Cheapest Credit Card Processing for 2026

In the hunt for savings? Explore the cheapest credit card processing companies offering free accounts and affordable transaction fees.

|

| © CreditDonkey |

The cheapest credit card processing companies are:

- Square for new businesses

- Helcim for quickly growing businesses

- Stripe for large online businesses

- Payment Depot for businesses processing $15,000+/mo

- Stax for US-only businesses

- PaymentCloud for high-risk businesses

- Chase Payment Solutions for Chase clients

- Dharma Merchant Services for high-volume businesses

- National Processing for businesses with physical locations

- Host Merchant Services for best customer service

- PayPal for e-commerce businesses

Don't be fooled by credit card processors. The cheapest credit card processing companies won't charge you hidden fees and excessive transaction fees. Some of them even offer your accounts for free, so you can say goodbye to monthly fees.

That said, your sales volume, business size, and business operations all play a role in the overall cost. You should be able to find the right fit at the end of the article.

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 15¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

Online Payment Processing

- Accept payments worldwide and automate payouts and financial workflows seamlessly

- Grow with confidence: Whether you're running an e-commerce store, subscription service, or marketplace, Stripe adapts to any business model

- Trusted by millions: From startups to Fortune 500 companies, Stripe powers businesses of every size

- Predictable costs: Transparent flat-rate pricing with no setup fees or monthly charges – pay only for what you use

- Enable more sales: Support credit cards, mobile wallets, and 135+ international payment methods

- Developer-friendly tools: Integrate payments quickly with Stripe's intuitive APIs and documentation

Chase Payment Solutions℠

- Limited time offer: Get $100 off the Chase Point of Sale (POS)℠ Terminal. Fill out the form and ask a Payments Advisor how to claim.

- Fast funding at no additional cost. Get deposits as soon as same day.

- Get fair and transparent pricing with no hidden fees. 2.6% rate +10¢ per tap, dip and swiped transaction. 2.90% + 25¢ per eCommerce transaction and monthly fee starting at $9.95. 3.5% rate +10¢ per keyed transaction.

- Get paid fast and manage your business from anywhere with the Chase Point of Sale system. Use our mobile app, reader and terminal to take payments via tap, dip and swipe.

- Process payments with Chase Payment Solutions, the #1 merchant acquirer in the U.S.

- Tap to Pay on iPhone offers you the ability to accept contactless cards, Apple Pay and other digital wallets on your iPhone – no additional hardware required.

- Chase Customer Insights is a complimentary business intelligence platform that offers simple, actionable analytics and reports to help you make better business decisions and reach more customers.

First Month Free

- Flat Monthly Subscription Price, Starting at $99

- 0% Markup on Direct-Cost Interchange

- 24/7 Support

High Risk? No Problem

- Competitive Options for Payment Processing at All Risk Levels

- Fast Funding

- No Setup/Hidden Fees

- No Minimum Credit Score

- All Industries Accepted

Eliminate Credit Card Processing Fees With Surcharging

Accept Credit Cards at 0% Cost and Increase Your Margins Instantly

- How We Came Up With The List

We made sure to carefully analyze the best credit card processing companies and compare all their fees to determine the cheapest options. There needs to be little to no miscellaneous fees that can pile up the cost of processing.

They should also offer month-to-month contracts unless your business belongs to a risky industry like cannabis or adult industries. This way, you can easily switch processors when one no longer serves your needs. Long-term contracts with cancellation fees also drive up the cost.

The processor also needs to provide other features apart from cheap payment processing. You may be offered tools for inventory management, employee management, free reprogramming of equipment, etc. You shouldn't have to pay for add-ons just to keep your business running.

Cheapest Credit Card Processing Companies

Credit card transaction fees and your account's monthly fees will likely be the bulk of your processing costs.

Here's an overview of your cheapest options:

| Payment Processors | Monthly Fee and Per Transaction Fee | Company Highlights |

|---|---|---|

| Square | $0 (Free), $49/mo (Plus), and $149/mo (Premium); 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium) per transaction | Easy to use interface & free card reader available |

| Helcim | No monthly fees; Interchange rate + 0.40% + $0.08 (for processing up to $50,000/mo; discounts for larger volume) | Automatically lowers your processing fees |

| Stripe | No monthly fees; 2.7% + $0.05 per transaction | Supports over 135 currencies |

| Payment Depot | Starts at $79/mo; Interchange rate + $0.10 per transaction | Save up to 40% or up to $600 on processing fees |

| Stax | Starts at $99 per month; Interchange rate + $0.08 per transaction | All-in-one platform for US-only businesses |

| PaymentCloud | Custom pricing | Specializes in high-risk businesses |

| Chase Payment Solutions | 2.6% rate +10¢ per tap, dip and swiped transaction | Handles over 50% of all e-commerce payments |

| Dharma Merchant Services | Starts at $15/mo; Interchange + 0.15% + $0.08 per transaction | Discounts for businesses processing $100k+ per month |

| National Processing | Starts at $14.95/mo; 2.5% + $0.10 per transaction (Basic In-person Package), 2.41% + $0.10 per transaction (Advanced Package) | One of the lowest in-person flat rates |

| Host Merchant Services | $14.99/mo; 0.25% + $0.10 per transaction (retail); 0.20% + $0.09 per transaction (restaurant) | Prompt and reliable customer service |

| PayPal | Free account; 2.29% + $0.09 per transaction | Accept PayPal, Venmo, and cryptocurrencies |

This rule helps businesses remember the key aspects to consider when choosing a credit card processing service:

- Costs: Look for low transaction fees and minimal hidden charges.

- Accessibility: Ensure the service is easy to set up and use.

- Reliability: Choose a provider known for dependable service and support.

- Discounts: Check for volume discounts or special pricing for small businesses.

If you find a processor you like, you can skip to the calculator at the end of the list to estimate your processing cost.

Square: For New Businesses

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Flat-rate |

| Monthly Fee | $0 (Free), $49/mo (Plus), and $149/mo (Premium) (free plan); Plus plan starts at $29+/mo |

| Contract | Month-to-month |

| Swipe or Chip Transactions | 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium) per transaction |

| Online Transactions | 3.3% + 30¢ (Free) and 2.9% + 30¢ (Plus/Premium) per transaction |

| Full Review of Square | |

Square is a credit card processor that works great for new businesses because it offers a free account. You can sign up easily without worrying about approval or underwriting.

You can also get a free Square reader, which lets you accept payments in person. Card readers and terminals can get really pricey, so this can mean huge savings on your end. Square's point-of-sale app is free as well.

If you set up an online store, card transactions will cost you 3.3% + 30¢ (Free) and 2.9% + 30¢ (Plus/Premium) per transaction. Accepting payments in person is a little cheaper, costing you 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium) per transaction.

- Pricing

Square offers a free plan, so you can get started right away. If you need more features, you can upgrade to a paid plan.

Square's processing fees are:

- Swipe or chip transactions: 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium)

- Online transactions: 3.3% + 30¢ (Free) and 2.9% + 30¢ (Plus/Premium)

- Keyed-in transactions: 3.5% + $0.15

- Invoices: 3.3% + 30¢ (Free) and 2.9% + 30¢ (Plus/Premium)

- ACH payments: 1% ($1 minimum)

- Afterpay: 6% + $0.30

All card payments are charged the same processing costs, whether it's credit cards or debit cards, Visa, Mastercard, Discover, or American Express cards.

In comparison, Helcim charges differently per card type due to varying interchange rates. This can mean more savings due to certain card brands.[1] - Swipe or chip transactions: 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium)

- Features

Regardless of your business type, Square lets you:

- Accept online, in-person, and over-the-phone payments

- Accept payments in offline mode

- Send invoices

- Manage multiple store locations

- Customize the checkout experience

- Manage inventory

- Get detailed reporting

- Sell on Instagram, Facebook, and Google

- Offer local delivery, shipping, and curbside pickup

- Manage employees and set permissions

- Create personalized marketing and loyalty campaigns

Square also offers business-specific features for retail, restaurants, and professional services like consultants. You may be able to use Square's Kitchen Display System, print barcodes automatically, schedule recurring classes, etc.

Square Add-ons

Square offers more business tools like Payroll and Banking. You can integrate these features into your POS, but they will come with separate pricing. Some add-ons offer a free trial for 30 days. - Accept online, in-person, and over-the-phone payments

- Equipment

Square offers a free magstripe card reader to help you get started. Additional magstripe readers cost $10 each. You can choose one with a headset jack, USB-C, or one with a lightning connector.

There are also lots of other POS equipment to choose from:

- Square register: $799 or $39/mo for 24 months

- Square terminal: $299 or $27/mo for 12 months

- Square Stand and Square Kiosk: each costs $149 or $14/mo for 12 months[2] [3]

- Square Reader for contactless and chip (2nd generation): $59 or $21/mo with financing

All equipment comes with free 30-day returns. You also get a 2-year limited warranty for the Square register and a 1-year limited warranty for other Square hardware.

- Square register: $799 or $39/mo for 24 months

- Pros + Cons

Pros:

- Pay-as-you-go pricing

- No hidden fees

- No long-term contracts

- Free Square reader

- Easy-to-use POS

- Next business day transfer

- Instant bank transfer (1.75% fee)

- Accept payments with no internet connection

- Square App Marketplace for integrations

Cons:

- Pricey for high-volume businesses

- Limited customer support

- Account is susceptible to holds or freezes

- Not for high-risk businesses

- Pay-as-you-go pricing

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 15¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

If your business is no longer new and you're looking to scale, Helcim may be the better (and still affordable) option.

Helcim: For Quickly Growing Businesses

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Interchange plus |

| Monthly Fee | No monthly fees |

| Contract | Month-to-month |

| Swipe or Chip Transactions | Interchange rate + 0.40% + $0.08 (for processing up to $50,000/mo; discounts for larger volume) |

| Online Transactions | Interchange rate + 0.50% + $0.25 (for processing up to $50,000/month; discounts for larger volume) |

| Full Review of Helcim | |

Helcim is the most transparent a payment processor can get. It breaks down the fees for you—interchange rates, card brand fees, and processor markup—so you know exactly how much you're paying per transaction.

This isn't the case for other processors like Square and Stripe. In addition, Helcim automatically lowers your processing fees the higher your sales volume, which means you'll get cheaper rates.

For example, if your monthly sales are at $50,000, your in-person rates can cost you interchange + 0.40% + 8¢ per transaction. But once your business starts processing up to $100,000, your rates will be reduced to interchange + 0.35% + 7¢ per transaction.

Just like Square, Helcim offers a free account. You'll get access to all of Helcim's tools so you can accept credit card payments effectively. But unlike Square, your business will need to get approved for an account with Helcim.

You can check out Helcim Fee Saver to pass on credit card processing fees to your customers. This is also known as surcharging and is most suitable for businesses that send invoices to accept payments.

- Pricing

Helcim offers interchange-plus pricing. The average cost of in-person transactions is 1.83% + $0.08. For keyed and online transactions, the average is 2.27% + $0.25.[1]

Here are the rates you can expect as you grow your sales volume:

Monthly Volume In-person Transactions Online and Keyed Transactions $0 - $50,000 Interchange + 0.40% + 8¢ Interchange + 0.50% + 25¢ $50,001 - $100,000 Interchange + 0.35% + 7¢ Interchange + 0.45% + 20¢ $100,001 - $500,000 Interchange + 0.25% + 7¢ Interchange + 0.35% + 20¢ $500,001 - $1,000,000 Interchange + 0.20% + 6¢ Interchange + 0.25% + 15¢ $1,000,001+ Interchange + 0.15% + 6¢ Interchange + 0.15% + 15¢ Your pricing tier is automatically applied based on your three-month processing average. So there's no need to call Helcim and negotiate a discount as your business grows.

There are no monthly fees, cancellation fees, setup fees, deposit fees, user fees, and PCI compliance fees.

- Features

With a free Helcim account, you can:

- Accept debit and credit card payments

- Take contactless payments like Apple Pay and Google Pay

- Use the Helcim app for mobile payments

- Use the virtual terminal on any smart device

- Accept QR code payments

- Send unlimited invoices

- Set up recurring billing

- Take ACH payments (no extra signup needed)

- Manage inventory

- Create unlimited employee accounts

- See reports and sales trends

- Build a new online store

- Integrate with popular shopping carts and business software like WooCommerce and QuickBooks

Take note that Helcim lets you accept USD and CAD payments. It might not be the best option for international businesses.

- Accept debit and credit card payments

- Equipment

Unlike its competitors, there are only 2 POS hardware options with Helcim: $199 for Helcim Card Reader; $349 for Helcim Smart Terminal.

- Helcim Smart Terminal

The smart terminal is a standalone terminal that uses the Helcim POS app. You can accept tap and chip payments, digital wallet payments, and take keyed-in payments with the device. There's also a built-in printer for your receipts.The device connects to WiFi and is easy to charge through the dock that comes with it.

- Helcim Card Reader

The card reader connects to any device, such as iOS, Mac, Android, or Windows.You can use the card reader to accept tap, chip, and debit payments. You can also take contactless payments such as Apple Pay and Google Pay.

- Helcim Smart Terminal

- Pros + Cons

Pros:

- Interchange-plus pricing with volume discounts

- No monthly fees

- No long-term contracts

- No early termination fees

- No hidden fees

- Unlimited access to all payment solutions

- 1-2-day funding

- Highly praised customer service

Cons:

- Underwriting process

- Only 2 equipment options

- Limited third-party integrations

- Doesn't accept high-risk businesses

- No 24/7 customer support

- Interchange-plus pricing with volume discounts

Start Accepting Payments Fast

- Interchange Plus Pricing

- No Monthly Fees

- No Contracts

If you have an online store and accept international currencies, our research suggests that Stripe can be your best bet.

Stripe: For Large Online Businesses

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Flat-rate |

| Monthly Fee | No monthly fee |

| Contract | Month-to-month |

| Swipe or Chip Transactions | 2.7% + $0.05 per transaction |

| Online Transactions | 2.9% + $0.30 per transaction |

Stripe is one of the most flexible credit card processors. It supports over 30 languages, 135+ currencies, and over 100 payment methods, so it's ideal if you have an online store and sell to customers worldwide.

Your account is also free, so you won't need to worry about monthly fees. You'll only pay when you make a sale. Online payments will cost 2.9% + $0.30 per transaction.

Additionally, Stripe offers a smart terminal and card readers so you can accept payments in person. This costs 2.7% + $0.05 per transaction. This means a $100 purchase will cost $3.2 (online) and $2.75 (in person).

That said, Stripe is ideal for larger e-commerce businesses because you can only maximize the platform with a developer on your team. Stripe has a lot of advanced API developer tools for you to completely customize the checkout experience.

- Pricing

Here are Stripe's processing fees per transaction:[4]

- In-person transactions: 2.7% + $0.05

+ 1.5% for international cards - Online transactions: 2.9% + $0.30

- Keyed-in transactions: 3.4% + 30¢

- International payments: Additional 1.5%; + 1% if currency conversion is required

- Invoicing: 0.4% per paid invoice

- Recurring billing (invoices and subscriptions): 0.7%

- ACH Direct Debit: 0.8%; $5.00 cap

- Instant payouts: 1.5%; minimum fee of 50¢

- Tap to Pay: 10¢ per authorization

- Chargeback protection: 0.4% per transaction

- Disputes: $15.00 per dispute

Note that the prices are the same regardless of the card or digital wallet used by your customers. You can also opt for custom pricing if you have a high sales volume, high-value transactions, or have a unique business model.

You can issue partial or full refunds to your customers. But these may come with fees depending on your agreement with Stripe.

- In-person transactions: 2.7% + $0.05

- Features

With a Stripe account, you can:

- Accept one-time, recurring, or pay-what-you-want payments

- Integrate with online shopping carts like Shopify and WooCommerce

- Use a pre-built checkout optimized to convert

- Use a one-click checkout for returning customers

- Send shareable payment links

- Use automatic currency conversion

- Set up promo codes or coupons for your customers

- Set up extra authentication for high-risk payments

- Access chargeback protection features

- Access free and advanced reporting

- Work with Stripe Experts to make the setup easier

You can choose to embed Checkout into your website, so customers don't need to be redirected to a different page. But a Stripe-hosted page is also available for more security. - Accept one-time, recurring, or pay-what-you-want payments

- Equipment

Although Stripe is ideal for e-commerce businesses, it also offers POS hardware for when your business is on the go:[5]

- BBPOS WisePOS E (terminal): $249; up to 12 hours of active use

- Stripe Reader S700: $349; up to 15 hours of active use

- Stripe Reader M2: $59; up to 28 hours of active use

The Stripe terminal unifies your customers' payments online and in person. You can email customers their receipts.

The terminal also comes with end-to-end encryption, cloud-based ordering, and remote management and monitoring.

If you need smaller devices that fit in your pocket, Stripe card readers are available as well. Or you can just opt for Tap to Pay on iPhone or Android.

- BBPOS WisePOS E (terminal): $249; up to 12 hours of active use

- Pros + Cons

Pros:

- Month-to-month contract

- No setup fees, monthly fees, or hidden fees

- No cancellation fee

- Highly customizable with advanced APIs

- Pre-built payment UIs for if you don't need to customize

- One-click checkout available

- Supports 135+ currencies

- Extensive security features

- 24/7 customer support

Cons:

- May get confusing for small business owners

- Needs developers to maximize the platform

- Can get pricey due to flat-rate pricing

- Plenty of miscellaneous fees

- Month-to-month contract

Online Payment Processing

- Accept payments worldwide and automate payouts and financial workflows seamlessly

- Grow with confidence: Whether you're running an e-commerce store, subscription service, or marketplace, Stripe adapts to any business model

- Trusted by millions: From startups to Fortune 500 companies, Stripe powers businesses of every size

- Predictable costs: Transparent flat-rate pricing with no setup fees or monthly charges – pay only for what you use

- Enable more sales: Support credit cards, mobile wallets, and 135+ international payment methods

- Developer-friendly tools: Integrate payments quickly with Stripe's intuitive APIs and documentation

What if you don't have a lot of customers abroad? If you have at least $15,000 in monthly sales, try for the next option.

Payment Depot: For Midsize Businesses

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Subscription |

| Monthly Fee | Starts at $79/month |

| Contract | Month-to-month |

| Swipe or Chip Transactions | Interchange rate + $0.10 |

| Online Transactions | Interchange rate + $0.18 |

| Full Review of Payment Depot | |

For midsize businesses with a sales volume of around $15,000 to $20,000+ per month, Payment Depot offers the cheapest credit card processing fees.

If you accept payments in person, each transaction will cost Interchange rate + $0.10. Online payments cost Interchange rate + $0.18. The average interchange rate is 2%. So a $100 purchase will cost you $2.10 (in person) and $2.18 (online).

That said, unlike Square, Helcim, and Stripe, Payment Depot charges monthly fees starting at $79/mo. But you can get your first month for free.

The membership plan depends on your industry, which can lead to significant savings for your business. Healthcare businesses, for example, can save up to $600+ per month. Pet Groomers, on the other hand, save an average of $400 per month.

- Pricing

Payment Depot doesn't state how much its plans are. But this is what you'll find on the processor's website:

- Start at $79/month (Process up to $250,000/yr)

- Custom quote (Process more than $250,000/yr)

You'll also be charged a very low per-transaction fee with no percentage markup.

- Swiped payments: Interchange rate + $0.10

- Online payments: Interchange rate + $0.18

- Keyed-in payments: Interchange + 18¢

Payment Depot recommends certain plans depending on your industry. For example, a B2B company may do well with its Executive or Premier plans. This may be due to the features that come with these plans. - Features

A membership plan with Payment Depot can get you:

- E-commerce payment processing

- Mobile payment processing

- A virtual terminal for keyed-in payments

- Next-day deposits

- Chargeback and risk monitoring features

- Business software integrations like Shopify, QuickBooks, and WooCommerce

If you opt for the Clover POS System, you'll also get features for inventory management, loyalty program, reporting, taxes, etc.

- E-commerce payment processing

- Equipment

Payment Depot offers standard terminals and smart terminals. You can choose from Clover, Dejavoo, and SwipeSimple products.

- Clover Flex LTE or WiFi: handheld POS (smart terminal)

- Clover Mini LTE: all-in-one POS; compact but powerful

- Clover Station Solo: all-in-one POS; comes with a cash drawer and receipt printer

- Clover Station Duo: all-in-one POS with a customer-facing display

- QD2 and QD4 Dejavoo terminals: smart terminals; QD2 is a wireless terminal while QD4 is a countertop terminal

- SwipeSimple B250 Reader: card reader; use with your iOS or Android device; optional base stand available

You'll have to contact Payment Depot for the price.

- Clover Flex LTE or WiFi: handheld POS (smart terminal)

- Pros + Cons

Pros:

- No early termination fee

- Low per-transaction fee; no percentage markup

- Next-day funding available

- Third-party hardware options

- Can reprogram existing equipment

Cons:

- Not for high-risk businesses

- Can be expensive for small businesses

- Plans and monthly fees are not transparent

- 20% restocking fee for returned equipment

- No early termination fee

Payment Depot is a Stax company, which is why you'll find their processing fees similar. But you may get more features with Stax.

Stax: For Large and Established Businesses

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Subscription |

| Monthly Fee | Starts at $99 per month |

| Contract | Month-to-month |

| Swipe or Chip Transactions | Interchange rate + $0.08 |

| Online Transactions | Interchange rate + $0.18 |

| Full Review of Stax | |

Unlike Square, Helcim, and Stripe, Stax has no processor percentage markup. You only pay the interchange rates with a flat fee per transaction, plus the monthly fee.

This can make it the cheapest option for large businesses. But it can be expensive for smaller ones since the monthly fee costs $99/mo to $199/mo.

Card payments made in person will cost you Interchange rate + $0.08 per transaction. Online payments, on the other hand, costs Interchange rate + $0.18 per transaction. The average interchange rate is 2%. This means a $100 purchase will cost you $2.08 (in person) and $2.18 (online).

That said, Stax offers a good combination of technology and price. It offers an excellent integrated payment platform with a lot of robust tools like invoicing, customer management, inventory management, etc.

- Pricing

You'll be getting the same features with Stax regardless of your membership plan. The monthly fee only changes based on your sales volume.[6]

- $99/mo: if you process up to $150,000/year

- $139/mo: if you process $150,000-$250,000/year

- $199/mo: if you process over $250,000/year

Here's how much each transaction may cost you:

- In-store transactions: Interchange rate + $0.08

- Online transactions: Interchange rate + $0.18

- Keyed-in transactions: Interchange + $0.18

- $99/mo: if you process up to $150,000/year

- Features

In every Stax subscription, you can:

- Accept in-person, online, over-the-phone, mobile, and contactless payments

- Manage inventory

- Send digital invoices

- Set up recurring invoices and scheduled payments

- Send website-hosted payment links

- Set up a one-click shopping cart

- Access reporting and analytics through the dashboard

- Securely store your customers' information (card on file)

- Sync with QuickBooks Online

If these aren't enough, you can also purchase add-ons like ACH payment processing, terminal protection, next-day funding, and digital gift cards.

You can even pass on the credit card fees to your customers through CardX. It's a payment solution from Stax that makes surcharging easier and your business fully compliant.

- Accept in-person, online, over-the-phone, mobile, and contactless payments

- Equipment

You can choose from a variety of cloud-based smart terminals, specifically Clover, Dejavoo, and SwipeSimple products.

But you'll have to contact Stax to know how much these costs:

- Clover Flex LTE or WiFi: a handheld POS system

- Clover Mini LTE: all-in-one POS system

- Clover Station Solo: all-in-one POS system that comes with a receipt printer and a cash drawer

- Clover Station Duo: all-in-one POS with a customer-facing display

- QD2 and QD4 Dejavoo: Android terminals

- SwipeSimple B250 Reader: card reader

Technically, you don't really need a credit card machine to accept payments with Stax. The Stax mobile app, available for Android and iOS, lets you scan credit cards with your phone camera to take payments.

That said, opting for these terminals may help you save on processing fees.

- Clover Flex LTE or WiFi: a handheld POS system

- Pros + Cons

Pros:

- Month-to-month contract

- No early cancellation fees

- Integrated payment platform

- No processor markup

- In-house customer and technical support

- All-in-one package

- Same-day deposit

Cons:

- Underwriting process

- Pricey for small businesses

- Add-ons can add up to the total cost of your monthly subscription

- Month-to-month contract

Save Up to 40%

- Flat Monthly Subscription Price, Starting at $99

- 0% Markup on Direct-Cost Interchange

- 24/7 Support

If you're a high-risk business, Stax may not be the best option. But PaymentCloud may gladly work with you.

PaymentCloud: For High-risk Businesses

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Customized |

| Contract | Depends on your agreement; potentially long-term contracts for high-risk businesses |

| Full Review of PaymentCloud | |

Have you been told that your business belongs in risky industries? Unfortunately, some industries like cannabis, pharmaceuticals, and construction are considered high-risk. Many traditional payment processors will not work with them.

Luckily, PaymentCloud does and it's one of the best merchant account providers, too. You'll get offered customized pricing based on the payment solutions your business needs.

That said, it may be unlikely that you'll get affordable processing rates. Being in a risky industry inherently makes your rates more expensive than average due to higher possibilities of fraud.

As a solution, PaymentCloud lets you pass on the credit card fees to your customers.[7] Your customers will be charged additional fees if they pay with a credit card. However, only fees for credit card payments (not debit card payments and others) can be passed to your customers.

- Processing history (if any)

- Credit history

- Sales volume

- Chargeback ratio

- Merchant Category Code (MCC)

- Accepted mode of payment (this affects your level of risk)

- Pricing

PaymentCloud doesn't explicitly state its fees on its website since it offers customized solutions for businesses. Your rates will depend on your business type (industry and risk level).

The merchant account provider will perform a side-by-side cost savings analysis. This will help you understand the products and services you need.

Depending on the result, you may be offered interchange-plus pricing, flat-rate pricing, or tiered pricing.

You also have the option to surcharge your customers. Surcharging will get you a month-to-month contract.

The merchant agreement should include all the fees in detail. So be sure to read the fine print. Make sure there are no hidden fees. And if possible, negotiate. - Features

With a merchant account from PaymentCloud, you can:

- Accept payments internationally

- Use the virtual terminal to take keyed-in payments

- Send personalized payment pages

- Accept QR code payments through Paysley

- Customers can pay through text message

- Send invoices and set up recurring billing

- Implement a cash discount program

- Access chargeback and fraud prevention tools

- Integrate with various payment gateways and shopping carts like Shopify, WooCommerce, and BigCommerce

PaymentCloud offers amazing customer support, too. You get a dedicated account manager to help you with your concerns.

Plus, support is available 24/7. Many business owners report high satisfaction and even attest to great customer service.

Since PaymentCloud is a merchant account provider, expect an underwriting process. That's unless you opt for the ACH processing solution, in which case, you can create an account and start processing right away. - Accept payments internationally

- Equipment

PaymentCloud works with Clover, Verifone, Ingenico, and Dejavoo. You can choose from wireless card readers, full point-of-sale systems, mobile readers, and payment accessories.

You can even get a free terminal if you're a low-risk business. You can visit the PaymentCloud Shop for the pricing of these POS equipment.

- Pros + Cons

Pros:

- Free terminal for low-risk businesses

- Dedicated account manager

- Easy to start accepting ACH payments

- Surcharge-compliant card terminals

- Works with low-risk to high-risk businesses

- Hundreds of integrations available

Cons:

- Underwriting process

- Need to contact for a quote

- Possible long-term contracts for high-risk businesses

- Free terminal for low-risk businesses

High Risk? No Problem

- Competitive Options for Payment Processing at All Risk Levels

- Fast Funding

- No Setup/Hidden Fees

- No Minimum Credit Score

- All Industries Accepted

This next affordable payment processor is best suited for a niche group of business owners.

Chase Payment Solutions: For Chase Business Complete Banking Account Holders

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Flat-rate |

| Contract | Month-to-month |

| Swipe or Chip Transactions | 2.6% rate +10¢ per tap, dip and swiped transaction |

| Online Transactions | 2.90% + 25¢ per eCommerce transaction and monthly fee starting at $9.95 |

| Full Review of Chase Payment Solutions | |

Over 5 million businesses use Chase, making it an established and trusted credit card processing company. You also get "relationship" pricing and access to many branches and ATMs.

You may get flat-rate pricing—similar to Square, or you can opt for interchange-plus pricing if your transaction volume qualifies. Interchange-plus pricing is typically more affordable.

If you're a Chase Business Complete Banking account holder, you can opt for Chase Payment Solutions to have everything under one roof. You also get exclusive features like Tap to Pay on iPhone and same-day deposits with no fee.

Chase Payment Solutions handles 50% of all e-commerce payment processing. That means about half of all online transactions!

- Pricing

Here are the flat-rates offered by Chase:[8]

- In-person: 2.6% rate +10¢ per tap, dip and swiped transaction

- Online: 2.90% + 25¢ per eCommerce transaction and monthly fee starting at $9.95

- Keyed-in: 3.5% rate +10¢ per keyed transaction

You can contact Chase for custom pricing.

- In-person: 2.6% rate +10¢ per tap, dip and swiped transaction

- Features

Here's what you can do with Chase:

- Accept credit and debit card payments in-store, online, or on the go

- Accept contactless payments like Apple Pay

- Use the Chase Mobile app to accept payments

- Send secure payment links to customers

- Use Authorize.net as your payment gateway

- Issue refunds and track disputes

- Access real-time monitoring and alerts for fraud protection

- Set up recurring billing

- Create a product catalog

- Manage customer information + review customer insights

Chase Payment Solutions also integrates with various business tools, like BigCommerce and FreshBooks. You can even get deals like a 15-day free trial for BigCommerce and 50% off FreshBook's Premium plan.

Similar to PaymentCloud, Chase gets you a payments advisor you can contact for support. Customer support is available 24/7.

Chase Payment Solutions Supported Industries:- Retail

- Restaurants

- Professional Services

- E-commerce

- Healthcare

- Accept credit and debit card payments in-store, online, or on the go

- Equipment

Chase Payment Solutions primarily highlights mobile payment processing. So you can count on it to offer credit card terminals and mobile payment options.[9][10]

- Countertop terminal: $399

- Wireless Terminal: $499; one charge can take up to 1,000 transactions

- Chase Card Reader: $99

- Chase Card Reader and Base bundle: $129; pocket-sized card reader; use in tandem with the POS app

- Countertop terminal: $399

- Pros + Cons

Pros:

- Established and trusted payment processing company

- No hidden fees

- 24/7 customer support

- Payments Advisor available

- No-fee same-day deposits (with Chase Business Complete Banking)

- Perks from integrations due to being a Chase customer

Cons:

- Limited integrations

- Limited hardware options

- Authorize.net is the only option for a third-party payment gateway

- Established and trusted payment processing company

Chase Payment Solutions℠

- Limited time offer: Get $100 off the Chase Point of Sale (POS)℠ Terminal. Fill out the form and ask a Payments Advisor how to claim.

- Fast funding at no additional cost. Get deposits as soon as same day.

- Get fair and transparent pricing with no hidden fees. 2.6% rate +10¢ per tap, dip and swiped transaction. 2.90% + 25¢ per eCommerce transaction and monthly fee starting at $9.95. 3.5% rate +10¢ per keyed transaction.

- Get paid fast and manage your business from anywhere with the Chase Point of Sale system. Use our mobile app, reader and terminal to take payments via tap, dip and swipe.

- Process payments with Chase Payment Solutions, the #1 merchant acquirer in the U.S.

- Tap to Pay on iPhone offers you the ability to accept contactless cards, Apple Pay and other digital wallets on your iPhone – no additional hardware required.

- Chase Customer Insights is a complimentary business intelligence platform that offers simple, actionable analytics and reports to help you make better business decisions and reach more customers.

Maybe you're not a Chase banking client. But do you have a large monthly sales volume? If so, check out Dharma instead.

Dharma Merchant Services: For High-Volume Businesses

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Interchange plus |

| Monthly Fee | Starts at $15/month (may vary depending on your account type) |

| Contract | Month-to-month |

| Swipe or Chip Transactions | Interchange + 0.15% + $0.08 |

| Online Transactions | Interchange + 0.20% + $0.11 |

Dharma Merchant Services charges some of the lowest credit card processing rates on the market. However, they only work with merchants with higher transaction volumes.

If you process more than $100,000/mo, you can get even more discounts. For example, rates for card-present transactions start at 0.15% + $0.08 plus interchange fees. But this can get reduced to as low as 0.10% + $0.08 plus interchange.

Many businesses that make the switch from their current processor to Dharma see a reduction of 20% to 40% from their current rates. That said, you'll still want to watch out for Dharma's monthly fees and consider them on your budget.

- Pricing

Dharma charges a monthly fee of $20 ($15/month for high-volume merchants). That said, there are no long-term agreements that will tie you to the processor.

Here are the rates you can expect with your account:

Card-present transactions

(VISA, Mastercard, Discover)[11][12][13]Interchange + 0.15% + $0.08 Card-present transactions

(American Express)[14]Interchange + 0.25% + $0.08 Card-not-present transactions

(VISA, Mastercard, Discover)[13][15]Interchange + 0.20% + $0.11 Card-not-present transactions

(American Express)[14]Interchange + 0.30% + $0.11 Watch out for other miscellaneous fees:[16][17]

- Closure fee: $49

- Chargeback fee: $25/instance

- B2B app (app that can be used by B2B businesses to get lower interchange rates): $20/mo

- Merchant Insights app for detailed reporting: $10/mo

- ACH monthly fee: $25/mo

- Invoice and recurring billing: $10/mo

- Account updater for cards-on-file: $25/mo

- e|tab for online ordering, pick-up, or delivery: $49/mo

Dharma doesn't charge annual fees, monthly minimums, PCI-compliance fees, batch fees, and fees for the virtual terminal.

- Closure fee: $49

- Features

MX Merchant, or Merchant Exchange, is an account that comes with your Dharma merchant account.

It comes with a virtual terminal that qualifies you for lower interchange rates. Plus, you get other essential tools such as mobile processing, online reporting, customer database, online payment links, and next-day funding.

Depending on the equipment you use, you may get additional POS features, too. Dharma supports a variety of point-of-sale systems, including Clover. You can accept swipe, chip, and contactless payment depending on your equipment.

In addition, you can integrate your merchant account to ACH.com to access ACH processing. This is how you can set up recurring ACH payments, which can be more affordable to process than credit card payments.

The underwriting process for an ACH processing account is different from your merchant account. Approval can take up to 10 days. You may also be asked for additional documents with your application. - Equipment

Dharma supports a variety of terminals. You can choose from Verifone, Dejavoo, Ingenico, First Data, and Clover products. Prices range from $295 to $480 (but the price for Clover POS may differ).

You can use these terminals to accept swipe, chip, and contactless payments. Bluetooth swipers are also available in case your business is on the go and needs something wireless and compact.

That said, be sure to inquire about the compatible MX apps for each terminal. For example, Ingenico Desk/5000 ($369), requires an MX B2B App to be used, which means you'll need to pay an additional $20/mo for the app.

On the other hand, Dejavoo Z11 ($295) is what you'll have to use to surcharge your customers. It's compatible with the MX Advantage Surcharging app.

- Pros + Cons

Pros:

- Free consultation

- No long-term contracts

- No setup fees

- 24-hour tech support

- 24-hour funding

- You can surcharge your customers

- Mobile POS app available

Cons:

- Miscellaneous fees

- Not suitable for newer small businesses

- Rates vary per card type

- Free consultation

Not quite convinced with Dharma? This next option can be another affordable processor, especially for brick-and-mortar stores.

National Processing: For Businesses with Physical Locations

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Flat-rate pricing |

| Monthly Fee | Starts at $14.95/mo; custom pricing starts at $14.95+/mo |

| Contract | Month-to-month |

| Swipe or Chip Transactions | 2.5% + $0.10 per transaction (Basic In-person Package), 2.41% + $0.10 per transaction (Advanced Package) |

| Online Transactions | 2.9% + $0.30 per transaction |

| Full Review of National Processing | |

National Processing is a merchant account provider that offers low in-person transaction fees. Its flat rate even beats the in-person rates of Stripe, Square, and Chase.

There are no long-term contracts or monthly minimums. You'll also access everything you need to process payments.

That said, National Processing is nearer to the bottom of the list because flat rates can be pricier than other pricing models. Plus, you'll have to pay monthly fees with your account.

In comparison, Square charges a flat rate with no monthly fee (free plan). Dharma charges interchange-plus pricing with monthly fees. Depending on your sales volume, National Processing can be pricier than the two.

- Pricing

National Processing offers 4 plans:[18]

- Basic In-Person Package: $14.95/mo; you can get a free mobile reader or terminal, and a free gateway setup

- Basic eCommerce Package: $14.95/mo; aside from free equipment and gateway setup, you can also integrate with eCommerce platforms

- Advanced Package: $19+/mo; you can choose from various POS systems and reprogram existing equipment

- Premium Package: $14.95+/mo; custom rates; for businesses with over $30,000 in monthly sales

Here are the processing rates per transaction:[19]

- In-Person transactions: 2.5% + $0.10 per transaction (Basic In-person Package), 2.41% + $0.10 per transaction (Advanced Package)

- Online transactions: 2.9% + $0.30 per transaction

- Keyed-in transactions: 3.5% + $0.15 per transaction

There's no termination fee for Basic and Advanced plans.[20] But there will be a termination fee if you choose to switch processors without giving National Processing the chance to beat the competitor's rates.

If you apply as a high-risk business, then you may be required a long-term contract. Long-term contracts may come with termination fees.

- Basic In-Person Package: $14.95/mo; you can get a free mobile reader or terminal, and a free gateway setup

- Features

National Processing offers a lot of payment processing solutions, such as:

- Point-of-sale (POS) systems

- Mobile payment processing

- Virtual terminal

- ACH payment processing

- Payment gateways

- Software integrations

POS systems include Pax, Clover, and SwipeSimple. Some of the features you'll get include invoicing, recurring payments, and reporting. You can also use the virtual terminal if you mostly take over-the-phone payments.

As for payment gateways, you get 2 options: National Processing Gateway and Authorize.net. Both can work great for accepting online payments, even international currencies.

And if your business works with multiple software, you may find that you can integrate them with your merchant account. National Processing works with multiple accounting tools, eCommerce tools, and CRMs.

- Point-of-sale (POS) systems

- Equipment

You can get a free mobile reader or terminal with National Processing. But you can also purchase terminals if you need more. Free equipment is available for the Basic plans.

Advanced and Premium plans let you choose from various POS systems, like Pax, Clover, and SwipeSimple. There are also smart terminals available for when you accept payments on the go.

Pricing can range from $345 to $2,000. If you already have equipment of your own, National Processing can reprogram them if you opt for the Advanced plan.

- Pros + Cons

Pros:

- No long-term contracts

- No monthly minimums

- 4 flexible pricing plans to choose from

- Free equipment available

- Can reprogram existing equipment

Cons:

- Underwriting process

- Monthly fees with flat-rate pricing

- Can get pricey with larger sales volume

- Additional fees with the Clover software

- No long-term contracts

What if your main priority is the processor's effectiveness in supporting your business? Check out this next option.

Host Merchant Services: Best Customer Service

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Interchange-plus |

| Monthly Fee | $14.99/mo |

| Contract | Month-to-month |

| Swipe or Chip Transactions | Interchange rate + 0.25% + $0.10 per transaction (retail); Interchange rate + 0.20% + $0.09 per transaction (restaurant) |

| Online Transactions | Interchange rate + 0.35% + $0.10 per transaction |

Host Merchant Services prides itself on its customer service, boasting that you'll never have to wait in line to get your concerns addressed. And if you make a call, a real person will also get to you in just 3 rings!

The company has received an average rating of 4.6 out of 5 stars in Trustpilot, which could testify to this.

In addition, Host Merchant Services supports a variety of industries, including retail, restaurants, eCommerce, and even high-risk industries. Rates vary depending on your industry. You may even get processing equipment for free.

- Pricing

Host Merchant Services charges a monthly fee of $14.99/mo. Your processing rates depend on your industry type:[21]

- Retail Storefront (in-person transactions): 0.25% + $0.10 per transaction

- Restaurant: 0.20% + $0.09 per transaction

- eCommerce (online): 0.35% + $0.10 per transaction

Note that there are other fees to budget for:

- Batch fee: $0.20 per batch

- Voice authorization: $0.75

- Gateway fee: $5/mo (optional)

- Annual 1099 reporting fee: $24/year

Host Merchant Services supports other industries like medical, construction, and automotive. Be sure to inquire about the respective processing rates if you belong to these industries.

- Retail Storefront (in-person transactions): 0.25% + $0.10 per transaction

- Features

Host Merchant Services offers all the tools you need to accept and process payments.

Some of these tools include:

- Payment gateways

- Virtual terminals

- Online shopping carts

- Business tools integration

You can accept credit card payments in person through a terminal or your own mobile device. There are wireless terminals available, too, so you can accept payments on the floor.

To use your Android or Apple device, just download the free HMSPay app. But you can also purchase a tablet if you need one.

In addition, Host Merchant Services works with 100+ payment gateways, including Authorize.NET, so you can accept payments in your online store.

As for the virtual terminal, you can use it from your PC or Mac, which is most convenient if you take over-the-phone payments.

Some of Host Merchant Services' supported shopping carts include WooCommerce, Shopify, Magento, BigCommerce, and Wix. - Payment gateways

- Equipment

Host Merchant Services offers a variety of point-of-sale systems, which come with their own set of POS equipment.

You can choose from:

- Clover POS

- Vital POS

- SwipeSimple

- Bonsai POS

These POS systems have their own features, too. For example, you may get features on inventory management and employee management.

The price to budget for equipment depends on the system you go for. You could choose a complete workstation or limit your purchase to a smart terminal.

- Clover POS

- Pros + Cons

Pros:

- Free consultation

- Free equipment available

- No contracts

- No cancellation fees

- No upfront or hidden fees

- 24/7 customer service

- Works with high-risk businesses

Cons:

- Locked-in rates (although it won't increase, that also means it won't decrease, unlike with other interchange-plus competitors like Helcim)

- Miscellaneous fees like batch fees, voice authorization, and gateway fees

- Free consultation

You've reviewed most of the processors on this list. Still looking for the most trusted brand of them all? It's PayPal.

PayPal: For E-commerce Businesses

| CreditDonkey Rating | |

|---|---|

| Pricing Model | Flat-rate and Interchange-plus |

| Monthly Fee | No monthly fees |

| Contract | Month-to-month |

| Swipe or Chip Transactions | 2.29% + $0.09 per transaction |

| Online Transactions | 3.49% + $0.49 per transaction |

PayPal is one of the trusted brands when it comes to making and accepting payments. There's a reason why it's used by over 30 million merchants.

Your customers can pay through credit or debit cards, Apple Pay, Google Pay, Venmo, PayPal, and Pay Later options. If you're an e-commerce business, you even get to sell to customers worldwide since you can accept over 140 currencies.

PayPal works with many popular e-commerce platforms, too, such as BigCommerce, WooCommerce, and GoDaddy.

The downside is that there are a lot of fees to consider. Although you can open a free PayPal business account, that doesn't mean all the other tools are free.

You can get significant conversion rates with PayPal. Through the platform, you can have a:

- 33% increase in checkout conversion

- 20% more repeat customers

- 43% higher spend from customers

Additionally, 69% of customers feel that their payments are more secure if a business accepts PayPal. Offering that PayPal button at checkout may just increase your brand's trustworthiness.

- Pricing

PayPal has a lot of fees. It's why the processor is the last on our list. These fees should be disclosed in your contract, specifically, since they may vary depending on the services you opt for.

PayPal Processing Rates:[22]

- Swipe Rate:

- Card-present transactions: 2.29% + $0.09 per transaction

- QR code transactions: 2.29% + $0.09 per transaction

- Online Rate:

- 2.99% + $0.49 for credit and debit cards

- 3.49% + $0.49 for PayPal payments

- Keyed-in transactions:

3.49% + $0.09 (through PayPal POS)

3.39% + $0.29 (through the virtual terminal)

That said, there are a lot of other fees to consider, so be sure to read the fine print. International transactions will have an additional 1.50% added to the fee. Fees for donations differ.

PayPal "Standard" and PayPal "Advanced" refer to your PayPal Checkout option. PayPal Standard only includes simple PayPal payment buttons. PayPal Advanced lets you build and customize payment forms.Other Fees To Consider:

- Virtual Terminal: $30/mo

- Recurring Billing: $10

- Chargeback Fee: $20

- Chargeback Protection: 0.40% to 0.60% per transaction

- Dispute Fee: $15

- High-volume dispute fees: $30

- Instant withdrawal fee: 1.50% of the amount transferred

If you're hoping to get more affordable rates, you can try PayPal Card Payment Services' Interchange Plus Plus fee structure. Eligible credit and debit card payments will be charged interchange + 0.49% + $0.39 per transaction.

- Swipe Rate:

- Features

Your customers won't need a PayPal account to pay for their purchases. And aside from accepting over 100 currencies, you can also accept local payment methods from different locations.

Here are some of PayPal's main features:

- Online checkout (option to custom code available)

- Point-of-sale system

- Virtual terminal

- Recurring payments and subscriptions

- Estimates and invoicing

- E-commerce integrations

Apart from accepting credit and debit card payments, you can accept PayPal, Venmo, digital wallets, installments, and cryptocurrencies.

If your customer chooses a Pay Later option, you still get paid upfront at no extra cost. And if they check out with crypto, you'll still be getting cash as payment.

PayPal POS system offers the essentials, like inventory management, reporting, employee management, etc. You can set prices and stock levels, note your best-selling products, manage employee shifts, and more.

PayPal offers financial services, too, if you need them. You can apply for credit cards, debit cards, and business loans. - Online checkout (option to custom code available)

- Equipment

PayPal offers a card reader and an all-in-one terminal for when you accept in-person card payments. You can also simply use your mobile device to take contactless payments through Tap to Pay (through the PayPal POS app).

- Wireless card reader: $29 for the first reader; additional readers cost $79 each

You can use the card reader together with your mobile phone. It syncs with your phone through the PayPal POS app. And it's available in white and black.The card reader's battery lasts up to 8 hours or 100 transactions, so you'll want to be sure that this is enough for a shift. You'll have to get another hardware otherwise.

- All-in-one terminal: $199

With PayPal's smart terminal, the PayPal POS app is already built-in. You won't need to connect your smartphone or tablet with it.The battery can last for up to 12 hours, but this can be cut short to 4 if used intensely. The terminal also comes with a SIM card and is available in dark gray.

You can purchase the terminal with a built-in barcode scanner ($239) or one with a printer and dock ($269).

PayPal also offers accessories, like receipt printers, registers, and barcode scanners. Ready-made kits are available, too.

- Wireless card reader: $29 for the first reader; additional readers cost $79 each

- Pros + Cons

Pros:

- Trusted brand

- No setup fees

- Mobile-friendly

- Use with other credit card processors

- Accept payments even without a website

- Accept Venmo, Pay Later, and cryptocurrency payments

- Discounted rates for donations

Cons:

- Long list of fees can get confusing

- Charge for features that competitors provide for free

- Trusted brand

Given all of these processors' pricing, how do you know if the rates aren't too much? Keep scrolling.

How to Choose the Cheapest Credit Card Processor

Although it's tempting to go for the cheapest monthly fee (i.e., $0/mo over $99/mo), that's not always going to be the cheapest processor for your business specifically.

Here's an example. Let's say your business has:

- $20,000 in average monthly sales

- An average order value of $100

If your processor charges each in-person card payment 2.6% + 10¢, with $0 in monthly fees, your processing cost for the month is at least $540.

BUT if a processor charges you $99 in monthly fees, with an in-person transaction fee of interchange + $0.08, your processing cost for the month will at least be $515.

In general, it's always better to calculate the cost depending on the sales of your business.

Estimate Your Processing Cost

It's not easy to understand if a processor's rate is really cheap for your business. All those percentages and flat fees don't really paint the full picture.

You can use the calculator below to understand your processing cost based on your average monthly sales and order value.

How to Use the Calculator:

- Input your average order value. This is the average price of the products or services you sell your customers.

- Input your average monthly sales. This refers to the dollar amount your business earns per month (i.e., $20,000/mo).

- Input the percentage fee of the processor of your choice. Note that you can only calculate one type of transaction at a time (i.e., in-person payments).

For example, if you choose Square, the percentage fee would be 2.6% for in-person transactions. If you choose to calculate the fees for online transactions, input 2.9%.

- Input the flat fee per transaction. In the previous example, Square's flat fee for in-person transactions would be $0.10.

- Click "Calculate"!

You should be able to get an estimate of your average monthly transaction cost. But don't forget to factor in the monthly fee for the total processing cost.

What is a Reasonable Credit Card Processing Fee?

|

| © CreditDonkey |

Credit card processing fees generally range from 1.5%-2.9% for in-person swiped transactions. Online transaction fees are a little higher at 3.5% due to higher risks of fraud.

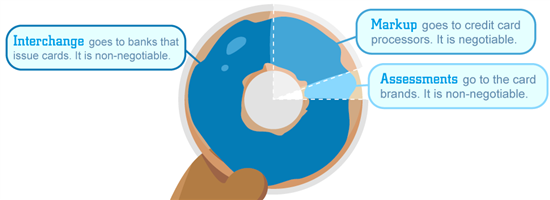

These transaction fees have three components:

- Interchange fees: fees charged by credit card networks like Visa and Mastercard; cost the same regardless of the processor

- Assessment fees: charged by card networks and take up a small percentage

- Processor markup: charged by your processor and can be negotiated

These fees are presented differently by each credit card processor depending on the pricing model they offer.

Types of Credit Card Processing Fees

The interchange, assessment, and processor markup fees can be packaged as:

- Flat-rate pricing

All transactions are charged the same flat rate, whether a customer pays with Visa, Mastercard, Discover, or Amex.This model is more suitable for businesses with lower sales volumes. The percentage markup per transaction can make it pricey for larger sales.

- Interchange-plus pricing

This is the most transparent of all pricing models, specifying the interchange and markup fees.This model also provides more room to negotiate since you can clearly see the processor's markup. It's best for businesses with larger sales volumes.

- Subscription pricing

You'll pay a membership fee with this model. You don't typically need to worry about percentage markups found on flat rates, which can mean significant savings on your end.This is also ideal for large businesses.

- Tiered pricing

Tiered pricing is similar to flat-rate. But instead of one flat rate, you get three. The rate you'll be charged depends on the type of card used, which will be categorized as qualified, mid-qualified, and non-qualified.This can make your fees confusing to understand, and so isn't highly recommended.

How to Lower Your Credit Card Processing Fees

Credit card processing fees can be expensive, but there are ways you can lower them. Here's how:

- Surcharge your customers

Surcharging is passing on the credit card fees to your customers. Let's say your customer made a purchase for $100. A surcharge of 2% will mean an additional payment of $2.Note that surcharging is only allowed for credit card payments. You cannot surcharge debit cards. Read our article on Credit Card Surcharges to learn more about surcharging rules. - Set up a cash discounting program

You can reward customers with a discount when they pay in cash. Your customers will save money while you save on processing fees.That said, your base price will be the price with processing fees considered. This way, you don't have to lose profit.

- Negotiate with your creditors

You can negotiate the processor markup and other fees set by the processor. This can include monthly fees, payment gateway fees, equipment fees, etc.The more valuable client you are, the more negotiation power you get to have. And you're a valuable client if you have a high sales volume, a good account history, and few chargebacks. - Choose scalable plans

It makes sense to switch processors if it will save you on processing fees. But a payment processor that lets you access cheaper rates as your business grows can be convenient. - Accept alternative payment methods

Some payment processors let you take ACH payments, eChecks, and cryptocurrencies, which may offer cheaper processing costs. Card-present transactions are also more affordable than online payments.

Frequently Asked Questions on Credit Card Processing

- Can you process credit cards without a fee?

You can avoid credit card processing fees if you surcharge your customers. This means you'll pass on the credit card fees to them, provided surcharging is legal in your state.

That said, you cannot surcharge debit card payments. So, you'll still be paying processing fees for these payments. In addition, your payment processor may also charge monthly fees, PCI compliance fees, chargeback fees, etc.

- Who charges least credit card fees?

You may get the cheapest processing fees from Square if you're a small or seasonal business. The pay-as-you-go pricing ensures that you only pay when you make a sale. Plus, Square offers a free plan, so you don't need to worry about monthly fees.

However, midsize and larger businesses will do better with interchange-plus pricing from Helcim or membership pricing from Stax. Flat-rate pricing gets more and more expensive the larger your sales volume.

- How do small businesses take card payments?

Small businesses can accept credit and debit card payments through payment processors. You may get POS equipment to take in-person card payments. You can also use the processor's virtual terminal to take keyed-in payments, which is suitable if you take orders over the phone.

And if your small business has an online store, processors work with payment gateways so you can accept card payments online.

- What is the cheapest way to take card payments?

Going for payment processors suitable for your business size can be the cheapest way to accept debit and credit card payments. Accepting in-person card payments will also be cheaper than taking online payments.

- What is the cheapest card machine?

You can typically get card readers for free. The cheapest credit card processing companies offer them as a bonus for signing up for an account.

- Which credit card processing is cheapest for small business?

Square is the cheapest credit card processing company for small businesses. You get no monthly fee with the free plan.

Plus, since you get pay-as-you-go pricing, you only pay when you make a sale. You can even get a free magstripe reader from Square.

Bottom Line

Processing fees will cut into your profit. So, the cheapest credit card processing company can provide a breather. But "cheap" isn't the same for all types of businesses.

For example, if you're a new or seasonal business, you're better off with a flat-rate processor like Square. That way, you get to skip paying monthly fees.

A large and established business, on the other hand, may save the most with processors like Stax or Payment Depot. You do get monthly fees. But you'll only pay low interchange rates per transaction and avoid hefty processor markups.

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 15¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

Save Up to 40%

- Flat Monthly Subscription Price, Starting at $99

- 0% Markup on Direct-Cost Interchange

- 24/7 Support

References

- ^ Helcim. Pricing, Retrieved 06/26/2025

- ^ Square. Square Stand, Retrieved 06/26/2025

- ^ Square. Square Kiosk, Retrieved 06/26/2025

- ^ Stripe. Pricing, Retrieved 06/26/2025

- ^ Stripe. Payment devices, Retrieved 06/26/2025

- ^ Stax. Pricing, Retrieved 06/26/2025

- ^ PaymentCloud. No-Fee Credit Card Processing: A Complete Business Guide, Retrieved 06/26/2025

- ^ Chase. Credit card processing fees, Retrieved 06/26/2025

- ^ Chase. Credit card terminal, Retrieved 06/26/2025

- ^ Chase. Credit card reader, Retrieved 06/26/2025

- ^ Dharma Merchant Services. Retail & Small Business Rates, Retrieved 06/26/2025

- ^ Dharma Merchant Services. Restaurant Rates, Retrieved 06/26/2025

- ^ Dharma Merchant Services. B2B Processing Rates, Retrieved 06/26/2025

- ^ Dharma Merchant Services. American Express OptBlue, Retrieved 06/26/2025

- ^ Dharma Merchant Services. Virtual & Online Rates, Retrieved 06/26/2025

- ^ Dharma Merchant Services. MX Merchant, Retrieved 06/26/2025

- ^ Dharma Merchant Services. Is there a closure fee?, Retrieved 06/26/2025

- ^ National Processing. Our Merchant Services Pricing, Retrieved 06/26/2025

- ^ National Processing. Processing fees, Retrieved 06/26/2025

- ^ National Processing. FAQ: What happens if I need to cancel my contract early?, Retrieved 06/26/2025

- ^ Host Merchant Services. Pricing, Retrieved 06/26/2025

- ^ PayPal. PayPal Merchant Fees, Retrieved 06/27/2025

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Not sure what is right for your business?

|

|

|

|

|

| ||||||

|

|

|