Credit Card Machine

Credit card machines will keep your business running smoothly. But they aren't created equal. Find the best card machine for your business.

|

Whether you have a large retail store or small market pop-up, you need a way to take credit cards.

There are many different types of credit card machines to choose from. The right one can help you run your business more efficiently and improve customer experience.

How do you choose the best for your business? We'll go over the differences between the types of machines, cost, and the top brands.

What Is a Credit Card Machine?

A credit card machine is a device that reads swiped, dipped, and tapped credit cards. It reads the credit card data and sends it the acquiring bank to be processed.

Some different types of machines include:

- Mobile card reader

- Traditional countertop terminal

- Wireless terminal

- Smart terminal

- Integrated POS terminal

- Virtual terminal (not a physical machine)

The machine can be as simple as just a reader to read cards, to something with all the bells and whistles including receipt printer and POS tools. Read on to learn the differences to find the best one for you.

- What type of cards will you accept?

- Is there an existing POS or do you need one?

- Do you need mobility or will the machine sit in one spot?

- Will you hardwire the phone or internet or do you need Bluetooth/wireless capabilities?

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 15¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

Types of Credit Card Machines

First, we'll go over the different types of card machines, their common features, pros and cons, and cost. We'll also share some examples to help you get started.

Mobile Credit Card Reader

|

| Credit: Square |

A mobile card reader is a small device that attaches to your smartphone or tablet typically through the earphone jack. Other times, you pair it through Bluetooth. It turns your smart device into a point of sale.

This is an ideal solution for small mobile businesses, pop-up shops, and those who travel to their clients. All you need is your phone, and you can take payments anywhere on-the-go.

Mobile readers require an internet connection to process cards. You'll need cellular data, Wi-Fi, or hotspot.

Common Features:

The mobile reader is partnered with a software app so you can capture and transmit payment details securely. Some payments you can take include e-wallet payments, EMV chip cards, and magstripe payments.

Contactless payments typically have a maximum transaction limit. This is to limit the risks since they don't require a pin or verification.

Some processors let you send electronic receipts through email, text, or in-app. But you can also print paper receipts using a wirelessly connected printer. Depending on your mobile reader, other POS management tools can also be integrated.

Cost:

Mobile card readers are the cheapest. They run from $10 for a simple swipe reader to $50 - $80 for a swipe, chip, and tap reader. Many processing companies, like Square, even offer a free card reader.

|

|

Examples of Mobile Card Readers

- Square Reader

There are 2 types of Square readers. You can choose from magstripe or contactless and chip readers. Magstripe readers have 2 models; one connects to a headset jack and another to a lightning connector.Why we like it:

Square readers work with the free Square POS app and is available for iOS and Android devices. You'll also get a free card reader just by signing up for a free account.You can process payments in offline mode if you ever lose internet connection. But the EMV reader requires a connection.

Once your customers make payment, they can give you private feedback through digital receipts. They can also tip through your device.

Processing fees:

The transaction rate is 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium) for tap, dip, and swipe payments.Pricing:

- Square Reader for Magstripe: $10

- Square Reader for Contactless and Chip: $59

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 15¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

- Square Reader for Magstripe: $10

- Clover Go

Clover Go works with the Go app available for Android and iOS. It uses a micro-USB for charging, but it can connect with your mobile devices through Bluetooth.Why we like it:

The mobile reader syncs with your Clover Dashboard and other Clover devices. Not only can you accept payments, but you can also set discounts and tips. You can even set tax rates and fees right through your phone.The dashboard lets you get an overview of your transaction history, including open and pending ones. It will also include transactions made with other Clover devices.

After taking payments, you can send digital receipts to your customers through email or text.

Processing fees:[1]

- Card-present transactions: 2.6% + 10¢

- Card-not-present transactions: 3.5% + 10¢

Pricing:

- Starter: $49; comes with Clover Go reader, virtual terminal, and Payments plan

- Standard: $49 + $14.95/mo; comes with Clover Go reader, virtual terminal, Essentials plan, sales tracking and reporting, and inventory management

Clover Go for $49

- Accepts swipe, chip, tap, including Apple Pay and Google Pay

- Process credit cards anywhere

- Works with free Clover Go app on iOS and Android

- Card-present transactions: 2.6% + 10¢

- National Processing Mobile Swiper

National Processing is a payment processing solution that also works with other devices such as Clover, Ingenico, and Verifone.Why we like it:

You can get lots of free stuff with National Processing aside from a free mobile reader. If you have an existing equipment, you can get it reprogramed for free. You can also get a free gateway setup.And if you're switching from an old payment processor, you can get $500 with National Processing if they can't beat your current rates.

The mobile reader has a long-lasting battery life, so you know it won't die on you in the middle of the day.

Processing fees:

They don't explicitly say how much the transaction rates are. But you can use their calculator to get an estimate.Pricing:

The mobile reader is free.

Now, let's say you don't want to use your phone for processing payments. What's your next option?

Countertop Terminal

|

Also called standard terminal, this is the most common type of machine that you see in stores. A countertop terminal sits on the counter and is physically wired to your internet or phone line. As such, you can't freely move it around the store.

They're ideal for any kind of retail stores, restaurants, and service retailers that have a payment counter/desk.

You can use them as standalone devices or connect them to other equipment like a cash drawer and receipt printer.

Common Features:

There are many different types of countertop terminals depending on your needs. Modern ones should have the availability to read swipe, chip, and contactless cards.

Other options feature a:

- PIN pad

- Signature screen

- Built-in receipt printer

- Stand that swivel for ease of use

Aside from printing receipts, other countertop terminals let you send digital receipts to your customers. You can often set tipping options for your employees as well.

Depending on your processor, other features may include tax calculations, sales discounts, inventory management, and customer engagement features.

Cost:

Standard credit card terminals usually cost between $100 - $400 depending on the model and features offered.

|

|

In order to send credit card information to the processor, credit card machines do need a phone/internet connection of some kind.

You can go "old school" by choosing a dial-up machine that uses your phone line for connection. But make sure it's not interrupted by phone calls. A phone connection also causes slower speeds. A credit card machine using internet connection offers faster transaction speed.

Examples of Countertop Terminals

- Ingenico Desk/5000 from Chase Payment Solutions

You can purchase Ingenico Desk/5000 from Ingenico or other payment processors. Chase Payment Solutions is one of the many that offers it.Why we like it:

Just like other modern terminals, you can connect Desk/5000 to other POS devices. It can process chip cards, PIN debit cards, contactless cards, and select mobile wallets.It has features for tipping and reporting. It'll fit well with your retail or restaurant workflow.

Processing fees:

If you use Chase Payment Solutions, card-present transactions will cost 2.6% rate +10¢ per tap, dip and swiped transaction.[2]Pricing:

The countertop terminal costs $299.[3] - PAX A80 from National Bankcard

National Bankcard is one of the many processors that provide PAX A80.Why we like it:

Although it is a countertop terminal, there's an optional battery backup you can use. That way, you can transform it as a portable payment terminal.Aside from a backlit physical keyboard, you also get a touchscreen which makes it easier to navigate through the device. It also comes with its own camera and printer.

Processing fees:

You'll have to contact National Bankcard for the processing fees. But tiered and interchange pricing are available.Pricing:

The device is free if you sign up for their services. But it's valued around $125.

Wired terminals will not work if your business is on the move. Good thing there's a wireless option. Read on to learn about them.

Wireless Terminals

|

A wireless, or portable, terminal looks a lot like a standard terminal, but it doesn't require a physical wired connection. It uses a wireless connection (wifi, Bluetooth, cellular) to transmit data to and from the processor.

It's a great option if you want more mobility. You can take the terminal to customers to pay tableside or on the shop floor. They don't need to line up to pay. It's also good if your work is often on the move.

Common Features:

More than processing payments, wireless terminals are often customizable with features. You can set up a loyalty program and offer rewards to your customers. You can also provide digital coupons for marketing.

To motivate your staff, you can set tip prompts. You can even access reporting tools with some of these devices.

Typically, you can also print receipts.

Cost:

Wireless terminals cost about the same as standard countertop terminals. You can expect to pay around $100 - $400 depending on the model.

|

|

Both let you process payments on-the-go. The difference is that a mobile card reader plugs into your smartphone, and you process the payment on your phone with the POS app. A wireless terminal is a standalone credit card machine. You don't need your phone. It also offers more functions.

Examples of Wireless Terminals

- Helcim Card Reader

The Helcim card reader is a portable device you can connect to any other device you own. You can connect it to your computer, tablet, or smartphone. Do it through Bluetooth or by plugging it into your desktop.Why we like it:

You use it with the free Helcim app. Some of its features include customer tracking, batch history, and analytics & reporting. You can also keep cards on file for recurring customers. You can email receipts as well.When we say portable, we mean it fits right in your pocket. It fits with the OtterBox uniVERSE Case System too. That way, you bring it with you wherever you take your phone or your tablet.

Processing fees:

Transaction rates for Helcim depend on your monthly processing volume.[4]Monthly Volume In-person Transactions Online and Keyed Transactions $0 - $50,000 Interchange + 0.40% + 8¢ Interchange + 0.50% + 25¢ $50,001 - $100,000 Interchange + 0.35% + 7¢ Interchange + 0.45% + 20¢ $100,001 - $500,000 Interchange + 0.25% + 7¢ Interchange + 0.35% + 20¢ $500,001 - $1,000,000 Interchange + 0.20% + 6¢ Interchange + 0.25% + 15¢ $1,000,001+ Interchange + 0.15% + 6¢ Interchange + 0.15% + 15¢ Pricing:

The device costs $199 and comes with a free countertop stand.Helcim Card Reader for $199

- Tap & Pay

- Chip & PIN

- PIN Debit

- Email receipts

- Customer tracking

- Analytics & reporting

- Batch history

- Card on file

- Surcharging

- Built-in 4G/LTE data

- Compatible with Helcim Payment Extension

- Clover Flex

Clover Flex is an all-in-one POS device. You can use it by itself or together with other Clover devices. Since it's a cloud-based POS, making a change on one device will automatically reflect on others.Why we like it:

You can easily accept payments, track sales, and manage inventory with Clover Flex. Use it for tableside ordering or bring it with you if your business is on the go.You can take swipe, dip, tap, and contactless payments. It also comes with a built-in camera and barcode scanner. If you need to print receipts, there's a built-in receipt printer as well.

Processing fees:

Processing fees depend on the Clover Plans you choose.For Starter and Standard Plans, the transaction rates are:

- Card-present transactions: 2.6% + 10¢

- Card-not-present transactions: 3.5% + 10¢

For the Advanced Plan:

- Card-present transactions: 2.3% + 10¢

- Card-not-present transactions: 3.5% + 10¢

Pricing:[5]

- Starter Plan: $35/mo for hardware and software; full hardware price at $599 + $0/mo

- Standard Plan: $50/mo for hardware and software; full hardware price at $599 + $14.95/mo

- Advanced Plan:$80/mo for hardware and software; full hardware price at $599 + $44.95/mo

Clover Flex Handheld Terminal

- Accepts swipe, chip, tap, including Apple Pay and Google Pay

- Full-fledged POS in a handheld device

- Built-in receipt printer

- View sales transactions and business reports

- Card-present transactions: 2.6% + 10¢

- Dejavoo Z11 Terminal from Payment Depot

Payment Depot provides Dejavoo Z11, but you can also get it from other processors. It's another option if you prefer a terminal with a touchscreen and physical pin pad.Why we like it:

You can accept EMV and NFC payments with it. Some accepted payments include Apple Pay, Google Wallet, Samsung Pay, MasterCard PayPass, and Visa payWave.Through the touchscreen, you can take customer signatures. If your terminal is in idle mode, you can also input images on the display to help with marketing or promotions.

Processing fees:

There are no markup rates with Payment Depot. You only pay the wholesale rates and the membership fees.The membership fees are:

- Pricing Plans start at $79/month (Process up to $250,000/year)

- Custom quote if you need to process more than $250,000 annually

Pricing:

You'll have to contact Payment Depot for the price of the terminal. But it costs around $200 to $500 with other providers. - Pricing Plans start at $79/month (Process up to $250,000/year)

Next, let's talk about the more advanced terminals.

Smart Terminal

|

| Credit: Square |

A smart terminal is a modern type of credit card machine. Instead of a number pad with a small screen, you typically get a large touchscreen. It's like a smartphone vs. an old cellphone.

It works great for mobile businesses such as food trucks. You could bring it with you to your pop-up shops. But it's also commonly used for restaurants and cafes.

You can tap, dip, and swipe card payments with it. Customers can also pay you with their e-wallets.

Common Features:

They usually come integrated with POS software, so it does more than just processing. You can set discounts, issue refunds/exchanges, manage inventory, manage employees, and more right on the machine.

Often enough, you can take payments in offline mode. That way, you don't have to stop doing business when the internet suddenly goes down.

Some may even have other hardware features, like a receipt printer or scanner, all built into one sleek package. They're also often wireless so you can bring it around the store.

Cost:

Smart terminals cost more than standard terminals. They typically range between $300 to $600.

|

|

Examples of Smart Terminals

- Square Terminal

The Square Terminal is an all-in-one credit card machine. It works with your free Square POS software. You can use it for your restaurant, retail, or service business.Why we like it:

You can plug it into a power source on your counter. But you can also use it cordlessly since it has a battery that can last all day.That makes it portable for tableside ordering and convenient for on-the-go businesses. You also don't need a separate printer since you can print receipts with the device itself.

Although it's an all-in-one POS, it works great with your other Square devices. It can also work with other POS.

Processing fees:

Square's rate is 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium) per card-present transaction.Pricing:[6]

Square Terminal costs $299. But you can choose to pay $27/mo for 12 months.Square Terminal

- 2.6% + 15¢ per tap, dip, or swipe

- Fully integrated POS system with built-in receipt printer

- 5.5" display

- Clover Mini

Clover Mini is a full POS system that won't take too much space on your countertops. It works great for retail stores, quick-service, and full-service restaurants.Why we like it:

You can manage inventory, monitor sales, and set up loyalty programs. It can even work with payroll and other accounting software such as QuickBooks.It comes with a contactless reader, credit card readers, built-in camera, and a barcode scanner. You can also use the built-in printer to print receipts, or just send them to your customers through text or email.

Use a cash drawer with it to accept cash payments; it's an add-on you can purchase. That said, this all-in-one device also works great with other Clover devices and accessories.

Processing fees:

The processing fees depend on the pricing plan, business type, and type of transaction.For retail businesses, transaction rates for Starter and Standard Plans are:

- Card-present transactions: 2.6% + 10¢

- Card-not-present transactions: 3.5% + 10¢

The Advanced Plan costs:

- Card-present transactions: 2.3% + 10¢

- Card-not-present transactions: 3.5% + 10¢

The fees per transaction for quick-service and full-service restaurants are:

- Card-present transactions: 2.3% + 10¢

- Card-not-present transactions: 3.5% + 10¢

Pricing:

The price for the device also depends on the plan and type of service.For retail and service businesses:[7]

- Starter plan: $45/mo for hardware + software; full hardware price at $799 + $0/mo for software

- Standard plan: $60/mo for hardware + software; full hardware price at $799 + $14.95/mo for software

- Advanced plan: $95/mo for hardware + software; full hardware price at $799 + $44.95 /mo for software

For restaurants and food services:[8]

- Quick service dining: $100/mo for hardware + software; full hardware price at $799 + $44.95/mo for software

- Full-service dining: $130/mo for hardware + software; full hardware price at $799 + $74.95/mo for software

Clover Mini

- Accepts swipe, chip, tap, including Apple Pay and Google Pay

- Full POS system in a sleek 7" display

- Built-in receipt printer, camera, and barcode scanner

- Integrate with barcode scanners, weight scales, and other accessories

- Card-present transactions: 2.6% + 10¢

- Shopify POS Go

POS Go is a smart terminal that boots to Shopify. It has an integrated card reader that lets you accept tap, chip, and swipe payments. Your customers can also pay through their mobile wallets.Why we like it:

It comes with a barcode scanner you can use to scan products and view inventory. It's handy for retail businesses.Use it to monitor sales, manage employees, and review reports. It's powered by the Shopify POS software, so you get the features to fully manage your business wherever. For the software, you can choose from the POS Lite or the POS Pro.

POS Lite is free for all Shopify plans. But POS Pro can give you more features such as omnichannel selling and smart inventory management.

Processing fees:

Transaction fees for Shopify Payments depend on the Shopify plan.In-person rates are:

- Basic: 2.7% + 0¢

- Shopify: 2.5% + 0¢

- Advanced: 2.4% + 0¢

Pricing:

POS Go costs $399. You can purchase a case with it for $39.Since you'll need a POS plan, here's a list of the price for Shopify plans:

- Basic: $39/mo

- Shopify: $105/mo

- Advanced: $399/mo

Opting for POS Pro will cost an additional $89/mo/location.[9]

- Basic: 2.7% + 0¢

Technically, these smart terminals are already integrated with different POS systems. But let's talk about that in more detail below.

Integrated POS System

These are credit card machines integrated with a POS system. This is a comprehensive credit card payment system that includes the processing equipment and software for running your business. Everything is seamlessly connected.

Because of this, you can reduce manual data entry errors and get access to real-time reporting. You can also manage inventory across the board and avoid awkward situations in restaurants.

With their hardware and software, these systems usually come with everything you need, such as a large screen display, cash drawer, and receipt printer.

Common Features:

Aside from inventory management, reduced errors, and reporting features, you can also get features on:

- Employee management

- Customer management

- Marketing

- Website integration

- Integration with other apps

Typically, hardware includes stand-alone displays, customer facing displays, barcode scanners, receipt printers, and cash drawers.

Cost:

Full integrated POS systems can cost several hundred to $2,000 or even more.

|

|

Examples of Integrated POS Terminals

- Square Register

Square Register is a sleek and well-designed register that can fit right onto your countertop. It's a fully integrated POS system with no need for other devices and applications. But of course, other Square products still work well with it.Why we like it:

It comes with a customer facing display for more accurate orders. Through it, your customers can see the details of what they're purchasing. They can even pay and tip your staff with it.You get protection from chargebacks as well. And if your internet goes down, you can keep taking payments through Offline Mode.

You can also take online orders and delivery. It's especially useful for food businesses. For a better workflow, you can connect it with a cash drawer, receipt printer, barcode scanner, and kitchen printer.

Processing fees:

- Tap, dip, swipe, or scanned payments: 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium) per transaction

- Afterpay: 6% + 30¢ per transaction

Pricing:

Get the Square Register for $799. Or you can pay in installments at $39/mo for 24 months.Square Register

- 2.6% + 15¢ per tap, dip, swipe, or scan

- Fully integrated POS system

- Dual screen for seller and customer

- Tap, dip, swipe, or scanned payments: 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium) per transaction

- Clover Station Solo and Station Duo

There are two registers to choose from with Clover. And the two - Station Solo and Station Duo - provide almost the same features. The main difference is that the Station Duo comes with a customer facing display that lets you accept contactless payments.The Station Solo comes with a credit card reader for swipe and dip payments, receipt printer, and cash drawer. There's also a built-in camera, barcode scanner, and a thumb print log in reader for your employees.

Why we like it:

The features that you'll get depends on the type of business and plan you choose. But you can get real-time reporting, remote ordering, bill splitting, and online ordering features.You can also manage your staff and let them be rewarded with tips. If you have an online store, you can integrate the POS with it. Or you can create a new online store if you need one.

The registers are an all-in-one solution, but they still work well with other Clover devices. Some accessories that can go with them are Flex, Go, barcode scanner, weight scale, and kitchen printer.

Processing fees:

- Card-present transactions: 2.3% + 10¢

- Card-not-present transactions: 3.5% + 10¢

Pricing:

Pricing depends on your type of business.Station Solo:

- For retail and services: $125/mo for hardware and software or $1,699 + $49.95/mo

- For restaurants: $160/mo for hardware and software or $1,699 + $84.95/mo

Station Duo:

- For retail and services: $135/mo for hardware and software or $1,799 + $49.95/mo

- For restaurants: $140/mo for hardware and software or $1,799 + $54.95/mo

Clover Station Solo

- Accepts swipe, chip, tap, including Apple Pay and Google Pay

- Fully integrated POS system

- 14" touchscreen that swivels to face customers

- Includes cash drawer, receipt printer, built-in camera and barcode scanner

- Card-present transactions: 2.3% + 10¢

- Toast Flex

Toast Flex is a POS terminal that operates on Android. For that reason, it can be more flexible in terms of customization. Unlike other options however, Toast is specialized for restaurants.Why we like it:

It's not just the software, but even the hardware is flexible with Toast. You can flip the screen and adjust the height to make it ergonomic for your countertop. Or you could choose to mount it on the wall.Because it is optimized for restaurants, the hardware is spill-proof and durable. Aside from taking card payments, you can take online orders and use third-party delivery services.

You can also collect phone orders and send online invoices. All of which are suitable for food businesses. Not only can you receive payments from your customers, but from your suppliers as well.

You can also opt for Toast Flex for Guest. It's a customer facing display that will help you take payments more quickly and accept tips for your staff.You can attach it directly to Toast Flex or use a wedge mount on your counter. It depends on your design preference.

Processing fees:

They don't specifically state how much their processing fees are. You'll have to consult with them.Pricing:[10]

The hardware comes with the pricing plans. You can choose your own hardware regardless of the plan you choose (except for Starter Kit):- Quick Start Bundle: Starting at $0/month

- Core: Starting at $69/month

- Growth: Starting at $165/month

- Build Your Own: Custom Pricing

Pro tip: You can actually get the Toast Starter Kit for free. It's made for new restaurants. You'll get Toast Flex, Toast Tap, a PCI-compliant router, and a software subscription to help you get started. - Quick Start Bundle: Starting at $0/month

What if budgeting for a machine isn't yet your priority? Here's an option for you.

Virtual Terminal

|

A virtual terminal is a web-based platform that lets you manually enter credit card payments straight from your computer or smart device. You don't need physical equipment. You only need a device and an internet connection.

Usually, this is used to take orders over the phone. But virtual terminals are also good for businesses that don't have physical card machines or online payment options. Some examples could be freelance professionals and local services (lawyers, accountants, etc.).

But the downside is that transactions through the virtual terminal have much higher processing rates. Because they're "card not present" transactions, there's a greater risk of fraud.

Common Features:

Aside from accepting card-not-present payments, you can also issue refunds, review past transactions, and set up recurring billing for your regular clients.

Because online payments are riskier, you also have access to fraud management tools which include:

- Address Verification Service (AVS)

- Credit Card Verification Value (CVV)

- Card Identification Number (CID)

- Two-factor authentication (2FA)

If you need to take in-person payments, it's more convenient if you can connect a card reader to your desktop. But it's not necessary to use the virtual terminal.

Cost:

Just about all processing providers offer a virtual terminal. Some may include it for free, while some may charge an extra monthly fee for this feature. If so, it's usually $10 - $30 a month, and includes other online tools as well.

|

|

Examples of a Virtual Terminal

- Helcim Virtual Terminal

Aside from a card reader, Helcim provides you a virtual terminal you can use to process credit card payments. You can also accept bank transfer payments if you prefer.Why we like it:

Not only can you accept payments from clients or customers, but you can also take payments from vendors and other businesses. The invoicing feature helps with that.You can also store details of your customers through the client management feature. That way, it's easier to pull up information and charge them as needed.

You can process dollar amounts in USD or in CAD.

To learn more about Helcim, you can read our full review on it.Processing fees:

Transaction rates for Helcim depend on your monthly processing volume.[11]Monthly Processing Volume Online and Keyed Payments $0 - 50,000 0.50% + $0.25 $50,001 - $100,000 0.45% + $0.20 $100,001 - $500,000 0.35% + $0.20 $500,001 - $1,000,000 0.25% + $0.15 $1,000,001 and more 0.15% + $0.15 Pricing:

The virtual terminal is free to use. You'll just have to sign up for a merchant account with them. - Clover Virtual Terminal

Even without a Clover device, you can process payments and refunds. Just use the Clover Web Dashboard with your smartphone, tablet, or computer.Why we like it:

You can take in-person and online payments with it. Then send digital receipts through email. If you work with suppliers or clients, you can also send invoices.To make billing more efficient, you can store your customers' card information for recurring payments. And since online payments are risky, you can set up fraud protection tools such as AVS and CVV.

Other features let you manage inventory and employees. You can also set up loyalty programs for your recurring customers.

Processing fees:

The keyed-in rate per transaction is 3.5% + 10¢.Pricing:

There are no additional monthly fees for the dashboard. But you'll have to be a Clover merchant to use it. - Square Virtual Terminal

Typically, you'll need a merchant account to access a virtual terminal. However, Square has one for you, so you don't need to go through the usual underwriting process.Why we like it:

The virtual terminal is free given that creating a Square account is also free. Because it's a browser-based terminal, you can use it whether you're a Windows or Mac user.Aside from taking card and contactless payments, you can also record cash, checks, and Square gift cards. You can even request payments through secured payment links. Just send them to your customers through text.

Pro tip: Square Charge for Mac is a free app Mac users can download. It makes managing payments easier and more efficient. Since you can access it from your desktop (from your menu bar), you don't need to continuously log in to your Square Dashboard to charge your clients.The platform is packed with features.

You can:

- Split transactions with different payment methods

- Set up your library of goods and services

- Set taxes and discounts

- Review real-time reports

- Create customer profiles

- Manage disputes

- Integrate accounting software such as QuickBooks

You can also connect a Square Terminal to accept in-person payments.

Processing fees:

- Keyed-in transactions: 3.5% + $0.15

- Tap, dip, or swipe payments: 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium)

- Afterpay and payment links: 6% + 30¢

Pricing:

There are no monthly fees to pay for the basic free plan. But there may be late fees for Afterpay payments. - Split transactions with different payment methods

Now that you know about the types of machines and their providers, let's talk about how to actually get one.

How to Get a Credit Card Machine

To get a credit card machine, you typically have these choices:

- Purchase from provider. For new businesses, your best option is to buy equipment from your processing provider. It'll already come equipped to work with their software. But you'll be limited to what the provider offers.

- Reprogram existing equipment. Depending on what kind of machine you already have, your new provider may be able to reprogram it to work with their software. We'll go over it more later.

- Lease a machine. We DO NOT recommend this option. Equipment leases usually have a long unbreakable contract. And over a 2-4 year lease, you would be paying thousands of dollars for a machine that you don't even get to keep.

- Rent a machine. Instead of leasing, some modern providers are offering the option to rent a machine. This option could be a good way to get equipment for a low monthly cost. Just make sure it's true month-to-month rental with no contract.

But instead of stressing over which machine brand and model you want, it's better to choose the right provider instead.

Just about all providers will offer a range of machines, from basic card readers to terminals to full POS systems. Machines more or less have the same functions. But the right processing provider can cut down processing fees, offer the right features for your business, and provide the support you need.

Of course, if you narrowed down to 2 or 3 providers, you can look at their machine choices. Perhaps that will help you decide.

Features to Look for When Choosing a Credit Card Machine

Regardless of the type of credit card machine, there are features you'll want to have. These considerations are important for your type of business, workflow, and security.

- Hardware and Software

Credit card machines vary in their hardware and software features. Some are portable while others need wired connection. Some are all-in-one systems while others have more limited functions.You can also get built-in receipt printers for physical receipts. But there are those who let you email them instead. Other credit card machines are bulkier so if you're on the go, you'll want to opt for the slimmer ones.

The smart and more advanced terminals may be the best option if you're looking for longevity.

- Compatibility and Interoperability

If you subscribe to the services of your payment processor, they'll often provide you with a credit card machine. However, there are those that work with third-party equipment. You'll want to ensure that the device you'll use is compatible with the software.Some processors reprogram your machine for free. But others charge a fee for it. It's also best if your credit card machine is integrated with the other POS devices you use. That way, you can get real-time updates and more accurate reporting.

- Connectivity

Downtime interrupts your business. Many card machines have an offline mode that helps with this. What about lags? That's where you need to choose from ethernet, WiFi, dial-up, and cellular data connection.Dial-up connections are slower than ethernet. But it can serve as a backup if the internet goes down. WiFi and cellular data connection are suitable for on-the-go businesses. But keep in mind that data plans typically add to costs.

- Fraud Protection and Security

Your business collects sensitive data every time you accept card payments. It's best to ensure that the credit card machine has security features and follow PCI compliance requirements.Different security features include tokenization, encryption, verification, and blacklists. Verification tools may include Address Verification Service (AVS), Card Verification Value (CVV), and device identification.

Check if your processor provides seller protection and support in case fraud happens. This can help you reduce losses from chargebacks and claims. Claims can include "unauthorized transactions" and "items not received". - Ease of Use

If the credit card machine is easy to use, then it doesn't require much training. You can easily get your employees on board. Since they can grasp the machine more easily, they can accept card payments more quickly. - Customer Support

Next to ease of use, you'll want to know that you can rely on your provider if you have technical questions. And since no system is perfect, problems can occur. Quick and responsive customer support can go a long way.

Choosing the Best Credit Card Machine

Here are some factors to consider when choosing the best machine for your business:

Payment acceptance types

At the very least, you want your card machine to take swipe, chip, and tap cards. With digital wallets becoming more and more popular, do you also want to be able to accept those? If so, look for a NFC-enabled credit card machine to accept Apple Pay, Google Pay, etc.

How your business operates

Do you attend pop-up shows and markets? If so, you'll want a portable machine that you can take with you. Or maybe you run a fast-food restaurant? Then you can go for a wired countertop terminal instead.

Cost and budget

Of course, you need to consider your budget. New micro businesses may not have the capital for a smart terminal or full POS system that costs several hundred dollars.

PCI compliance

Your processing equipment need to adhere to PCI standards, such as end-to-end encryption and no storing of credit card data. Make sure the merchant account provider you choose is PCI compliant.

Can You Reuse Credit Card Machines

When you invest in credit card processing equipment, you probably want to use it for a long time. Is it possible to keep on using the same machine even if you switch providers?

To answer that, we need to understand the different types of credit card machine brands. They are:

Universal credit card machine companies:

These companies make equipment that can work with a variety of different processors. An advantage of one of these brands is that the machines can be reprogramed if you decide to switch providers. So you can reuse the same machine for years.

You've very likely seen these brands before in many different stores. They include:

- Ingenico

- Verifone

- Dejavoo

- Ponyt

- PAX

Though these machines can be programmed, not all providers will do so. Check with your new provider to make sure.

Limited credit card machine providers:

These machines are made by a large company but they only work with the processing provider that you purchased from. These have lots of resellers, so you still have choices. A couple of popular brands are:

- Clover (from First Data)

- Vital (from TSYS)

But, they can't be reprogrammed if you switch. So make sure you really love that provider and plan to stay with them for many years before purchasing.

Proprietary credit card machines:

Proprietary machines can only be used with the specific processing company that makes it. Some popular examples are Square, PayPal, and Shopify, who have their own branded equipment.

The advantage is that the machines are designed to work seamlessly with the provider's software. But the con is that if you switch providers, you can't reuse the machine.

The opposite is true too. For example, if you switch to Square from another company, you can't continue to use your own equipment, and must purchase Square's.

How Credit Card Machines Work

|

| © CreditDonkey |

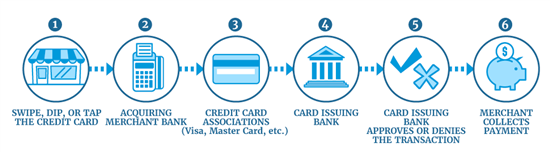

Credit card machines require a connection via internet line or phone line to transmit card data. Here's how credit card processing works:

- A customer swipes, dips, or taps the credit card.

- The transaction transmits to the acquiring merchant bank.

- Merchant bank sends request to the card association (Visa, Mastercard, etc.) for authorization.

- Card association sends the request to the issuing bank for approval.

- Issuing bank checks for adequate funds and approves or denies the transaction.

- Issuing bank sends approval to the card issuer and merchant bank to complete the transaction.

All of this happens behind the scenes within a matter of seconds. But the exact time depends on the type of connection.

Bottom Line

Accepting credit cards is imperative to your business' success. Explore your options to find a credit card machine that is affordable and provides the features you need.

But your search should first start with the right merchant account provider. It's much more important to have a good provider, than to have the perfect equipment.

References

- ^ Clover. Pricing, Retrieved 5/19/2023

- ^ Chase. Credit card processing fees, Retrieved 04/25/2024

- ^ Chase. Countertop terminal, Retrieved 5/19/2023

- ^ Helcim. Transaction rates, Retrieved 06/22/2025

- ^ Clover Flex. Pricing, Retrieved 5/19/2023

- ^ Square. Terminal, Retrieved 06/27/2025

- ^ Clover. Pricing, Retrieved 5/19/2023

- ^ Clover. Pricing, Retrieved 5/19/2023

- ^ Shopify. POS pro, Retrieved 5/19/2023

- ^ Toast. Pricing, Retrieved 5/19/2023

- ^ Helcim. Transaction rates, Retrieved 8/10/2023

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Not sure what is right for your business?

|

|

|

|

|

| ||||||

|

|

|