Find Your Routing Number on a Check

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Your routing number is the 9 digit code on the bottom of your check. Don't use the wrong number. Find the correct routing number for your bank.

|

| © CreditDonkey |

What Is a Routing Number?

A routing number is a 9-digit "electronic address" for transactions between financial institutions in the U.S. Your routing number, along with your bank account number, ensures the money you send or receive through a bank ends up in the right place.

Banks with branches in more than one state often use multiple routing numbers. Why? Routing numbers are usually linked to the location of the bank where you opened your account. (This won't be the case with online banks, of course.)

You'll also use different routing numbers for different types of transactions. We cover that below.

What Is the Difference Between Routing and Account Numbers?

Every bank account has a routing and account number, but they both serve different functions.

- Routing numbers are associated with your specific bank. Each financial institution has its own routing number—and some have several.

- Account numbers are associated with your specific account.

If you opened several accounts at the same bank location, they will likely have the same routing number. However, each will always have its own account number.

Here's another important difference: Routing numbers are public information while account numbers are private. You should take great care never to share your account numbers.

Where Can I Find My Routing Number?

Depending on the type of account, here are several ways to identify your routing number. It's important to remember, however, that the routing number you need depends on the type of transaction.

Bank Website

Log in to your account through the bank portal or mobile app and search for the term "routing number." Many financial institutions also list them on their general website.

Checks

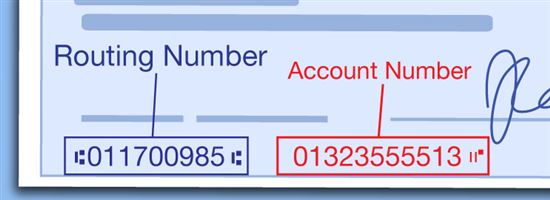

For checking accounts, the routing number is the series of digits on the bottom left of every personal check. Be sure not to confuse this with your account number, which is located on the bottom right of the check.

|

| © CreditDonkey |

For savings accounts at traditional banks, look for your routing number on the deposit slips you received when opening your account.

Monthly Statement

Your routing and account number should be printed on your checking and savings account statements. These are mailed to your address monthly. If you opt for paperless statements, you can access them online through the bank website or mobile app.

ABA website

The American Bankers Association provides ABA routing information. Search by your bank's name, city, state, and zip code.

Web search

If all else fails, enter the name of your bank and "routing number" into any online search engine. Remember, routing numbers are public information.

When Do I Need a Routing Number?

You'll need your routing number to send or receive money directly from your bank account. Here are some common examples:

- Direct deposit from an employer

- Online banking transactions like scheduling one-time or automatic bill pay

- Sending money to family members or friends

- Depositing money from a third-party payment app (like Venmo or PayPal)

- Transferring money between accounts at different banks or between a bank and a retirement or investment account

- Domestic wire transfers

The first four digits are connected to the Federal Reserve. The next four are unique to your bank. Consider those the bank's address for the Federal Reserve. The final digit is a mathematical calculation of the first eight digits—it's used to prevent check fraud.

Types of Routing Numbers

Just as banks may have different routing numbers based on location, the type of transaction also matters. Some banks have different routing numbers for Automated Clearing House (ACH), domestic wire, or international wire transfers. Read on to learn more.

Automated Clearing House

ACH transfers are made between financial institutions through third-party clearinghouses. They are the most common types of money transfers. You use them when you:

- Move between accounts at different banks

- Pay a bill online from your account

- Send or receive funds from a third-party payment apps like Venmo, Square, and PayPal

ACH transfers are typically free, but they take several business days to complete. And any transfers started after business hours won't be processed until the next business day.

Domestic Wire Transfers

Domestic wires are direct bank-to-bank transfers that require no third-party clearinghouse. They are great for time-sensitive transactions, since unlike ACH transfers, they are processed in real-time. However, they typically cost between $0—30.

Some banks use different routing numbers for domestic wire transfers. For example, PNC bank uses a routing number for incoming wire transfers that differs from the one displayed on your account. Always check with your bank for the correct routing number before sending/receiving a wire.

International Wire Transfers

These types of transfers use a different type of routing number entirely. SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes have eight to eleven digits with letters and numbers, unlike the 9-digit routing number.

If you work overseas and want to send money from your international account to a U.S. account, you'll need a SWIFT code. Call your bank or visit its website to find the SWIFT code for an international wire transfer.

International wire rates vary depending on the bank and whether you're receiving or sending money. In general, you can expect to pay anywhere from $0—$65.

Always check with your bank for specific rules and restrictions. Some smaller banks don't allow for international wire transfers while others may allow customers to receive but not send them.

The Bottom Line

Routing numbers are 9-digit codes that enable banks to identify the location of your bank account and make sure your money doesn't get lost.

ACH transfers and domestic wire transfers use routing numbers. If you plan to send money internationally, you'll need a SWIFT code, which is how banks locate each other internationally.

You can find your routing number on a check, on your online account portal, or at your bank's website.

Write to Andrea Sielicki at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|