Robinhood Alternatives: Better Platforms to Use Instead

Robinhood is one of the top stock trading apps in the US, but it might not be for you. If you're looking for another broker to try, read on.

|

Here are the top 8 alternatives to Robinhood:

Robinhood changed the trading game with its easy-to-use platform, zero commissions, and no minimums.

But Robinhood may not be the best platform if you:

- Prefer better research tools

- Want to invest in mutual funds or bonds

- Feel skeptical due to their issues

You may find a better fit by checking out its alternatives. Read on.

J.P. Morgan Self-Directed Investing - Get Up to $700

- Get up to $700 when you open and fund a J.P. Morgan Self-Directed Investing account with qualifying new money.

- $700 when you fund with $250,000 or more

- $325 when you fund with $100,000-$249,999

- $150 when you fund with $25,000-$99,999

- $50 when you fund with $5,000-$24,999

- Get unlimited commission-free online stock, ETF, fixed income, and options trades when you open an account.

- $0 Online Commission trades

- Choose an account that's right for you: General Investing, Traditional IRA or Roth IRA.

- Access our secure, easy-to-use trading experience online or through the Chase Mobile® app.

- Our powerful tools and resources are built to help you take control of your investments.

INVESTMENT AND INSURANCE PRODUCTS ARE:

Transfer and Earn Up to $5,000 Bonus

Enroll your new eligible TradeStation account in this offer either by using promo code BDEVAGFG on your new account application or by requesting to enroll, via telephone, with a TradeStation Representative. Within 45 days of account enrollment, fund your account with at least $500. Maintain at least $500 in your account for 270 calendar days. New assets will be aggregated during the 45-calendar day period following the enrollment date to determine the amount of your cash offer.

| New Assets | Cash Bonus |

|---|---|

| $500 - $24,999 | $50 |

| $25,000 – $99,999 | $250 |

| $100,000 – $199,999 | $400 |

| $200,000 – $999,999 | $800 |

| $1,000,000 – 1,999,999 | $3,000 |

| $2,000,000+ | $5,000 |

Top 8 Robinhood Alternatives

|

These 8 platforms allow you to invest in the stock market or trade crypto just like Robinhood.

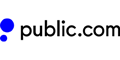

Webull: Best Analytical Tools

|

| Screenshot of Webull |

Webull is considered a major competitor to Robinhood. Like Robinhood, it offers stock trading with a user-friendly interface, zero commission, and no minimums.

However, Webull gives you more investment options than Robinhood. You can trade futures, short stocks, invest in commodities, and even use robo-advisors. It also offers more order types, giving you extra flexibility when trading.

Despite its easy-to-use platform, Webull has extensive research and analytical tools that could help you analyze your trade more.

Lastly, Webull offers paper trading, while Robinhood doesn't. If you want to practice with a demo account before going live, Webull has you covered.

Pros + Cons

|

|

Fund and Get 2% Match Bonus

Enroll in this offer and complete one or more qualifying deposits of $2,000 or more into your Webull account. Maintain the funds in your account until the payment date of the final installment of the match bonus. The 2% match bonus will be automatically credited to your eligible Webull account in 12 equal monthly installments.

Moomoo: Best for International Stocks

Moomoo is another zero-commission stock broker, but its unique feature is its access to the China A-Shares, Singapore, Hong Kong, and Australian markets.

In addition to the ADRs, you'll get direct access to these international markets through Moomoo. For example, you could buy shares of Pop Mart, the company that sells collectible toys, even though it's listed on the Hong Kong Exchange.

Moomoo's user interface is slightly more advanced than Robinhood's, but it offers better research tools if you want to analyze your trades more. You can also use the paper trading account to test trades.

However, Moomoo does not offer IRAs, unlike Robinhood. So, if you're investing for retirement, it might be better to look into other brokers like Webull.

Pros + Cons

|

|

Deposit $50,000, get $1,000 in NVDA stock + 8.1% APY on uninvested cash

Terms and conditions apply

TradeStation: Best for Experienced Traders

Consider TradeStation if you want more control over your trades. While Robinhood is a good trading app, sometimes its features can be too limited for experienced traders.

