Cloud POS Systems

Not all cloud POS systems are the same. Some of them are better for certain businesses. Read on to find out which can work best for you.

|

Cloud POS Systems synchronize your data online, so you can access them on any device. But not all industries work the same way. What happens if the POS features don't fit your workflow?

That means more add-ons or a complete overhaul. Choosing the wrong POS will be costly, especially if it ties you to unwanted long-term contracts.

But don't worry. In this list, you will find the niche industries and popular selling points of the best cloud-based POS systems. Read on to learn about them.

Here are the top 5 Cloud-Based POS Systems for your business:

- Toast for Restaurants

- Clover for Retail Businesses

- Square for Service Businesses

- Shopify for Omnichannel Selling

- Lightspeed Large Businesses

Top 5 Cloud-Based POS Systems

Cloud-based POS systems have different features and come at different price points. Some offer a free plan, while others have a reasonable price.

Other options even come with free POS equipment. Let's start with something suitable for restaurants.

Cloud POS Systems lets you process payments online. You can typically do so with your own device through virtual terminals. If the internet goes down, some cloud POS systems have the offline mode feature that enables you to keep taking payments. Payments will be processed when you reconnect.

Also, unlike traditional POS systems, your data is synced in the cloud. That way, you can make product changes or view reports in person or on the go.

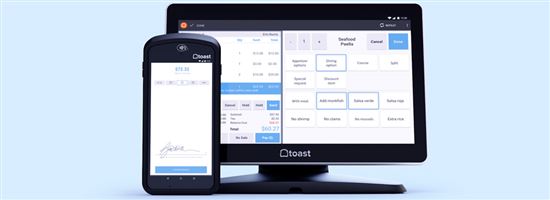

1. Toast: Best for Restaurants

|

| CREDIT TOASTTAB |

Toast POS is one of the leading POS systems for restaurants. It's suitable for quick service and full-service restaurants. So whether you own a café, food truck, fine dining, or casual dining restaurant, you'll find features that work for your business.

|

|

Why we like it:

You can take orders, process payments, market your restaurant, and manage your team in this all-in-one cloud-based POS system. It also integrates with partners such as Staples Connect, DoorDash, and Uber Eats.

If you're starting your new restaurant, then you'll enjoy their starter kit. It's the free plan best for single-location restaurants, and it comes with 1-2 terminals.

The cloud POS software also runs on Android OS, so it's more customizable to your needs.

"Toast thought about the issues that other POS systems forgot about. It was designed for the industry with simplicity." - Andy, Toast User

Toast Features:

Features vary depending on the plan you choose. But many good features are available as add-ons.

Generally, Toast POS offers:

- Order and table management

- Reporting and analytics even with multiple restaurants

- Menu management

- Invoicing

- Online ordering and delivery

- Marketing

- Employee management

- Contactless ordering with QR codes

Toast is not just convenient for you, but for your customers as well. They can browse the menu, order, and pay from their devices. You'll also get real-time item countdowns, so your customers are updated on what's available and what's not.

Toast Hardware:

Toast's hardware selection is restaurant-grade. This means they are spill-proof and dust-proof. They are perfect for any restaurant's hustle and bustle.

Here's a list of their hardware selection:

- Toast Flex (POS terminal)

- Toast Flex for Guest (customer display)

- Toast Go 2 (handheld POS)

- Toast Flex for Kitchen

- Kiosk

You can also purchase accessories such as printers, cash drawers, and readers. Unfortunately, you cannot use Toast with a POS equipment you already own.

Toast Pricing:[1]

There are three plans to choose from:

- Quick Start Bundle: $0/mo; best for single-location restaurants; comes with 1-2 terminals

- Core: $69/mo; choose your own hardware with custom configurations

- Growth: $165/mo; includes Point of Sale and digital ordering features

You can also build your custom plan with custom pricing.

Contract Terms:

Toast requires a contract, but the terms are unique to your business. Your contract will renew every year unless you cancel.

