Ally Invest Review: Pros and Cons

Ally Invest offers free trades for stocks and ETFs. But is it good? Find out how it compares to other online brokers.

Overall Score | 4.5 | ||

Stock Trading | 5.0 | ||

Options Trading | 5.0 | ||

Mutual Fund Trading | 5.0 | ||

Banking | 4.5 | ||

Mobile App | 3.5 | ||

Commissions and Fees | 5.0 | ||

Ease of Use | 4.0 | ||

Online Community | 5.0 | ||

Research | 3.5 | ||

Trading Platform | 4.0 | ||

Pros and Cons

- Low commission for stock trades

- No account minimums

- Ally platform

- No physical locations

Bottom Line

Good low-price discount stock broker for savvy investors

Though not as well-known as competitors (such as E*TRADE and TD Ameritrade), Ally Invest can certainly hold its own against the big boys. It

And best of all, its trade fees are among the lowest of any online brokerage around.

But there are some drawbacks you'll want to know before opening an account. Read on to find out:

- About Ally Invest

- Who Ally Invest Is Best For

- Pros & Cons

- Ally Invest Promotions

- Opening an Account

- Types of Accounts

- Fees & Commissions

- Investment Offerings

- Platforms and Tools

- Robo Portfolios

- Ally Invest Forex

- Mobile App

- Is Ally Invest Safe?

- How It Compares

About Ally Invest

Ally's long history goes back to 1919 when it was founded as GMAC (the financial sector of General Motors). It slowly expanded its financial services and was rebranded as Ally Bank in 2009, offering online banking with high interest rates and minimal fees.

In 2016, Ally Financial acquired TradeKing, which became

- Self-directed or managed options

- Investments offered: Stocks, ETFs, mutual funds, options, fixed income securities, penny stocks, Forex.

- Account types: Individual taxable, joint, custodial, IRAs, Coverdell, and entity accounts.

Who Ally Invest Works Best For

|

| © CreditDonkey |

Ally Invest is a good choice for:

- Casual traders who want a simple online brokerage account and have a basic understanding of markets and security types.

- Active traders who can take advantage of the $0 commissions.

- Advanced traders who wish to invest in Forex and/or options.

- Ally banking customers who want investing and banking under one account and app.

- Beginner investors who want completely hands-off easy investing with Ally Invest Robo Portfolios.

If any of the above sound like you, Ally Invest is a

However, Ally Invest doesn't offer fractional shares. So it's not good for small investors who just want to invest a few bucks at a time. Check out one of these micro investment apps (like Robinhood or Stash) instead.

Pros & Cons

PROS:

- $0 online stock and ETF trades

- No account minimum to open

- Wide variety of investment options

- Strong Forex platform

- Robo Portfolios option for no advisory fees

- Customer support by phone and live chat

- Thorough FAQ and education section

- Also has full online banking services, so you can invest and bank at the same place

- Check out Ally Invest here >>

CONS:

- No fractional shares

- No physical locations

- No practice trading platform

- Research and tools not as extensive as other brokerages

- Fee for transferring or closing IRAs

We'll explain more below. But first, let's highlight the current Ally Invest promotions.

Ally Invest Promotional Codes

OPENING AN ACCOUNT

|

To open an Ally Invest account, you must be a US citizen or legal permanent resident and have a US address. You can get started in two ways:

- A self-directed account.

If you're comfortable investing on your own, you can manage your own investment portfolio.There is no

no account minimum to open a self-directed account. And there are no annual fees, no maintenance, and no inactivity fee.If you have a margin account (which is governed by federal regulation), you must maintain a minimum of $2,000, regardless of the brokerage you choose.[1] - A managed account.

If you're a beginner or don't have the time to self manage, the automated robo portfolio offers an easy solution. This is a robo-advisor that will automatically invest and manage your portfolio for you based on your goals.You need an account minimum of $100 to open. There are no advisory fees for Robo Portfolio.

You can fund your account via electronic transfer from your bank, wire transfer, or by mailing in a check.

Wire transfer will be the fastest method, while an electronic bank transfer can take 3 business days.

Once you're into your account, the platform is pretty simple to use. You'll see menu options across the top of the page. The Dashboard is an overview of your activities and links to other parts of the platform.

You'll do all your buying and selling in the Trading tab. The Research tab is where you'll find Ally's news and research for markets, stocks, and options.

TYPES OF ACCOUNTS

Ally Invest supports the following accounts for self-directed trading:[2]

- Individual taxable

- Joint

- Custodial

- IRAs (Traditional, Roth, Rollover)

- Coverdell

Robo Portfolios support:[3]

- Individual and joint taxable

- IRAs (Traditional, Roth, Rollover)

- Custodial

Ally Invest Fees & Commissions

Ally Invest always had one of the lowest fees on the market. And in October 2019, it announced that there will no longer be any commission fees on U.S. listed stocks, ETFs, and options trades.[4]

- Stock and ETFs: $0 per trade

- Options: $0 per trade plus $0.50 per contract

- Mutual funds: $0 to buy or sell no-load mutual funds

- Penny stocks: Additional $0.01 per share for stocks under $2

- Bonds: $1 per bond (minimum $10)

- Forex: No commission

- Broker assisted trades: $20 + regular commission

- IRA transfer fee: $50

- IRA closure fee: $25

All new accounts (no matter your opening amount) will get commission-free stock trading. But note that option trades still cost 50 cents per contract. This is lower than the standard 65 cents that most other online brokers charge.

INVESTMENT OFFERINGS

Ally Invest offers a wide assortment of investment options:

- Stocks

- Mutual Funds: Ally offers thousands of choices and they also offer commission-free mutual fund trades.

- ETFs: Ally offers 500+ commission-free exchange traded funds from Vanguard, GlobalX, WisdomTree, iShares and more.

- Fixed Income Securities: Corporate, agency, treasuries, municipals, strips & zeros, CDs, and new issues.

- Options (equity & index): Ally's platform offers very strong tools for options traders, such as options chains and profit/loss calculator.

- Penny Stocks: Also known as pink sheets or over-the-counter bulletin board. These are very high-risk if you don't know what you're doing.

- Forex (Foreign Exchange): Ally offers a robust Forex trading platform for investors, plus a free practice account. You need a minimum deposit of $50. Read more about it in detail below.

- Margin trading: This means trading with borrowed money. Ally offers tiered margin interest rates, meaning that as your loan amount increases, your interest rate decreases.[5]

Ally Invest does not offer futures or cryptocurrency. It also doesn't offer fractional shares. You must purchase a full share of stock.

PLATFORM AND TOOLS

Ally's investment platform - called Ally LIVE - is available for free for anyone who opens an account.

It offers trading tools such as:

- Customizable dashboard. You can drag/remove modules however you want.

- Streaming charts. 8 chart types (such as candlestick, bar, mountain, and line) with 117 chart studies and 36 drawing tools.

- Alerts. Add alerts to your charts

- Watchlists. Create customized watchlists.

- Research data. See market stats, charts, company quotes, high/low prices, and peer performance comparisons.

- Free tools by Recognia.

Ally Invest offers robust tools for options. Options traders will especially find that the platform is well-developed to help you make informed decisions for these risky trades. Options tools include:

- Profit/loss graph: Understand a trade's potential before placing it.

- Probability calculator: Uses implied volatility to help you estimate the likelihood of hitting your targets.

- Options chains: Easily see what's available and place trades.

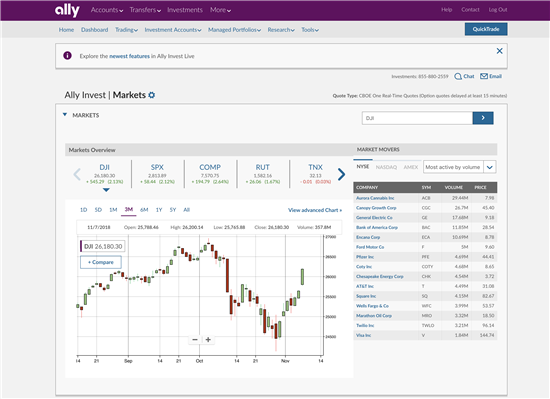

Here are some screenshots:

|

| Markets Overview |

|

| Options Chains and Probability Calculator |

Ally's platform is obviously looking to bat with the big brokers. But it's still lacking in some trading tools, such as heatmaps.

It's constantly listening to feedback and making improvements based on customer needs, so hopefully, even more tools will come in the future.

Managing Tax Strategies

Ally offers a Tax Lot Allocation tool and Maxit Tax Manager to manage the sale of your positions. These tools allow you to pick different tax lot methods to help minimize your tax bill.

Say you bought the same stock at different prices on different dates. Being able to select which lots to sell will affect your gains and losses, which affects how much tax you pay.

