Best Places to Buy Bitcoin: Safest for Beginners

Bitcoin has gone from a niche digital currency to an economic powerhouse. But how can a beginner get started? How high are the fees? Read on.

|

Are you tired of hearing how everyone's cashing in on Bitcoin and wanting to try it yourself?

If you've been watching the crypto hype grow, you may be wondering:

What's the best place to buy Bitcoin?

To pick the right platform, there's a lot to consider, including:

- Fees

- Security

- Privacy

- Liquidity

- Location

- And many more

In this guide, you'll discover the top platforms for buying Bitcoin. These are the best picks for crypto newbies, including how to reduce your fees and avoid getting hacked.

Let's dive in.

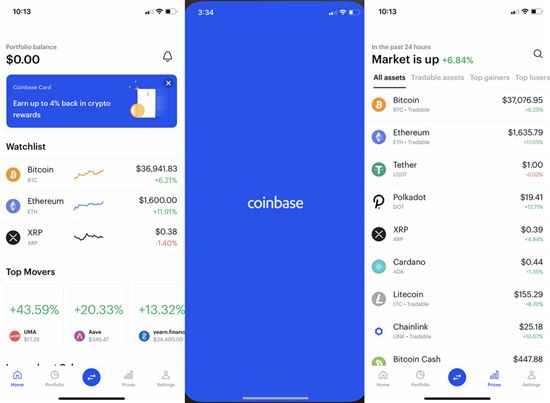

Best for Beginners: Coinbase

|

| Screenshot of Coinbase |

Pros:

- Easy-to-use

- Educational resources

- Earn free crypto

Cons:

- Higher fees than some exchanges

If you're just getting started trading crypto, Coinbase makes it easy. With a user-friendly interface and a range of educational offerings that will pay you to learn, there's a reason it's one of the most popular exchanges around.

Coinbase was founded in 2012 and is based in San Francisco. They started out offering the ability to buy and sell Bitcoin via bank transfers and have been growing ever since. Now they offer over 200 cryptocurrencies to buy, sell, and trade, with more added regularly:

- 0x

- 1inch

- Aave

- Amp

- Ampleforth Governance Token

- Ankr

- Augur

- Balancer

- Bancor Network Token

- Band Protocol

- Basic Attention Token

- Bitcoin

- Bitcoin Cash

- Cartesi

- Celo

- Chainlink

- Civic

- Compound

- Cosmos

- Curve DAO Token

- Dai

- district0x

- Dogecoin

- Enjin Coin

- Enzyme

- EOS

- Ethereum

- Ethereum Classic

- Filecoin

- Gitcoin

- iExec RLC

- Internet Computer

- Kyber Network

- Litecoin

- Loopring

- Maker

- Mirror Protocol

- NKN

- NuCypher

- Numeraire

- OMG Network

- Orchid

- Origin Token

- Polkadot

- Ren

- SKALE

- Stellar Lumens

- Storj

- SushiSwap

- Synthetix Network Token

- Tellor

- Tether

- Tezos

- The Graph

- UMA

- Uniswap

- USD Coin

- Wrapped Bitcoin

- yearn.finance

- Zcash

If you're interested in learning more about the world of crypto, you can earn crypto currencies like Amp, The Graph, and Stellar Lumens while you do it. Watch videos and take quizzes that usually take 1-3 minutes, and earn about a dollar a minute.

Coinbase isn't the cheapest exchange out there, but if you're looking for an easy on-ramp to crypto trading, it doesn't get much simpler.

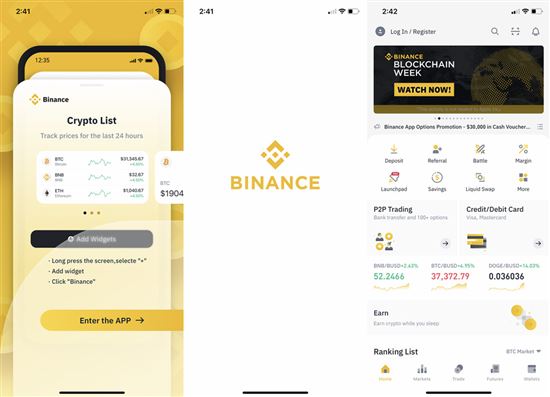

Best for Active Traders: Binance

|

| Screenshot of Binance |

Pros:

- Low fees

- Lots of coins

- High liquidity

Cons:

- Not available in 4 US states[2]

With some of the lowest fees in the industry and the highest liquidity of any of the spot exchanges by a fair margin, Binance is a likely choice for high-volume traders.

The variety of coins they offer is multiple times larger than most other exchanges, and they're available all over the world, so whether you're interested in Bitcoin or something a little more obscure, you can probably trade it there.

They boast an impressive list of over 350 cryptocurrencies internationally, and over 130 in the U.S.

- 0x

- Augur v2

- Band Protocol

- Basic Attention Token

- Bitcoin

- Bitcoin Cash

- BNB

- BUSD

- Chainlink

- Compound

- Cosmos

- DAI

- Dogecoin

- Elrond

- Enjin Coin

- EOS

- Ethereum

- Ethereum Classic

- Harmony

- Hedera Hashgraph

- Helium

- Horizen

- ICON

- KyberNetwork

- Litecoin

- Maker

- Matic Network

- MIOTA

- NANO

- NEO

- OMG Network

- Ontology

- Orchid

- PAX Gold

- QTUM

- Ravencoin

- Stellar Lumens

- Storj

- TetherUS

- Tezos

- Uniswap

- USD Coin

- VeChain

- VeThor Token

- Waves

- Zcash

- Zilliqa

According to CoinMarketCap, which monitors crypto trading, Binance had a 24-hour trading volume of over $76 billion at time of writing, and a Bitcoin liquidity score around 700 / 1000, making it one of the most liquid exchanges running.

In addition to their basic trading platform, Binance also offers free peer-to-peer trading, a trading widget compatible with the privacy-focused Brave internet browser, a range of savings, and more.

Binance

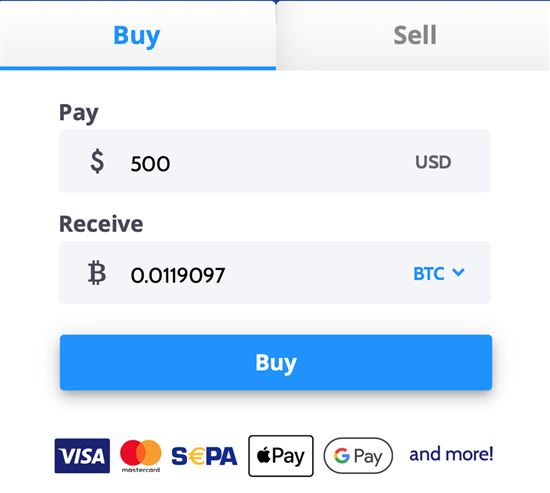

Best for Instant Purchases: Coinmama

|

| Screenshot of Coinmama |

Pros:

- Buy coins quickly with many options

- Easy-to-use

- Available in most countries

Cons:

- Higher fees than some exchanges

- Smaller range of coins

While Coinmama isn't the cheapest exchange on this list, if you're interested in making quick purchases of Bitcoin and other popular coins, it's not a bad place to look. They're a non-custodial exchange with a range of buying options, so your coins are always safe and in your own hands.

Compared to other platforms, the services that Coinmama offers are pretty bare-bones. It's desktop only, and they don't have any features other than their exchange, which currently offers 18 cryptocurrencies:[4]

- Aave, Bitcoin, Bitcoin Cash, Chainlink, Dogecoin, EOSIO (Not available in the UK), Ethereum, Ethereum Classic, Litecoin, Loopring, Numeraire, OMG Network, Ripple (Not available in the US or Canada), Uniswap, USDC, USDT, Wrapped Bitcoin (Not available in the UK), and Yearn Finance.

But their limited nature is part of their appeal. There's no getting lost or overwhelmed at Coinmama.

Once you've set up an account and verified your identity, it's as simple as clicking "Buy." Since they're a non-custodial exchange, your coins will be sent directly to your wallet within 10 minutes of purchase.

While the fees can be rather steep, they're available just about everywhere, and if you are looking for a no-frills experience, it's not a bad choice.

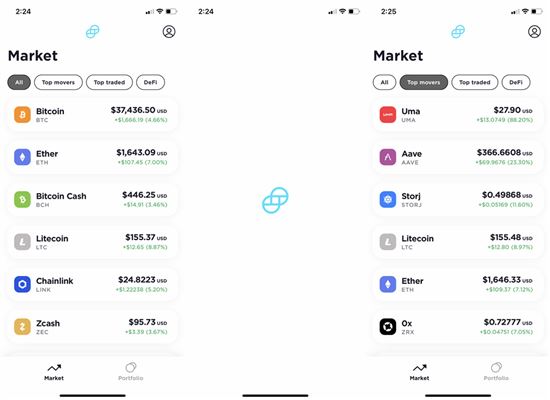

Best Security: Gemini

|

| Screenshot of Gemini |

Pros:

- Strong security

- Medium range of coins

- Easy-to-use

Cons:

- Higher fees than some exchanges

Gemini is a security-minded exchange with a moderate selection that includes most of the big names you've heard of, like Bitcoin and Ethereum. If you're worried about your crypto falling into the wrong hands, you'll be hard-pressed to find an exchange that's done more to prevent it than Gemini.

Gemini keeps most of their crypto holdings in cold storage—offline in air-gapped, geographically distributed facilities. What they do keep in hot wallets is insured and protected with an FIPS 140-2 Level 3 rating or higher.[5]

They've partnered with third-party vendors to protect against DDoS attacks, keep much of their internal site off the public internet, and employ strict internal controls over the transfer of crypto.

Gemini offers over 120 cryptocurrencies:[6]

- 0x

- 1inch

- Aave

- Amp

- Balancer

- Bancor Network

- Basic Attention Token

- Bitcoin

- Bitcoin Cash

- Chainlink

- Compound

- Curve

- Dai

- Enjin Coin

- Ethereum

- Filecoin

- Gemini Dollar

- Kyber Network

- Litecoin

- Loopring

- Maker

- Orchid

- PAX Gold

- Ren

- Skale

- Storj

- Synthetix

- The Graph

- The Sandbox

- Uma

- Uniswap

- Yearn.finance

- Zcash

User accounts are protected by multifactor authentication and address allowlisting. Account operations are rate-limited to prevent brute force attacks, and personal information is encrypted. They even offer a bug bounty to deter potential hackers.

While other platforms were trying to make crypto easier, or faster, or cheaper, Gemini was working to make it safe. And it appears to be working. Unlike several other major exchanges, Gemini has never been hacked.

Best for Altcoins: Crypto.com

Pros:

- Large range of coins

- Low fees

- Wide range of features

Cons:

- Fees aren't transparent

A solid all-around platform, Crypto.com supports a growing list of over 250 cryptocurrencies and stablecoins.

And that's on top their other impressive features:

- NFT marketplace

- Crypto-rewards Visa cards

- Custodial and non-custodial wallets

- Pay feature that allows you to spend your crypto at local merchants

Basically, there isn't much you can't do at Crypto.com.

The list of coins supported by Crypto.com is long, and it's growing.

- 0x

- 1inch

- Aave

- Aavegotchi

- aelf

- Amp

- Ampleforth Governance Token

- Ardor

- Ark

- Arweave

- Audius

- Avalanche

- Axie Infinity

- BakeryToken

- Balancer

- Bancor

- Band Protocol

- BigONE Token

- Binance Coin

- Binance USD

- Bitcoin

- Bitcoin Cash

- Bluzelle

- Casper

- Celer Network

- Chainlink Solana

- Chiliz

- Chromia

- Compound

- Compound Coin

- Contentos

- Cosmos

- Cronos

- Curve DAO Token

- Dai

- DIA

- DigiByte

- Dogecoin

- Ellipsis

- Elrond

- Enjin Coin

- Enzyme

- EOS

- Epanus

- Ethereum

- Ethereum Classic

- Everipedia

- Fantom

- Fetch.ai

- Filecoin

- Flow (Dapper Labs)

- Game.com

- Gas

- Gemini Dollar

- Gitcoin

- Golden Ratio Token

- Golem

- Harmony

- Helium

- Holo

- HUSD

- Hydro Protocol

- ICON

- iExec RLC

- Injective Protocol

- Internet Computer

- IOST

- IQ.cash

- IRISnet

- Kava

- Komodo

- Kusama

- Kyber Network Crystal Legacy

- Lisk

- Litecoin

- Livepeer

- Loopring

- Luna Coin

- Maker

- Nano

- NEAR Protocol

- Neo

- Nervos Network

- NKN

- NuCypher

- Numeraire

- Ocean Protocol

- OMG Network

- Ontology

- Ontology Gas

- Origin Protocol

- Pancake Swap

- PAX Gold

- Paxos Standard

- Polkadot

- Polkastarter

- Qtum

- Raiden Network Token

- Rally

- Rarible

- Ravencoin

- Ren

- Reserve Rights

- Ripple

- Shiba Token

- Siacoin

- SKALE Network

- SoMee.Social

- Stacks

- Stellar

- Storj

- Stox

- STRAX

- SushiSwap

- Synthetix Network

- Tellor

- Terra

- Tether

- Tezos

- The Graph

- The Sandbox

- THETA

- Theta Fuel

- THORChain

- TomoChain

- TrueUSD

- UMA

- UNICORN Token

- Uniswap

- Universe

- USDC

- VeChain

- Venus

- VeThor Token

- Waltonchain

- Waves

- Wrapped Bitcoin

- XSGD

- yearns.finance

- Zilliqa

In addition to its impressive variety of coins and features, Crypto.com charges reasonably low fees—not the lowest, but lower than many of the other popular exchanges.

Best for Social Trading: eToro

Pros:

- Social trading options

- Educatitonal resources

- Curated crypto portfolios

Cons:

- Limited coins

eToro is a popular exchange known best for their CopyTrading feature, which allows users to mimic the trades of other, successful investors automatically.

Public feeds and comments sections, trader ratings and risk scores, as well as a range of educational content and financial reports make eToro a viable option for those looking to learn more about crypto, or take their hands off the wheel entirely.

If investors aren't confident following a single individual, they can also take advantage of eToro's Smart Portfolios, curated sets of crypto coins from different sectors of the market. Some examples include their FuturePayments and CryptoEqual portfolios.

As for their supported coins, they offer a somewhat limited range drawn from the most popular:[9]

- Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Ethereum Classic, Iota, Stellar, EOS, NEO, Tron, ZCash, Tezos, Compound, Chainlink, Uniswap, Yearn.finance, Dogecoin, Aave

Where to Buy Bitcoin

Nowadays, you have plenty of options when it comes to where you can buy Bitcoin. But they usually just fall under these three categories:

- Crypto Exchanges

These are the main way you can buy Bitcoin and other crypto. A crypto exchange is great if you want to focus on cryptocurrency trading because they usually have other digital currencies besides Bitcoin. Some of the best cryptocurrency exchanges around are Coinbase and Binance.Custodial vs. Non-Custodial Crypto ExchangesA custodial or centralized exchange will hold your coins. A non-custodial or decentralized exchange requires you have your own crypto wallet, either online or offline, to store them.

- Trading Apps/Brokerages

Some trading platforms, like Robinhood and SoFi, have also started offering crypto to clients. These can be a good option if you also want to trade stocks, bonds, and other types of investments.

How to Choose a Trading Platform

| Transaction Fee | Minimum Deposit |

|---|---|

| 2.93% - 3.90% | $100 to Buy or Sell |

When trying to decide which trading platform to use, there are several factors you ought to keep in mind.

- Location

Trading is a highly regulated business. Laws vary by country and even by state, so not every platform will be available where you're located. - Security and Privacy

Security is always a major concern with any investment. Make sure to look for features like multifactor authentication, encryption, and insurance policies to cover your holdings. - Fees

Lowering your fees can guarantee you'll keep more of your returns. Ideally, you'd choose the trading platform with the lowest fees possible, but it can be difficult to understand cryptocurrency trading fees.The most common fees are transaction fees, usually a percentage of your trade. Spread fees are the difference between the buy and sell prices. These charges are often hidden, so looking for crypto trading platforms that are transparent about these fees can save you money.

- Features

Aside from the trading platform's tools, you'll want to consider what other features might appeal to you as a trader. - Speed

Different platforms require different amounts of time to execute trades, deposits, and withdrawals. If you think you'll need to do something in a hurry, make sure the one you choose is capable of it.

How to Buy Bitcoin

If you're buying Bitcoin for the first time, you may be wondering how it's done. Don't worry, in most cases, it's very simple if you just follow a few steps.

- Choose a trading platform and set up an account: Which platform is up to you, but rest assured, pretty much all of them carry Bitcoin.

- Get verified: Every platform is different, but most will require some sort of identity verification the first time you use them. You may need to give personal information, photograph IDs, and even photograph yourself to get started.

Some will also require that you set up two-factor authentication before you start trading. You can typically do this with a phone number or an app like Google Authenticator. Verification can take anywhere from a few minutes to several days to process, depending on the platform.

- Set up a payment method and fund your account: Most trades start with fiat currency, like USD or GBP. You'll start by connecting a bank account or making a wire transfe to deposit fiat currency into your account.

- Make your purchase: Once your account is funded, it should be a matter of choosing the currency you want—or trading pair, like BTC/USD, as some exchanges operate this way—and setting the amount. You can either buy it outright, or, if the exchange supports it, set a limit order, which will allow you to buy Bitcoin at a specific price when it reaches it, assuming the market cooperates.

Where to Store Bitcoin

You'll need a safe place to store your Bitcoin purchases and other digital assets. That's where crypto wallets come in.

Your wallet stores your private key, which you'll need to authorize crypto transactions.

If you need a Bitcoin wallet, there are several types you need to know about.

Hot Wallets

These are just crypto wallets connected to the internet. Software and custodial wallets are considered hot wallets.

- Software wallets: These are programs that store your private keys. They can be a browser extension, a desktop program, or a mobile app.

- Custodial wallets: These are built-in wallets in crypto exchanges. They allow you to buy, sell, and trade crypto directly on their platform. You won't have access to your private key with this type.

Cold Wallets

Cold wallets are just basically "offline" crypto wallets - they're not connected to the internet. Hardware wallets fall under this category.

- Hardware wallets: A hardware wallet is a physical device that stores your private keys. It can be a piece of paper or a USB flash drive. There are even special devices that act specifically as crypto wallets.

Should You Buy Bitcoin?

Ultimately it's up to the individual trader to decide whether they think any investment is a good one, including Bitcoin, but there are several points you can use to frame your decision.

First, crypto is very volatile. That means the price fluctuates wildly compared to other investments. After you buy it, the chance of increasing in price (and losing value) are extremely high.

In November 2021, Bitcoin was trading at an all-time high at over $60,000, before dropping to $35k in just a couple of months in January 2022. Since then it's continued its decline to less than $16k by November 2022.

As far as experts go, everyone has their own opinion on the viability of Bitcoin long term. But it's hard to say if these prices will go up and reach $100k per Bitcoin at some point, or if it'll stabilize at a lower range like $20k to $30k.

Ultimately, it's up to you to decide if it's a worthwhile investment.

Another factor to consider is the environmental impact of Bitcoin mining, which some say is too high. For one, Bitcoin mining is energy-intensive. And the high energy consumption adds to the world's carbon emissions - one of the key factors in climate change.

It may be that they'll find a way to solve the problem, or another, more environmentally-friendly cryptocurrency will grow in popularity.

Or you might simply choose to support something greener by putting your money there in the first place. In the end, it's up to you.

According to CNBC, most investors (around 76%) want cryptocurrencies to become more environmentally-friendly. The majority also stated they were willing to sacrifice their crypto investment's performance to achieve their ESG goals.

FAQs

- Where is the cheapest and safest place to buy Bitcoin?

Coinbase and Binance are good choices if you're buying Bitcoin because they're reputable platforms with advanced security measures.Binance is the best choice if you want the cheapest fees and a wider range of cryptocurrencies.

But Coinbase is better if you want to earn free crypto while learning more about the crypto market. But they have higher fees compared to other platforms.

- How much Bitcoin should a beginner buy?

Most investors agree that it shouldn't be more than 5% of your overall investment portfolio because of the high market risk. But some say it shouldn't be more than 10%. Ultimately, it depends on your investment goals and personal tolerance to risk. - What is the best way to buy Bitcoin?

Crypto exchanges are usually the best way to buy Bitcoin.Centralized crypto exchanges are the most beginner-friendly because they're easier to use. They also allow you to convert digital currencies into fiat and vice-versa.

Decentralized exchanges can be better for advanced traders because they offer better control and flexibility.

- Can I start Bitcoin with $10?

Yes, you can. Most exchanges set $10 as the minimum amount you can buy or trade Bitcoin for.

Bottom Line

Buying Bitcoin doesn't have to be hard, and plenty of popular exchanges are vying for your business. If you're ready to get started trading Bitcoin, you should now have the tools and the knowledge to do it. All that's left is to decide which exchange is right for you, and make it happen.

References

- ^ Coinbase Asset Directory, Retrieved 1/12/2022

- ^ Binance.US List of Unsupported States, Retrieved 12/9/2022

- ^ Binance List of Supported Assets, Retrieved 1/12/2022

- ^ Coinmama Cryptocurrencies, Retrieved 12/9/2022

- ^ Gemini Security, Retrieved 1/12/2022

- ^ Gemini. Cryptocurrency Prices, Retrieved 12/9/2022

- ^ What Cryptos are Supported on the Gemini Exchange?, Retrieved 1/12/2022

- ^ Crypto.com: Which Crypto Can I Buy in the Crypto.com App?, Retrieved 1/12/2022

- ^ Cryptocurrency on eToro, Retrieved 1/12/2022

Jeremy Harshman is a creative assistant at CreditDonkey, a crypto comparison and reviews website. Write to Jeremy Harshman at jeremy.harshman@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next: