What is Chase Overdraft Protection?

Chase charges a hefty $34 insufficient funds policy. Find out how to avoid fees with their overdraft protection services.

The easiest way to avoid overdraft fees is to sign up for Chase overdraft protection. Once you're enrolled, Chase will transfer money from your savings to cover an overdraft in your checking balance. The process is actually pretty simple.

Take a look at how to get rid of overdraft fees once and for all.

What is an overdraft?

An overdraft is when you don't have enough money in your account to cover a purchase, check or payment. And your bank or credit union pays the transaction for you.

Many banks and credit unions will charge you a fee for covering the transaction. In addition, you're required to repay the overdraft amount.

For example, you can overdraw in ATM transactions, automatic bill payments, and electronic or in-person withdrawals.

Banks and credit unions have different fees for overdraft protection. You should research a bank's overdraft policy before signing up for a checking account. Overdraft fees are one of the biggest and most frustrating charges for banking customers.

Overdraft Services

To help out checking account holders, Chase offers two main overdraft services: overdraft protection and debit card coverage.

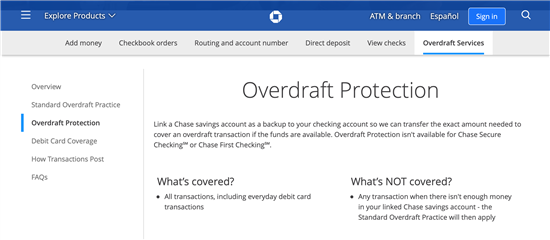

1. Overdraft Protection

Chase's overdraft protection feature lets you link your Chase savings account to your checking account. If your checking account doesn't have enough funds to cover the purchase but your savings account does, you can transfer that amount into your checking account.

|

| Screenshot of Chase |

This service covers all transactions, including everyday debit card transactions. However, when there isn't enough money in your linked Chase savings account then you'll be charged an overdraft fee.

How to set up Chase overdraft protection on Chase Mobile ® App:

- Sign in to your Chase Mobile ® App

- Select the checking account you want to have Overdraft Protection

- Swipe up to view the rest of the page

- Select Overdraft protection

- Select Choose account

- Choose the savings account as the Overdraft Protection backup account for your checking account

- Select Done

- Review the Overdraft Protection Service Terms & Conditions and select your agreement

- Select Update protection

2. Debit Card Coverage

Chase offers Debit Card Coverage for everyday debit card transactions. If you're purchasing an item and you don't have enough funds in your account, you can choose "Yes" or "No."

- Select "No" - the purchase will be declined and you won't be charged a fee

- Select "Yes" - Chase may cover this transaction and charge a fee. This fee will vary based on your account history, deposits you make and transaction amount.

This service covers everyday debit card transactions only (such as groceries, gasoline or dining out).

How to set up debit card coverage on Chase Mobile ® App:

- Sign in to your Chase Mobile ® App

- Select the checking account you want to have Debit Card Coverage

- Swipe up to view the rest of the page

- Select Debit card coverage

- Review the Chase debit card coverage Terms & Conditions and select your agreement

- Choose Coverage selection

- Select Update coverage

Overall, Chase's overdraft protection is simpler than their debit card coverage service.

Overdraft Fees

If you incur an overdraft, these are the checking account fees:

- $34 Insufficient Funds Fee per item

- $34 Returned Item Fee per check automatic payment

- If a merchant submits the same check or automatic payment multiple times, it may result in both a Returned Item Fee and Insufficient Funds Fee. If Chase returns one of these items, they'll charge you one Returned Item Fee for that item within a 30-day period.

- Maximum of three fees per day (total of $102)

If you overdraw your account, you can avoid the overdraft fee. Just deposit or transfer funds into your account to cover the payment before the business day ends. Here are the cutoff times:

- At a branch, before it closes

- At an ATM, before 11PM ET / 8PM PT

- On Chase.com or the Chase Mobile ® app or use Chase QuickPay®, before 11PM ET / 8PM PT

You can try to negotiate overdraft fee refunds via the Secure Message Center on the Chase website or by calling customer service (1-800-935-9935). If it's your first time, they will likely give you a free pass.

There's no fee to enroll in Overdraft Protection or Debit Card Coverage. But Overdraft Protection has fewer potential fees. To make your finances simpler, enroll in Chase Overdraft Protection.

Bottom Line

After opening a Chase bank account, signing up for overdraft protection should be one of the first things you do. You'll avoid headaches and unnecessary fees. And if you don't have a checking account with Chase yet, check out the current Chase coupon promotions.

Chase Total Checking® - $400 Bonus

- New Chase checking customers can receive $400 when you open a Chase Total Checking® account and make direct deposits totaling $1,000 or more within 90 days of coupon enrollment.

- Unlock more offers with Chase. Get up to $500 per calendar year by referring friends and family. Plus, get cash back from top brands with Chase Offers when you use your debit card.

- Chase Total Checking® has a $15 monthly service fee, you can easily avoid the fee with direct deposits totaling $500 or more, or a minimum average daily balance each statement period.

- Chase Overdraft Assist℠ – no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*

- Chase Mobile® app makes banking simple. Manage accounts, pay bills, send money to friends with Zelle® and deposit checks on the go with Chase Quick Deposit℠.

- Chase has the largest branch network in the U.S. with thousands of ATMs and branches. Use the Chase locator tool to find a branch or ATM near you.

- Chase helps keep your money protected with features like Zero Liability Protection, fraud monitoring and card lock.

- Chase Total Checking includes FDIC insurance up to the maximum amount allowed by law.

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

U.S. Bank Business Essentials - $400 Bonus

Promo code Q1AFL26 MUST be used when opening a U.S. Bank Business Essentials® or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

To earn a business checking bonus, open a qualifying U.S. Bank business checking account between 1/15/2026 and 3/31/2026. Make the required deposit(s) in new money within 30 days of account opening, maintain the same required daily balance through the 60th day, and complete 6 qualifying transactions based on posted date within 60 days of account opening.

Business Essentials: $400 bonus with $5,000 new money deposits, daily balance, and 6 qualifying transactions.

Qualifying transactions include debit card purchases, ACH and wire credits or debits, Zelle credits or debits, U.S. Bank Mobile Check Deposit, electronic or paper checks, Bill Pay (excluding payments made by credit card), and payment received via U.S. Bank Payment Solutions. Other transactions, such as person-to-person payments, credit card transfers, or transfers between U.S. Bank accounts, are not eligible.

New money is defined as funds from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees may reduce the required daily balance during the qualifying period.

Bonus will be deposited into your new eligible U.S. Bank business checking account within 30 days after the month-end in which all offer requirements are met, provided the account remains open with a positive available balance.

Offer may not be combined with other business checking bonus offers. Existing businesses with a business checking account or had one closed within the past 12 months, do not qualify.

All regular account-opening procedures apply. For full checking account pricing, terms and policies, refer to your Business Pricing Information, Business Essentials Pricing Information, and YDAA disclosure. These documents are available at any U.S. Bank branch or by calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice.

Member FDIC

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Amber Kong is a content specialist at CreditDonkey, a bank comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|

Compare: