Empower Review

Empower offers wealth management services and free financial tools. But is it legit? Find out if this robo advisory service is right for you.

| |||

Join Empower For Free | |||

Overall Score | 4.6 | ||

Human Advisors | 5.0 | ||

Robo Advisor | 3.0 | ||

Price | 5.0 | ||

Goal Tracker | 5.0 | ||

Budgeting | 3.0 | ||

Customer Service | 5.0 | ||

Ease of Use | 5.0 | ||

Investment Tracking | 5.0 | ||

Retirement Planning | 5.0 | ||

Pros and Cons

- Retirement planner

- Free portfolio advice

- Robo plus human advisors

- $100,000 min for advisory service

- Higher fees than competitors

Bottom Line

Free advanced tools plus hybrid advisory service for people with over $100k in investments

With a 0.89% annual management fee, Empower is more expensive than other robo-advisory services.

But it claims to offer a more personalized investing strategy that can lead to a better financial outcome. So is it worth the higher fee?

If you're not sure about using their investment service, you can always use their free financial tools and get a free portfolio consultation. You'll still receive custom advice you can implement yourself.

Read on to learn how Empower works, and how it can help you reach your goals.

What is Empower?

Empower is an all-in-one financial toolkit. It offers 2 main services:

1. Advanced financial tools (free)

Empower's robust

- Track your net worth

- See your entire financial life

- Track your portfolios and get advice

- Plan for retirement

2. Wealth management (paid)

Empower currently has over 18 million customers and manages over $1.6 trillion of assets.

In this Empower review, you'll learn:

Advanced Money Management Tool

- Free and easy to set up

- Retirement planner

- Investment tracking

How Empower Works

Anyone can

- Bank accounts (checking, savings, CDs)

- Credit cards

- Investments including individual stocks, ETFs and mutual funds

- Employer-sponsored retirement plans

- Mortgages

- Loan accounts

Empower is linked to over 16,000 financial institutions, so you should have no problem finding your accounts.

If you have at least $100,000 in investment assets, you can sign up for Empower's wealth management services. You will first get a free consultation. A financial advisor will go over your current state and goals.

They'll then come up with a custom investment strategy. If you like it, you can open an investment account. If you decide it's not right for you, don't feel pressured to use their wealth management service.

Who Empower is Best For

|

- DIY investment trackers

Empower offers some of the best free investment tracking tools available. It even gives you personalized advice. You can track all your portfolios and get insights on how you're doing. - High net worth investors

The wealth management service is open to those with $100,000 or more to invest. Use Empower's unique combination of robo-advising and professional financial advisors to maximize your investment returns. - Retirement planners

Empower's retirement tools can project how different scenarios will impact your retirement nest egg. And if you are an investment client, the financial advisors will help you develop a retirement plan.

Empower Pros & Cons

PROS:

- Free and easy to setup

- Wealth management plan offers more custom strategy than other robo advisors

- Advanced money management tools

- See all your financial accounts in one place

- Retirement planner

- Free personalized investment advice

- Cryptocurrency tracking

CONS:

- Limited budgeting tool

- Cannot import from Quicken

- Cannot manually enter transactions

- Higher fees for wealth management service

- $100,000 minimum for wealth management service

Empower has over $1.6 trillion in assets under management. Therefore, it's able to offer tools for free (unlike its competitors). The idea is: once you do build up enough wealth, you consider using their paid wealth management service. We'll explain everything you need to know below.

Keep reading for the full Empower review.

Empower Fees

Empower's financial planning tools are offered at no cost. Everyone can use the app for free without signing up for the investment services.

If you do decide to use their wealth management service, the fees start at 0.89% of assets under management. The more you have to invest, the lower the fees.

The annual structure for the fee-based service is:[2]

Wealth Management Service

| Investment Assets | Fees |

|---|---|

| Up to $1 million | 0.89% |

| $1 - $3 million | 0.79% |

| $3 - $5 million | 0.69% |

| $5 - $10 million | 0.59% |

| Over $10 million | 0.49% |

These are all-inclusive management fees. There are no additional trade commissions or any other hidden charges.

The wealth management fees are higher than purely robo-advisors like Betterment, but less than traditional human wealth managers.

In comparison, Betterment's fee of 0.25% (for the basic service) means you'll only pay $250 per year. Even Vanguard Personal Advisor service (for those with $50,000 or more) charges just 0.30% flat rate.

Is Empower Worth It?

|

If you want to track your own investments and retirement outlook, then Empower's free tools are 100% worth it. They go beyond the standard budgeting tools and usual calculators.

It even gives you free custom advice on how to adjust your portfolio to reach your goals. You could just follow their free advice and continue to manage your portfolios for yourself.

For their wealth management services, the annual advisory fee is on the high end compared to other robo-advisors. But the difference is that you get real financial advisors to help design your portfolio. They help you make the best choices based on your goals.

Whether it's worth it depends on what you value. If you're a hands-off investor who wants a more personal relationship with an advisor, then many say it's worth it. The advisor can guide you if you have life changes or simply have money questions.

With this in mind, let's go over all of Empower's features.

Advanced Money Management Tool

- Free and easy to set up

- Retirement planner

- Investment tracking

Empower Free Tools

|

Here's a detailed breakdown of Empower's tools.

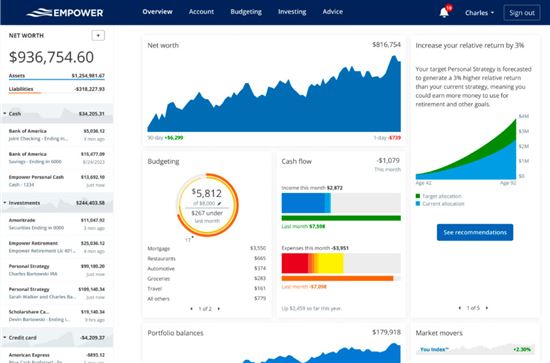

Empower Personal Dashboard

The visual charts and graphs make it highly readable, something we appreciate. After linking your accounts, you'll see a dashboard like this:

|

| credit empower |

Use it to review summaries of:

- Your total net worth (including assets and liabilities)

- A balance of all your accounts (checking, savings, investment accounts, credit cards, and loans)

- Your monthly cash flow

- How you're doing on budget this month

- Your overall portfolio balance

- Your retirement savings progress for the year

- Your emergency fund balance

Try It Out: Empower Personal DashboardTM

Portfolio Overview

If you have multiple investment accounts, Empower will combine everything to show you the overall performance of your portfolios.

|

| credit empower |

The You Index feature measures the performance of all of your stock, cash, ETF, and mutual fund holdings extrapolated backward. You can compare your portfolio's performance to the S&P 500, DOW, etc.

Investment Checkup

- Stocks, bonds and ETFs

- Mutual funds

- Other types of assets

- Cash

Based on your goals and risk profile, Empower may suggest you change your asset allocation (like more bonds and fewer stocks) much like a personal financial planner would.

|

| credit empower |

In the above screenshot, you can see the current and suggested target allocation. You'll also get very specific recommendations on how to reach the target asset allocation.

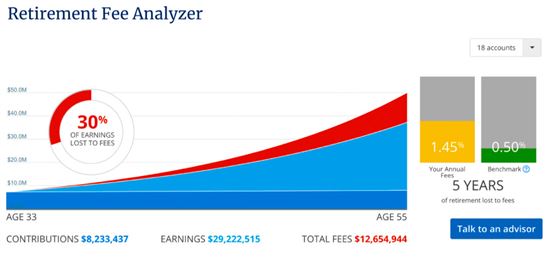

Fee Analyzer

This is the area where most folks lose money without even realizing it. Why? Many people don't know the hidden fees within their accounts. Empower's tool tells you just how much of your funds you may be losing to fees.

|

| credit empower |

In this example, 30% of the earnings are being lost to fees. The number at the bottom projects costs based on current contributions and savings goals. More than $12M will be spent on fees by the time the user reaches retirement age.

Empower also shares the expense ratio for each fund and how much it costs in fees a year. For example:

|

| credit empower |

This will help you see which funds have the highest expense ratios and you can consider switching them out.

Cryptocurrency Tracking

Empower's newest feature is the Cryptocurrency BETA. You can track all your coins and their current values.

To add a crypto, you must manually add an account like what you'd do for home, car, or jewelry. This is good because you don't need to enter your password or link your personal wallet.

Then select your exchange and enter your coins and quantity. You can track thousands of coins across hundreds of exchanges. Empower pulls from public data to track their value.

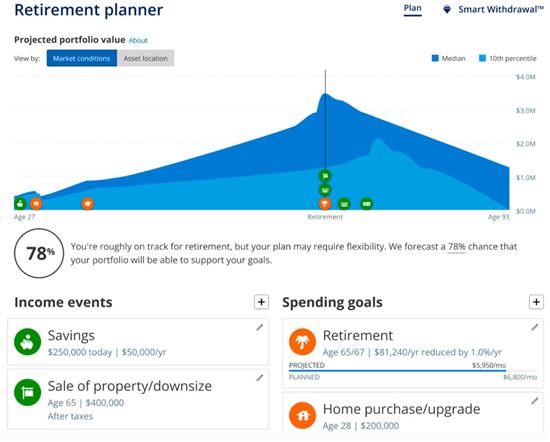

Retirement Planner

Empower's retirement planner is one of the most advanced on the market—and it's free. Using your linked retirement accounts, the platform will calculate projected income, investments, and Social Security distributions.

|

| credit empower |

One of the best tools is the scenario simulator. You can manually add different life scenarios (like buying a house, paying for a wedding, traveling). The program will let you know how these will impact your retirement.

Empower Wealth Management Services

|

Empower's wealth management services are for clients with $100,000 to invest. It combines robo-investing with human financial advisors.

A financial planner will take the time to understand your personal financial situation and long-term needs to design a custom strategy. The robo-advisor's automated software then handles the investing and maintenance of your portfolio.

You get unlimited advice and retirement planning help from Empower's financial advisory team.

3 Levels of Service

The level of investment management you get depends on your balance. Here are the 3 tiers:[3]

| Investment Service ($100k - $250k balance) | Wealth Management ($250k - $1M balance) | Private Client (Over $1M balance) |

|---|---|---|

| Unlimited help from financial advisors | 2 dedicated financial advisors | 2 dedicated financial advisors |

| Portfolio of ETFs | Customized portfolio with individual stocks | Customized portfolio with individual stocks and bonds |

| Reviews upon request | Regular reviews | Regular reviews |

| Tax optimization | Tax optimization | |

| Financial decisions support | Financial decisions support, plus in-depth support for retirement and wealth planning | |

| Access to specialists | Priority access to specialists and Investment Committee | |

| Private equity investment options (for accounts $5M+) |

Wealth Management Service

| Investment Assets | Fees |

|---|---|

| Up to $1 million | 0.89% |

| $1 - $3 million | 0.79% |

| $3 - $5 million | 0.69% |

| $5 - $10 million | 0.59% |

| Over $10 million | 0.49% |

Investors in the Wealth Service Management and Private Client tiers (those investing $200,000+) can customize their portfolio with specific stocks in addition to ETFs. Clients in the Investment Service tier ($100,000-$200,000) choose from only ETFs (which can be composed of stocks).

Empower's Investment Strategy

Empower's goal is to yield the highest returns with the least risk. Here's how their portfolio works:

- Personalized strategy

Empower uses your entire financial picture to build a personalized portfolio tailored to you. A financial advisor works with you to identify the best strategy for your goals. As life changes, your portfolio strategy will evolve too. - Diversified portfolio

Like most robo-advisors, your investment portfolio is made up of ETFs, which tend to be cheaper. Your portfolio allocation will consist of 6 different asset classes:- U.S. stocks

- U.S. bonds

- International stocks

- International bonds

- Alternative assets, such as real estate investment trusts, precious metals, and energy

- Cash

- U.S. stocks

- Tactical weighting

This strategy weighs your investments equally between different styles and sectors (for example, so you're not so heavily weighted towards large-cap companies or technology stocks). This provides better diversification with less risk. - Tax optimization

Empower uses these strategies to reduce your tax burdens:- Asset location: Diverting high-yield assets into tax-protected accounts like IRAs.

- Tax loss harvesting: Selling some investments at a loss to offset capital gains.

- Tax efficiency: Investing in tax-efficient stocks and ETFs over mutual funds.

- Asset location: Diverting high-yield assets into tax-protected accounts like IRAs.

- Socially responsible investing

Empower offers a personalized socially responsible investment strategy, so you can invest in companies that align with your values.

Financial Roadmap

Financial Roadmap is the newest feature for wealth management clients. It's designed to help you prioritize your financial planning.

There are 19 different financial planning topics. The tool first creates a priority list for you based on its analysis of your accounts. You can customize the list according to your needs. As your data changes, Empower will introduce new priority topics.

- Emergency fund

- Debt management

- Personal savings

- Employer plan analysis

- Retirement cash flow planning

- Mortgage and real estate analysis

- Education savings

- Pension optimization

This list is meant to let you know areas you should work on first. It will give you personalized recommendations and track your progress toward each goal.

It also gives your personal advisor a real-time view of your finances. You can work together with your advisor to discuss your financial goals and how to achieve them.

Empower Private Client

Private Clients are those with over $1 million invested with Empower you get a higher level of personalization. Your portfolio is separately managed and completely personalized to your needs.

You get two dedicated financial advisors. They can help with any money topics from estate planning to college savings to 401k review.

Private Clients also get access to private banking services. And if you have at least $5 million in investment assets, you get access to private equity funds, which may have the potential to outperform public markets.

Empower Personal CashTM

Empower now offers a high-yield Cash Management account through its platform. You can open this account even if you don't use the Wealth Management service.

Similar to an online savings account, Empower Personal CashTM offers high interest rates on your cash (even higher if you are paying for the advisory service). There are no monthly account fees or minimums.

Empower Personal CashTM account offers a few specific advantages, including:

- Unlimited withdrawals with no fees (unlike bank savings accounts with withdrawals/month limit).

- FDIC insured up to an aggregate of $5,000,000 (instead of $250,000) at their program banks.[4]

- Transfer between your Cash account and Empower investment account.

Empower is not a bank. However, its Empower Personal Cash is FDIC-insured through a relationship with UMB Bank. In fact, your cash management account is insured up to an aggregate of $5 million—that's 20 times the amount at an online or traditional bank.

That's because UMB Bank distributes your funds using its network of banks so you won't surpass the $250,000 FDIC threshold. None of this affects how you manage your money. To transfer funds in or out of your account, you'll go through the Empower website or mobile app.

Empower Personal Cash

- 3.00% APY

- $0 monthly fee

- Withdraw up to $100k per day

Is Empower Safe?

- AES-256 encryption with multi-layer key management

- Strict internal access controls so no one at Empower has access to your credentials

- Multi-factor authentication process to verify each new device you log in from

- Extra log-in protection in the app via Touch ID (on iPhone) or PINS (on iOS and Android).

- Bank and brokerage credentials stored at Yodlee[5] (not in Empower's database)

- Year-round third-party security audits.

Empower aggregates your financial information on a read-only platform. Even if someone manages to get into your account, they can only read the information. No one can access your accounts and move your funds through Empower. Not even you.

It's actually safer to view your accounts from Empower. That's because you risk exposure every time you log into your bank account. But with Empower, you don't enter your bank credentials each time, so they're not transmitted.

Remember, personal responsibility is also important. For security, be sure to sign out of any financial-oriented program you use after every session and safeguard your password. Treat your email address like your phone number and don't give it out to strangers.

Does Empower Sell Your Information

Empower never sells your personal information to advertisers and companies.

However, Empower does use third-party service providers (such as Yodlee) to provide their services. Your personal information is provided to those third-party service providers, on a need to know basis. These providers are required to safeguard your information and only use your data to provide their services.

For the cash account users, as Empower Personal Cash Program is partnered with UMB Bank, your account information will be shared with UMB.

For the advisory clients, they will share some of your info with third-party identity verification providers. This is required by regulations in order to verify you.

Customer Service

For general customer support, you can reach Empower at (855) 855-8005, 24 hours a day, 7 days a week.

All users can also contact technical support at any time from the web or mobile app.

From the webpage, just click on the "Help" button at the bottom right corner to leave a message. From the mobile app, you can submit a help ticket in the "Support Center." You can also directly submit a request here.

Advisory service clients can contact their advisors through the online dashboard when logged in. You can schedule a call or send your advisor an email.

How To Open an Account

|

We think it's worth checking out. And remember, you don't need to use the wealth management services. Sign-up is free and pretty simple.

- Sign up and link accounts

Register for an Empower account and link all your external financial accounts, such as your banks, CDs, investments, etc.You'll immediately gain access to all the various tools and calculators. They're all free to use and you can stop here if you want.

- Free consultation

If you decide to use the wealth management service, you need to have $100,000 in investable assets. Then you can schedule a free phone consultation with an Empower financial advisor.The advisor will review your current financial state, goals, risk tolerance, and any big financial plans for the future. In a second follow-up consultation, they'll present you with a personalized investment strategy.

The initial phone call will cover topics like:- Ways to build a tax-efficient portfolio

- Insights on budgeting and cash flow

- 401k advice and diversification

- Ways to build a tax-efficient portfolio

- Open investment account

If you choose to go ahead with it, you'll open an investment account and fund it. If you decide not to use Empower's investment service, no problem. You got a free consultation and hopefully some good advice.

Already have an account? Log into your dashboard in the upper right corner of the home page

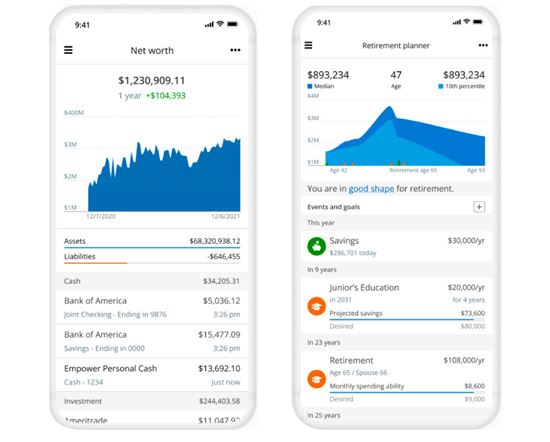

Mobile App

The Empower Personal DashboardTM app is a mobile version of the desktop dashboard. You can view:

- A summary of all your accounts and your current total assets

- Your cash flow, income, and expenses

- Detailed lists of your recent transactions

- How you're doing on budget and a breakdown of spending

- Overview of your investments

- Chart of your portfolio performance

- Investment checkup advice

- Your projected portfolio value for retirement (including estimates based on changes)

|

| credit empower |

The app doesn't have all the platform's features, including tools like bill reminders and fee analyzer. But it's a convenient way to view your financial information from anywhere.

How It Compares

There are many digital budgeting apps on the market today. So how does Empower stack up against the rest?

Empower vs Betterment

Betterment: Better for new investors with less capital

Empower: Better for high wealthier investors

Betterment is one of the most popular robo-advisors. Plus, there is no account minimum balance. You can use it even if you have just $5 to invest.

The annual fee for the basic service is just 0.25% for balances of $20,000 or more, or if you set up recurring monthly deposits totaling $250 or more. Those with less than $20,000 will be charged a $4 monthly fee so beginners may feel more comfortable with that.[6]

However, because of the low fee, Betterment is truly just a robo-advisor. The software invests for you based on your age, financial goals, and risk tolerance. You don't get any kind of real human financial advisor. So you are completely trusting a computer to design your investment portfolio.

If you have $100,000 or more, you have the option to upgrade to the Premium service. You get unlimited access to certified financial planners. They can provide financial guidance on your other investments outside of Betterment and on big life events.

Betterment does not have such advanced tools. But remember, you can still use Empower's tools for free. So if you're a newbie investor, you can certainly use Betterment's cheaper service plus Empower's tools.

Empower | Betterment | |

|---|---|---|

| Annual Fee | Investment Account: $0; Wealth Management:0.89% for first $1 million, 0.79% for first $3 million, next $2 million 0.69%, next $5 million, 0.59%, and 0.49% over $10 million |

|

| Minimum Investment | Investment Account: $0; Wealth Management: $100,000 | |

| Human Advisors | ||

| IRA Accounts | ||

| Tax Loss Harvesting | ||

| Assets Under Management | ||

| Mobile App | ||

| Visit Site | Learn More | |

Empower: Pricing information from published website as of 04/30/2020 Betterment: Pricing information from published website as of 11/22/2025 | ||

Empower vs Quicken

Quicken: Better for business managers

Empower: Better for everyone else

Quicken is one of the first-ever money management software (it came out in the 1980s). It provides a very comprehensive set of personal finance tools.

However, almost nothing from Quicken is free. You must pay an annual subscription to use it. Read our detailed comparison of Quicken vs Empower for more information.

Quicken's Starter program offers barebones budgeting and expense tracking. The Deluxe program lets you set up savings goals, customize your budget, and start working to reduce debt. The Premier program has services like:

- Bill pay

- Investment tracking

- Market comparisons

- Built-in tax reports

For the average investor without business managing needs, Empower Personal Dashboard app is more than enough.

Empower vs Robinhood

Robinhood: Better for DIY investors

Empower: Better for hands-off investors

Robinhood is not a robo-advisor—it's a trading app. The platform offers commission-free trades for stocks, options, and ETFs with zero commissions. But unlike with Empower's hands-off approach, you'll be responsible for selecting investments and trading yourself.

Robinhood is a basic online brokerage that offers individual taxable accounts and retirement accounts. There's no account minimum, compared to Empower's which has a $100,000 minimum to invest.

Its basic platform lacks research and tools, so you need to be comfortable researching yourself. If you aren't, you may be better paying a small fee to use a robo-advisor like Empower.

Hear from an Expert

CreditDonkey asked Andrew MacDonald from the University of San Diego for his expert advice on what the average person should look for in a budgeting app.

Here's what he had to say:

FAQ

Is Empower safe to link accounts?

It is safe to link your financial accounts to Empower. It uses military-grade 256-bit AES encryption to hide your data. Plus, your credentials are not stored in Empower's own database.

Read more in detail about how Empower's security works and what happens if your account gets hacked.

What's Empower age requirement?

To use Empower, you must be of legal age where you're located. This is typically 18 years old or older, depending on your jurisdiction.

Is Empower a fiduciary?

Yes, Empower is a fiduciary. They are a Registered Investment Advisor (RIA) regulated by the Securities and Exchange Commission. This means Empower is legally obligated to act in your best interest.

Can I import Quicken data into Empower?

No, Empower does not allow you to import Quicken data. Instead, you link all your bank and investment accounts and Empower will collect all the information for you automatically.

How does Empower make money?

Empower makes money from their wealth management service, which has a tiered annual fee starting at 0.89% of assets under management. This service is available to clients with at least $100,000 to invest.

Bottom Line

You can use Empower's money management tools at no cost. These are some of the most advanced tools on the market. It doesn't hurt to sign up for a free account to get a handle on your financial life.

The wealth management service is aimed for individuals with at least $100,000. The fees are much higher than other robo-advisors, but you do get personal service from financial advisors. If you have a lot to invest (as in millions), the fees get lower and it is a good value for the level of service.

References

- ^ Empower. Wealth Management: Our fee structure, Retrieved 09/01/2024

- ^ Empower. Wealth Management, Retrieved 09/01/2024

- ^ Empower. Wealth management tiers, Retrieved 09/01/2024

- ^ Empower. Empower Personal Cash, Retrieved 09/01/2024

- ^ Empower. Empower Personal Dashboard Terms of Use (Financial account aggregation), Retrieved 09/01/2024

- ^ Betterment. Pricing, Retrieved 09/01/2024

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Charles Tran is the founder of CreditDonkey, a personal finance comparison and reviews website. Write to Charles Tran at charles@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Empower Personal Wealth, LLC (“EPW”) compensates CREDITDONKEY INC for new leads. CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

|

|

| ||||||

|

|

|

Compare: