT accounts and other banks

- Deposit checks by taking a photo

- Set up one-time or recurring bill payments

- Check balances and transaction history

- Send and receive money through Zelle®

- Make secure payments with Apple Pay and Samsung Pay

- Manage debit card preferences

In addition to the mobile app, you can also enroll in text banking. This allows you to check your account balance and recent transactions by texting a simple command.

How CIT Bank Compares

|

Which is better Ally or CIT Bank?

Ally Bank is an online-only, full-service financial institution with checking, savings, IRAs, and investment services. It uses the Allpoint ATM network across the country. Ally is well known for the excellent 24/7 personal support with real human reps and competitive rates.

Ally Bank charges no account fees for any of its accounts.

CIT Bank | Ally Bank | |

|---|---|---|

| Savings | Platinum Savings: 3.75% APY with a balance of $5,000 or more Savings Connect: 3.65% APY Savings Builder up to 1.00% APY with $25,000+ balance or $100 monthly deposit | |

| CD | Term CDs up to 3.75% APY. $1,000 minimum opening deposit. | 3.00% to 3.75% APY. Terms of 3 months to 5 years. 12-month CD APY of 3.75% |

| Checking | 0.10% APY for daily balances less than $15,000. 0.25% APY for daily balances over $15,000 | |

| Money Market | ||

| Mobile App | ||

| Customer Service | Mon - Fri: 9 am - 9 pm ET Sat: 10 am - 6 pm ET Sunday: Closed | |

| Locations | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. CIT Bank: For complete list of account details and fees, see our Personal Account disclosures. Ally Bank: Pricing information from published website as of 01/17/2026. | ||

What is the difference between CIT Bank and Citibank?

Though their names are similar, CIT Bank and Citibank are two different financial institutions.

Citibank is one of the largest banks in the world. It has over 600 locations in the US (mostly in California and New York) and 1,800 branches overseas. You may consider it if you travel abroad often and still want access to branches and ATMs.

Citibank offers checking and savings packages. Like most traditional banks, the accounts have a monthly service fee that can be waived with certain direct deposit or balance requirements.

In comparison, CIT Bank is online only, but because of CIT's merger with First Citizens Bank, you can now also bank at any First Citizens Bank location. All of CIT's deposit accounts are free with no monthly fees. It's a good choice if you want higher savings rates and hate banking fees.

CIT Bank Promotions | Citibank Promotions | |

|---|---|---|

| Savings | Platinum Savings: 3.75% APY with a balance of $5,000 or more Savings Connect: 3.65% APY Savings Builder up to 1.00% APY with $25,000+ balance or $100 monthly deposit |

|

| CD | Term CDs up to 3.75% APY. $1,000 minimum opening deposit. |

|

| Checking | ||

| Money Market | ||

| Customer Service | Mon - Fri: 9 am - 9 pm ET Sat: 10 am - 6 pm ET Sunday: Closed | 24/7 Live Customer Service (Telephone) |

| Locations | 645 retail bank branches concentrated in the six key metropolitan areas of New York, Chicago, Los Angeles, San Francisco, Miami, and Washington, D.C. | |

CIT Bank: For complete list of account details and fees, see our Personal Account disclosures. Citibank: Pricing information from published website as of 02/05/2026. This content is not provided by Citi. Any opinions expressed are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by Citi. | ||

CIT vs Synchrony

CIT Bank Promotions | Synchrony Bank Promotions | |

|---|---|---|

Benefits and Features | ||

| Savings | Platinum Savings: 3.75% APY with a balance of $5,000 or more Savings Connect: 3.65% APY Savings Builder up to 1.00% APY with $25,000+ balance or $100 monthly deposit | 3.65% APY. No monthly service fee and no minimum deposit. An ATM card is provided for easy withdrawal. Synchrony will refund ATM fees for other banks up to $5 per statement cycle |

| CD | Term CDs up to 3.75% APY. $1,000 minimum opening deposit. | 0.25% to 4.00% APY. Terms of 3 months to 5 years. No minimum deposit to open. |

| Money Market | 2.00% APY. No monthly service fee and no minimum deposit. | |

| Customer Service | Mon - Fri: 9 am - 9 pm ET Sat: 10 am - 6 pm ET Sunday: Closed | Mon-Fri 8:00 am - 10:00 pm (ET); Sat-Sun 8:00 am - 5:00 pm (ET) |

CIT Bank: For complete list of account details and fees, see our Personal Account disclosures. Synchrony Bank: Pricing information from published website as of 01/18/2026. | ||

CIT vs Capital One 360

CIT Bank Promotions | Capital One 360 Promo Code | |

|---|---|---|

Benefits and Features | ||

| Savings | Platinum Savings: 3.75% APY with a balance of $5,000 or more Savings Connect: 3.65% APY Savings Builder up to 1.00% APY with $25,000+ balance or $100 monthly deposit | |

| CD | Term CDs up to 3.75% APY. $1,000 minimum opening deposit. | 3.60% to 3.90% APY. Terms of 6 months to 5 years. 12-month CD APY of 3.90% |

| Checking | ||

| Money Market | ||

| Customer Service | Mon - Fri: 9 am - 9 pm ET Sat: 10 am - 6 pm ET Sunday: Closed | Phone: 800-655-2265 Monday - Sunday: 8AM - 11PM (ET) |

| Locations | ||

CIT Bank: For complete list of account details and fees, see our Personal Account disclosures. Capital One: Pricing information from published website as of 01/25/2026. | ||

What the Experts Say

It's not easy to find the right bank. As part of our series on banking and saving, CreditDonkey asked a panel of industry experts to answer some of our readers' most pressing questions:

Bottom Line: Is CIT Good?

CIT is a safe online bank offering competitive deposit products. Its interest rates are often higher than many online banks and credit unions.

Savings Connect is a premier high-yield savings account with relatively low deposit requirements.

Platinum Savings can help grow your money faster if you maintain a balance of $5,000 or more.

Even if you only have $100, you can still earn competitive interest in their

Or if you have at least $1,000 set aside and aren't concerned about liquidity, you can take advantage of higher yields with an 18-month

Overall, CIT is a solid option for savers looking to maximize interest through an online platform.

References

- ^ FDIC. First-Citizens Bank & Trust Company, Retrieved 11/10/2025

- ^ CIT Bank. CIT Bank Savings Builder, Retrieved 11/10/2025

- ^ CIT Bank. FAQs: What are the penalties for Term, Jumbo, Ramp-Up and Ramp-Up Plus CDs?, Retrieved 11/10/2025

- ^ CIT Bank. CIT Bank Schedule of Fees, Retrieved 11/10/2025

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Personal Savings - Earn 3.80% APY

- Earn 3.80% APY

- No minimum balance requirement

- No monthly service fee

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Donna Tang is a content associate at CreditDonkey, a bank comparison and reviews website. Write to Donna Tang at donna.tang@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: