How to Get Free Money

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Need extra cash? Discover how apps and websites (and even the government) can put free money in your pocket now.

|

| © CreditDonkey |

Think there's no such thing as free money?

You might be surprised.

$5 Signup Bonus

- Get paid to take surveys, play video games, watch videos

- Cash out to PayPal or gift cards

In this guide, you'll learn how to earn extra money with little to no effort. It could be from cutting fees, cashing in on hobbies, or getting free money from your employer.

How easy is that?

Don't miss this list of ideas for finding free money, including some unexpected hacks, sign-up bonuses, and more.

Here are the easiest ways to get free money quick:

- Robinhood: Get free stock worth between $5 and $200

- Ibotta: Earn cash back

- Find unclaimed money

- Trim: Save up to $100 on bills

- Cut out hidden service fees

- Swagbucks: Get $5 instantly

- Earn $$ with high-yield savings

- Cleo: Get $5 for referrals

- Score free money with 401(k) matching

- UserTesting: Earn $10 in 20 minutes

- HealthyWage: Lose lbs and win up to $10K

- Earn $20 for your junk mail

- Get $50 for registering your mobile device

- Gazelle: Earn $20 for referrals

- Foap: Earn up to $30 on photo "missions"

- Wrap your car for $100 per week

- Cash in with credit card rewards

- Get $20 per meal when dining out

- Earn $100 in clinical trials

- Cut down student debt by refinancing

- Earn up to $200 with a balance transfer card

Transfer and Earn Up to $5,000 Bonus

Enroll your new eligible TradeStation account in this offer either by using promo code BDEVAGFG on your new account application or by requesting to enroll, via telephone, with a TradeStation Representative. Within 45 days of account enrollment, fund your account with at least $500. Maintain at least $500 in your account for 270 calendar days. New assets will be aggregated during the 45-calendar day period following the enrollment date to determine the amount of your cash offer.

| New Assets | Cash Bonus |

|---|---|

| $500 - $24,999 | $50 |

| $25,000 – $99,999 | $250 |

| $100,000 – $199,999 | $400 |

| $200,000 – $999,999 | $800 |

| $1,000,000 – 1,999,999 | $3,000 |

| $2,000,000+ | $5,000 |

Check out these checking account promotions before it's too late:

- Bank of America Advantage Banking:

Up to $500 Cash Offer - HSBC Premier:

Earn Up to $3,500 - Wells Fargo Everyday Checking Account:

$325 Bonus - KeyBank:

Key Select Checking® - $500 Bonus - BMO Smart Advantage Checking account:

Earn $400 Cash Bonus*

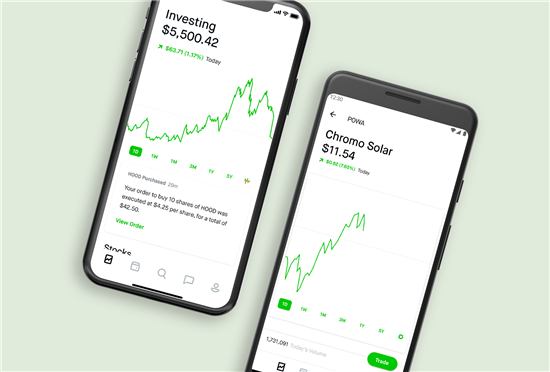

Get a Free Stock (and then some)

|

| Image Courtesy of Robinhood |

Trading in the stock market can turn a small upfront investment into a decent chunk of change. With investing apps like Robinhood, you'll even get stock on the house, just for signing up.

The free stock is chosen for you randomly, but like any stock, it has the potential to grow. Plus, if you decide to keep investing with Robinhood, trading is 100% commission-free.

If you're looking to invest with an app, consider some of our favorites:

Stash: Offers a great way for beginner investors to invest in stocks, ETFs, fractional shares, and more.

Before you pick an investment app, always check for any trading fees or management fees they may charge. And if you're totally overwhelmed by investing, our next option is more hands-off.

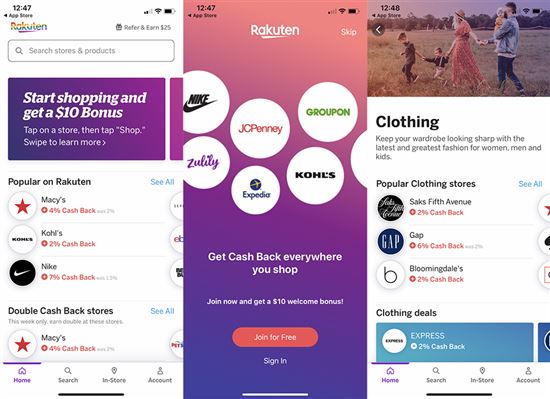

Score with Cash Back Apps

|

| Screenshot of Rakuten |

Heading out to the grocery store? Don't shop before downloading a cash-back app. It's one of the easiest (and most passive) ways to earn free money.

Here are a few of our favorites:

Ibotta: Earn money by grocery shopping and uploading a pic of your receipt.

Shopkick: Shop in-store or online and turn 'kicks' (points) into cash for minor tasks like scanning barcodes.

Rakuten: Formerly known as Ebates, Rakuten pays roughly 5% cash back for shopping online, grocery purchases, booking travel and more.

Drop: Earn around 1% cash back every time you make a purchase at your favorite stores like Best Buy, TJ Maxx, Amazon, Walmart, and more.

Capital One Shopping Price Protection: Formerly Paribus, Price Protection scan your recent online purchases and helps you get refunds from retroactive price drops.

Dosh: Rather than requiring you to scan your shopping receipts, Dosh lets you link your debit or credit card directly to the app.

- BeFrugal: Earn up to 40% cash back at 5,000+ stores.

- RebateKey: Get up to 100% cash back & rebates.

- Fetch Rewards: Get money back from purchases you already made.

Find Unclaimed Money

|

| © CreditDonkey |

You may be thinking, "Unclaimed money? How is that possible?" As it turns out, state treasuries across the U.S. have millions of dollars in unclaimed funds, made up of insurance money, tax refunds, forgotten deposits paid to a utility company, and more.

Several websites let you check for unclaimed money, and it's as easy as typing in a few personal details and hitting enter.

Try searching the following sites:

- National Association of Unclaimed Property Administrators

- MissingMoney.com, or

- The Unclaimed Money Tool from Credit Karma

Less than a minute may find you some easy, free money online in your name.

Get a Robot to Find You Free Money

Are you paying for a streaming service that you've used only a few times? You're definitely not alone.

That's where Trim comes in.

Trim connects with your bank accounts, looks for subscription services in your statements, and lets you cancel them with a simple swipe of a finger.

Chances are you're paying more for subscriptions than you realize. Video streaming, music streaming, and magazines add up fast. "Trim" the fat and you could end up with $200+ in your pocket next month.

Cut Hidden Fees and Pocket the Cash

Have you ever signed up for a free trial or subscription service? You could be paying more in fees than you have to.

Luckily, some apps will spot hidden fees that you may be charged for. These apps are two great options for doing just that:

Empower: See all your finances (investments, debt, and more) in one place. Identify any hidden, sneaky fees and cancel services to get that money back.

Rocket Money: Cancel those long-lost subscriptions, get refunded on bank fees and even negotiate down your bills.

Getting money can be as easy as taking an online quiz. The next sites reward you for spending your free time online.

Earn Cash in Your Free Time with Surveys

Survey sites and apps can be a fun way to earn free rewards for things you already do online, like searching the web, playing games, and watching videos.

These are some of the best-paying online surveys:

Swagbucks: This is a well-known site that lets users earn up to $35 per survey. They give you a $10 bonus just for signing up. You can also earn cash back by using their shopping portal and search engine.

$10 Signup Bonus

Member must "Activate" the Bonus in the Swag Ups section of your account. Bonus value is earned in the form of points, called SB. Get a 1000 SB bonus, which is equivalent to $10 in value, when you spend at least $25 at a store featured in Swagbucks.com/Shop. You must receive a minimum of 25 SB for this purchase, which you must complete within 30 days of registration. MyGiftCardsPlus.com and travel purchases do not qualify.

InboxDollars: This company has paid out more than $80 million for user feedback from people like you. You'll get $5 just for signing up, just be mindful of their small processing fee when you cash out.

$5 Signup Bonus

- Get paid to take surveys, play video games, watch videos

- Cash out to PayPal or gift cards

Survey Junkie: You can earn up to $40 per month. Cash out your Survey Junkie rewards through PayPal or get a gift card for your favorite store.

Take Surveys. Get Paid

- Take surveys and earn points

- Redeem points for PayPal or e-Giftcards

Opinion Outpost: Fill out surveys on Opinion Outpost and cash out your rewards via PayPal or gift card. Every survey you fill out will be counted as an entry toward a $10,000 quarterly drawing.

- Respondent: Pays up to $150 an hour for phone surveys

- Maru Springboard America: Earn for completing surveys & other tasks.

- American Consumer Opinion: Make $0.05 to $0.50 for short surveys.

- MySoapBox: Share opinions on products to earn rewards.

- LifePoints: Get rewarded for sharing your opinions.

- Qmee: Use their browser extension and get paid to search the web.

- PrizeRebel: Earn a little under a buck per survey and cash out at $5.

- SavvyConnect (SurveySavvy): Get free money by answering questions.

- User Interviews: Earn for participating in market research.

- S'more: Put ads on your mobile lock screen.

Don't miss: Our guide to online survey sites breaks down the pros, cons, and little-known hacks for maximizing your earnings.

If you haven't built up an emergency fund yet, it's a good time to start. Check out the next tip to make the most of your savings.

Open a High Yield Savings Account

You already know savings accounts earn interest. But by using a high-yield savings account, you can take advantage of interest rates much higher than what traditional banks offer.

Multiple online banks will offer competitive interest with low fees. When choosing a bank, be sure to check for any requirements for minimum balance or opening deposit.

Shortcut: If you're eager to start earning high yields, don't miss our guide on the best high-yield savings accounts available.

It can be hard to save when you're in debt. Learn how you can earn money just by organizing your finances below.

CIT Bank Platinum Savings - $300 Bonus

- Qualify for a $300 cash bonus with a minimum deposit of $50,000

- This limited time offer to qualify for a $225 cash bonus with a minimum deposit of $25,000 or a $300 bonus with a minimum deposit of $50,000 is available to New and Existing Customers who meet the Platinum Savings promotion criteria. The Promotion begins on September 23, 2025 and can end at any time without notice.

CIT Bank Platinum Savings - $225 Bonus

- Qualify for a $225 cash bonus with a minimum deposit of $25,000

- This limited time offer to qualify for a $225 cash bonus with a minimum deposit of $25,000 or a $300 bonus with a minimum deposit of $50,000 is available to New and Existing Customers who meet the Platinum Savings promotion criteria. The Promotion begins on September 23, 2025 and can end at any time without notice.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Get Free Money to Budget

Adding a budgeting app to your arsenal of financial tools can be a great way to get the most from your money. Some even offer free sign-up bonuses. Budgeting apps can:

- Help you get control of your finances

- Save cash that might have been spent elsewhere

- Give you better awareness of your spending habits

Consider the following two apps to get your finances on track:

Oportun: Struggle to save? Digit automatically analyzes your daily and monthly spending and saves the perfect amount for you.

Cleo: This app creates a budget based on your spending and helps you stick to it.

Getting paid to budget is easy money. Find out how being a loyal employee can get you free money too.

Take Advantage of 401(K) Matching

If you have a retirement account from your employer, you may be missing out on opportunities for truly free money. Many companies match your 401(k) contributions, usually around 50%-100% of your total contributions.

If your employer offers this option, it's a no-brainer. That money can add up quickly in your bank account - and it really is free.

Talk to your company's human resources rep and be sure to check the vested policy. If your contribution is "vested" at 3 years, it means your money will be 100% yours after 3 years at the company.

Review Products

Your opinion can be worth free money. Here's how:

SlicethePie: This is the largest paid review site on the internet. Review clothing, music and more before they are released to the public.

UserTesting: UserTesting pays you for using your phone to test websites and apps. Most testing will get you $10 per 20-minute video completed.

For the ultimate two-birds-one-stone option, see which apps are great for your body and your wallet.

Get Paid to Get In Shape

|

| Screenshot of Sweatcoin |

If you're looking to get in shape, or if you're working on it, you can get free money to lose weight and shape up. Using some of these apps can be a simple way to get free money.

Sweatcoin: Take walks and earn 'sweatcoins' which you can redeem for gift cards and other rewards.

HealthyWage: Bet money on your own weight loss goals, and win it back when you achieve them. You can even win up to $10,000 for some weight loss challenges.

Evidation: Track your steps, sleep and more to earn money. Your health data also contributes to valuable medical research.

The Evidation app also earns bonus points for syncing with popular health tracking apps like Fitbit, MyFitnessPal, and Garmin.

Not into running? Discover how you can get free money just from a short walk to the mailbox.

Get Money for Your Junk Mail

Did you know you can get free money for your junk mail? It's a strange concept, but it's true. The Small Business Knowledge Center will pay you to send them your junk mail.

The catch: You have to physically mail in the junk mail. However, the company will provide paid postage.

You can earn an extra $20 every few months in gift cards from sending in your mail. Not bad for something you would usually throw away.

After getting rid of your junk mail, find out how to make money on what most people give away for free.

Sell Your Data

If privacy is not an issue to you, selling your data is an easy way to make money. In fact, many companies already pay money for it. Many people give away their data for free.

National Consumer Panel (NCP): Sell your purchase history to National Consumer Panel with one of their special handheld scanners. Earn cash prizes, gift cards, and more.

Nielsen Computer and Mobile Panel: Nielsen will reward you for sharing info about your internet usage via cash or gift card. In order to qualify, you'll need to download their app to all your devices because they track your usage.

SavvyConnect: Their VIP program will collect your data as you use the internet. You'll earn $3 per device, per month.

Declutter Your House

There are a number of ways to turn your clutter into ways to earn free money. Of course, these options don't come free, exactly: You have to get rid of your stuff. Take a look at some of the best options.

Bookscouter: Sell your used books to Bookscouter to make some extra money. Even better, you can ship your books for free.

Gazelle: Sell your old smartphones and other used electronics for cash.

Are you the amateur photographer of your friend group? Some apps will pay for those photos of yours…

Get Free Money to Take Photos

Phone cameras are better than ever, so why not use yours to make some easy cash? These apps and websites will pay for quality photos that otherwise sit idly in your camera roll. Not bad, right?

Foap: This app accepts photos and videos and pays you when a brand, agency, or any person decides to buys it. (Keep in mind that you'll split the profit 50/50 with Foap.)

Agora Images: Offers weekly photo contests that you can enter to win for prize money. It's a decent amount, too: anywhere from $1,000 to $25,000.

Shutterstock: Get free money each time someone downloads your photo or video or for referring new customers. Sign up to be a Shutterstock contributor here.

Make Money with Your Car (Without Ridesharing)

|

| © CreditDonkey |

One of the best ways to get free money is to wrap your car in an advertisement. If you don't care what your car looks like, this could be an easy way to earn.

The amount you earn will depend on how far you drive in your car and the area you drive in.

Earn more than $100 a week if you're a big commuter in a busy town.

Ridesharing not your thing? You can still get cash rewards by spending smart with your credit card.

Cash In with Credit Card Rewards

Signing up for cash-back credit cards is one of the easiest ways to earn money. Banks and credit card companies offer sign-up bonuses and cash-back offers for various cards.

One of the easiest ways to get started is by signing up for a cash back credit card. As long as you spend responsibly and pay off what you purchase, the card will reap benefits.

Banks and credit card companies will reward you for being a loyal customer. Find out how being a foodie can get you free money too.

Book Reservations with Seated

|

| © CreditDonkey |

The Seated app gives you rewards for dining out.

Just simply walk in or make dinner reservations with the app's partner restaurants, and then upload a photo of your receipt after you have dined there. You can get up to $10-$20.

You can use your rewards points for gift cards for Amazon, Uber, Airbnb, Delta, Nordstrom, and more.

Willing to get creative? Here's how you can earn free cash by contributing to science…

Participate in Clinical Trials

Don't be put off by the name: many clinical trials can be easy money that comes at little to no cost. Use the below websites to find paid clinical trials in your city or state:

Before applying, make sure to check the requirements for each clinical trial. Some are more lenient and others more restrictive. Money per clinical trial will vary from a couple hundred dollars to thousands of dollars.

Save Thousands by Refinancing Student Loans

Your student loan payments are a lot more flexible than you think. When you refinance, a lender pays off your existing student loans and creates a single new loan for you to repay, often with a lower interest rate (depending on your credit score).

In addition to offering a lower rate, some refinancing companies pay a cash bonus to refinance your loans with them.

Ever feel like you're bleeding money? You're not alone. Our next option can help can get your finances back on track.

Crush Debt with a 0% APR Balance Transfer Card

Paying off credit card debt may seem like an uphill battle, but a balance transfer credit card could help you eliminate it faster.

Sound too good to be true? There's no catch. Banks give you the opportunity to pay off debt at 0% APR for up to 2 years because they ultimately want your business.

And because federal law prohibits card issuers from using offers like this to "bait and switch" customers,[1] they stick to the generous 0% period as advertised. Find our best balance transfer card offers here.

What the Experts Say

CreditDonkey asked a panel of industry experts to answer some of readers' most pressing questions:

- Why does it feel worse psychologically to lose money than it does to win money?

- What is the best way to invest a windfall of $50?

- What gives money economic value?

- Why do people find it hard to stick to a budget?

- Can side hustles replace full-time employment?

Here's what they had to say:

Bottom Line

Are you leaving money on the table?

Maybe you're saving up for a big purchase, or you just want more money. (Who doesn't?) No matter your situation, try these tactics to get extra cash. It feels good to bulk up your wallet.

Additional Resources

References

- ^ FTC. Penalty Offenses Concerning Bait & Switch, Retrieved 11/27/2022

Write to Samantha Tatro at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Empower Personal Wealth, LLC (“EPW”) compensates CREDITDONKEY INC for new leads. CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

|

|

| ||||||

|

|

|