9 Great Online Budgeting Tools You'll Love

Looking for the best online tools to budget? See how apps like Mint, YNAB, Empower and more compare.

|

Having a solid budget is the first step to a healthy financial life. It can help you keep spending in check, save more, and reach your goals faster.

Luckily, you don't have to mess around with spreadsheets. There are many budgeting tools and apps to help you create a budget and stick to it. And most of them are even free.

If you're ready to take control of your financial future, check out these budgeting apps.

Here are the 9 best online budgeting tools to help you manage your money:

- Mint for Free Budgeting App

- YNAB for Monthly Budgeting

- Empower for Long-Term Goals

- Clarity Money for Habit Tracking

- EveryDollar for Beginners

- PocketGuard to Track Spending

- Buxfer for Forecasting Budgets

- MoneyStrands for Calendar-Based Budgeting

- Wally for Traveling

Plus, learn about the 50/30/20 rule, how to pay off debt, and tips to actually stick to a budget down below.

What are online budgeting tools?

Online budgeting tools are apps and software that help people manage their finances and budget. Many of these tools are free; others charge a subscription fee for advanced features.

Having powerful budgeting tools on your phone or laptop can reduce the busy work that prevents many people from creating a budget.

You can connect most of them to your bank account, and they will automatically track your expenses and let you know if you're on track.

Why Use Budget Tools?

Budgeting tools help you stay on top of your finances and save money. Some features could include:

- Track spending on your debit and credit cards

- See how and where you are spending your money

- Create savings goals and track progress

- Alerts for low balance on bank accounts

- Track investments

Budgeting tools can help you crush your money goals. Plus, many tools even help monitor your credit score as well.

Best Online Budgeting Tools and Apps

|

Take a look at some of the best budgeting apps available for nailing down your personal finance situation.

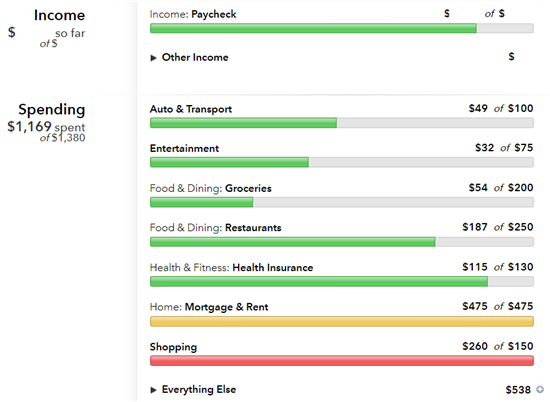

Mint: Best Free Budgeting App

Mint is one of the most popular online budgeting tools. It was the first app to automatically sync your financial accounts all in one place for a well-rounded picture of your finances.

You start by linking all your bank accounts and credit cards to the app. Mint then tracks all your transactions and automatically categorizes them.

You can make your own budget and assign a monthly limit to each category. Mint will track your spending in real time. You can see how much you've spent in each category.

|

| Screenshot of Mint |

Other features include:

- Set goals and track your savings progress

- Debt payoff planner

- Bill reminders

- Investment tracking

- Free credit score and monitoring from TransUnion

- Custom alerts on your accounts

Overall, Mint is a good budgeting app for day-to-day money management. It keeps track of your spending, but it doesn't teach you how to budget.

Pros:

- Completely free

- Connects all your bank, investment, and credit card accounts

- Transactions are automatically tracked and categorized

Cons:

- Expenses often assigned to the wrong category

- Won't link to all financial accounts

- Ad experience could be better

Cost: Completely free

YNAB: Best for Planning a Monthly Budget

You Need a Budget (YNAB) focuses on the "forward-looking" approach to budgeting. Unlike Mint, it doesn't just give you a report card of your expenses. It forces you to plan for your entire month of expenses ahead of time.

|

| Screenshot of You Need A Budget |

It helps you gain control of your money with these four rules:

- Give every dollar a job: Decide how to divide up your paycheck before you spend it. Create a budget for each category and stick to it.

- Plan for big expenses: Create goals to fund large one-time expenses throughout the year. This way, when it comes, you already saved for it and it won't break the bank.

- Adjust as needed: If you accidentally overspend, no biggie. Just move over some money from another category.

- Live on old money: Eventually, you will live on money you already have, as opposed to budgeting based on future income. This is the ultimate goal.

YNAB members also get access to 100+ free, live online workshops every week. They range in topics from creating a debt payoff plan to how to save on groceries. You get to ask questions and interact with the expert teacher.

Pros:

- Can link all your accounts

- Real-time information on any of your devices

- Live customer support and educational webinars

Cons:

- Less automated functionality

- Won't track your investments

Cost:

$14.99 per month or $99 per year (after 34-day free trial). It's best for more committed budgeters looking to stop living from paycheck-to-paycheck.[1]

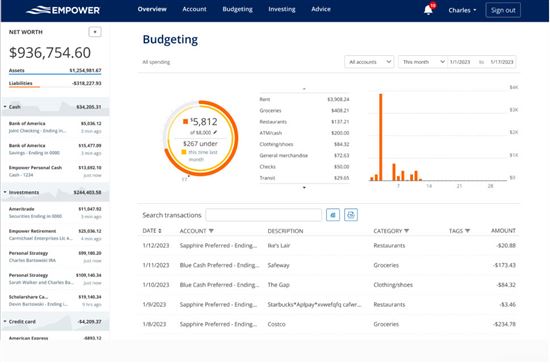

Empower: Best for Long-Term Wealth Tracking

Empower offers some of the best free money management tools. You link all your accounts to see your overall net worth, cash flow, investment portfolios, and more.

|

| credit empower |

Though Empower does offer budgeting, it's more basic. You can set an overall budget for the month and it'll track how much you've spent so far. Unlike Mint, you can't assign a budget to each spending category.

|

| credit empower |

Empower is better for long-term financial planning. Their main focus is on investment tracking and retirement planning. It'll analyze your investment strategy and give personalized advice on how you can adjust to better reach your goals.

Other features include:

- Tells you how much uninvested cash you have sitting around

- Analyzes hidden fees within your investments

- Advanced retirement calculator

- Education planner

Pros:

- Completely free

- Connects all your bank, investment, and credit card accounts

- Advanced investing tools like a retirement planner and fee analyzer

Cons:

- Won't link to all financial accounts

- Wealth management upsells can be annoying

Cost: Free for financial tool.

Clarity Money: Create Better Money Habits

Clarity Money is a completely free budget manager from Marcus by Goldman Sachs.

Do you know where your money goes each month? Clarity Money helps you understand your spending habits, so you can make smarter financial decisions.

It does that through these features:

- See how much money you have left to spend each month

- Track how much you spend at your favorite restaurants and retailers

- Get notifications of budget updates

- Identify subscriptions you may have forgotten about

- Organize your monthly bills

You can link accounts from hundreds of financial institutions to automatically track your expenses. Clarity Money will calculate your average weekly spending to help you create a budget goal.

As a bonus, it also offers credit score monitoring with free monthly updates.

Pros:

- Completely free

- Connects all your bank, investment, and credit card accounts

- Will cancel unused subscriptions for you

Cons:

- Won't link to all financial accounts

- Harder to customize than other apps

Cost: Completely free

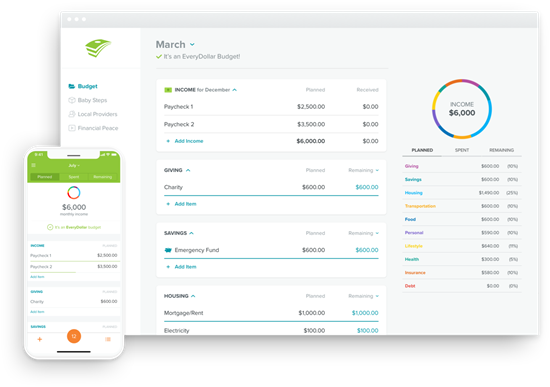

EveryDollar: Dave Ramsey's 7 Baby Steps

EveryDollar is the budgeting app created by celebrity money expert Dave Ramsey. It follows the guidelines of his signature "7 Baby Steps" to financial success.

|

| Credit: Everydollar |

This budgeting app is based on the zero-sum budgeting system. Similar to YNAB, you're required to assign every dollar a "job," whether that's for expenses, savings, or debt payoff.

What makes EveryDollar unique is that it incorporates the Baby Steps program. The app helps you figure out where you are in the steps. If you have leftover money, it guides you to apply it towards the next step.

Once one step is completed, you move on to the next. The steps are:

- Save $1,000 for an emergency fund

- Use the debt snowball method to pay off debt

- Save up to six months of expenses in an emergency fund

- Invest 15% of your income for retirement

- Save for your child's college fund

- Pay off your mortgage

- Build wealth and give to charity

If you're not really sure where to start your financial journey, Ramsey's Baby Steps may just be the direction you need.

Pros:

- Syncs with multiple users

- Can split a transaction into two categories

Cons:

- Must pay to track your transactions automatically

- Won't track your investments

Cost:

EveryDollar is free, but the free version is limited to just budgeting. You have to enter transactions manually.

There is also a paid version for $129.99/year that offers automatic account syncing. It also includes auto bank syncing, Baby Steps, and unlimited money lessons.[2]

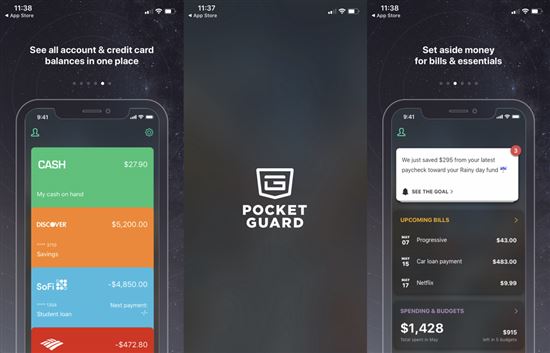

PocketGuard: Know Your Leftover Pocket Money

PocketGuard helps you manage your budget better by telling you how much you actually have to spend. Link up all your accounts and it calculates how much disposable money you have left after your budgets, bills, and savings goals.

|

| screenshot of pocketguard |

This way, you know how much you have left "in your pocket" and can avoid overspending.

Another cool feature is that it helps you save more by negotiating better rates on your cable, cell phone, and other bills

Pros:

- In My Pocket feature shows how much cash you have on hand

- A.I. algorithm offers tips to save money

- Easy-to-use goal tracking helps you see if you're on track

Cons:

- Must pay to access all categories and goals

- Ads are shown even with a paid subscription

Cost:

The basic version is free. PocketGuard Plus costs $7.99/month, $34.99/year, or $79.99 one-time lifetime purchase,[3] and allows you to create your own categories, set up multiple goals, and manually add cash spending/earnings.

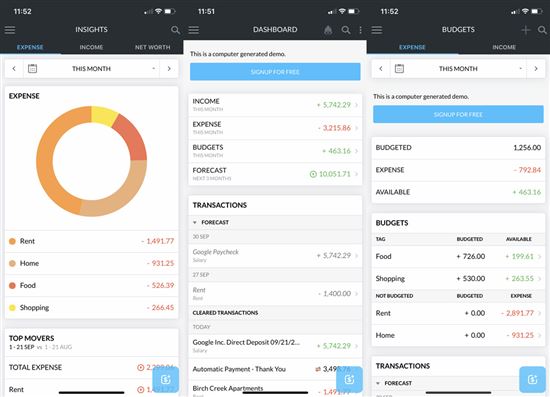

Buxfer: Best for Forecasting Budgets

Buxfer's main focus is helping you plan by giving you previews into your future.

|

| Screenshot of Buxfer |

You can set weekly, monthly, and yearly budget limits on spending categories. This helps you not only plan month-to-month but to plan ahead as well.

One really cool feature is that it forecasts your future net worth and cash flow, based on your earnings and past spending. This is useful to help you plan near-future expenses.

Buxfer also alerts you to future situations ahead of time. For example, it can predict that your checking account will go negative next week after a bill payment. This allows you to transfer over funds to avoid overdrafts.

Other features include:

- Bill reminders

- Investment tracking

- Retirement and education planning

- Track shared expenses with other people

- Track accounts in other currencies

Pros:

- Connects all your bank, investment, and credit card accounts

- Colorful charts and graphs to track your budget

- More customization than most apps

Cons:

- Must pay for advanced features

- Interface takes time to learn

Cost:

Free for the basic account, which only supports manual inputs. For automatic syncing and more features, plans range from $4.99 - $11.99 monthly.[4]

MoneyStrands: Calendar-Based Budgeting

MoneyStrands is a free easy-to-use budgeting app. Like other apps, you link your financial accounts to see everything in one place.

The app has several facets:

- Budgeting: Create a custom budget and track your spending in each category.

- Calendar: See your upcoming income and expenses in a calendar view. This is helpful for planning ahead for future expenses.

- Savings Goals: Create savings goals and track your progress for each goal.

- Community: Interact with other MoneyStrands users and compare budgets and habits.

MoneyStrands even predicts your budget and forecasts any potential low spots of cash in the future. It can measure your cash flow for the future and predict how much money you can spend both now and in the coming months.

Pros:

- Completely free

- Best looking charts and graphs to track your budget

- Can compare finances with other users

Cons:

- Can only link U.S. banks

- No desktop version

Cost: Completely free

Wally: Wide Global Network

Wally's main focus is on expense tracking and budgeting. Like other apps, you can set budgets by category and it'll keep track of your leftover money.

Wally can track over 200 foreign currencies and you can link to banks in 70 countries. This makes Wally a great choice for frequent travelers and expats.

Other features include:

- See 2 years of insights on your spending patterns

- Take and upload photos of receipts and bills

- Financial calendar of your past and upcoming transactions

- See upcoming expenses with bill reminders and shopping lists

- Create private groups to sync and track joint accounts with family or housemates

Pros:

- Connects all your bank, investment, and credit card accounts

- Automatically scans 2 years of past financial data

- Free version has enough features for most users

Cons:

- Must input some data manually

- No desktop version

Cost: Basic version is free and includes account syncing. You can pay for specific advanced features (such as Currency Converter) for an extra $5.99-$9.99/year. Or get all features for $24.99/year with Wally Gold membership.[5]

Other Budgeting Apps

Here are some other budgeting apps to check out:

GoodBudget

GoodBudget allows for multiple users, so it's good if you share a budget with a partner. The free basic version only allows one account. The premium version is $8 per month or $70 a year and allows for unlimited synced accounts.[6]

BudgetSimple

BudgetSimple is a more basic web-based budgeting software. Its main goal is to help you get you out of debt and build savings.

It'll help you create a budget plan that makes sense for you, so you can actually stick to it. It'll also give suggestions on where you can cut down spending or save more.

Lunch Money

Lunch Money is a simple web app that streamlines all your accounts and spending. It even lets you track your crypto portfolio and has multi-currency support. If you travel a lot for work, this could be a great choice to keep your finances in check.

MoneyDance

MoneyDance is one of the only budgeting programs that stores data on your computer instead of in the cloud. It offers advanced financial tracking, including bill pay through the platform. It costs $65 once for lifetime access.[7]

CountAbout

CountAbout is a web-based software that allows you to import from Quicken or Mint. It's often thought of as a cloud-based alternative to Quicken, so it's better for using on-the-go. The basic plan is $9.99 per year.[8]

What Makes a Great Budgeting App?

|

There are so many budget apps available online, both free and paid. To find the best option for you, think about what features you need. Consider:

Budgeting Creation

What kind of budgeting does the app offer? Some apps only give you a report of your spending, while others force you to assign every dollar a job.

Auto Sync or Manual

Apps that allow you to link bank accounts will automatically sync transactions. Some other apps are manual entry only. This depends on what you prefer.

Goal Tracker

This feature is great for keeping track of your progress toward your goals. Some apps will help you set aside money every month toward your goals.

Debt Payoff

If you have debt, look for an app that helps you create a debt payoff plan.

Bill Management

If you have trouble keeping track of bills and payments, look for an app that sends bill reminders.

Alerts

Some apps will send alerts to your phone or email when your bank account balance reaches a certain level.

Credit Score Monitoring

Some apps come with credit score monitoring. This lets you keep an eye on your credit profile and any new/suspicious activities.

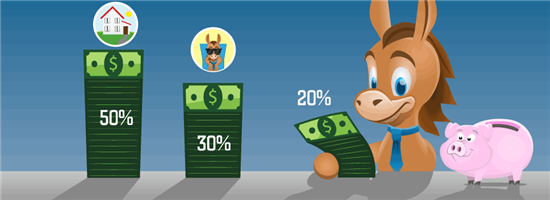

Simple Rule: 50/20/30 Budget

|

| © CreditDonkey |

So how do you start making a budget? The simplest rule-of-thumb is called the 50/20/30 rule. Here's how it works.

- 50% for needs: These are items that you absolutely have to have to survive, like rent, utilities, car costs, health insurance, and basic food.

- 30% for wants: This is your fun spending, like shopping, eating out, movies, Netflix subscription, etc.

- 20% for savings: This is for paying off debt and savings for retirement and other life goals (like buying a house).

To start, first calculate your after-tax income. This is your take-home income after automatic deductions for health insurance and retirement contributions.

Once you have that number, then you will split it up according to the 50/30/20 percentages.

This budgeting method can work for some people, but may not work for others who need stricter guidelines. For example, if you have a lot of debt, then allocate more to paying it off first.

How to Pay Down Debt

Some debts, like student loans, can be good since it's an investment that will increase in value over time. Others, like credit cards, don't help your financial situation at all.

No matter how much of each debt you have, you'll need to pay it back. There are two ways you can approach paying off debt. Choose one that you feel you can stick to in the long run.

Avalanche Method

This method tackles your highest-interest debt first. After paying the minimum on all your debts, any money you have left over goes to the debt with the highest interest rate. This method saves you the most money in the long term, since less of it is going to interest.

Snowball Method

This involves completely paying off your lowest balance debts first and working your way up. The key is to roll over your payments to the next debt each time you knock one out.

Psychologically, this keeps you motivated as you see progress with every debt you pay off.

Even after your debts are paid off, budgeting is an important life skill. But, it's not always easy. Find out clever ways to keep your financial health in check down below.

Tips to Actually Stick to Your Budget

|

Creating a budget is one thing. Actually sticking to it can be a whole different challenge.

The first rule to keep in mind? It's OK to mess up! Many people do. Keep pushing forward and you will get there, even if it seems difficult. Here are some smart ways to keep yourself on track:

Change Your Point of View

You're not cutting out pizza night every Friday, you're budgeting in one pizza night a month. It seems silly, but flipping the script helps keep you sane as you allow yourself some fun while spending less each month.

Learn to Cook 3 Yummy Meals

Cooking doesn't have to be complicated for it to be delicious. Look up 3 recipes for pasta, soups, or stews—anything that you can make in bulk and store in the freezer for later. If you have great food on hand, you'll be less inclined to spend on takeout.

Buy Secondhand

Thrift stores, Facebook Marketplace, and Craigslist sell just about anything you can think of. Whether you're in the market for clothes or electronics, check secondhand options first. You'll save money and help the environment too!

Rethink Wants vs. Needs

Let's be honest: You don't absolutely need a top-of-the-line laptop or new designer clothes. There is always a cheaper, high-quality alternative you can buy instead. Take that mindset to your everyday purchases too. Off-brand groceries will help you save.

Stick to Your Grocery List

Before you go shopping, make a list of what you actually need. At the store, buy only what's on your list. This will help you avoid making impulse purchases that sneakily drain your wallet.

What Experts Say

CreditDonkey asked a panel of industry experts to answer some of readers' most pressing questions. Here's what they had to say:

Bottom Line

If you're having trouble staying on top of your finances, a budgeting app can definitely help. It can help you cut down on cost, reduce debt, and reach your goals.

There are many free and paid budgeting tools. If you really need help with your finances, it may make sense to commit to a paid app that forces you to stick to a budget and savings goals.

Additional Resources

References

- ^ You Need a Budget Pricing, Retrieved 7/18/2022

- ^ EveryDollar Ramsey+, Retrieved 12/17/2020

- ^ App Store. PocketGuard Plus subscription lengths and prices, Retrieved 7/18/2022

- ^ Buxfer Pricing, Retrieved 7/18/2022

- ^ App Store. Wally, Retrieved 7/18/2022

- ^ Goodbudget Sign up, Retrieved 7/18/2022

- ^ Purchase Moneydance, Retrieved 12/17/2020

- ^ CountAbout Pricing, Retrieved 7/18/2022

Write to Samantha Tatro at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Empower Personal Wealth, LLC (“EPW”) compensates CREDITDONKEY INC for new leads. CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

|

|

|