Options Trading

Compare Options Trading

Robinhood

- Options Trading: $0

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

eToro

- Options Trading: $0

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Webull

- Options Trading: $0

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Moomoo

- Options Trading: $0 for US Options;

$0.50 per contract for Index Options

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Deposit and Get 15 Free Stocks plus 8.1% APY on uninvested cash

OANDA

- Options Trading: No

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Vanguard

- Options Trading: $0 + $1-per-contract fee. Discounts available if you have more than $1 million assets invested in Vanguard ETFs and mutual funds

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Ally Invest

- Options Trading: $0 base + $0.50 per contract

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

TradeStation

- Options Trading: $0 Commission + $0.60 per contract

50% Off Futures Brokerage Fees for New Customers with Code FUTRAFZT

TD Ameritrade

- Options Trading: $0.65 per contract

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Commission-Free Trading - Online Stock, ETF and Option Trades

Charles Schwab

- Options Trading: $0 + $0.65 per contract

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

E*TRADE

- Options Trading:

- $0 per trade + $0.65 per contract

- $0 per trade + $0.50 per contract if you make 30+ trades a quarter

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Fidelity

- Options Trading: $0.65 per contract

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Merrill Edge

- Options Trading: $0 + $0.65 per contract

Acorns

- Options Trading: No

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Uphold

- Options Trading: No

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Stash

- Options Trading: No

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Bitstamp

- Options Trading: No

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Coinbase

- Options Trading: No

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

M1 Finance

- Options Trading: No

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Public.com

- Options Trading: No

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Interactive Brokers

- Options Trading: $0.15-$0.65 per contract ($1 minimum per order)

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

Paybis

- Options Trading: No

Pros:

| Cons:

|

Our Review: ![]()

![]()

![]()

![]()

![]()

tastytrade

- Options Trading: $1 per contract ($10 max per leg)

ZacksTrade

- Options Trading: $1 for First Contract + $0.75 per additional

Articles on Options Trading

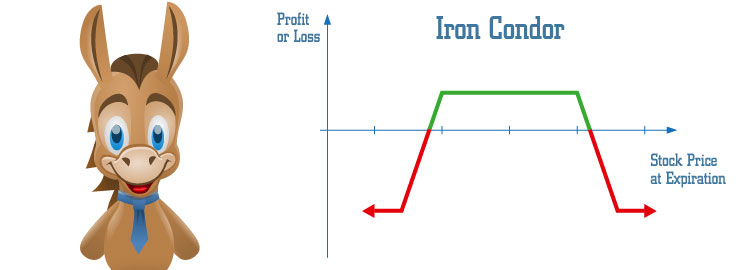

Iron Condor

Butterfly Spread

Long Call

Calls and Puts

Put Options

Call Options

You might also be interested in