You can backtest your trading system at TradeStation with its extensive historical data. It also has its own programming language, EasyLanguage, allowing you to automate your trades.

That said, TradeStation's user interface can be quite complex for beginners. This broker is a better fit for experienced investors who prefer to customize their trading experience.

Like Robinhood, it offers zero-commission stocks, ETFs, and options. It also offers futures trading.

Pros + Cons

|

|

Transfer and Earn Up to $5,000 Bonus

Enroll your new eligible TradeStation account in this offer either by using promo code BDEVAGFG on your new account application or by requesting to enroll, via telephone, with a TradeStation Representative. Within 45 days of account enrollment, fund your account with at least $500. Maintain at least $500 in your account for 270 calendar days. New assets will be aggregated during the 45-calendar day period following the enrollment date to determine the amount of your cash offer.

| New Assets | Cash Bonus |

|---|---|

| $500 - $24,999 | $50 |

| $25,000 – $99,999 | $250 |

| $100,000 – $199,999 | $400 |

| $200,000 – $999,999 | $800 |

| $1,000,000 – 1,999,999 | $3,000 |

| $2,000,000+ | $5,000 |

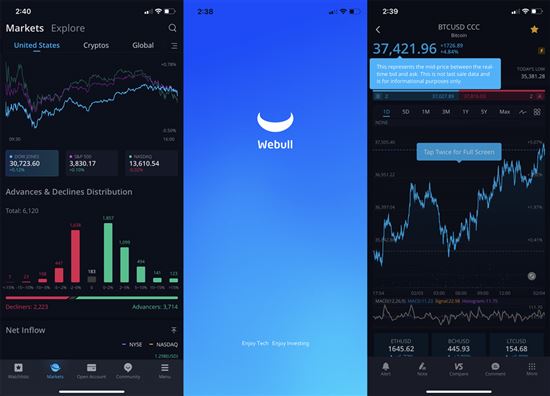

Coinbase: Best for Crypto

|

| Screenshot of Coinbase |

If you're interested in trading crypto rather than stocks, you might want to look at Coinbase. While Robinhood does offer a limited range of cryptocurrencies (49, at the time of writing), crypto is what Coinbase is known for. They offer over 18,300 coins to buy sell and trade, with more added regularly.

New investors will find Coinbase just as easy to use as Robinhood, and in fact, their interfaces are quite similar. Coinbase is known for being one of the easiest places to start trading crypto.

In addition to their crypto exchange, Coinbase has partnered with Visa to offer a crypto rewards card that will get users crypto back on purchases.

The Coinbase Wallet offers users a safe place to store their crypto as well. However, keep in mind that Coinbase's fees are quite high.

Pros + Cons

|

|

Acorns: Best for Young Investors

|

| Screenshot of Acorns |

Acorns is an app that aims to make it easy for you to save and invest by rounding up the spare change on your purchases.

They offer portfolios designed by experts that automatically adjust to keep your investments on track. These portfolios are made up of securities and ETFs, but you also have the option to add some securities that you want.

That said, this means that Acorns is not your typical stock broker, where you can select individual stocks for investment.

Acorns charges a monthly fee before you can use its service. Check the table below to know the fees for each type of account:

- Acorns Bronze ($3/mo) - includes personal taxable account, IRA, and checking account

- Acorns Silver ($6/mo) - includes everything in Bronze, emergency fund, 25% match on rewards, and 1% IRA match on Acorns Later contributions

- Acorns Gold ($12/mo) - includes everything in Silver, investment accounts for kids, 50% match on rewards, custom portfolio, Trust & Will, $10K Life Insurance, free Acorns Early account, and 3% IRA match on Acorns Later contributions

Pros + Cons

|

|

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

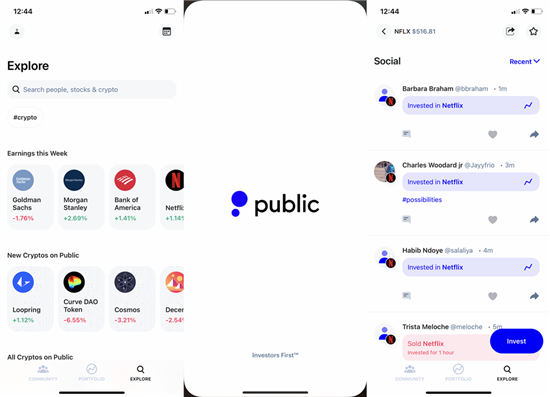

Public: Best for Fractional Shares

|

| Screenshot of Public |

New York-based Public is an investing social network. Their goal is to make investing accessible by promoting financial literacy and offering fractional shares of expensive stocks. Like Robinhood, they focus on the trading of stocks and ETFs.

Public is free to download and commission-free as well. At Public, you can see what others are trading in its community.

Users can also follow curated themes. These are groups of stocks that support a central industry or sector. Examples include Artificial Intelligence, Most Popular Stocks, and Spot Bitcoin ETFs.

For investors who are wary of Robinhood because of payment-for-order-flow (PFOF), Public might be a good alternative. It's one of the zero-commission brokers that do not use PFOF for execution.

Pros + Cons

|

|

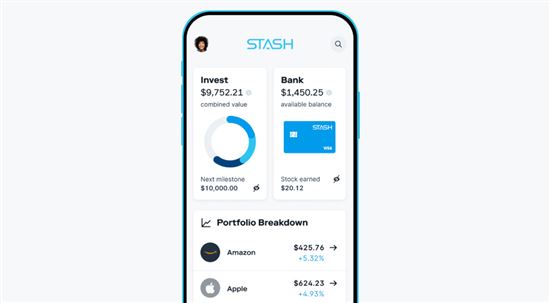

Stash: Best for Investment Guidance

|

| COURTESY OF STASH |

Stash is a micro-investing app geared toward beginners to the world of investing. While they aren't a robo-advisor, they do offer a lot of guidance to those who are still finding their feet when it comes to choosing what to invest in.

They offer stocks and ETFs, which they've organized by risk to help you pick the investments that suit your goals and personality, whether you're a conservative or ambitious trader.

They offer traditional and Roth IRA accounts for those interested in saving for retirement as well.

Their accounts come with monthly fees. If you're only investing small amounts, be careful not to let the fees eat up all your earnings.

- STASH Growth ($3/mo)

- STASH+ ($12/mo)

Pros + Cons

|

|

Stash: Sign Up and Get $5

- Sign up, add at least $5 to your account and get a $5 bonus.

- Invest with fractional shares

- Get portfolio recommendations

IBKR: Best for Mutual Funds

One of the things missing in Robinhood's platforms is mutual funds. If you want to invest in these products, check out the mutual fund marketplace at Interactive Brokers (IBKR).

IBKR's Mutual Fund marketplace offers over 48,000 funds, with 18,000 of them having no transaction fees.

This marketplace includes mutual funds from notable institutions like Allianz, American Funds, BlackRock, Fidelity, Franklin Templeton, Invesco, MFS, PIMCO, Vanguard, and many others.

However, one downside is that IBKR's platform is really quite complex. Beginners might require a bit of a learning curve just to buy mutual funds.

Pros + Cons

|

|

More Robinhood Alternatives to Try Out

Fidelity

Fidelity is another well-known broker that has something to offer for beginners and experts alike. With in-depth research tools as well as articles and videos to get you started, every trader will find something that works for them.

Traders can invest in stocks, mutual funds, ETFs, bonds, and CDs, and open IRA accounts, 529 college savings accounts, or cash management accounts. Normal trades are commission-free.

E*Trade

E*Trade is a popular online brokerage that caters to low-frequency traders and beginners, offering helpful guidance and even access to investing professionals for advice. They offer a wide range of investments like stocks, bonds, ETFs, and mutual funds.

Traders can also open checking accounts and IRAs, or apply for a mortgage through E*Trade.

Binance

For those looking to trade a wide range of cryptocurrencies at low fees, Binance has a lot to offer. Consistently one of the biggest cryptocurrency exchanges by volume, Binance is available all over the world, with Binance.US for residents of the United States.

What is Robinhood?

Robinhood is a 100% commission-free investing app. There are no account or trade minimums, so you can start investing with as little as $1.

Robinhood lets US investors trade stocks listed on the Nasdaq and New York Stock Exchange. Or you can trade a range of popular stocks from international exchanges. You can also invest in ETFs, options, and cryptocurrencies.

For $5 a month, you can sign up for Robinhood Gold. It gives you instant access to larger deposits (from $5,000 to $50,000). You can see ~1,700 stock reports from Morningstar and access Level II Market Data.

Many new investors will love Robinhood's simple and easy-to-use interface. But they're no longer the only fee-free investing app. Most apps now offer this. So depending on your priorities, you may find a better alternative.

According to their CEO, this was due to insufficient capital to process all the trades being ordered. Since then, they have been subject to investigation by the SEC, a lawsuit filed in the Southern District of New York, potential investigations by the New York and Texas attorneys general, and at least one class-action lawsuit.

Why Robinhood May Not Be for You

While Robinhood has some things going for it, several factors make it a poor choice for some investors. Here's why Robinhood may not be right for you.

- Limited research and tools: While Robinhood lets you create watchlists and view real-market data, that's really about it. Many online brokerages offer a wealth of research, data, and advanced investing tools to help investors succeed.

- Candlestick charting options: Robinhood's candlestick charting options are limited at best. You cannot adjust the candle period to minutes or hours. Without this essential trading feature, you could be at a disadvantage.

- Limited educational resources: Newcomers and young investors are Robinhood's target audience, yet it lacks the vast educational resources you'd find at other online brokerages. Robinhood Learn offers articles covering basic topics like, "What Is a Portfolio?" But Webull has step-by-step courses to walk you through financial concepts like IPO Basics.

- No mutual funds or bonds: Mutual funds offer diversification, while bonds offer low-risk, predictable returns. If you're hoping to invest in either of those, you'll have to look at other online trading platforms.

- Poor customer service: If you want speedy customer service, Robinhood won't be a good fit. The app is known for long customer wait times and has struggled with lawsuits and regulatory inquiries.

What to Look for in a Robinhood Alternative

There are plenty of excellent alternatives to Robinhood, but they're not all the same. Below, check out the important factors to look for when choosing your next platform.

- Fees: Luckily, many trading apps are free. But some make you pay per trade, or charge a yearly or monthly fee. Review the fees to see if an app makes sense for your trading behaviors and portfolio.

- Variety of offerings: Not all investing apps offer every type of trade or account type. Make sure the app supports what you're looking for, be it mutual funds, IRAs, bonds, or others. For instance, an app like Webull lets you invest in Rollover, Roth, and Traditional IRAs.

- Accessibility: Some apps work on both iOS and Android devices, and others are best suited for desktops. Be sure to look for compatibility with your preferred device before downloading an app.

- Research and tools: This is important if you count on research to make informed decisions. Many online brokerage accounts offer in-depth company research and market analysis, while Robinhood is more bare-bones.

- Automated investing: Apps with robo-advisors offer investment guidance at lower fees than those with human advisors. Investors who are saving for a financial milestone, like a new home, can use this feature to optimize their returns with a minimal time investment.

Bottom Line

If you think that Robinhood isn't the place you want to be trading, don't worry. There are plenty of platforms offering comparable services for retail investors.

It doesn't matter if you want to buy stocks and bonds, crypto or ETFs, invest in a mutual fund, or save for retirement with an IRA.

Whether you want an easy app or desktop access, helpful guides or friendly advice, analytical tools or just to take your hands off the wheel and let someone else decide, there's an investment platform that's right for you.

Fund and Get 2% Match Bonus

Enroll in this offer and complete one or more qualifying deposits of $2,000 or more into your Webull account. Maintain the funds in your account until the payment date of the final installment of the match bonus. The 2% match bonus will be automatically credited to your eligible Webull account in 12 equal monthly installments.

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

Jeremy Harshman is a creative assistant at CreditDonkey, a personal finance comparison and reviews website. Write to Jeremy Harshman at jeremy.harshman@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: