Best Credit Card Processing for Small Business

Explore top-rated small business credit card processors. Transparent pricing. Flexible terms. Outstanding features.

|

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 15¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

Save Up to 40%

- Flat Monthly Subscription Price, Starting at $99

- 0% Markup on Direct-Cost Interchange

- 24/7 Support

Here are the best credit card processors for different businesses:

- Square for mobile credit card processing

- Payment Depot for growing businesses

- Stax for large and established businesses

- National Processing for restaurants

- PayPal for accepting PayPal and Venmo

- Stripe for online businesses

- Clover for brick-and-mortar businesses

- Helcim for multi-channel businesses

- Merchant one for a veteran credit card processor

- Elavon for jampacked features

Choosing the right credit card processor can be overwhelming. High fees and hidden charges create confusion and financial stress.

That said, this isn't something you should worry about with the best credit card processing companies.

With clear and predictable pricing, no long-term contracts, and exceptional features, they can simplify transactions and keep your business running smoothly. Read on for your options.

- Why you can trust CreditDonkey

CreditDonkey has a PROCESS rule used to evaluate credit card processing services. It stands for:

- Pricing: to ensure competitive and transparent pricing without hidden fees

- Reliability: to only select services known for its reliability and uptime

- Options: to consider a variety of payment options and methods

- Customer Support: to ensure strong and helpful customer service

- Ease of Use: to ensure user-friendliness and ease of implementation

- Security: to select processors with robust security measures for safe transactions

- Speed: to select processors with fast processing speeds

Bottom Line Recommendations

If you want to skip going through 10+ credit card processors, here are the top 3 options which may be suitable for your business:

- For new and small businesses

Square is the best option due to its simple flat-rate pricing. You can get a free card reader, use it with the free mobile point-of-sale app, and start accepting payments right away. - For medium-sized or growing businesses

Consider opening a merchant account for a more stable account. Payment Depot is a good option and it offers interchange-plus pricing. This can be more affordable than the flat-rate pricing offered by Square. - For high-volume businesses

Stax's membership pricing is most suitable for businesses with large sales volumes. It's an all-in-one platform packed with features for in-person and online payments.

Read on for more details about these companies.

|  |  | |

| Visit Site | Visit Site | Visit Site | |

Square Reader: Free Mobile Credit Card Reader - | Save Over $400 Per Month on Average - | Save Up to 40% - | |

| Pricing Model | |||

| Swipe Rate | 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium) | ||

| Online Rate | 3.3% + 30¢ (Free) and 2.9% + 30¢ (Plus/Premium) | ||

| Monthly Fee | $0 (Free), $49/mo (Plus), and $149/mo (Premium) |

| |

| Visit Site | Visit Site | Visit Site | |

10 Best Credit Card Processing Companies

|

| © CreditDonkey |

Businesses in different stages will have varying needs. So when reviewing a credit card processing company, take note of:

- The processing fees that fit your budget (here's a processing fee calculator if you need it)

- Point-of-sale features that work with your business operations

- Term contract (long-term contracts mean cancellation fees)

- Miscellaneous fees (especially for certain transactions)

Start by checking out the best of the best.

Square for Small Mobile Businesses

| Monthly Fee | $0 (Free), $49/mo (Plus), and $149/mo (Premium) |

|---|---|

| Swipe Rate | 2.6% + 15¢ (Free), 2.5% + 15¢ (Plus), and 2.4% + 15¢ (Premium) per transaction |

| Online Rate | 3.3% + 30¢ (Free) and 2.9% + 30¢ (Plus/Premium) per transaction |

| Keyed-in Rate | 3.5% + $0.15 per transaction |

| Contract | Month-to-month |

With a free mobile card reader and simple flat-rate fees, Square is an easy and affordable option for new businesses. There's no approval process, so you can start accepting credit cards right away.

If you start with the free plan, you'll only pay when you make a sale. This makes it ideal for mobile shops or small businesses with sporadic sales (such as food trucks, seasonal sellers, market vendors, coffee shops, etc.)

Additionally, Square offers one of the most robust mobile POS apps. Even at the most basic level, it includes a wide range of features to help run your business efficiently. Dive deeper into what it offers below.

- Point-of-Sale Features

Straight from Square's point-of-sale app, you can:

- Accept swipe, chip, and contactless payments like Apple Pay, Google Pay, and Samsung Pay

- Accept payments in Offline Mode when your internet connection fluctuates

- Send custom invoices to bill your clients easily

- Set discounts and issue refunds

- Set installment plans for customers, with upfront payments to you

- Manage employees and your customer database

- Track inventory

- Get detailed reports and sales trends

The point-of-sale features depend on your plan and industry. Square supports various industries, including professional services, restaurants, and retail.

Additionally, Square offers a variety of POS hardware to help run your business. Unlike other credit card processors, you won't have to look for third-party equipment. With Square, you can choose from registers, smart terminal, card readers, kiosks, etc.

Square's Accepted Modes of Payment

Square accepts many modes of payment such as credit cards, debit cards, corporate, rewards, prepaid, international cards, etc. It works with Visa, Mastercard, AMEX, Discover, UnionPay International, and JCB.All card types will be charged the same standard rates.

- Accept swipe, chip, and contactless payments like Apple Pay, Google Pay, and Samsung Pay

- Plans and Pricing

Given the rates for swipe, online, and keyed-in payments, you can get custom pricing with Square if you process more than $250,000 per year. This could potentially lead to lower processing fees.

That said, you can also get discounted rates depending on the plan you choose. Square offers 3 plans with a monthly fee of $0 (Free), $49/mo (Plus), and $149/mo (Premium).[1]

Square has no chargeback fees and does not charge hidden fees. However, the standard processing fees can get pricey if you have very small average ticket sizes. For example, if your sales are usually $10, the fee would be $0.41 if you are a Square Free subscriber.

Square is an ideal entry-level option. But as your business grows, other processors may save you more money.

Pro tip: The Square point-of-sale app for iOS and Android is free. Partner it with the free magstripe card reader to easily start accepting payments from your customers. - Pros and Cons

Pros:

- Predictable flat-rate pricing with no extra fees

- Fast and easy to get started

- Free mobile swipe reader

- Great app with lots of features

- Robust security features like fraud protection, dispute management, and data security

- PCI-compliant

- Instant transfers available for a 1.75% fee

- Offers a live phone support for free

Cons:

- Potential account holds and freezes

- Poor customer service

- Not for high-risk businesses

- Predictable flat-rate pricing with no extra fees

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 15¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

Payment Depot for Growing Businesses

| Monthly Fee | Need to contact for a quote |

|---|---|

| Processing Fees | Need to contact for a quote |

| Contract | Month-to-month |

Unlike Square, Payment Depot offers a merchant account tailored to your specific needs.

It offers interchange-plus pricing, which means you'll pay the interchange rate plus markup per transaction. This pricing model is more transparent and can be more cost-effective.