When selling securities, the account default is FIFO (first-in, first-out). But you can select a different tax lot method like LIFO (last-in, first-out) or choose specific shares. You must submit the change within 2 business days after execution of the trade.

Robo Portfolio

|

If you're a beginner or just wants to be hands-off, Ally Invest offers a robo-advisor called Robo Portfolios.

Ally will automatically build a portfolio for you based on your goals and risk tolerance. Your portfolio will be professionally managed so you don't have to worry about maintaining it.

Some features include:

- Diversified portfolio of ETFs

- Automatic rebalancing

- 4 portfolio options: core, income, tax-optimized, and socially responsible

You just need to invest a minimum of $100 to start. Robo Portfolios is free of advisory fees.This is lower than other robo-advisors like Betterment. However, the catch is that 30% of your portfolio will be held in cash. Read more about it in our detailed review.

Robo Portfolios lacks tax loss harvesting, which is a feature offered by many other robo-advisors.

- Are new to investing and don't feel confident to make choices

- Want completely easy hands-off investing

- Don't have time to invest and manage their own portfolios

ALLY INVEST FOREX

For Forex traders, you must sign up for an entirely separate platform and mobile app. Ally Invest Forex is a separate, but affiliated, company from Ally Invest.

Forex is the most popular traded market in the world. In a nutshell, Forex is traded in pairs: you're buying one currency while selling another. There's a fair amount of risk involved.

Ally offers two forex platforms: their own Ally Invest Forex and MetaTrader 4. Both allow you to trade over 80 currency pairs and offer fractional pricing.

Ally's Forex platform features include:

- Customized layout. You can choose from pre-set layouts or create your own to your preferences.

- Advanced charting. Includes more than 80 technical indicators, drawing tools, and integrated order management features. You can overlay technical studies and flip between charts and trade setups. You can even track, trade, and modify orders directly on the charts.

- Automation. You can create a custom trading strategy and automate it for real-time buy and sell signals.

- Research. Stay on top of the market with streaming updates, forecasted results, and potential impacts.

- Practice platform. You get a free $50,000 virtual practice account with full access to the platforms and tools for 30 days.

You need at least $50 to open an Ally Forex account, and $500 for MetaTrader 4. But it's recommended to start with at least $2,500 so you have more flexibility and better risk management.[6]

MOBILE APP

Ally Invest offers trading on-the-go with its iPhone and Android apps - Ally Mobile. It's the same app as the Ally online banking. So if you use banking services as well, you can bank and invest under one roof.

Ally Mobile app has an average 4.8-star rating on the App Store. It provides investors with a single access to your banking and investing life. The reviews tend to highlight the ease of use.

The app offers a simplified version of the desktop platform. The functions are limited, but they have most of the core abilities, such as:

- Buy and sell stocks and options from your phone

- Get real-time streaming quotes, chart positions, and current news

- Use charting tools

- View your watch lists

- Monitor your investments and check balances

Is Ally Safe?

Ally Invest is a member of SIPC and FINRA (CRD #136131). SIPC, created under federal law, protects your securities (up to $500,000) and cash (up to $250,000) if your brokerage firm fails. FINRA ensures compliance with industry regulations. Additionally, Ally has a track-record going back to 1919.

While SIPC protects against the loss of cash and securities (such as stocks and bonds) in the case that Ally Invest fails, it does not protect against investment losses from the market. Forex accounts are not protected by the SIPC.

Ally Invest's clearing firm, Apex Clearing, also has an additional insurance policy through London Underwriters to supplement SIPC protection. This additional insurance policy covers you if the SIPC limits are exhausted, for up to $150 million.[7]

CUSTOMER SERVICE

Besides low fees, Ally Invest has high user satisfaction ratings. It offers good customer support with a human. You can reach Ally Invest by:

- Phone: 1-855-880-2559

- Live chat online

- Email: support@invest.ally.com

How It Compares to Other Online Brokers

|

No review of Ally Invest is complete without a look at how Ally Invest compares with industry heavyweights Fidelity, E*TRADE, and TD Ameritrade. Here are the side-by-side comparisons to see how the brokers compare.

Ally Invest vs E*TRADE

E*TRADE also made the move to commission-free trades. Like Ally Invest, E*TRADE also offers a large selection of no-transaction-fee mutual funds.

E*TRADE's investment platform is top notch when it comes to research and trading tools. Investors with more experience may find more value in E*TRADE.

E*TRADE also offers checking account benefits and 30 physical locations across the country.

