Bank of America Routing Number

Find your Bank of America routing number and learn about money transfers in our guide.

PRO TIP: Are you trying to send money internationally? The quickest and cheapest way to send money internationally is to use a money transfer service, such as Wise, Remitly or Xe.

Routing numbers are 9-digit numbers that banks use to identify themselves. Think of them as addresses that let other banks know where to find or send your money.

You need your routing number for many tasks, including:

- ACH payments

- Setting up direct deposit

- Receiving benefits from the government, including tax refunds

- Transferring money between accounts at different banks or investment firms

- Automatic bill payment

- Wire transfers

Bank of America has branches throughout the United States and uses different routing numbers for different states and regions.

Bank of America Routing Numbers by State

Your Bank of America routing number is associated with the location of the bank where you opened your account. Even if you bank at another Bank of America branch, what matters is the bank where you opened your account.

Here are the Bank of America routing numbers by state:[1]

| State | Routing Number |

|---|---|

| Alabama | 051000017 |

| Alaska | 051000017 |

| Arizona | 122101706 |

| Arkansas | 082000073 |

| California | 121000358 |

| Colorado | 123103716 |

| Connecticut | 011900254 (electronic payment) / 011900571 (paper) |

| Delaware | 031202084 |

| District of Columbia | 054001204 |

| Florida—East | 063100277 (electronic payment) / 063000047 (paper) |

| Florida—West | 063100277 |

| Georgia | 061000052 |

| Hawaii | 051000017 |

| Idaho | 123103716 |

| Illinois—Chicago Metro | 081904808 (electronic payment) / 071103619 (paper) |

| Illinois—North | 071000505 |

| Illinois—South | 081904808 |

| Indiana | 071214579 |

| Iowa | 073000176 |

| Kansas | 101100045 |

| Kentucky | 064000020 |

| Louisiana | 051000017 |

| Maine | 011200365 |

| Maryland | 052001633 |

| Massachusetts | 011000138 |

| Michigan | 072000805 |

| Minnesota | 071214579 |

| Mississippi | 051000017 |

| Missouri East/St. Louis | 081000032 |

| Missouri West/Kansas City | 081000032 (electronic) / 101000035 (paper) |

| Montana | 051000017 |

| Nebraska | 123103716 |

| Nevada | 122400724 |

| New Hampshire | 011400495 |

| New Jersey | 021200339 |

| New Mexico | 107000327 |

| New York | 021000322 |

| North Carolina | 053000196 |

| North Dakota | 051000017 |

| Ohio | 071214579 |

| Oklahoma | 103000017 |

| Oregon | 323070380 |

| Pennsylvania | 031202084 |

| Rhode Island | 011500010 |

| South Carolina | 053904483 |

| South Dakota | 051000017 |

| Tennessee | 064000020 |

| Texas—North | 111000025 |

| Texas—South | 111000025 (electronic) / 113000023 (paper) |

| Utah | 123103716 |

| Vermont | 051000017 |

| Virginia | 051000017 |

| Washington | 125000024 |

| West Virginia | 051000017 |

| Wisconsin | 123103716 |

| Wyoming | 051000017 |

If you don't see your state listed or are unsure where you opened your account, keep reading.

The first four digits pertain to the Federal Reserve. The next four digits are unique to your bank. Consider those the bank's address for the Federal Reserve. The final digit is a mathematical calculation of the first eight digits—it's used to prevent check fraud.

Tip: Save for what matters most with a savings account. Enjoy the benefits of earning interest while keeping your money secure.

Other Ways to Find Your Bank of America Routing Number

|

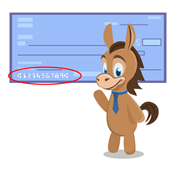

Use a Check

For checking accounts, you can find the routing number in the lower left-hand corner of the checks corresponding with your checking account. It's the first 9 digits located at the bottom of the check.

Go Online

On the Bank of America website, visit the Information and Services tab after logging into your account to find your routing number.

On the mobile app, sign in and select the Accounts Overview tab to select your checking or savings account. Scroll down to the Account Info heading.

Call Customer Service

Call Bank of America at 800.432.1000, Mon–Fri 8 a.m.–11 p.m. ET or Sat–Sun 8 a.m.–8 p.m. ET. After you provide a few specific details to identify yourself, a representative will be able to confirm your account's routing number.

Routing Numbers for Domestic/International Wire Transfers

Wire transfers are a faster way to send money than an ACH transfer. From your Bank of America account, you can wire money to other bank accounts, and other accounts can wire funds to you.

For all domestic and international wire transfers using a Bank of America account, the routing number is 026009593.

Domestic Transfers

For all domestic wire transfers using a Bank of America account, the routing number is 026009593.

To SEND a domestic wire transfer, you'll also need:

- The recipient's name and home address as on file

with their bank - Recipient's account number and account type

- Recipient bank's wire transfer routing number

International Transfers

For all international wire transfers with a Bank of America account, use the routing number 026009593 and the appropriate Bank of America SWIFT code depending on which currency is being sent:[2]

- US Dollars: BOFAUS3N

- Foreign currency: BOFAUS6S

- Not sure? Use: BOFAUS3N

To SEND an international wire, you'll also need:

- The recipient's country, currency, name, and home address as on file with their bank

- Recipient bank name and address

- Recipient account number (you may need a country-specific account structure, e.g., a CLABE for Mexico or an IBAN for international bank accounts)

- Recipient bank's SWIFT code

Cheaper and Faster Way to Send Money Internationally

The quickest and cheapest way to send money internationally is to use a money transfer service (instead of Bank of America).

Keep reading to learn how to enable your account for wire transfers.

Setting Up Your Account for Wire Transfers

To be eligible for higher transaction limits, you'll need to add Secured Transfer to receive a one-time passcode on your mobile. If you don't have access to a U.S. mobile number, you can sign in to your online banking account with a USB security key for secure transactions.

Here are the steps to set up your account:

- Sign into online banking portal

- Hover over Transfer | Zelle tab

- Select Transfer and To/from other banks (includes wires)

- Select I agree in the Service Agreement

- If this is a new recipient, click Add account/recipient

- Enter the required information

- Select Make Transfer and folow the onscreen instructions to send a wire

Incoming domestic wire: $15

Incoming international wire: $15

Outbound domestic wire: $30

Outbound international wire sent in foreign currency: $0

Outbound international wire sent in US dollars: $45

Which Bank of America Routing Number Should You Use?

For Any Domestic Money Transfer Activity Besides Wire Transfers:

Use the routing number for the bank where you opened your account.

For Domestic Wire Transfers:

Use the routing number 026009593.

For International Wire Transfers:

Use the routing number 026009593 plus the correct Bank of America SWIFT code.

- For U.S. dollars, use BOFAUS3N.

- For foreign currency, use BOFAUS6S

- If you are unsure which currency you are receiving, use BOFAUS3N.

Although your debit card is associated with a bank account, you do not use a routing number for debit card transactions. Routing numbers are only used for transfers directly between bank accounts.

Likewise, credit cards do not have routing numbers since they are not directly linked to any bank account. When you pay your credit card online, you may need to use your bank account routing number to set up the link between your credit card account and checking account, like you would for any other bill.

Bottom Line

You'll likely need your Bank of America routing number when managing your finances. Keep it handy should you need to set up a direct deposit, automatic payment, or wire transfer.

References

- ^ Bank of America. FAQs: Routing Numbers: Do you have a list of Routing Numbers I can review, Retrieved 12/01/2023

- ^ Bank of America. Wire Transfers FAQs: Which Bank of America SWIFT code should I provide?, Retrieved 12/01/2023

- ^ Bank of America. Personal Schedule of Fees, Retrieved 12/01/2023

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 1/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

U.S. Bank Business Essentials - $400 Bonus

Promo code Q4AFL25 MUST be used when opening a U.S. Bank Business Essentials®, or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

Earn your $400 Business Checking bonus by opening a new U.S. Bank Business Essentials account between 10/01/2025 and 1/14/2026. You must make deposit(s) of at least $5,000 in new money within 30 days of account opening and thereafter maintain a daily balance of at least $5,000 until the 60th day after account opening. You must also complete 5 qualifying transactions within 60 days of account opening.

Qualifying transactions include debit card purchases, ACH credits, Wire Transfer credits and debits, Zelle credits and debits, U.S. Bank Mobile Check Deposit or Bill Pay or payment received via U.S. Bank Payment Solutions. Other transactions such as (but not limited to) other Person to Person payments, transfers to credit card or transfers between U.S. Bank accounts are not eligible.

New money is considered money that is new to U.S. Bank. Funds must come from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees (e.g., monthly maintenance, paper statement fee, etc.) could reduce the qualifying daily balance, therefore you must make deposit(s) to cover the fees to maintain the daily balance during the qualifying period to be awarded the bonus. Refer to the Business Pricing Information or Business Essentials Pricing Information Document for a list of fees.

Bonus will be deposited into your new eligible U.S. Bank Business Checking account within 30 days following the last calendar day of the month you complete all of the offer requirements, as long as the account is open and has a positive available balance.

Offer may not be combined with any other business checking account bonus offers. Existing customers (businesses) with a business checking account or customers (businesses) who had an account in the last 12 months, do not qualify.

All regular account-opening procedures apply. For a comprehensive list of checking account pricing, terms and policies, reference your Business Pricing Information or Business Essentials Pricing Information and YDAA disclosure. These documents can be obtained by contacting a U.S. Bank branch or calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice. Member FDIC

CIT Bank Platinum Savings - $300 Bonus

- Qualify for a $300 cash bonus with a minimum deposit of $50,000

- This limited time offer to qualify for a $225 cash bonus with a minimum deposit of $25,000 or a $300 bonus with a minimum deposit of $50,000 is available to New and Existing Customers who meet the Platinum Savings promotion criteria. The Promotion begins on September 23, 2025 and can end at any time without notice.

Free Business Checking - Earn $500 Bonus

To earn the $500 bonus, customers must apply for a Bluevine Business Checking account anytime between now and 01/31/2026 using the referral code CD500.

After opening your account, deposit a total of $5,000 within the first 30 days. After 30 days, maintain a minimum daily balance of $5,000 while also completing at least one of the following eligibility requirements every 30 days for 90 days:

- Deposit at least $5,000 from eligible merchant services to your Bluevine account OR

- Make at least $5,000 of outbound payroll payments from your Bluevine account using eligible payroll providers OR

- Spend at least $2,000 on eligible transactions with your Bluevine Business Debit Mastercard® and/or Bluevine Business Cashback Mastercard®

Banking services provided by Coastal Community Bank, Member FDIC

Write to Andrea Sielicki at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: