Best National Banks

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

There are over 5,000 FDIC-insured banks in America. How do you choose a good national bank to keep your money safe?

|

National banks offer some big perks that smaller banks don't. They're more convenient and usually have more features and services.

You've probably heard of some big ones like Chase, Bank of America, and Wells Fargo. Which one is best? How do you choose between them?

This article will cover the best banks in America (there are some gems in here that you may not know of). We'll go over what's unique about each one so you can find the right bank for you.

The best national banks in the United States are:

- Chase for Checking Accounts

- CIT Bank

for Savings Accounts - Bank of America

for Mobile Banking - Citibank

for International Branches - Wells Fargo

for Mortgage and Loans - PNC Bank

for East and Southwest - TD Bank

for East Coast - U.S. Bank

for West and Midwest - Huntington Bank

for North Central - Ally Bank

for Online Banking - Capital One

for Young Adults - Alliant Credit Union

is the Best National Credit Union Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

U.S. Bank Business Essentials - $400 Bonus

Promo code Q1AFL26 MUST be used when opening a U.S. Bank Business Essentials® or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

To earn a business checking bonus, open a qualifying U.S. Bank business checking account between 1/15/2026 and 3/31/2026. Make the required deposit(s) in new money within 30 days of account opening, maintain the same required daily balance through the 60th day, and complete 6 qualifying transactions based on posted date within 60 days of account opening.

Business Essentials: $400 bonus with $5,000 new money deposits, daily balance, and 6 qualifying transactions.

Qualifying transactions include debit card purchases, ACH and wire credits or debits, Zelle credits or debits, U.S. Bank Mobile Check Deposit, electronic or paper checks, Bill Pay (excluding payments made by credit card), and payment received via U.S. Bank Payment Solutions. Other transactions, such as person-to-person payments, credit card transfers, or transfers between U.S. Bank accounts, are not eligible.

New money is defined as funds from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees may reduce the required daily balance during the qualifying period.

Bonus will be deposited into your new eligible U.S. Bank business checking account within 30 days after the month-end in which all offer requirements are met, provided the account remains open with a positive available balance.

Offer may not be combined with other business checking bonus offers. Existing businesses with a business checking account or had one closed within the past 12 months, do not qualify.

All regular account-opening procedures apply. For full checking account pricing, terms and policies, refer to your Business Pricing Information, Business Essentials Pricing Information, and YDAA disclosure. These documents are available at any U.S. Bank branch or by calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice.

Member FDICBest Banks in America in June 2024

We picked the best national banks based on their reputation, fees (must be easy to waive), range of services, bonus offers, and overall customer satisfaction.

Here's a quick overview of the best banks in the U.S.:

States Branches ATMs Chase 48 5,000+ 15,000+ Wells Fargo 36 + D.C. Approx. 4,100 11,000+ Bank of America 38 + D.C. Approx. 3,800 Approx.15,000 U.S. Bank 26 2,000+ 37,000+ PNC Bank 27 + D.C. Approx. 2,200 60,000 TD Bank 16 1,100+ 2,600 Huntington Bank 11 1,000+ 1,600+ Ally Bank N/A N/A 43,000+ CreditDonkey TRUST Rule: Transparency, Reliability, User experience, Services, TechnologyThe TRUST rule helps you remember the key aspects to consider when choosing a national bank:

- Transparency: Look for clear and transparent fee structures and terms.

- Reliability: Choose a bank with a strong reputation and solid financial stability.

- User experience: Ensure the bank offers a user-friendly online and mobile banking experience.

- Services: The bank should offer a wide range of services to meet your needs.

- Technology: Look for a bank with advanced technology for secure and efficient banking.

Chase Bank: Best for Checking Accounts

Why it stands out: Chase has generous bonus offers, strong customer service, and unique checking options for different needs.

![Mike Mozart (CC BY 2.0) https://www.flickr.com/photos/jeepersmedia/14822983879/in/photolist-ozREFz-oStCfv-ozZ9xm-oStBHP-oScLFM-2m4VLnx-2igZc]()

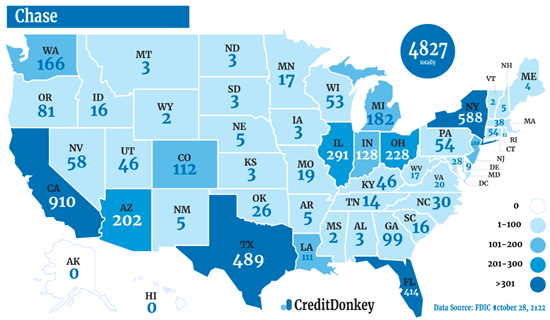

Mike Mozart (CC BY 2.0) via Flickr Number of states 48 Number of branches 5,000+ Number of ATMs 15,000+ Domestic assets held $2.52 trillion Mobile app ratings 4.8 (App Store), 4.4 (Google Play) FDIC insured Yes Chase is the largest bank in the U.S. by assets. It has more locations than anyone else with 5,000 branches and 15,000+ ATMs. It's the only nationwide bank to be in all 48 contiguous states.

Chase has lots of checking account options. The most popular Total Checking account (don't forget to get the bonus if you apply) lets you waive the monthly fee with just $500 in direct deposits each month.

There are also a few premium accounts, including the elite-tier Chase Private Client Checking℠.

It even has accounts that many other banks don't offer. Like a college student account, debit card for kids, and a Secured Checking option for those who have trouble opening bank accounts.

And as a bonus (literally), new customers can earn some extra cash with one of Chase's many welcome offers. Check out the current promotions.

Chase Bank Pros and Cons

- More than 5,000 branches

- Generous promotions

- Easy to waive fees

- Fewer branches in some states

- Low savings interest rates

![]() Chase Private Client Checking comes with exclusive perks. If you seek similar banks that offer elite perks and a personalized banking experience, here are the best private banks to consider.

Chase Private Client Checking comes with exclusive perks. If you seek similar banks that offer elite perks and a personalized banking experience, here are the best private banks to consider.Chase is the top pick if you're looking for checking accounts, but their savings accounts are nothing special.

Find out which bank is offering the best savings rates below.

CIT Bank: Best for Savings

Why it stands out: CIT Bank offers some of the highest savings interest rates in the nation. All of CIT's bank accounts have no monthly service fees.

Number of states N/A Number of branches None (online-only bank) Number of ATMs No ATM network; up to $30/mo ATM fee rebates Domestic assets held More than $100 billion (First-Citizens Bank & Trust Company) Mobile app ratings 4.6 (App Store), 2.8 (Google Play) FDIC insured Yes CIT's Savings Connect savings account offers 3.65% APY on your entire balance. You only need $100 to open, but there's no balance requirement after that. But if you can maintain $5,000, CIT's Platinum Savings is the best option. You earn 3.75% APY with a balance of $5,000 or more.

They also offer a money market account and CDs with competitive APYs. They even have a unique no-penalty CD that lets you withdraw funds early with no penalty if needed.

CIT is an online bank. This means everyone nationwide can apply and start earning with their high rates.

CIT Bank is a division of First Citizens Bank, which has over 120 years of history. It's the largest family-controlled bank in America with over $100 billion in assets. Because of CIT's merger with First Citizens Bank, you can now also bank at any First Citizens Bank location.CIT Bank Savings Connect - 3.65% APY

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

DisclosuresCIT Bank Term CDs - Up to 3.75% APY

- Up to 3.75% APY

- $1,000 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Term CD Rates 6 Month 3.75% APY 1 Year 0.30% APY 13 Month 3.25% APY 18 Month 2.75% APY 2 Year 0.40% APY 3 Year 0.40% APY 4 Year 0.50% APY 5 Year 0.50% APY The information for CIT Bank Term CDs have been collected independently by CreditDonkey. The details on this page have not been reviewed or provided by the bank.

Bank of America: Best Mobile Banking

Why it stands out: Bank of America has one of the best and most user-friendly mobile apps - perfect if you often bank on the go.

![Mike Mozart (CC BY 2.0) https://www.flickr.com/photos/jeepersmedia/14766180607/in/photolist-ouQx3P-ouQx6V-oixsQq-o26bGZ-oMh1Qb-oyCvQp-oM2Sbz]()

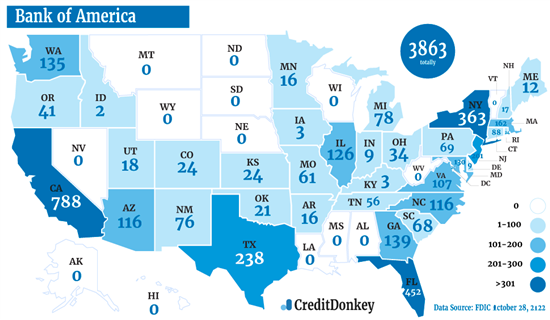

Mike Mozart (CC BY 2.0) via Flickr Number of states 38 + D.C. Number of branches Approx. 3,800 Number of ATMs Approx.15,000 Domestic assets held $2.28 trillion Mobile app ratings 4.8 (App Store), 4.6 (Google Play) FDIC insured Yes Bank of America has thousands of ATMs and financial centers in 38 states (+D.C.)[1] Similar to other big national banks, you can find a range of checking and savings accounts, loan options, and credit cards.

It has a unique flexible checking account. Bank of America knows that people's financial situations don't stay the same. So you can upgrade or downgrade your account as you need (to more premium or more basic version).

Unlike other banks, you're not stuck with the checking account you opened.

Bank of America won #1 for banking mobile app satisfaction, in a recent J.D. Power study.[2]. The app has a cool Spending and Budgeting tool that tracks your money habits so you have more control over your spending. Erica, the virtual assistant, can also help you manage bills, track FICO score, lock debit card, and more.

Bank of America Pros and Cons

- Top-tier banking app

- Flexible account options

- Wide range of products

- Monthly service fee

- Miscellaneous banking fees

![]()

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Most big banks charge monthly fees because they have high overhead costs. But #8 on our list actually has a free checking account. Keep reading.

Citibank: Best Big Bank with International Branches

Why it stands out: Citibank has an international presence, fee-free ATMs, and a savings account with a high APY.

![Mike Mozart (CC BY 2.0) https://www.flickr.com/photos/jeepersmedia/22606057792/in/photolist-ArBXp7-zvMokN-Abd6pw-JgShzc-HkTvXK-JgSizP-ArBSCU]()

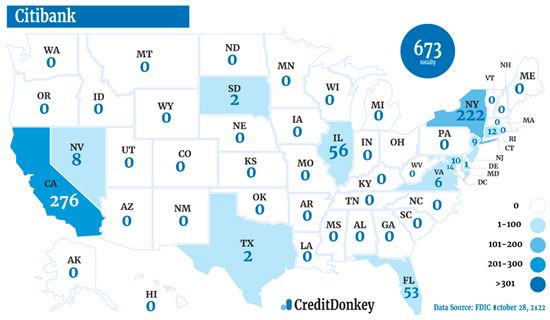

Mike Mozart (CC BY 2.0) via Flickr Number of states 13 Number of branches 600+ Number of ATMs 65,000+ Domestic assets held $1.038 trillion Mobile app ratings 4.9 (App Store), 4.7 (Google Play) FDIC insured Yes Citibank has a smaller footprint in America (mostly in California and New York), but it has a huge global presence. In addition to over 600 bank branches in the U.S., there are 1,800 overseas locations. If you travel a lot, you'll still have access to branches and ATMs.[3]

In the U.S., you get fee-free access to more than 65,000 Citi, Allpoint, and MoneyPass ATMs, as well as participating machines in popular stores like Target, CVS, and Rite Aid.

Citi's bank accounts usually offer some of the most popular bonuses (see current promotions) if you can meet the qualifying requirements.

Citibank Pros and Cons

- Perks for high-balance customers

- Many fee-free ATMs

- Global presence

- Not a lot of branches in the US

![]() Citibank has one of the highest-rated mobile apps. Its personal finance tools are open to everyone, even non-Citi customers. You can link all your financial accounts to get an overview of your financial life. Tools include budgeting, spending analysis, goal tracking, and investment tracking.

Citibank has one of the highest-rated mobile apps. Its personal finance tools are open to everyone, even non-Citi customers. You can link all your financial accounts to get an overview of your financial life. Tools include budgeting, spending analysis, goal tracking, and investment tracking.Wells Fargo: Best for Mortgage and Loans

Why it stands out: Besides banking, Wells Fargo is known for being one of the biggest lenders for home loans and auto loans in America. It's a good choice if you want banking and lending with one bank.

![Mike Mozart (CC BY 2.0) https://www.flickr.com/photos/jeepersmedia/14634894961/in/photolist-oieEpc-noEXac-noF7fh-oikhyu-noEY2m-oikh1W-oiwipX]()

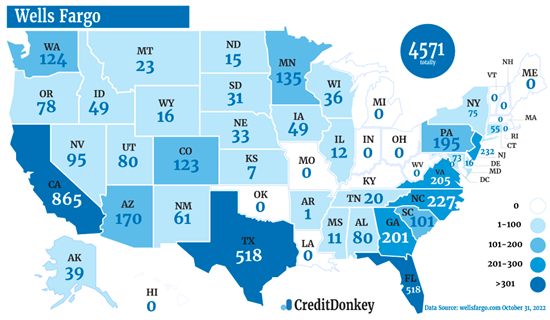

Mike Mozart (CC BY 2.0) via Flickr Number of states 36 + D.C. Number of branches Approx. 4,100 Number of ATMs 11,000+ Domestic assets held $2.01 trillion Mobile app ratings 4.9 (App Store), 4.8 (Google Play) FDIC insured Yes Wells Fargo has approximately 4,100 brick and mortar locations and more than 11,000 ATMs spread across the US. You get convenient access to branches if you need help opening an account or with the loan process.

For checking, Wells Fargo offers specialty checking accounts, like a second-chance account and a teen checking account.

It has very reasonable requirements to waive monthly fees for its checking and savings accounts.

Wells Fargo Pros and Cons

- Wide range of services and less-common offerings

- Large mortgage lender

- 24/7 fraud monitoring

- Suboptimal interest rates

- Overdraft protection fees

![]()

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

Personal Checking Account - $125 Bonus

Open a new qualifying consumer checking account. Make 10 or more qualifying transactions posted to the new checking account within 60 days of account opening. This offer is for new checking account customers only.

The information for Personal Checking Account has been collected independently by CreditDonkey. The details on this page have not been reviewed or provided by the bank.

Personal Checking Account - $400 Bonus

Open a new qualifying consumer checking account. Receive a total of $1,000 or more in qualifying electronic deposits to the new checking account within 90 calendar days from account opening (qualification period). Bonus will be deposited to the account within 30 days after the qualification period. This offer is for new checking account customers only.

The information for consumer checking has been collected independently by CreditDonkey. The details on this page have not been reviewed or provided by the bank.

Are big banks better than smaller banks?

Big national banks are good if you want lots of branches. They also tend to offer more financial services and have better mobile banking apps. But smaller banks (like local banks and credit unions) can give you more personalized service.A regional bank could be a good middle ground. They serve a large region, so you still get convenient access, but often have better service. Keep reading for the best regional banks.

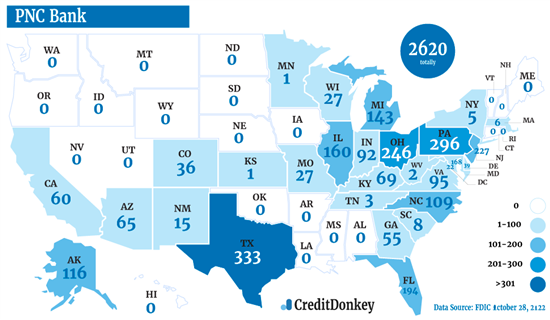

PNC Bank: Best in East and Southwest

Why it stands out: PNC offers a unique checking and savings combo with lots of digital tools to help you manage your finances in one place.

![Tony Webster (CC BY 2.0) https://www.flickr.com/photos/diversey/48171777871/in/photolist-2goLXhk-tx4BGC-8h9hJW-f4eX43-28yjxx6-uuhQiv-nid5PS-]()

Tony Webster (CC BY 2.0) via Flickr Number of states 27 + D.C. Number of branches Approx. 2,200 Number of ATMs 60,000 Domestic assets held $560 billion Mobile app ratings 4.8 (App Store), 4.4 (Google Play) FDIC insured Yes PNC Bank was a large regional bank on the East Coast. With their acquisition of BBVA in 2021, it extended its footprint to the south and west as well.[4] It's now one of the largest national banks in America, with approximately 2,200 bank branches in 27 states + D.C.

PNC's most popular product is the Virtual Wallet. It comes with a Spend account (for everyday needs), a Reserve account (for short term planning), and a Growth account (for long term savings goals).

Plus, it has lots of tools to help you take control of your money. You can create a budget, set savings goals, know how much is free to spend, get low cash alerts, and more.

PNC often offers cash bonuses for opening a new account. Check them out below.

PNC Bank Pros and Cons

- Virtual Wallet tools

- Easy to waive fees

- Free student account

- Not in some regions

- Low APY

![]()

Virtual Wallet with Performance Select Checking - $400 Bonus

Open a new Virtual Wallet with Performance Select checking account and make qualifying direct deposits totaling $5,000 or more within 60 days of account opening. Bonus will be awarded within 60-90 days of meeting the requirements.

Virtual Wallet Checking - $100 Bonus

Open a new Virtual Wallet checking account and make qualified direct deposits totaling $500 or more within 60 days of account opening. Bonus will be awarded within 60-90 days of meeting the requirements.

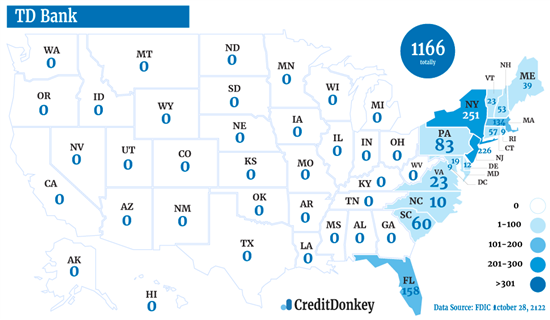

TD Bank: Best on the East Coast

Why it stands out: TD Bank offers extended banking hours when many banks don't, including on some national holidays. It also has a variety of specialty checking accounts.

![Mike Mozart (CC BY 2.0) https://www.flickr.com/photos/jeepersmedia/13754929464/in/photolist-mXtBjh-mXryyv-mXtERN-mXrCfP-mXrBDt-oL7CaL-otE2pY]()

Mike Mozart (CC BY 2.0) via Flickr Number of states 16 Number of branches 1,100+ Number of ATMs 2,600 Domestic assets held $394 billion Mobile app ratings 4.8 (App Store), 4.3 (Google Play) FDIC insured Yes TD Bank is one of the largest banks on the East Coast, with over 1,100 branch locations from Maine to Florida.

TD Bank calls itself "America's Most Convenient Bank." Most TD Bank locations are open on weekends and even some holidays, and offer drive-thru and curbside delivery services.

You can call customer service 24/7 and always reach a real, live person.

TD Bank Pros and Cons

- Extended banking hours

- Low requirement to waive fees

- No foreign transaction fees

- No free checking

- Only on east coast

![]()

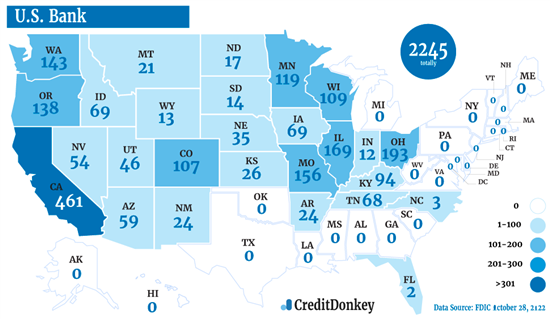

U.S. Bank: Best in the West and Midwest

Why it stands out: U.S. Bank offers an attractive checking account plus high rates for their CD special.

![Lorie Shaull (CC BY 2.0)https://www.flickr.com/photos/number7cloud/51235427342/in/photolist-2m4uXwW-2hukmGz-A5mnpc-nR3VxH-NwLVfA-26gStAc-A3a]()

Lorie Shaull (CC BY 2.0)via Flickr Number of states 26 Number of branches 2,000+ Number of ATMs 4,700+ Domestic assets held $582 billion Mobile app ratings 4.8 (App Store), 4.7 (Google Play) FDIC insured Yes U.S. Bank has more than 2,000 branches in the West and Midwest, and 4,700+ U.S. Bank ATMs across the country. Even if you don't live near a branch, you can do all your banking on the highly rated mobile app. It also charges no surcharge at approximately 40,000 MoneyPass ATMs throughout the country. So you'll never be far from ATM access.[5]

U.S. Bank offers a U.S. Bank SmartyTM Checking account that gives you more rewards the higher your balance is. It comes with features like overdraft benefits, interest on checking, and automated budgeting tools.

There are lots of ways to waive the monthly fee. The account is free for teens, young adults 24 and under, and seniors 65+.

U.S. Bank also frequently offers large sign-up bonuses for new customers. Check it out below.

U.S. Bank Pros and Cons

- Promo CD with high APY

- Free student account

- 24/7 customer service

- Very limited east coast presence

- Low savings APY

![]()

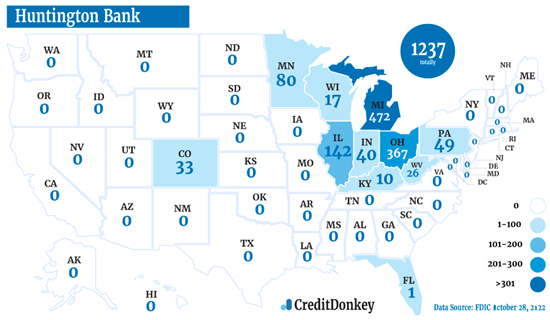

Huntington Bank: Best in North Central

Why it stands out: Huntington has a free checking account, which is rare among big banks. You don't have to worry about keeping a certain balance.

![Tim Evanson (CC BY 2.0) https://www.flickr.com/photos/timevanson/25661914275/in/photolist-F6E24R-G9ph5k-2m63mpj-EX1FtN-8p22XJ-2df17bp-deVy3y]()

Tim Evanson (CC BY 2.0) via Flickr Number of states 11 Number of branches 1,000+ Number of ATMs 1,600+ Domestic assets held $179 billion Mobile app ratings 4.8 (App Store), 4.2 (Google Play) FDIC insured Yes Based in Ohio, Huntington Bank has a large presence in the North Central region, with over 1,000 branches spread across 11 states.[6]

It has a great Asterisk-Free Checking free checking account with no monthly fee or minimum balance requirements. It's loaded with awesome features too, like $50 free overdraft protection and up to 2 days early direct deposit. [7]

Eligible Huntington personal checking customers also get access to Standby Cash. This feature lets you borrow up to $500 line of credit instantly. You just pay it back over 3 months. And it's free when you set up automatic payments. Terms and conditions apply.[8]

Huntington Bank Pros and Cons

- Free checking account

- Deposit checks via mobile app

- All-day deposit

- Mostly in the Midwest

- Low savings APY

![]()

Ally Bank: Best Online Bank

Why it stands out: Most online banks have limited products, but Ally is a full-service online-only bank. It has better interest rates than traditional banks.

Number of states N/A Number of branches None (online-only bank) Number of ATMs 43,000+ Domestic assets held $178 billion Mobile app ratings 4.7 (App Store), 2.6 (Google Play) FDIC insured Yes Ally is the best online bank if you're looking for the full spectrum of banking products. Ally offers checking and savings accounts, personal loans, and mortgages.

All deposit accounts have no monthly fees and no balance requirements. They also have higher interest rates than traditional banks, so you can grow your money faster. Even their checking account offers some interest.

You get free access to over 43,000+ Allpoint ATMs. And if you go out-of-network, Ally will rebate up to $10 in ATM fees per month.[9]

Ally consistently gets high ratings for customer satisfaction. It offers 24/7 customer service via phone and live chat. You'll always speak to a real person.

Ally Pros and Cons

- No monthly fees or min. balance

- Wide range of services

- Highly-rated mobile app

- No physical locations

- ATM reimbursement capped at $10

Interest Checking

- 0.10% APY for daily balances less than $15,000

- 0.25% APY for daily balance over $15,000

- $10/month rebate for ATMs outside of Ally Network

- $0 minimum opening deposit

- No fees to open or maintain account

- FDIC insured

- Daily compounding interest

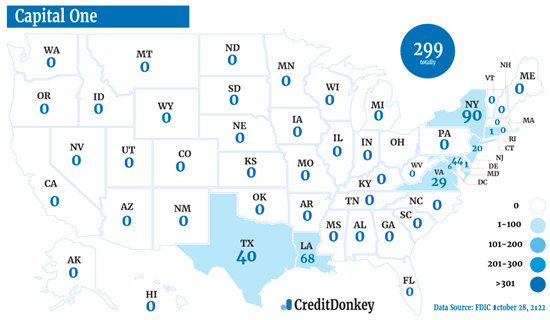

Capital One 360: Best for Young Adults

Why it stands out: Capital One is a great choice for young adults because their checking and savings accounts have no monthly fees and higher-than-average interest rates.

![Tony Webster (CC BY 2.0) https://www.flickr.com/photos/diversey/50923083313/in/photolist-2kzU7x4-Kt64Bu-2j6Kuh9-4YjhMe-MZ4uKV-2khKquk-2kD4rR]()

Tony Webster (CC BY 2.0) via Flickr Number of states 8 Number of branches 298 Number of ATMs 70,000+ Domestic assets held $391 billion Mobile app ratings 4.9 (App Store), 4.6 (Google Play) FDIC insured Yes Other cool features include getting paid up to 2 days early, no overdraft fees, and free access to over 70,000 ATMs. The debit card also has no foreign transaction fees, so it's great for young adults studying abroad or traveling.

Depositing cash can be an issue with online banks, but Capital One makes it easy. You can make cash deposits at any CVS store for free. Just hand the cash to the cashier and confirm the deposit on the mobile app.

If you need help, you can pop into any of the Capital One cafes. You can meet with financial advisors and engage with the community while getting a cup of coffee. In fact, you don't even need to be a Capital One customer.

If you want to get a head start on banking, Capital One even offers a MONEY Teen Checking account. It can be transferred to the regular 360 Checking later once you're an adult.Capital One Pros and Cons

- No account minimums

- Interest on your checking account balance

- No monthly fees

- Few cafes and physical branches

- Higher wait times for customer support

![]()

360 Checking Account

- Minimum Deposit Required: $0

- Balance Requirement: $0

- Monthly Fee: $0

- APY: 0.10% APY

- ATMs: 70,000+ Capital One, MoneyPass, and Allpoint ATMs

- Perks: Free first set of checks

For kids and teens looking to open a checking account, check out the best student checking accounts for options with minimal requirements and fees.Instead of a bank, you can also consider a credit union, like Alliant below. Credit unions are nonprofit financial institutions owned by its members. So they're more committed to giving back to their members.

Alliant: Best National Credit Union

Why it stands out: Alliant is a digital credit union, so it's open to everyone nationwide. It offers high interest rates, good customer service, and extra perks.

Number of states N/A Number of branches None (digital credit union) Number of ATMs 80,000+ Domestic assets held $17 billion Mobile app ratings 4.7 (App Store), 4.4 (Google Play) NCUA insured Yes Alliant Credit Union is one of the nation's largest credit unions with over 700,000 members.

Anyone is eligible to join by becoming a member of Foster Care to Success (FC2S). Alliant will even pay a $5 membership fee to FC2S on the member's behalf.[10]Alliant's High-Rate Checking account has no monthly fee. To earn interest, you must opt for eStatements and have a recurring monthly electronic deposit. You get access to over 80,000 fee-free ATMs, plus up to $20 in ATM fee refunds per month.[11]

You can pair that with a High Rate Savings account, which gives you 3.10% APY if you maintain a $100 average daily balance.

Alliant also offers personal finance tools to help you manage your money. You can add your external financial accounts to see your finances all in one place.

Alliant Credit Union Pros and Cons

- Competitive APYs

- Personal finance management tools

- Good customer service

- Requires credit union membership

- No physical branches

High-Rate Checking

- 0.25% APY when you opt in to eStatements and have at least one monthly electronic deposit to your account

- No monthly service fee

- No minimum balance requirement

- Up to $20/month in ATM fee rebates

Are credit unions as safe as banks?

If the credit union is backed by NCUA, your money is safe. Just like the FDIC, the NCUA insures your money up to $250,000.[12]Other Banks to Consider

HSBC Premier - Earn Up to $7,000

It's easy. The more you fund, the more you earn. Discover all that Premier can do for you- Send and receive money with Zelle® right from our mobile app

- Manage your money safely, easily and fee-free around the world - from Global Money Transfers to multi-currency needs

- Enjoy peace of mind with unique travel benefits available through our credit cards

Here's how the offer works: Open a new HSBC Premier checking account by March 31, 2026. Add New Assets to your Premier checking account, Premier Savings account, Premier Relationship Savings account, Managed Portfolio Account and/or Spectrum account (Eligible Accounts) by March 31, 2026, and maintain the New Assets through June 30, 2026.

- Get a $1,500 Cash Bonus: Add and maintain New Assets of $150,000 to $249,999

- Get a $2,500 Cash Bonus: Add and maintain New Assets of $250,000 to $499,999

- Get a $3,500 Cash Bonus: Add and maintain New Assets of $500,000 to $999,999

- Get a $7,000 Cash Bonus: Add and maintain New Assets of $1,000,000+

If all offer requirements are met, the bonus will be paid by August 31, 2026.

Key Select Checking® - $500 Bonus

Earn $500 after qualified activities until 5.22.26 with interest-bearing Key Select Checking®.- Open a Key Select Checking® account online by May 22, 2026.

- Make the minimum opening deposit of $50 and make a total of $5,000 or more in eligible direct deposits within the first 90 days of account opening.

- Your $500 cash bonus will be deposited into your account within 60 days of meeting requirements. Account must not be closed at the time of gift payment.

What are National Banks?

A national bank is a bank that is regulated by the US federal government. National banks usually offer services throughout the entire country, but some may operate in just certain regions.

Not all national banks are brick-and-mortar banks. Some of the best national banks on this list are online banks that let you bank from anywhere.

National banks are insured by the Federal Deposit Insurance Corp. This means if the bank were to fail, the federal government insures your deposits up to $250,000 per depositor, per ownership category.

Are brick-and-mortar banks or online banks better?

A brick-and-mortar bank is better if you prefer in-person customer service. However, these banks tend to have more fees and lower savings interest rates.On the other hand, online banks are better if you want higher savings APYs, fewer fees, and lower balance requirements. But they often have limited services and it can be hard to deposit cash.

How to Choose the Best Bank

Banks usually offer the same features (such as online bill pay, mobile deposits, Zelle®, alerts, etc.).

To decide on the best bank for you, carefully compare accounts, fees, and customer reviews. Here are some things to consider:

- Monthly fees

Brick-and-mortar banks usually charge monthly fees. To avoid the fee, you must meet certain direct deposit or minimum balance requirements. This isn't necessarily a bad thing if the bank fits your needs and you can easily meet the requirements. - Locations

If you prefer face to face banking, you'll want to find a nationwide bank or regional bank with a large number of branches where you live and work.If you're okay with online banking, then national online banks can help you save on fees and even offer higher savings rates. They partner with nationwide ATM networks so you still have convenient access with no ATM fees.

- Overdraft fees

Americans pay billions in overdraft fees every year. You can avoid this by seeing what kind of overdraft services the bank offers. Many online banks don't even charge overdraft fees. - Additional services

A lot of banks also offer credit cards, loans, small business products, and investment tools. If you might want any of these in the future, having a good banking relationship could help. It's also good if you want to do everything under one roof. - Customer service

How can you contact the bank if you have a problem? What are their hours? Also read reviews from existing customers to get an idea of their experience with the bank. - Sign up bonuses

If all other features are similar, this may be the final deciding factor.

Which among these considerations do you think is the most important?How We Chose The Best National Banks in America

We came up with this list of the best national banks by looking at several factors:

- National footprint and reputation of the bank

- Range of services and products offered

- Banking fees and if they are easy to waive

- Welcome bonuses

- Customer reviews and satisfaction

- Mobile banking app satisfaction

It's important that the bank offers a lot of services (like checking, savings, credit cards, loans). We don't believe in paying to bank, so account fees and minimums must be reasonable and easy to waive. And with 41% of banking customers going digital-only,[2] it's more vital than ever to have a good mobile app.

We also considered J.D. Power's studies for the US retail banking satisfaction and best banking mobile app satisfaction.

Common Questions

- What is the number 1 bank in America?

Chase is the top bank in America by assets and number of branches, with $2.57 trillion in domestic assets and over 5,000 locations. The second largest bank is Bank of America, with $2.31 trillion in assets.[13] - What banks give you money for opening an account?

Banks that frequently offer cash bonuses to new customers include: Chase, Bank of America, PNC Bank, Huntington Bank, and TD Bank. Typically, you need to deposit a certain amount of money or make a certain qualifying direct deposit. - Which bank is safest in USA?

In general, a financial institution is considered safe if it's covered by FDIC insurance, has strong security measures, and is a large established bank. Chase, Wells Fargo, Bank of America, U.S. Bank, and all the other banks on our list meet these requirements.FDIC insurance protects your deposits up to $250,000 if the bank defaults. This gives you peace of mind that your money is safe.

- Which bank is in every state?

Chase Bank is the first and only bank with physical branches in all 48 states in the contiguous US. Plus, it's the only bank to accept government deposits in all 50 states. With over 5,000 locations, it's the national bank with the most number of branches.

What the Experts Say

As part of our series on banking and saving, CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

Going with a national bank is a good choice if you're looking for convenience. They often offer nationwide access and more products and services.

If you don't need to visit a physical branch, consider an online bank. These usually provide higher interest rates and have fewer fees.

References

- ^ Bank of America. Bank of America Financial Centers and ATMs, Retrieved 04/07/2024

- ^ Big Bank Investments in Mobile Apps Pay Dividends as Customer Volume Shifts to Digital, J.D. Power Finds, Retrieved 1/17/22

- ^ Citibank. Citibank ATMs, Retrieved 04/07/2024

- ^ PNC. PNC Completes Acquisition of BBVA USA, Retrieved 3/1/2022

- ^ U.S. Bank. U.S. Bank at a glance , Retrieved 04/07/2024

- ^ Huntington. About Us, Retrieved 04/07/2024

- ^ Huntington. Asterisk Free Checking Account Personal Account Charges Form, Retrieved 3/1/2022

- ^ Huntington. Standby Cash, Retrieved 3/1/2022

- ^ Ally. ATMs & withdrawals FAQs: What are your ATM fees?, Retrieved 3/1/2022

- ^ Alliant. Who is eligible to join Alliant?, Retrieved 3/1/2022

- ^ Alliant. Does Alliant rebate fees if I use an out-of-network ATM?, Retrieved 3/1/2022

- ^ NCUA. Deposits Are Safe in Federally Insured Credit Unions, Retrieved 3/1/2022

- ^ Federal Reserve. Large Commercial Banks, Retrieved 11/11/2022

Anna G is a research director at CreditDonkey, a bank comparison and reviews website. Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Subscribe to CreditDonkey: Get updates on the latest deals and keep up with the best money moves.

Best Online Bank

How to Choose a Bank

Best Free Checking Accounts

Free Business Checking

Best High Yield Checking Accounts

Bank Without Social Security Number

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Articles on Best National Bank

Largest Banks in the US

A list of the largest banks in the US was released. Which banks came out on top? Read on to find out, plus the benefits of working with a big bank.Best Banks in Illinois

The best banks in Illinois can positively impact your financial future thanks to their interest rates, fees, or features. Start your hunt in this article.Best Banks in Minnesota

From community credit unions to national powerhouses, which banks in Minnesota truly rise above the rest? Find out here.Best Banks in Massachusetts

Wondering which banks in Massachusetts are worth your time? Explore this article to find out.Banks Open on Weekends

No free time on weekdays to head to the bank? Here are a few banks that can serve you on weekends.Best Banks in Orlando

Are you looking for a new bank in Orlando? Look no further than this guide to the best banks in Orlando, Florida.Best Banks in Georgia

On the hunt for a new bank in Georgia? Look no further than this helpful list of the best banks in Georgia.Best Banks in Florida

Are you a Floridian trying to find a new bank? It's easy with this helpful guide to the best banks in Florida. Read on to learn more.Best Banks for Trust Accounts

Seeking to open a trust account and not sure which bank to do it with? Look no further than this helpful guide to the best banks for trust accounts.Best Banks in Texas

Looking for the right bank in Texas? Don't miss this helpful guide to the best banks in the Lone Star State. Read on to see which is right for you.Best Banks in California

Are you in California and searching for a new bank? Finding one is easy with this helpful guide to the best banks and credit unions in California.Which among these considerations do you think is the most important?94% Monthly fees2% Locations4% Overdraft fees![Best Reward Checking Accounts]()

Best Reward Checking Accounts

Maximize your money with the top 7 reward checking accounts. Dodge buyer's remorse today.Next Page: Online Banks