You can cancel 30 days before the end of the term. However, there will be an early termination fee.

Toast Processing Fees:[2]

With the Starter Kit, you have two payment plan options:

- Pay-as-you-go Plan

You'll pay no monthly software fee or separate equipment cost. But the processing fee can be pricey. The flat rate of 2.99% + 15¢ per transaction applies to all sales, regardless of card type and entry method. - Standard Plan

You'll pay $799 for equipment upfront and pay a $69/mo software fee. In exchange, you will pay lower processing fees. The rate varies based on card type and payment type.Card-present transactions cost 2.49% + 15¢ while card-not-present transactions cost 3.50% + 15¢.

Now for those in the retail business, check out our next POS system.

2. Clover: Best for Retail

Clover is an all-in-one POS system for retail. Its features let you easily run your physical and online retail store, from managing inventory to handling returns and exchanges.

|

|

Why we like it:

You can integrate your existing website or create a new one with Clover. Your orders, inventory, and customer data will be synced in all sales channels.

Using Clover Rewards, a built-in loyalty program, you can even entice customers to keep coming back. They can keep tabs on their points through the mobile app. This way, they'll get updated on upcoming rewards.

"The process was easy and seamless. Julia was great. She checked on me without being overbearing like a lot of other companies. She gave me some time to respond, and I really appreciated that. She gave me the run down and was straight to the point. I was sold. Great experience!" - Ivan, Clover User

Clover Features:

Although Clover works well with restaurants, there are features best for retail stores.

Some of them include:

- Online ordering

- Inventory management

- Employee management

- Reporting and analytics

It's reporting tools are really useful. You can track sales and staff schedules in real-time. You can also view them by order type, SKU, period, or employee sales.

You can even filter the report to see your best-selling items and busiest schedules. This info is available wherever you are through the Clover Go mobile app.

Clover Hardware:

Clover's cloud-based POS system only works with Clover hardware. But their selection is enough to cover your needs.

You can choose from:

- Station Solo (register)

- Station Duo (with customer-facing display)

- Mini (small POS system)

- Flex (handheld POS)

- Go (mobile POS)

Clover Pricing:[3]

For monthly hardware and software plans:

- Starter: $60/mo; comes with a mini touchscreen POS, built-in receipt printer, and cash drawer

- Standard: $130/mo; comes with Station Duo, weight scale, and barcode scanner

- Advanced: $175/mo; comes with Station Duo, handheld POS, weight scale, and barcode scanner

You can also pay for the hardware in full to lessen future expenses. Then just pay for the monthly software plan:

- Starter: $799 + $14.95/mo

- Standard: $1,799 + $44.95/mo

- Advanced: $2,398 + $54.90/mo

Contract Terms:

The minimum contract with Clover is 1 year. But you can provide a 30 days' notice prior the end of the term to cancel.

Clover Processing Fees:

The processing rates depend on the plan you choose and the type of payment.

| Plan | Card-present transactions | Keyed-in transactions |

|---|---|---|

| Starter | 2.6% + 10¢ | 3.5% + 10¢ |

| Standard | 2.3% + 10¢ | 3.5% + 10¢ |

| Advanced | 2.3% + 10¢ | 3.5% + 10¢ |

If you run a service establishment, this next one may work better for you.

3. Square: Best for Service Businesses

|

| CREDIT squareup |

Square POS is another all-in-one cloud-based POS system. Although there are specific features for restaurants and retail businesses, Square also offers the best POS features for service businesses such as salons, home and repair, health and fitness, etc.

|

|

Why we like it:

Square combines scheduling, payments, and customer management in one easy-to-use system. Its automated reminders and online booking features help streamline operations and minimize missed appointments.

You can take payments through the virtual terminal without any hardware. You can also sell merchandise if you have any.

"I've done business with Square for many years. Never had a problem. Square has assisted me with capital to expand my business. I've never used customer support. Never had a need. Fees are reasonable." - Tom, Square User

Square Features:

Square offers many features for booking services.

Some features you can get are:

- Free booking website

- Resource booking (book rooms, stations, chairs)

- Multilocation scheduling

- Social media integrations

- Client management

- Employee management

- Marketing

- Square Assistant (AI messaging tool)

- Physical and e-gift cards

- Discounts

- Integrations

You can take contactless payments and send professional invoices to your clients. You can also save their info through card-on-file to lessen the hassle for the next session.

When your client books an appointment, Square will automatically create their profiles. You can add notes, send them notifications, and save their data in one place. You can also set up cancellation policies and no-show protection to avoid losses.

For staff management, you can set up unlimited calendars and custom permissions. Payroll syncs with Square Advanced Access.

Square Hardware:[4]

You don't need to purchase Square hardware to run the cloud POS software. But here are some of your choices should you prefer to buy some:

- Register: $799; complete POS with customer-facing display and built-in payments

- Terminal: $299; all-in-one credit card terminal with printer for receipts

- Stand: $149; choose from Square Stand or Square Stand Mount; for your iPad POS; comes with payments; no readers required

- Reader: $49 for contactless and chip; first Square Reader for magstripe is free; $10 for additional readers

- Accessories: Choose from a dock, wall charger, bar code scanner, etc.

There are also hardware kits to choose from. You can get the Square Stand Kit or the Square Register Kit.

Square Pricing:[5]

Square can get pricey if you have multiple branches. Although it's quite affordable if you only have one physical location.

Here are your options:

- $0 (Free), $49/mo (Plus), and $149/mo (Premium) per location

- Custom Pricing: Quote-based pricing (for businesses that process over $250K per year in card sales)

Free trials are available for paid plans.

Contract Terms:

Square's contracts are month-to-month. There are also no termination fees if you cancel.

Square Processing Fees:

| Type of Payment | Processing Rates |

|---|---|

| In-person | 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium) |

| Online | 3.3% + 30¢ (Free) and 2.9% + 30¢ (Plus/Premium) |

| Keyed-in | 3.5% + $0.15 |

Our next cloud POS system is great for pop-up shops. Keep reading to know more.

4. Shopify: Best for Omnichannel Selling

Shopify is best known for its eCommerce features. But it's also a great cloud POS system. By downloading the Shopify Retail POS app, you can use your mobile device to take payments.

|

|

Why we like it:

Shopify POS is more suitable for pop-up shops. It lets you bring your online store to your customers in person. For example, if you don't have the inventory on hand, your customers can buy the product in person, then have it delivered to them.

Customers can also purchase products online and have them returned or exchanged in person. This makes Shopify great with omnichannel selling.

"Brilliant off-the-shelf platform where everything works as expected. The checkout flow is perfect for the end user. Have had some issues with plugins, but support is working on this for us now. Planning on moving a number of other sites over in coming months." - Hugh, Shopify User

Shopify Features:

To be suitable for omnichannel selling, Shopify offers many eCommerce features, such as:

- Inventory management

- Employee management

- Customer engagement

- Reporting and analytics

- Checkout

- Gift cards

- Marketing

When selling in person, you can attach QR codes to products your customers can scan. That way, they can view more information about the product on your online store.

Inventory is updated automatically, too. So if you're low on supplies, you can create purchase orders to send to your suppliers. You can also request transfers from one location to another. It works great if one product is more popular in a specific location.

Shopify Hardware:

You can integrate Shopify's card readers if you already have an existing POS.

Here's a list of your product choices:

- POS GO (mobile POS system)

- Card readers

- Tablet stands

Accessories such as barcode scanners, printers, and cash drawers are also available.

Shopify POS Pricing:[6]

There are two POS plans for Shopify - POS Lite and POS Pro. POS Lite is included in all Shopify eCommerce plans. To upgrade to POS Pro, just pay an additional $89/mo/location.

- POS Lite: Comes with mobile POS, order and product management features, and customer profiles

- POS Pro: Includes all POS Lite features, unlimited store staff, unlimited registers

Shopify eCommerce plans cost:[7]

- Basic: $39/mo or $29/mo if paid annually

- Shopify: $105/mo or $79/mo if paid annually

- Advanced: $399/mo or $299/mo if paid annually

Contract Terms:

You can choose from month-to-month or annually. Although, you can save 25% less on pricing if you sign up for a year. You can also cancel your account anytime.

Shopify Processing Fees:

Shopify Payments is the payment processor of Shopify. The processing rates differ per payment plan.

- Basic: 2.7% + 0¢ (in person)

- Shopify: 2.5% + 0¢ (in person)

- Advanced: 2.4% + 0¢ (in person)

Shopify also works with third-party payment providers.

The main benefit of cloud-based POS systems is that it stores your data in the cloud. That way, you can access it at any time on any device. You can view reports in real-time, for example, even when on the road. Purchasing POS hardware also isn't typically necessary.

5. Lightspeed: Best for Large Businesses

Lightspeed has features for multi-location restaurants and hotel restaurants. It's packed with management features and integrations, too. That said, it may be overkill for a small business.

|

|

Why we like it:

Lightspeed is a cloud POS for mainly 3 types of businesses: retail, restaurant, and golf. Features and pricing vary for each. But they're all scalable and offer extensive tools.

Since these types of businesses have unique needs of their own, it's surely helpful to have unique POS systems, too. That way, you're getting more than the generic offers.

"Excellent POS system with flexibility for miles! It was one of the few that could handle my unique situation for our retail & wholesale retail liquor store. Their support is good with accommodating and knowledgeable staff." - Dustin, Lightspeed User

Lightspeed Features:

For Lightspeed Retail, you can get features for:

- Inventory management

- Reporting and analytics

- Omnichannel selling

- Marketing

- Built-in SEO tools for opening your storefront online

- Integrations (Facebook, Instagram, Amazon, eBay and Google Shopping)

For Lightspeed Restaurant, features include:

- Order Anywhere

- Online ordering

- Lightspeed Delivery

- Floorplan management

- Ingredient management

- Employee management

- Kitchen Display System

- Multilocation restaurant

- Integrations with major food delivery apps (Uber Eats, DoorDash, SkipTheDishes, etc.)

For Lightspeed Golf (previously known as Chronogolf), you get:

- Tee-sheet

- Players database

- Event management

- Online booking

- Marketing

- Reporting

Lightspeed Hardware:

You can purchase kits or individual equipment with Lightspeed. But you can also use your own tablets as long as it's supported.

For Lightspeed Retail, the kits include:

- iPad POS Hardware Kit: Includes a receipt printer, cash drawer, Bluetooth scanner, iPad stand, and receipt paper

- Desktop Hardware Kit: Includes a receipt printer, cash drawer, and USB scanner

For Lightspeed Restaurant, you can also get an iPad POS Hardware Kit with the same contents. But the Bluetooth scanner is replaced with the kitchen printer. Lightspeed Golf, on the other hand, comes with bundles of scanners and printers.

Lightspeed Pricing:

There are different pricing plans for Lightspeed Retail and Restaurant. Lightspeed Golf requires a custom quote.

- Lightspeed Retail Pricing[8]

Pricing differs if you opt for Lightspeed Payments (Lightspeed's in-house payment processing.)Here's how it costs if you choose to pay annually:

Plan With in-house payment processing Without in-house payment processing Lean $69/mo 119/mo Standard $119/mo $169/mo Advanced $199/mo $249/mo Enterprise Custom Custom - Lightspeed Restaurant Pricing:[9]

Here's a list of how much the plans cost:Plan Price Essentials $69/mo Plus $189/mo Pro $399/mo Enterprise Custom

Contract Terms:

Contracts can be month-to-month or annually. For year-long contracts, you'll need to provide a notice of cancellation at least 90 days before if you plan to cancel.

Lightspeed Processing Fees:

For Lightspeed Retail:[10]

- Tapped, inserted, or swiped rate: 2.6% + 10¢

- Keyed-in rate: 2.6% + 30¢

For Lightspeed Restaurant:[11]

- Essentials: 2.6% + 10¢

- Plus: 2.6% + 10¢

- Pro: Custom rates

Now that you know your options, how do you exactly take your pick? Let's talk about that.

How to Choose a Cloud POS System

To find a suitable cloud point-of-sale system, you need to consider everything about your business.

The following criteria will revolve around it:

- Ease of use

An easy-to-use interface makes it easy for you to train your staff. That also means there's a lot less tendency for errors. Plus, it can lead to shorter lines on the counter and faster table turnovers.You can inquire about any onboarding or training programs from the provider.

- Reasonable Pricing

Your budget will be affected by 6 things: contract, pricing model, processing rates, monthly fees, miscellaneous fees, and price of equipment. For contracts, it may be better to opt for month-to-month terms. That way, you won't need to stick it out if the system doesn't work for you.The better pricing model, on the other hand, depends on your type of business. Small businesses may do well with pay-as-you-go pricing. While large businesses may save more with subscription pricing.

Also, it may be better to purchase equipment outright instead of leasing them. That way, if you end up switching providers, you may be able to reprogram the equipment. This can save you money instead of purchasing new hardware.

- Accepted payment methods

POS systems typically let you accept more than one payment type. You may be able to accept debit cards and credit card payments. Or opt for contactless payments like Apple Pay and Google Pay, especially if you have a physical location.Service or professional businesses may also do well with ACH payments, invoicing, QR codes, and payment links.

- POS equipment available

Next, consider the POS hardware based on your accepted payment types. You can choose from wired or wireless terminals, card readers, or virtual terminals. Other POS systems also offer kiosks, printers, and tablets.If you're a retail business, then you may also need accessories like barcode scanners.

- Security features

Since you're dealing with payments, data security features are essential. First and foremost, the POS should be PCI-compliant. These standards help protect cardholder data, especially with credit card transactions.There should also be features for end-to-end encryption and tokenization. That way, you're not storing any sensitive information. Other POS systems also offer chargeback and fraud prevention tools which are even more essential for high-risk businesses.

- Integrations

A cloud POS may work with third-party payment processors, payment gateways, website builders, accounting software, and other apps. Check if there are integrations you already work with for a smoother workflow. - POS features

Common features include inventory management, reporting and analytics, customer loyalty programs, and marketing. Some will even offer add-ons for more advanced features. - Scalability

The POS system should ideally be able to grow with you. For example, some options may offer installations in unlimited locations. While others are priced per location.Some POS also have multi-location management features, while there are those that provide omnichannel selling. Whatever you choose should depend on your business type.

These things to consider can get overwhelming. Why do you need a cloud POS again? Here's why.

9 Benefits of Cloud POS Systems

A cloud POS is only one type of POS system. You also have the option to go for a traditional POS system or a hybrid POS system (a combination of cloud and traditional POS).

But before you even consider the latter two, here are reasons why you should opt for a cloud POS instead:

- It stores data in the Cloud

Unlike traditional POS systems, your data will be stored on a remote server. That means you'll need an internet connection to use the system.But that also means you can make changes from wherever you are. Need to change menus quickly? No problem! Or maybe you just need to view sales reports on the go. That's possible, too.

- Upfront pricing is more affordable

Many cloud POS systems offer free equipment and pay-as-you-go pricing. That means it's easier for small businesses, even solopreneurs, to get a hold of the system.You won't need a huge capital to start. Traditional POS, on the other hand, can cost you up to $50,000 per year.

- You get multiple options for mobile POS hardware

Because cloud POS works with WiFi, you can now use wireless terminals, card readers, tablets, and mobile phones to take payments. It's especially beneficial for restaurant owners since it can increase table turnover.Mobile POS systems also typically have an offline mode feature. So even if you lose internet connection for a bit, you can still keep the business running.

- Allows for easier maintenance and software updates

If you ever encounter a problem with the POS, you can always call for technical support. But unlike traditional POS, the staff won't need to visit your store in person. They can fix the problem on their end since data is stored in the cloud.That also means you can update your POS software more easily by just downloading them. And these updates are essential for security purposes.

- It's easily scalable as your business grows

Because everything is in the cloud, you only need to worry about the number of hardware to purchase. You don't need to think about setting up multiple on-site servers.Many POS devices are affordable, too. For example, you can get card readers for as low as $10. And if you already have your own device, some POS software providers reprogram equipment for free.

- There's no need for long-term contracts

Many cloud POS systems offer month-to-month contracts. If the system doesn't work with your business operations, you can easily cancel and find a new provider.Just keep in mind that if your cloud POS system is from a merchant account provider, then you may be required a long-term contract. - There are many integrations available

Cloud POS systems typically integrate with website builders, payment gateways, and other business tools like QuickBooks (an accounting software). You may find apps you already use, making it more convenient. - Improves marketing and customer loyalty

Since your data is available in real time, you can also set up loyalty programs and apps for your customers. For every purchase, they'll be able to see right away any rewards they can claim.This also means you can provide more targeted marketing. You can use the updated data from various reporting tools to spread your promos through email or social media.

- It provides a better overall customer experience

Since cloud POS systems can provide a more seamless work experience, your customers may like it, too.Cloud POS systems can now accept a variety of new payment methods. You can also opt for hardware such as a customer-facing display to lessen order errors. These modern tools are surely a win-win solution.

A Cloud POS System stores data in the cloud, while a traditional POS system stores data on your local server. Cloud POS is the more modern solution. It's easier to use, plus you won't need to worry about manual backups. But depending on your type of business, traditional POS (or legacy systems) may provide more data security in terms of hacks.

Our Methodology

There are many cloud POS systems out there. We've listed the top-performing ones and identified what type of business they're best used for.

Because not all cloud POS is the same, listing their strengths and features will help you find what's most suitable for your business.

We understand that it can take a long while to shop around. So, narrowing down niches would help cut it down.

The four types of POS Systems include traditional or legacy, cloud, mobile, and tablet POS. Legacy POS systems store your data locally, while a cloud-based POS system saves it online. Mobile and tablet POS refers to the standalone devices you can use. Sometimes, multiple types are used in one system. You can use the cloud with mobile POS, for example.

What the Experts Say

CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

The Bottom Line

The best cloud POS systems cater to your business needs. They have the most suitable features, affordable pricing, and reasonable processing fees.

Some POS let you use your own devices. But you can also purchase hardware as needed. Or you could choose a pricing plan that provides such.

Take note that when choosing a POS, it's best to look at those specific to your industry. That way, you're more likely to get what you need.

References

- ^ Toast. POS Pricing Plans, Retrieved 3/16/23

- ^ Toast. Processing Fees, Retrieved 4/21/23

- ^ Clover. Retail systems pricing, Retrieved 3/16/23

- ^ Square Square Hardware, Retrieved 4/21/23

- ^ Square. Square Appointments, Retrieved 11/06/2025

- ^ Shopify. POS Pricing, Retrieved 3/16/23

- ^ Shopify. Pricing, Retrieved 3/16/23

- ^ Lightspeed. POS System Price for Retail, Retrieved 3/16/23

- ^ Lightspeed. Lightspeed Restaurant, Retrieved 3/16/23

- ^ Lightspeed. Lightspeed Retail Payments, Retrieved 3/16/23

- ^ Lightspeed. Lightspeed Restaurant Payments, Retrieved 3/16/23

Write to Karen Eloriaga at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Not sure what is right for your business?

|

|

|

|

|

| ||||||

|

|

|