This makes it an excellent choice for growing businesses, particularly those with over $15,000 in monthly revenue.

Flat-rate processing fees blend the interchange rates and processor markup together, so you won't really know how much the processor charges you. That said, it's more predictable to budget for this pricing model, since you get standard rates regardless of the card type used by your customer for payment.

Interchange-plus pricing, on the other hand, breaks down the interchange rate and processor markup. So you get more transparency, and most often, can negotiate with the processor about their fees. That said, you may be charged different rates per card type.

- Point-of-Sale Features

Payment Depot is ideal for online stores, since it integrates with various e-commerce platforms like WooCommerce and BigCommerce. It also provides a virtual terminal for manually entered payments.

However, if you plan to accept in-person payments, you'll need to be comfortable using third-party POS equipment. Unlike Square, Payment Depot doesn't have its own hardware.

Payment Depot works with Clover, Dejavoo, and SwipeSimple products. Depending on your plan, you may get a standard terminal, a mobile reader, or pinpad with your account.[2]

Accepted Mode of Payments

Payment Depot lets you accept credit cards from all major credit card companies. You can also set up recurring billing for when you offer subscription services. - Plans and Pricing

You'll need to contact Payment Depot to get a quote. But get a grasp of the cost by understanding the different interchange rates. Your contract will be month-to-month, so no need to worry about cancellation fees.

Payment Depot also doesn't charge setup fees and hidden fees.

- Pros and Cons

Pros:

- Transparent interchange rates

- No early termination fees

- Supports various industries

- Next day funding

- PCI-compliant

- Chargeback and risk monitoring features

- In-house and U.S.-based customer support

Cons:

- Not for smaller businesses

- Not for high-risk businesses

- Relies on third-party POS equipment (with limited options)

- Monthly fee is not specifically stated (if any)

- Transparent interchange rates

Stax Payments for large and established businesses

| Monthly Fee | Starts at $99 per month |

|---|---|

| Swipe Rate | Interchange rate + $0.08 per transaction |

| Online Rate | Interchange rate + $0.18 per transaction |

| Keyed-in Rate | Interchange + $0.18 per transaction |

| Contract | Month-to-month |

Stax Payments, the parent company of Payment Depot, is a subscription-based processing company. Its membership fees can be quite pricey, making it more suitable for larger businesses.

Despite these monthly fees, there is still a processor markup included in your per-transaction fees. However, you can still achieve significant savings with Stax's rates, especially if you process larger volumes of transactions.

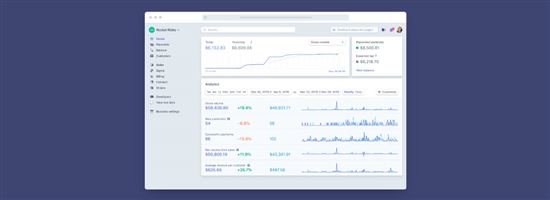

Additionally, Stax offers a very robust payments platform. It's an all-in-one solution that can help you run your business seamlessly. Learn more about what it offers below.

Stax's processor markup is a fixed fee and is added to the interchange rates. Interchange rates are generally more affordable than the percentage fee charged by other flat-rate processors like Square.

- Point-of-Sale Features

With Stax's all-in-one point-of-sale platform, you can:

- Monitor and reconcile payments, refunds, and deposits

- Send invoices and set up recurring billing

- Use a pre-built, no-code, hosted payment page with your e-commerce website

- Create and send payment links, buttons, and QR codes

- Manage customers and inventory

- Assign employee roles and permissions

- Access advanced analytics tools and insights

- Integrate online customer review tools like Google and Facebook Business

- Integrate business apps like QuickBooks Online, Slack, Facebook Ads, Mailchimp, etc.

With Stax, you can accept swipe, dip, and contactless payments like Apple Pay and Google Pay. These can be in-person payments, online payments, or manually entered payments.

Stax offers a selection of third-party point-of-sale hardware to help you accept these payments. Like Payment Depot, Stax works with Dejavoo, Clover, and SwipeSimple products which offer smart terminals and card readers alike.

Additionally, Stax integrates with most point-of-sale systems, so you may be able to use your existing solutions if you have any.

Stax Reliability and Uptime

You won't need to worry about disconnections or problems with your Stax software. Stax Payments tends to have a 99.99% uptime while other features such as web applications, mobile applications, analytics, and notifications have a 100% uptime. You can view this status at the Stax Status Page. - Monitor and reconcile payments, refunds, and deposits

- Plans and Pricing

Stax offers a subscription-based pricing. Your monthly fee will depend on your sales volume:[3]

- If you process up to $150,000/yr: $99/mo

- If you process $150,000 to $250,000/yr: $139/mo

- If you process $250,000+/yr: $199+/mo

Stax may offer an alternative pricing model when you reach out for a quote. In this case, you may get interchange-plus pricing. That said, you can also pass on the credit card fees to your customers by surcharging.

Pro tip: Stax offers merchant accounts like Payment Depot, so your account will be more customized to your business. Don't forget to negotiate the fees to potentially get more affordable rates! - If you process up to $150,000/yr: $99/mo

- Pros and Cons

Pros:

- No percentage processor markup

- No early termination fees

- Robust platform

- Multiple payment gateway options

- Next-day funding

- Data protection and security features

- Excellent and knowledgeable customer service

Cons:

- No free plan

- Underwriting process

- Not for smaller businesses

- Not for high-risk businesses

- Relies on third-party POS equipment (with limited options)

- No percentage processor markup

Save Up to 40%

- Flat Monthly Subscription Price, Starting at $99

- 0% Markup on Direct-Cost Interchange

- 24/7 Support

National Processing for Restaurants

| Monthly Fee | Starts at $14.95/mo; custom pricing starts at $14.95+/mo |

|---|---|

| Swipe Rate | 2.5% + $0.10 per transaction (Basic In-person Package), 2.41% + $0.10 per transaction (Advanced Package) |

| Online Rate | 2.9% + $0.30 per transaction |

| Keyed-in Rate | 3.5% + $0.15 per transaction |

| Contract | Month-to-month |

National Processing is a merchant account provider best suited for restaurants or businesses in the food and beverage industry. It works with some of the best POS systems, like Clover, to help you provide a seamless service to your customers.

You can also save more on payment processing fees. A $15,000 monthly sales volume may cost you $376 for in-person sales with National Processing, which costs $391 with Square.

Additionally, National Processing offers a free mobile reader and terminal along with a free gateway setup. If you already have POS hardware, National Processing may be able to reprogram your device, so you won't have to purchase a new one.

Merchant accounts enable you to accept and process credit card payments. But a merchant account provider doesn't always provide it's own point-of-sale hardware. This is where third-party POS comes in.

On the other hand, POS providers like Clover and Square typically also offer merchant accounts or submerchant accounts so you can accept credit card payments through the same platform.

- Point-of-Sale Features

National Processing's software is specifically designed for restaurants and retail stores. Some features you can get include:

- Inventory management

- Employee management

- Real-time reporting

- Recurring payments for subscription services

- Multi-currency support

- Reward programs

- Advanced fraud protection tools

- Secure tokenization

While National Processing offers its own payment gateway, you can also opt for Authorize.net, a popular payment gateway owned by Visa.

National Processing also relies on third-party POS hardware. It works with Pax, SwipeSimple, or a Clover POS, which offer terminals, card readers, and other POS devices.

These equipment lets you accept tap, dip, and swipe payments, online payments, and keyed-in payments. You'll be charged the same rate regardless of whether the customer uses Visa, Mastercard, American Express, or Discover.

Worried about cash flow?

According to National Processing, funds typically can arrive in your bank account after 2-3 business days. - Inventory management

- Plans and Pricing

National Processing offers 4 plans:[4]

- Basic In-person: $9.95/mo

This plan comes with a smart terminal, but you can also have your existing equipment reprogrammed. - Basic eCommerce: $9.95/mo

This is ideal for online businesses and businesses that take telephone orders as it integrates with top e-commerce platforms. It also does not require a terminal. - Advanced: $19+/mo

This plan is ideal for rapidly growing businesses. It lets you choose from a variety of POS systems, with the monthly fee depending on your selected features. - Premium: custom pricing

The Premium plan is for businesses with $30,000+ sales per month. Your monthly fee can start at $9.95+/mo, and the features will be customized to your business needs.

National Processing has no hidden fees.

- Basic In-person: $9.95/mo

- Pros and Cons

Pros:

- No early termination fees for the Basic and Advanced plans

- No hidden fees

- Free mobile card reader or terminal

- Free gateway setup

- Free reprogramming of equipment

- Fast applications (5-7 minutes)

- PCI-compliant

- Responsive customer service

- 24/7 U.S.-based customer support

Cons:

- No free plan

- Underwriting process

- Pulls your credit when you apply for a merchant account through Transunion

- No early termination fees for the Basic and Advanced plans

PayPal for Accepting PayPal & Venmo

|

| CREDIT: PAYPAL |

| Monthly Fee | No monthly fees |

|---|---|

| Swipe Rate[5] | 2.29% + $0.09 |

| Online Rate | 3.49% + $0.49 |

| Keyed-in Rate[6] | 3.49% + $0.09 (through PayPal POS) 3.39% + $0.29 (through the virtual terminal) |

| Contract | No contract |

PayPal offers the best range of payment options to customers. You can accept all major cards, digital wallets, PayPal, and Venmo. With hundreds of millions of PayPal and Venmo users, it can be a big advantage to offer these payment methods.

PayPal is incredibly easy to set up. You can use it with most major e-commerce platforms. Within minutes, you can install a free online checkout button on your site.

If you take in-person payments, it offers a PayPal POS app that lets you take cards on your smartphone. You can even accept PayPal and Venmo payments via QR code scan.

- Point-of-Sale Features

With PayPal's free point-of-sale software, you can:

- Simplify and improve your checkout process

- Accept payments with your phone through the mobile app

- Identify your bestselling products

- Manage your products and apply discounts

- Manage your employees

- Provide digital or paper receipts

- Access your earnings right away from your PayPal Business account

If you have another POS that works better for your business, PayPal integrates with several partner point of sale systems. It integrates with Lightspeed, Revel, Vend, Touch Bistro, etc.

That said, Paypal also offers its own receipt printers, barcode scanners, cash registers, etc.

- Simplify and improve your checkout process

- Plans and Pricing

Apart from the previously mentioned processing rates, PayPal Checkout and Pay with Venmo will cost you 3.49% + $0.49 per transaction. Card-Present & QR Code Fees (via PayPal POS):

- Card-present transactions: 2.29% + $0.09 per transaction

- QR code transactions: 2.29% + $0.09 per transaction

If you want to accept payments over the phone, the virtual terminal costs $30/month. Recurring payments for subscriptions is an extra $10/month.[7]

Additionally, PayPal offers the PayPal POS app for free. But the equipment will cost you:

- $29 for the first card reader; additional readers cost $79

- $199 for the smart terminal

- $239 for the smart terminal with a barcode scanner

- $269 for the mobile printer

High-volume businesses can ask for custom POS pricing.

PayPal supports Tap to Pay so you won't have to pay for a separate hardware. You can just use your iPhone or Android when accepting payments.

- Pros and Cons

Pros:

- Accept PayPal & Venmo in-person and online

- Fast and easy to get started

- No contract

- Affordable in-person processing rates

- Tap to Pay option available

Cons:

- Account holds and freezes

- Extra fees for additional features

- Can get really pricey due to various fees

- Accept PayPal & Venmo in-person and online

Stripe for Online Businesses

|

| CREDIT: STRIPE |

| Monthly Fee[8] | No monthly fees |

|---|---|

| Swipe Rate | 2.7% + $0.05 |

| Online Rate | 2.9% + $0.30 |

| Keyed-in Rate | 3.4% + 30¢ |

| Contract | No contracts |

Stripe is the most powerful processor for online businesses. You can accept payments globally as it supports over 135 currencies and payment methods. You can even sell using local currencies, which can increase conversion if you sell in other countries.

It's no surprise that Stripe is used by big businesses like Amazon, Shopify, H&M, Figma, etc. Small businesses may still find it useful, but it may be overkill if you just need a basic checkout.

That said, Stripe is ideal for subscription services, in-app purchases, online platforms, and B2B businesses. However, you can still accept payments in person through the Stripe terminal.

- Point-of-Sale Features

Here's what you can do with Stripe:

- Accept credit cards, debit cards, and wallet payments

- Set up buy now, pay later options

- Send payment links or turn them into QR codes

- Set up a one-click checkout

- Choose from and integrate with hundreds of partners for services you might need (i.e., e-commerce, accounting, scheduling, CRM, etc.)

- Collect one-time or recurring payments

- Set trial periods, tiered pricing, and usage-based pricing

- Set roles and permissions

- Access reporting and insights

You can work with Stripe Experts if you need help in setting up Stripe. Technically, Stripe is built with developers in mind. So you might need the help of one.

Stripe services has a historical uptime of 99.999%. This means you're most likely to avoid downtime and can count on its reliability. - Accept credit cards, debit cards, and wallet payments

- Plans and Pricing

Stripe offers two plans: Standard and Custom. A Standard plan comes with flat-rate per-transaction pricing. But larger businesses may get a custom interchange-plus pricing, which can have more affordable rates.

Additionally, there are no hidden fees, but there are a lot of fees to consider. Apart from the swipe, online, and keyed-in rate mentioned on the table, you may also consider the following:[9]

- Buy Now Pay Later: Starts at 5.99% + 30¢

- Stripe Billing (for subscriptions): Starts at $620/mo or 0.7% of billing volume

- Invoicing: 0.4% per paid invoice

- Tap to Pay: 10¢ per authorization

Card readers can cost you $59 to $349.

- Buy Now Pay Later: Starts at 5.99% + 30¢

- Pros and Cons

Pros:

- Advanced customization options

- No-code options for easier implementation

- Hundreds of partners in the Stripe ecosystem

- Accepts international cards

- Fraud prevention tools available

- Transparent pricing with no hidden fees

- 24/7 support via phone, chat, and email

Cons:

- Need a developer to maximize the platform

- Can get pricey for small businesses

- Account holds and freezes

- Not for high-risk businesses

- Poor customer reviews[10]

- Advanced customization options

Online Payment Processing

- Accept payments worldwide and automate payouts and financial workflows seamlessly

- Grow with confidence: Whether you're running an e-commerce store, subscription service, or marketplace, Stripe adapts to any business model

- Trusted by millions: From startups to Fortune 500 companies, Stripe powers businesses of every size

- Predictable costs: Transparent flat-rate pricing with no setup fees or monthly charges – pay only for what you use

- Enable more sales: Support credit cards, mobile wallets, and 135+ international payment methods

- Developer-friendly tools: Integrate payments quickly with Stripe's intuitive APIs and documentation

Clover for Brick-and-Mortar Businesses

| Monthly Fee | Starts at $0/mo |

|---|---|

| Swipe Rate | 2.3% to 2.6% (+$0.10) per transaction |

| Keyed-in Rate | 3.5% + $0.10 per transaction |

| Contract | Potential long-term contracts |

Clover has one of the most powerful point-of-sale systems, and it's specifically catered to retail and restaurant businesses.

You get features for faster table turnovers, one-touch tipping, online ordering, etc. There are marketing features too, which let you set up campaigns that can encourage customer loyalty.

Apart from a jam-packed set of features, Clover provides a variety of POS hardware. It offers a complete set of equipment so you can accept multiple payment methods seamlessly.

But since Clover is a merchant account provider, note that you need to be approved for an account.

You can purchase equipment from Clover or from resellers. This can give you more flexibility with pricing. Some popular Clover resellers include Dharma, Payment Depot, and National Processing.

- Point-of-Sale Features

Clover offers the essentials with its POS:

- Accept offline sales

- Accept payments over the phone through the virtual terminal

- Manage and track inventory for online and in-person sales

- Manage and schedule employees

- Set up a loyalty program

- Access cloud-based and customizable reports

- Integrates with accounting apps like QuickBooks and Xero

Regarding payments, Clover lets you accept credit cards, debit cards, gift cards, and contactless payments. For chip payments, you can take PIN entry and signatures.

You can also take contactless payments with your iPhone.

- Accept offline sales

- Plans and Pricing

Clover offers 3 plans for each industry, with varying inclusions. You can choose to pay the POS equipment in full or installment. The point-of-sale software also come with monthly fees.

Here are the starting prices for the Starter plan, the most basic plan, of each industry:[11]

- Full-service Dining: $165/mo for 36 months or $1,699+ $89.95/mo

- QuickService Restaurant: $105/mo for 36 months or $799+ $59.95/mo

- Retail: $60/mo for 36 months or $799+ $14.95/mo

- Professional Services: $0+ $14.95/mo

- Personal Services: $50/mo for 36 months or $599+ $14.95/mo

- Home and Field Services: $0+ $14.95/mo

Clover is known for its sleek and beautiful POS equipment. Some of the offered plans come with POS equipment, but you can also select a device you want for a price.

- Full-service Dining: $165/mo for 36 months or $1,699+ $89.95/mo

- Pros and Cons

Pros:

- Powerful POS system

- Customizable

- Available from resellers

- Fraud protection for up to $100,000

- PCI-certified system

- Next-day funding

- 24/7 expert phone support

Cons:

- Monthly software fee

- Expensive equipment

- Not ideal for e-commerce or online businesses

- Powerful POS system

Clover Go for $49

- Accepts swipe, chip, tap, including Apple Pay and Google Pay

- Process credit cards anywhere

- Works with free Clover Go app on iOS and Android

Square is better for indie sellers and small businesses looking for a quick, cheap way to process credit card payments. Clover is better for small to medium retailers and restaurants looking for a more customized POS solution and better rates. Read more in our detailed Square vs Clover comparison guide.

Helcim for Multi-Channel Businesses

|

| Monthly Fee | No monthly fees |

|---|---|

| Swipe Rate | Average of 1.83% + $0.08 per transaction |

| Online Rate | Average of 2.27% + $0.25 per transaction |

| Keyed-in Rate | Average of 2.27% + $0.25 per transaction |

| Contract | No contracts |

Helcim offers one of the best set of tools for merchants. All their merchant tools are free, unlike other companies that charge you for extra features.

This includes online ordering, virtual terminal, invoicing, recurring billing, customer self-service portal, etc. It's a great choice if you sell in multiple ways.

The only downside is that Helcim offers only 2 POS equipment, so you're more limited with your options. That said, the Helcim smart terminal and card reader are both packed with features. Keep reading for more details.

You can accept tap, chip, PIN, and mobile wallet payments. Helcim also works with all major card brands like Visa, Mastercard, American Express, etc.

- Point-of-Sale Features

Even though Helcim offers a free account, you're not lacking in the features you'll get. With Helcim, you can:

- Accept payments online and in person

- Take payments over the phone with the virtual terminal

- Set up subscription services

- Send and manage invoices

- Manage inventory

- Review sales insights

- Integrate your existing POS system (no extra fees)

Helcim is also suitable for mobile businesses, like Square, since you can take the card reader with you wherever you do business. The Helcim Payments app also works with your tablet or computer.

Helcim works best with businesses in the retail, professional services, healthcare, home services, and auto repair industry. - Accept payments online and in person

- Plans and Pricing

Helcim offers interchange-plus pricing. Here are the markup fees over the standard interchange rates:[12]

Monthly Volume In-person Transactions Online and Keyed Transactions $0 - $50,000 Interchange + 0.40% + 8¢ Interchange + 0.50% + 25¢ $50,001 - $100,000 Interchange + 0.35% + 7¢ Interchange + 0.45% + 20¢ $100,001 - $500,000 Interchange + 0.25% + 7¢ Interchange + 0.35% + 20¢ $500,001 - $1,000,000 Interchange + 0.20% + 6¢ Interchange + 0.25% + 15¢ $1,000,001+ Interchange + 0.15% + 6¢ Interchange + 0.15% + 15¢ Helcim's processing fees are not the cheapest. But all their merchant tools are available at no extra cost.

With great tools, transparency, and one of the best customer services, Helcim has strong overall value despite the slightly higher processing fee.

POS equipment: $199 for Helcim Card Reader; $349 for Helcim Smart Terminal

Note that Helcim's card reader is pricier than other credit card readers. It will connect with your device through Bluetooth, but you can also plug it into your computer.

- Pros and Cons

Pros:

- Robust merchant tools

- No monthly fees

- No setup fees

- No cancellation fees

- Volume discounts

- Fraud prevention tools

- PCI-compliant

- Highly praised customer service

Cons:

- Limited equipment option

- Doesn't work with high-risk businesses

- Chargeback fee of $15 ($0 if you win the dispute)

- $5 fee per ACH reject

- Robust merchant tools

Start Accepting Payments Fast

- Interchange Plus Pricing

- No Monthly Fees

- No Contracts

Merchant One for a Veteran Credit Card Processor

| Monthly Fee | $13.95/mo[13] |

|---|---|

| Swipe Rate | 0.29% - 1.55% |

| Online Rate | Not disclosed |

| Keyed-in Rate | 0.29% - 1.99% |

| Contract | Potential long-term contract (3 years)[14] |

Merchant One is one of the veterans of payment processing, having been in business for over 20 years. It's a merchant account provider that supports multiple industries like retail, restaurants, hospitality, B2B, etc.

You'll have to get approved for an account, but the credit card processor boasts a 98% approval rate. You can get a free terminal, too, where you can choose from various options.

Merchant One can be suited for e-commerce businesses since it works with 175+ shopping cart integrations. The only downside is you'll have to contact them for a quote regarding the online rates.

- Point-of-Sale Features

Merchant One offers the essential features, but what you get will depend on your chosen credit card processing service.

You may be able to:

- Take over the phone payments through the virtual terminal

- Set up recurring payments

- Process check payments

- Get robust reporting features

- Offer gift cards and set up a loyalty program

- Use text messaging for your marketing campaign

- Manage your customer database

- Get a free shopping cart for your website

- Set up Buy Now buttons

- Work with an online account manager

Merchant One works with third-party POS equipment, just like Stax and Payment Depot. You can get various terminals and POS stations from Pax, Verifone, and Clover.

Depending on your equipment, you may be able to accept EMV and NFC payments, and other payment types accepted by Clover. The POS equipment come with flexible lease terms.

- Take over the phone payments through the virtual terminal

- Plans and Pricing

Merchant One offers 4 credit card processing services:

- Retail or Swipe

- Full POS Systems

- Mobile

- Card Not Present or E-commerce

Each will come with its own sets of features. You can expect the same monthly fee of $13.95. There are no set up fees.

- Retail or Swipe

- Pros and Cons

Pros:

- 98% approval rate

- Fast setup within 24 hours

- Free terminal available

- Next-day funding

- No setup fees

- Dedicated account manager

- 24/7 customer support

Cons:

- Underwriting process

- Long-term contracts

- Not fully transparent with rates

- 98% approval rate

Elavon for Jampacked Features

| Monthly Fee | Need to contact for a quote |

|---|---|

| Processing Rates | Fixed rates; need to contact for a quote |

| Contract | Need to contact for the details |

Elavon is another veteran in the industry having been in business for more than 30 years. It's a merchant account provider whose clients range from small businesses to large worldwide enterprises.

It's not the most transparent among the processors on this list. You'll have to contact them to know the fees that will come with your account. That said, it's jampacked with features, so you're sure to get what you need and more.

You can be an online business, a mobile business, or a brick-and-mortar store. You'll also be able to set up convenience fees, surcharge your customers, and access funding options when you need them. Read on for everything you need to know.

With Elavon, you can accept major credit cards and debit cards, and contactless payments like Apple Pay and Google Pay. Additionally, you can accept checks like ACH and ECS, and offer gift cards to your customers.

- Point-of-Sale Features

Elavon uses the talech POS. With it, you can:

- Access a cloud-based system to easily scale your business

- Access robust business management tools

- Track the average spending and activity of your customers

- Get insights into what's selling the most with your products

- Accept online bookings

- Set up shifts for your employees

- Generate invoices

- Display prices in the cardholder's local currency

Additionally, Elavon connects with different softwares and gateways. Plus, there are various point-of-sale equipment to choose from. There are wireless terminals which can last for up to 8 hours, countertop terminals, and registers.

If you need help with cash flow, there are funding options, too. You'll get access to your funds when you need them.

Elavon's Reliability and Uptime

Elavon's average transaction period is 10 milliseconds, with a 99.99% uptime. You won't have to worry about long lines and disrupted business operations. - Access a cloud-based system to easily scale your business

- Plans and Pricing

You may get interchange-plus pricing with Elavon, but you'll have to contact them to get a quote. You may be asked your transaction history to qualify for lower rates.

Additionally, you can surcharge your customers to save on processing fees. Or just set up convenience fees when applicable.

- Pros and Cons

Pros:

- For small to very large businesses

- 24/7 in-house, multilingual customer support

- Dedicated relationship management team

- PCI-compliant

- Encryption and tokenization features

- Fraud prevention and chargeback management features

Cons:

- Need a quote for the pricing

- Underwriting process

- Need to qualify to access lower rates

- For small to very large businesses

Honorable Mentions

The following credit card processors didn't make our top list. But they may still be worth considering. Read on.

Dharma Merchant Services

| Monthly Fee | Starts at $15/month |

|---|---|

| Swipe Rate | Interchange + 0.15% + $0.08 |

| Online Rate | Interchange + 0.20% + $0.11 |

| Keyed-in Rate | Interchange + 0.20% + $0.11 |

| Contract | Month-to-month[15] |

Dharma Merchant Services is another credit card processor offering interchange-plus pricing. However, it's not the cheapest. Unlike Stax that offers a flat fee, with Dharma, you still get percentage-based fees on top of the interchange.

That said, it offers tools packed with features that can help your small business or enterprise. All accounts get the MX Merchant payment gateway, which also includes a virtual terminal, mobile processing, customer database, and reporting tools.

It also integrates with most major shopping carts.

|

|

Chase Payment Solutions

| Monthly Fee | For e-commerce, starts at $9.95[17] |

|---|---|

| Swipe Rate | 2.6% rate +10¢ per tap, dip and swiped transaction |

| Online Rate | 2.90% + 25¢ per eCommerce transaction and monthly fee starting at $9.95 |

| Keyed-in Rate | 3.5% rate +10¢ per keyed transaction |

| Contract | Month-to-month |

Chase Payment Solutions is a trusted and well-established merchant account provider. It can work with your business whether you're in the restaurant, retail, or e-commerce industry.

With the Chase POS, you can accept in-person payments through the smart terminal or the card reader, manage inventory, send and manage invoices, send payment links, etc.

|

|

Chase Payment Solutions℠

- Limited time offer: Get $100 off the Chase Point of Sale (POS)℠ Terminal. Fill out the form and ask a Payments Advisor how to claim.

- Fast funding at no additional cost. Get deposits as soon as same day.

- Get fair and transparent pricing with no hidden fees. 2.6% rate +10¢ per tap, dip and swiped transaction. 2.90% + 25¢ per eCommerce transaction and monthly fee starting at $9.95. 3.5% rate +10¢ per keyed transaction.

- Get paid fast and manage your business from anywhere with the Chase Point of Sale system. Use our mobile app, reader and terminal to take payments via tap, dip and swipe.

- Process payments with Chase Payment Solutions, the #1 merchant acquirer in the U.S.

- Tap to Pay on iPhone offers you the ability to accept contactless cards, Apple Pay and other digital wallets on your iPhone – no additional hardware required.

- Chase Customer Insights is a complimentary business intelligence platform that offers simple, actionable analytics and reports to help you make better business decisions and reach more customers.

PaymentCloud

| Monthly Fee | Not disclosed - offers customized pricing |

|---|---|

| Swipe Rate | Not disclosed - offers customized pricing |

| Online Rate | Not disclosed - offers customized pricing |

| Keyed-in Rate | Not disclosed - offers customized pricing |

| Contract | Month-to-month agreement available; potential long-term contracts for high-risk businesses |

PaymentCloud specializes in working with high-risk merchants. Whether you're in a risky industry or previously had a failed business, an experienced staff will work with your unique needs. They're there to support you for the entire life of your account.

PaymentCloud even works with "ultra" high-risk industries like adult, CBD, guns and firearms, nutraceuticals, and bail bonds.

|

|

High Risk? No Problem

- Competitive Options for Payment Processing at All Risk Levels

- Fast Funding

- No Setup/Hidden Fees

- No Minimum Credit Score

- All Industries Accepted

Best Credit Card Processing Cost Comparisons

It can be hard to understand just how much credit card processing costs in real terms. To give you an idea, here is what you can expect to pay for a single transaction for the different companies.

Processing costs for a $20 transaction:

| Company | In-person | Online |

|---|---|---|

| Square | $0.63 to $0.67 | $0.88 to $0.96 |

| Payment Depot | Need a quote | Need a quote |

| Stax | $0.56 | $0.66 |

| National Processing | $0.60 | $0.88 |

| PayPal | $0.55 | $1.18 |

| Stripe | $0.59 | $0.88 |

| Clover | $0.62 | N/A |

| Helcim | $0.47 | $0.75 |

| Merchant One | $0.31 | Need a quote |

| Elavon | Need a quote | Need a quote |

Processing costs for a $100 transaction:

| Company | In-person | Online |

|---|---|---|

| Square | $2.55 to $2.75 | $3.20 to $3.60 |

| Payment Depot | Need a quote | Need a quote |

| Stax | $2.48 | $2.58 |

| National Processing | $2.60 | $3.20 |

| PayPal | $2.38 | $3.98 |

| Stripe | $2.75 | $3.20 |

| Clover | $2.70 | N/A |

| Helcim | $2.01 | $2.74 |

| Merchant One | $1.55 | Need a quote |

| Elavon | Need a quote | Need a quote |

Processing costs are based on the advertised rates of each credit card processing company, as of 08/16/2024. The interchange rate used is 2.4%, based on the average.

Of course, don't only compare the processing costs per transaction. Also consider the monthly fees and other account fees. For example, Stax has the lowest per-transaction cost, but the monthly fee starts at $99/mo. So it may not work for smaller volume businesses.

What Is Credit Card Processing?

Credit card processing allows you to accept credit and debit cards from customers. But you can't do that on your own, so you need the help of a payment processor.

A processing company offers the equipment, technology, and services required to accept credit card payments. It acts as a middleman between you (the merchant), the banks, and your customers.

The main services include:

- Accepting and processing credit card and debit card payments, as well as other forms of electronic payments.

- Providing the necessary hardware and software for processing, such as card readers, POS, payment gateways (for online payments), and virtual terminal.

- Maintaining PCI compliance to protect your customers' credit card data.

- Providing online tools to keep track of transactions, monitor employees and inventory, manage customer data, see sales trends, and more.

How Much Does Credit Card Processing Cost?

|

In general, you can expect the overall cost to be 2.5% - 3.5% of your processing volume. This means if you have $10,000 in credit card sales each month, your processing fees will be $250 - $350.

Your total credit card processing fees includes several components:

- Interchange fee: Interchange fees are paid to the credit card companies / card issuing banks (like Chase, Bank of America, etc.) to cover operation costs and risk. These make up the major bulk of your processing fees.

See the detailed breakdown of the current interchange fees.

- Assessment fee: These are paid to the credit card networks (Visa, Mastercard, Discover, and Amex) for using their card brands.

- Processor fee: These are fees your processing company charges. This is the commission they get for each transaction, plus any fees for services and features.

Interchange and assessment fees are set by the card associations.[18][19] They're the same no matter which credit card processing service you use. So when shopping around, you only need to compare the fees charged by the credit card processing company.

According to the IRS, business expenses that are both ordinary and necessary are tax-deductible. An ordinary expense pertains to what's common and accepted in your business industry. A necessary expense, on the other hand, is something helpful and appropriate for your business.[20] Processing fees may be considered an ordinary and necessary business expense.

How to Choose the Best Credit Card Processing Company

|

To find the right credit card payment processor for you, don't only look at the cost. You want to find a company with the best processing fees while providing the services you need.

Here are some main things to consider when comparing companies.

Type of Processing Service

The first step is to decide which kind of company you want to use. This mostly depends on how new your business is and/or your sales volume. The two options are:

- Merchant account provider

Merchant account providers are a full-service credit card processor. You get a unique merchant ID number and a dedicated merchant account just for your business.These types of accounts require underwriting to approve you as a client. They will thoroughly review your business to determine how risky you are. Oftentimes, they only want to work with established businesses with a history of steady sales.

Merchant accounts usually offer lower processing costs, better account stability, and better customer support.

- Payment service provider (PSP)

Third party payment service providers (like Square) are the simpler option. You don't get your own merchant account ID. Instead, your transactions are processed together with many other businesses into one huge shared merchant account.These processors offer simple pricing and easy sign-up. Thus, they're better for new and micro-businesses.

But they usually have higher processing fees. And because there was no underwriting, your account is not as stable. Account holds and freezes are more common if they think a transaction seems suspicious.

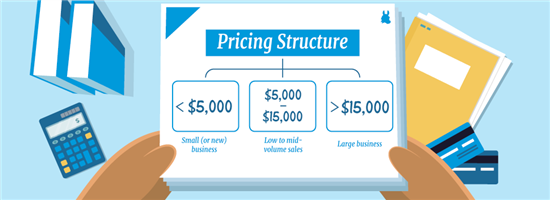

Pricing Structure for Your Size Business

|

It's important to get the right pricing model for your business. Most credit card processing services specialize in one type of pricing, so that helps narrow down your search right away.

It will depend on your monthly transaction volume:

- New or small business (under $5,000/month):

It's best to get started with a flat-rate payment processor, like Square or PayPal. This kind of pricing is predictable and simple.The downside is that all the fees are blended together, so you don't really know how much the processor is charging. The fees tend to be higher in exchange for the simplicity and convenience.

Ex: 2.6% + $0.15 per transaction

- Low to mid-volume sales (up to $15,000/month):

If you have steady sales between $5k and $15k per month, a merchant account provider with an interchange-plus pricing model (like Helcim) will allow you to save more.In interchange-plus, the interchange fees are clearly separated from the provider markups. So you know exactly how much commission is charged. This makes it easier to compare companies.

Ex: Interchange + 0.2% + $0.10 per transaction

- Large business (over $15,000/month):

For high volume businesses, you'll save the most with subscription pricing, like Stax or Payment Depot. The processor markups are very low, so your savings will more than justify the membership fee.Ex: Interchange + $0.10 per transaction; plus $100/mo

Choose the right processor for your needs right now. Of course, you hope your business grows over time. When you've outgrown it, you can switch to another company that fits better with your new situation.

Other Account Fees

|

Every dollar matters to small business owners. Besides just looking at the transaction fees, pay attention to other account fees and miscellaneous charges.

You'll want to especially look out for the hidden fees. Watch out for:

- Account setup fees

- Monthly fee or annual fee

- Monthly processing minimum

- Payment gateway fee

- Virtual terminal fee

- PCI compliance fees

- Chargeback fees

- Statement fees

A lot of additional fees can increase your overall processing rate. You want to take all the fees into account when comparing payment processors.

Account Setup Speed

For new businesses and indie sellers, a payment services provider will let you get started very quickly. There's no approval process. You just sign yourself up and can get started right away.

On the other hand, opening a proper merchant account will require underwriting. But if you have good credit and your business is easily verified, you could be approved in as fast as 1-2 days.

Contract & Early Termination Fees

|

Traditionally, merchant accounts required a contract (usually 3 years). But nowadays, a lot of companies have done away with contracts and offer month-to-month billing.

There should be no reason to choose a company with a contract. You should be able to cancel whenever you want with no termination fees.

Payment Methods

|

Consider all the ways you accept payments from customer:

- On your phone while on-the-go

- At a physical location

- Online

- Contactless

- Digital wallets (like Apple Pay, Samsung Pay, or Google Pay)

- PayPal / Venmo

- Invoicing

- Auto-recurring payments

- By phone

- ACH transfers

- Global payment options (if you're international)

Make sure the processor supports your payment methods. And see if they charge extra for it. A lot of providers may have an extra fee for virtual terminal, recurring billing feature, and ACH platform.

Funding Time

It typically takes 2-3 business days for funds from your sales to show up in your business checking account. But many payment processors offer next-day funding. Some even offer same-day funding for an extra fee.

Cash flow can really make or break a small business. Being able to get money quickly from your sales helps to keep your business running and growing. So it's important to consider the funding options and make sure they work for you.

Equipment

|

If you need equipment to process payments, see what options the company offers, and how much. If you already have your own POS hardware, see if they're able to reprogram it to work with their software.

If you really have your eye on specific equipment (like the Clover machines), then your options will be limited to providers that offer it.

Some processors offer free equipment. Ask in detail what the deal entails. Is there a contract in exchange for free equipment? Or fees when you return the equipment?

Some companies may have an option to lease equipment. But this is usually a terrible idea. You can end up paying way more over time than if you just bought it outright. Plus, leasing equipment often comes with long term contracts that's hard to break.

Customer Service

|

Quality of service is super important to your relationship with your processor. You want to be able to get help when you need it.

As you shop around, get a sense of how responsive and helpful their support staff is.

Generally, payment service providers have poorer customer service, and mostly rely on self-troubleshooting or email support. Merchant account providers offer better support. You often even get a dedicated account rep.

Is Credit Card Processing Secure?

Security is a big concern since you're handling customers' sensitive credit card data. All businesses that process credit cards must comply with Payment Card Industry Data Security Standards (PCI DSS).

This is a list of security requirements, such as proper encryptions, firewalls, anti-virus software, access controls, and more. The best way to meet these requirements is to work with a PCI-compliant payment processing company.

That means the processing provider takes care of PCI compliance for you. They ensure that their systems and equipment are compliant and up-to-date, so you can process cards securely. The companies on all our lists all include PCI compliance for free.

Another security concern for business owners is fraud. Fraud detection tools (such as CVV and address verification match) can help you prevent fraud so you minimize losses.

Merchants should upgrade to EMV-compliant processing equipment. Visa reports that merchants who upgraded to EMV readers have seen a counterfeit fraud drop by 76% since the U.S. payments industry began the shift to EMV chip.[21]

How Does Credit Card Processing Work?

There are two stages for processing credit (and debit) card transactions. There's the authorization stage and the settlement stage.

When a customer pays through a card, banks communicate in real-time to authorize the transaction. But you'll receive your money from the sale by the end of the settlement stage.

Let's first talk about how transactions are approved or denied.

Stage 1: Authorization

This stage begins when a customer pays through a card either in-person or online. The card information and transaction details are first sent to the merchant bank.

The merchant or acquiring bank will forward the details to the card network. Then, the card network shall send the information to the bank of the customer. The customer's bank (or the issuing bank) will confirm the details such as:

- Card number

- Card verification value (CVV)

- Credit or funds available in the account

The issuing bank will then send a response to the acquiring bank through the card network, approving or denying the transaction. The response will be shown at the screen of the POS equipment used. This response also comes with an authorization code.

Now, it's time to get your money from those sales.

Stage 2: Settlement

This step no longer involves the customer. It will instead revolve around you, the merchant, your credit card processor, the concerning banks and card networks.

Authorizations are stored in your POS. You can send them to the merchant bank at the end of the business day. Settlement begins when you send the batch of approved transactions.

The merchant bank sends the information to the issuing bank to verify the transactions. After verification, the funds are sent to the merchant bank, then forwarded to the merchant's bank account minus the processing fees.

Settlements can be processed within a day, but others could take up to 7 business days.

What is the difference between a payment processor and a payment gateway?

A payment processor or a credit card processing company lets you accept credit card payments. It provides the platform and equipment for you to do so.

A payment gateway is part of the processor's payment solution. It lets you collect customer information to approve or deny a transaction. It also encrypts the card information, which the payment processor uses to charge the customer's bank.

Customers can pay through an in-person payment gateway, such as a credit card terminal, or an online payment gateway. Online payment gateways are used in online stores or mobile apps.

Fees of credit card processing companies add to the total of your payment processing costs. But there are ways to lessen those fees. Let's talk about how in detail.

How to Lower Your Credit Card Processing Fees?

Credit card processing fees aren't set in stone. Let's talk about 5 ways on how you can lower them.

Negotiate your card processing rates and non-processing fees

When shopping for a payment processor, be sure to ask about their processing rates. If you're a merchant with a high volume of sales, you're considered an important client to them. Thus, you can negotiate your rates according to your sales.

If you're already working with a payment processor, you can still negotiate your card processing rates. You can ask for a change if you've seen an increase in the volume of your credit card sales.

Some payment processors also have non-processing fees. This includes the monthly or annual fees, PCI compliance fee, minimum processing fees, etc. You can ask if they can waive certain fees, or just look for options without them.

Also, take note if you're overpaying for processing fees. You can do so by computing for your effective rate.

Credit Card Processing Effective Rate

The "effective rate" is your average credit card processing rate. You get it by dividing the total card processing fees by the total card sales for a specific period.

Here's a calculator you can use to get your effective rate:

Keep in mind that monthly fees and costs on add-ons are also included in the total processing fees. If $100 is your total processing fee with $5,000 in total card sales, then your effective rate is 2%. That said, getting a lower rate can mean a better deal.

Reduce risks of fraud

The higher the security risks, the higher the processing fees. But you can reduce these risks by doing three things:

- Swiping cards instead of entering card information manually

- Entering security information

- Using an address verification service (AVS)

Card networks usually charge higher rates for keyed-in transactions because they pose higher risks. AVS helps reduce risks as it verifies the cardholder's billing address. Therefore, you can get a lower interchange rate if you use AVS.

For in-person sales, you can use signature-required receipts and ID checks to reduce these risks.

Review your merchant statement

Reviewing your merchant processing statement is a good habit to build. The statement shows the transactions you've had throughout the month and the fees that come with them. If anything's unclear to you, you can ask for clarifications.

It's especially advisable for tiered and interchange-plus statements. Tiered pricing can be confusing. While interchange-plus statements have transparent pricing, you might get confused with the rates set by different card networks.

Make sure you've set up your account properly

Speaking of pricing models, the model you choose should be suited to your business type and the number of transactions you have. You might incur a high processing fee with incorrect information.

To make sure you got it right from the get-go, you can consult with an expert.

Consult with an expert

If you're not sure of what to look for in a payment processor, you can always ask a credit card processing expert. That way, you can gain knowledge specific to your business. This can help you avoid costly mistakes.

Experts can also help you get lower rates if they have good relationships with credit card processing companies.

Consider passing the processing costs to your customers

Some businesses pass the processing costs to their customers through a convenience fee. These are fees placed on modes of payments not typically used by a business. For example, if you normally accept cash payments, you can place a convenience fee for credit card payments.

Keep in mind that convenience fees should be stated at the point of sale. It should be stated on your website if you sell online. It's also only allowed if another mode of payment is available.

Convenience fees can be mixed up with surcharges. But these are two different fees.

Convenience fees vs. Surcharges

Credit card surcharges are fees charged for the use of credit cards. These are legal in most states, but there are some rules you have to follow. Convenience fees, on the other hand, are legal in all states.

Convenience fees can also be applied in other modes of payment. But you cannot require surcharges for debit cards.

Credit card processing can get really expensive. That's why some merchants decide on passing the costs to their customers.

Free Credit Card Processing with Surcharging

- You keep 100% of every credit card sale: when you sell $100, you receive $100. Pay only for debit card transactions.

- Fully Compliant

- CardX passes on the fee for credit card transactions only. Your customers can always choose debit as a no-fee option.

You might think that it's better to just not accept credit cards. But that could also be a costly mistake. Let's discuss the benefits of credit card processing.

Why Credit Card Processing is Important?

Processing credit cards will increase your customer base. A lot of people prefer to pay with plastic nowadays. Mobile wallets such as Apple Pay and Google Pay are also getting increasingly popular.

If you don't adapt to how customers pay, you could lose a lot of sales.

It can also be beneficial as a business owner. Customers tend to spend more when they shop with a card rather than cash. According to a 2016 study by Boston Fed, the average amount spent for cash transactions was $22, but it was $112 for non-cash transactions.

Methodology

To find the best credit card processing companies, we first considered the different types of businesses out there. New businesses have different needs than established companies. Online startups have different needs than retail.

Once we established different business categories, we compared processing companies to find the best fit for that category. We looked at these factors:

- Competitive pricing

- Transparency

- No contract

- Setup and ease of use

- Good, well-rounded features

- PCI compliance

We finally narrowed down the list by picking companies with the best balance of fees against features offered (except for PaymentCloud for high-risk processing, since rates depend on your unique situation).

What Experts Say

CreditDonkey assembled a panel of industry experts to answer readers' most pressing questions:

- Should business owners pass on credit card fees to customers?

- How do sellers benefit from allowing customers to use credit cards?

- What's at risk when business owners accept credit cards?

Here's what they said:

Bottom Line

Ultimately, the best credit card processing for you will mostly depend on your business size.

New businesses have more limited options. It's best to start with a flat-rate payment processing service like Square or PayPal. They're easier to set up and offer simpler, more predictable pricing.

As your business grows, you'll find much cheaper rates with interchange-plus or subscription pricing.

Just like with any product, carefully compare and shop around. Get a few quotes from different companies. Make sure you get a full disclosure of all the potential fees. This way, you can compare which one offers the best overall value.

Additional Resources

References

- ^ Square. Pricing, Retrieved 11/06/2025

- ^ Payment Depot. Payment Depot vs. Stax, Retrieved 07/25/2024

- ^ Stax. Pricing, Retrieved 07/26/2024

- ^ National Processing. Pricing, Retrieved 07/26/2024

- ^ PayPal. POS Pricing, Retrieved 08/23/2024

- ^ PayPal. Merchant Fees, Retrieved 07/31/2024

- ^ Paypal. Paypal Pro, Retrieved 08/23/2024

- ^ Stripe. Pricing, Retrieved 07/31/2024

- ^ Stripe. Pricing, Retrieved 08/01/2024

- ^ Stripe. Stripe Reviews, Retrieved 08/01/2024

- ^ Clover. Pricing, Retrieved 08/23/2024

- ^ Helcim. Pricing & Fees, Retrieved 06/22/2025

- ^ Merchant One. Payment Processing, Retrieved 08/11/2024

- ^ Merchant One. Merchant Agreement, Retrieved 08/11/2024

- ^ Dharma Merchant Services. Dharma Account, Retrieved 08/16/2024

- ^ Dharma. Account Closure Fee, Retrieved 08/23/2024

- ^ Chase. Merchant Fees, Retrieved 08/16/2024

- ^ Visa. Visa USA Interchange Reimbursement Fees, Retrieved 08/23/2024

- ^ Mastercard. Mastercard 2023–2024 U.S. Region Interchange Programs and Rates, Retrieved 08/23/2024

- ^ IRS. Tax Guide for Small Business, Retrieved 08/16/2024

- ^ Visa. Chip technology helps reduce counterfeit fraud by 76 percent, Retrieved 08/23/2024

Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Not sure what is right for your business?

|

|

|

|

|

| ||||||

|

|

|