Ally Invest | E*TRADE | |

|---|---|---|

Benefits and Features | ||

| Stock Trading | ||

| Options Trading |

| |

| Minimum Deposit | $0 for self-directed brokerage accounts; Managed portfolios start at $500 minimum | |

| Mutual Fund Trading |

| $0 for no-load, no-transaction-fee funds; $19.99 for transaction-fee funds |

| Commission Free ETFs | ||

| Penny Stocks | $0.01 per share on the entire order for stocks priced less than $2.00. | |

| Broker Assisted Trades | ||

| Inactivity Fee | ||

| Maintenance Fee | ||

| Banking | Integrated with banking on ally.com. Manage your Ally banking and investment accounts in one place. | Checking account offers no minimum balance requirements, free online bill pay, and unlimited debit card and check transactions. |

| Mobile App | ||

| Desktop App | E*TRADE Pro (requires you to execute at least 30 trades during a calendar quarter or maintain brokerage account balance of at least $250,000) | |

| Forex Trading | ||

| Futures Trading | $1.50 per contract, per side + fees (excluding bitcoin futures) | |

| Customer Service | ||

| Virtual Trading | ||

| Stock Trading | ||

| Options Trading | ||

| Mutual Fund Trading | ||

| Banking | ||

| Mobile App | ||

| Commissions and Fees | ||

| Ease of Use | ||

| Online Community | ||

| Research | ||

| Trading Platform | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Ally Invest: Pricing information from published website as of 04/01/2021. E*TRADE: Pricing information from published website as of 01/04/2024. | ||

Ally Invest vs Fidelity

Fidelity also offers commission-free stocks, ETFs, and options trades. However, Fidelity's mutual funds trading price is significantly higher. But it does offer a huge selection of no-fee funds such as zero minimum investment Fidelity Mutual Funds.

A downside is that Fidelity's trading platforms require users to make a certain amount of trades before they're granted access. The lowest is 36 trades per 12 months, but more advanced tools require 120 trades per 12 months.[8]

Fidelity has more than 200 branch locations, so it's also good if you want in-person advice.

Ally Invest | Fidelity | |

|---|---|---|

Benefits and Features | ||

| Stock Trading | ||

| Options Trading | ||

| Annual Fee | ||

| Cryptocurrency Trading | ||

| Minimum Deposit | ||

| Mutual Fund Trading |

| |

| Commission Free ETFs | ||

| Penny Stocks | $0.01 per share on the entire order for stocks priced less than $2.00. | |

| Broker Assisted Trades | ||

| Inactivity Fee | ||

| Maintenance Fee | ||

| Banking | Integrated with banking on ally.com. Manage your Ally banking and investment accounts in one place. | |

| Mobile App | ||

| Forex Trading | ||

| Customer Service | ||

| Stock Trading | ||

| Options Trading | ||

| Mutual Fund Trading | ||

| Banking | ||

| Mobile App | ||

| Commissions and Fees | ||

| Ease of Use | ||

| Online Community | ||

| Research | ||

| Trading Platform | ||

| Savings | ||

| Fees | ||

| Customer Service | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Ally Invest: Pricing information from published website as of 04/01/2021. Fidelity: Pricing information from published website as of 07/05/2024. | ||

Ally Invest vs TD Ameritrade

TD Ameritrade now also offers $0 commissions on online stock, ETF, and options trades. Its trading platforms are among the most advanced out of all online brokers. You get free access to all elite tools. Plus, there is a virtual platform where you can make practice trades before committing real money.

It also offers a cash management account, which includes a debit card, free ATM withdrawals, free check writing, and free bill pay.

TD Ameritrade investors have access to 100 locations in 34 states. Charles Schwab recently announced their plans to acquire TD Ameritrade.

OTHER SERVICES

Ally Invest is part of Ally Financial, which also includes a full-service online bank. Ally Bank gets very high satisfaction ratings for its competitive savings rates, user-friendly website, and good customer support.

Services include:

- Online savings account with 4.20% APY

- Interest checking with no monthly fees

- A variety of CDs with no minimum deposits

- Home loans

- Car loans

If you like having all your personal finance in one place, Ally is definitely worth looking into. You use one single login for both Ally Invest and Ally Bank, so it's convenient to manage everything under one roof.

Ally Invest transfer time

There are a number of factors that may affect transfer times for Ally Invest users.

If you're making an online transfer between two Ally Bank accounts, it will be processed immediately.

If you make a standard transfer between an Ally Bank account and non-Ally account before 1:00AM EST Monday through Friday, it will take three business days.

If your transfer is eligible for next-day delivery and is requested before 7:30PM EST Monday through Friday, it will take one business day.

Transfers between banks won't be processed on weekends and federal holidays.

Eligibility for next-day transfers is based on account tenure, account activity, and transfer activity such as overdrafts and returns. Next-day transfers aren't available to new accounts.

Ally Invest Crypto

Ally Invest users can't directly trade cryptocurrency. But that doesn't mean you're entirely cut off from the crypto market.

Instead, you can get indirect exposure to cryptocurrency through a number of crypto trusts, futures, and stocks of companies that hold crypto on their balance sheets.

Crypto Trusts include:

- Grayscale Bitcoin Cash Trust (BCHG)

- Grayscale Bitcoin Trust (GBTC)

- Grayscale Ethereum Classic Trust (ETCG)

- Grayscale Ethereum Trust (ETHE)

- Grayscale Litecoin Trust (LTCN)

- Osprey Bitcoin Trust (OBTC)

Bitcoin Futures include:

- ProShares Bitcoin Strategy ETF (BITO)

- Global X Blockchain ETF (BKCH)

- Valkyrie Bitcoin Strategy ETF (BTF)

- VanEck Bitcoin Strategy ETF (XBTF)

Crypto-related Stocks include:

- Coinbase Global Inc. (COIN)

- Marathon Digital Holdings Inc. (MARA)

- MicroStrategy Inc. (MSTR)

- Tesla Inc. (TSLA)

- PayPal Holdings Inc. (PYPL)

- Riot Blockchain Inc. (RIOT)

Can I buy Dogecoin or Bitcoin on Ally Invest?

No, you can't buy Dogecoin or Bitcoin on Ally Invest.

Ally Invest and penny stocks

If you're interested in trading penny stocks, Ally Invest is probably not the best platform to do it on because of the fees associated with trading stocks valued at less than $2.

While stocks valued over $2 are free to trade, there is a $4.95 trading fee for stocks valued less than that, with an additional $0.01 per share

This can make buying penny stocks on Ally Invest unnecessarily expensive.

Instead, those looking to trade penny stocks should find a commission-free platform for that purpose.

Frequently Asked Questions

Let's look at some of the most frequently asked questions about Ally Invest.

What are Ally Invest unsettled funds?

Unsettled funds are the proceeds from selling a security from the time the sale is made to the time the trade order is completed, a period of two business days.

Once the settlement period is over, they become settled funds.

Can you short sell on Ally Invest?

Yes, you can short-sell on Ally Invest.

Can I trade options on Ally Invest?

Yes, you can trade options at Ally Invest.

Can I link Ally savings account to Invest?

Yes, you can link your Ally savings account to your Ally Invest account for easy transfers.

How can I withdraw money from Ally Invest?

You can withdraw money from Ally Invest by logging into your account and choosing Transfers. Wire transfers incur a $30 fee, or you can request a check for $5.

Does Ally Invest support trailing stops?

No, Ally Invest does not support trailing stops.

BOTTOM LINE: IS ALLY INVEST GOOD?

Even though Ally is a budget broker with no physical locations, it's worth considering.

It's hard to beat

Ally is worth considering for budget investors or active traders. It's also good if you want to invest in options or Forex, as those have strong platforms.

References

- ^ FINRA. 4210. Margin Requirements, Retrieved 10/20/2022

- ^ Ally. Opening an Account: What type of accounts are available?, Retrieved 10/20/2022

- ^ Ally. FAQs: What type of account can I open for my robo portfolio?, Retrieved 10/20/2022

- ^ Ally. Ally Invest Commissions and Fees, Retrieved 10/20/2022

- ^ Ally. Margin Accounts, Retrieved 10/20/2022

- ^ Ally. How much money do I need to open a Forex account?, Retrieved 10/20/2022

- ^ Ally. Clearing Disclosure, Retrieved 10/20/2022

- ^ Fidelity. Entitlements, Retrieved 10/20/2022

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Free Gold IRA Kit

- Up to $10,000 in free silver for eligible customers

- Highest buyback price, guaranteed

- Endorsed by Sean Hannity and Chuck Norris

Free Gold When You Open a Gold IRA

Free gold is only for qualified customers who have at least $100K saved for retirement and who open a gold IRA with Augusta Precious Metals.

Cynthia Cohen is a retail analyst at CreditDonkey, a personal finance comparison and reviews website. Write to Cynthia Cohen at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next:

Compare: