How to Use Chase QuickDeposit

Chase QuickDeposit℠ makes depositing checks quick and easy. Here's how to get started.

|

| Screenshot of Chase |

Chase mobile deposit is a huge time-saver. Instead of visiting your local Chase branch or ATM, you can deposit checks anytime and anywhere you want. Start cashing your paper checks on-the-go with this guide.

The Chase Mobile App

The Chase Mobile® App lets you scan checks and deposit them into your checking account.

With the app, you basically never need to visit a branch or ATM ever again. Here are some of the features:

- deposit checks

- withdraw cash

- make transfers between accounts

- pay bills

- check your balance

- Zelle® transfers between different financial accounts

- see spending summary

- check credit score

To use the Chase Mobile® App, you need a Chase checking/savings account with online banking or Chase Liquid® Card. If you don't have a Chase checking account yet, check out their current promotions and coupon codes.

Download the Chase Mobile® App to start using convenient features like Chase QuickDepositSM. There's no fee for using Chase QuickDeposit.

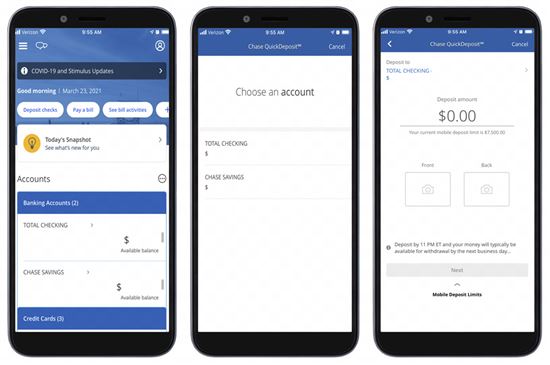

How to Use Chase QuickDeposit

Follow these steps to start depositing checks from your mobile phone.

|

| Screenshot of Chase |

- Log into the Chase Mobile® App

- Select "Deposit Checks" on the top right of screen

- Choose the account where you want the deposit to go

- Enter the deposit amount

- Select "Front" to take a photo of the front of the check

- Endorse your check, then Select "Next"

- Take a photo of the back of the check

- Choose "Deposit" and then "Yes" to confirm the details

Afterwards, you should receive two emails from Chase after submitting the deposit. The first will confirm receipt of the deposit. The second updates you on when the deposit has been accepted. If there's any issue or delay with your deposit, you will receive a separate email that explains the problem.

How Long does Chase's Mobile Deposit Take?

If you submit your deposit before 11PM ET on a business day, your funds will be available by the next business day.

If you submit your deposit after 11PM ET or during the weekend, your funds will be processed the next business day.

Chase may delay availability if they need to review the deposit. You will receive updates about delayed availability in the Secure Messages Center of your online account.

Be sure to keep the paper check until you see the available funds in your account. Once you see the funds, shred the check before throwing it in the trash.

Bottom Line

The process is super easy, fast and secure. You will need internet access and smartphone or tablet with at least a 4-megapixel rear-facing camera to make a mobile deposit.

Even if you don't want to perform mobile deposits, the Chase Mobile® App lets you do other financial tasks. You pay bills, view your balance, transfer money and more.

You need a Chase checking account to do QuickDepositSM. If you don't have a Chase checking account yet, check out the current Chase promotions and coupon codes.

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 1/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

U.S. Bank Business Essentials - $400 Bonus

Promo code Q4AFL25 MUST be used when opening a U.S. Bank Business Essentials®, or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

Earn your $400 Business Checking bonus by opening a new U.S. Bank Business Essentials account between 10/01/2025 and 1/14/2026. You must make deposit(s) of at least $5,000 in new money within 30 days of account opening and thereafter maintain a daily balance of at least $5,000 until the 60th day after account opening. You must also complete 5 qualifying transactions within 60 days of account opening.

Qualifying transactions include debit card purchases, ACH credits, Wire Transfer credits and debits, Zelle credits and debits, U.S. Bank Mobile Check Deposit or Bill Pay or payment received via U.S. Bank Payment Solutions. Other transactions such as (but not limited to) other Person to Person payments, transfers to credit card or transfers between U.S. Bank accounts are not eligible.

New money is considered money that is new to U.S. Bank. Funds must come from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees (e.g., monthly maintenance, paper statement fee, etc.) could reduce the qualifying daily balance, therefore you must make deposit(s) to cover the fees to maintain the daily balance during the qualifying period to be awarded the bonus. Refer to the Business Pricing Information or Business Essentials Pricing Information Document for a list of fees.

Bonus will be deposited into your new eligible U.S. Bank Business Checking account within 30 days following the last calendar day of the month you complete all of the offer requirements, as long as the account is open and has a positive available balance.

Offer may not be combined with any other business checking account bonus offers. Existing customers (businesses) with a business checking account or customers (businesses) who had an account in the last 12 months, do not qualify.

All regular account-opening procedures apply. For a comprehensive list of checking account pricing, terms and policies, reference your Business Pricing Information or Business Essentials Pricing Information and YDAA disclosure. These documents can be obtained by contacting a U.S. Bank branch or calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice. Member FDIC

CIT Bank Platinum Savings - $300 Bonus

- Qualify for a $300 cash bonus with a minimum deposit of $50,000

- This limited time offer to qualify for a $225 cash bonus with a minimum deposit of $25,000 or a $300 bonus with a minimum deposit of $50,000 is available to New and Existing Customers who meet the Platinum Savings promotion criteria. The Promotion begins on September 23, 2025 and can end at any time without notice.

Free Business Checking - Earn $500 Bonus

To earn the $500 bonus, customers must apply for a Bluevine Business Checking account anytime between now and 01/31/2026 using the referral code CD500.

After opening your account, deposit a total of $5,000 within the first 30 days. After 30 days, maintain a minimum daily balance of $5,000 while also completing at least one of the following eligibility requirements every 30 days for 90 days:

- Deposit at least $5,000 from eligible merchant services to your Bluevine account OR

- Make at least $5,000 of outbound payroll payments from your Bluevine account using eligible payroll providers OR

- Spend at least $2,000 on eligible transactions with your Bluevine Business Debit Mastercard® and/or Bluevine Business Cashback Mastercard®

Banking services provided by Coastal Community Bank, Member FDIC

Amber Kong is a content specialist at CreditDonkey, a bank comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: