How Credit Card Processing Works

What happens during credit card processing? Knowing the process will let you understand where the processing fees go and why. Read on.

|

Swiping a card or clicking "checkout" takes just one second. But a lot goes on behind the scenes.

Is it really important to know exactly how credit card processing works? Probably not. But it will help you understand more about why you pay processing fees. And maybe even reduce them.

Here's a look at how credit card processing works and just what happens when a card is swiped.

How Credit Card Processing Works: 1-Minute Summary

Accepting credit cards requires the help of a processing service. This is a provider that offers the equipment, technology, and services required to process card payments.

It acts as the middleman between you and the banks. It requests payment authorization from the banks and sends the approval and funds to you.

In a nutshell, this is how it works:

- Authorization: The customer pays for goods or services with a credit card. The card details are forwarded to the bank, which approves or denies the payment almost instantly.

- Settlement: If approved, funds from credit card sales are settled into your merchant account.

- Funding: From there, your provider transfers them to your business bank account (minus processing fees).

The above is a very simple explanation. There's a lot more communication and things happening in each step. If you'd like to learn more in detail, read on.

Main Parties Involved in Credit Card Processing

|

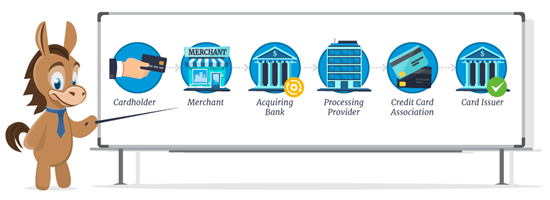

There are many different parties involved to help you process credit card payments. Here's a quick list of the key players:

- Cardholder

This is easy. The cardholder is the customer using the card to pay for the purchase. - Merchant

This is you, the business accepting the credit card, either in person or online. - Acquiring Bank

Also called a "merchant bank," this is the bank that maintains your merchant account. You actually don't get direct access or contact with this bank. Your processing provider is the one who facilitates this relationship. - Processing Provider

This is the "middleman" that connects you with the banks. They set you up with a merchant account to process and receive credit card payments. This is the only party you directly deal with. They handle everything else. - Credit Card Association

This is the brand of the card, such as Visa, Mastercard, Discover, and American Express. These networks set the interchange fees for processing credit cards. - Card Issuer

This is the bank that issues the credit cards to consumers, such as Chase, Bank of America, Capital One, etc. They approve or deny the transactions.Note: American Express and Discover act as both the card issuer and the card network.

Now that you know the key players, let's take a deeper look into what happens during a credit card payment.

Step 1: Authorization

|

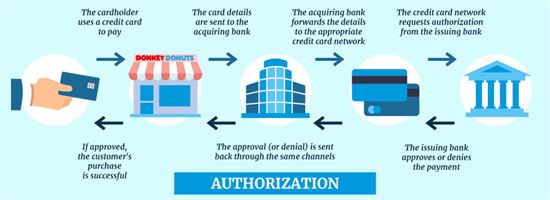

This step approves or declines the payment in real time. It takes just seconds. Here's what happens:

- The cardholder uses a credit card to pay.

- The card details are sent to the acquiring bank.

- The acquiring bank forwards the details to the appropriate credit card network (Visa, Mastercard, etc.).

- The credit card network requests authorization from the issuing bank.

- The bank approves or denies the payment, based on the cardholder's account standing, balance, etc. It also detects potential fraud by verifying and matching expiration number, CVV code, and billing address.

- The bank sends the approval (or denial) back through the same channels.

- If approved, the customer's purchase is successful. Hooray!

For in-person purchases, your POS system will send the card details to your acquiring bank. For online purchases, your payment gateway forwards the info.

If the card is declined in-person, you will get a declined code. Here is a detailed guide of credit card declined codes and how to deal with them.

Step 2: Clearing and Settlement

|

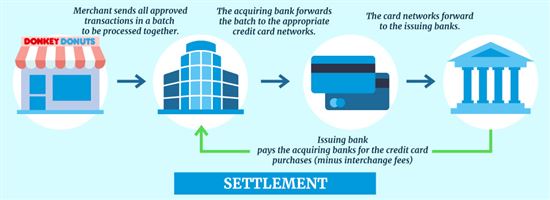

After the transaction is authorized, the next step is the final processing. At the first stage, no funds have actually been transferred. That happens in this step.

- Throughout the day, your merchant account collects the approved authorizations.

- You (the merchant) send all approved transactions in a batch to be processed together. It's best to do this at the end of each business day.

- The acquiring bank forwards the batch to the appropriate credit card networks.

- The card networks forward to the issuing banks.

- Each issuing bank pays the acquiring banks for the credit card purchases, with the interchange fees deducted.

- Your merchant bank settles the funds in your merchant account.

This usually happens overnight. So you can get the funds the next day.

At the same time, the transaction is posted to the customer's credit card account, with the expectation that the cardholder will pay it back later during the billing cycle.

Basically, the card-issuing bank first pays for the credit card purchases. That's why it's a big risk to them if there is fraud. The interchange fees they get help cover that risk, which we'll talk about in a bit.

Step 3: Funding

In this final step, the processing provider deposits funds into your business bank account, where they become available for you to use.

The merchant account provider will also deduct their processing fees. They can do this either daily or monthly.

For daily discounting, this means the processing fees are deducted each day before depositing funds into your account. So the final amount you will receive is minus all processing fees.

For monthly discounting, the total fees are billed to you in a lump-sum at the end of each month.

Most merchant account providers offer next day funding. This means the credit card sales you make today will show up in your business account tomorrow. You just have to settle your batch by a certain time.

Some also offer an instant funding option for an extra fee (usually 1% - 1.5%).

Credit Card Processing Fees

|

| © CreditDonkey |

Swiped transactions cost between 1.5% and 2.9% per transaction. Keyed-in transactions cost an average of 3.5% per transaction.

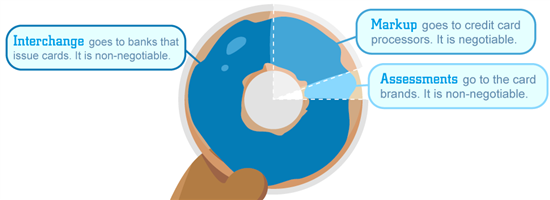

The main parties each get a piece of the processing fee. Your total processing fees are made up of these components:

- Interchange Fees

The interchange fees are set by the 4 card associations. Each one has their own interchange rates. The fees are different based on the type of card and transaction method.For example, debit cards have much lower rates compared to credit cards (0.5% vs 2%) because of the lower risk of fraud. Premium rewards cards have higher rates because banks use that to make up for the rewards.The interchange fees are paid to the card-issuing banks to cover operation costs and risk.

Interchange fees account for most of your processing costs. The average interchange fee for credit cards is around 1.7% - 2%. They're non-negotiable so unfortunately, there's nothing you can do about them.

See a full list of interchange fees from Visa, Mastercard, American Express, and Discover.

- Assessment Fee

The card associations (Visa, Mastercard, Discover, and Amex) take a small assessment fee for using their card brands. This fee is just 0.13-0.14%. - Processor Markup

Your provider also earns a commission with each purchase, along with other fees they charge for their service. For example, they may charge a monthly account fee, payment gateway fee, statement fee, etc.When choosing a provider, compare their markup fees to see who offers a better deal. These fees are also open to negotiation, since the provider has control over them.

If you're paying too much on fees, read our guide on how to lower your processing fees.

How to Accept Credit Cards

As mentioned before, taking credit cards will require the help of a processing service. Look for a provider that supports the ways you want to accept payment.

Here are the requirements for the different ways of taking cards.

In-person Payments

If you're taking cards in-person, you need physical equipment to scan the card and transmit the data. This can be as simple as a mobile card reader or a more robust terminal or register.

Card-present payments have the lowest processing fees.

Online Payments

For online stores, you need a payment gateway to pass on credit card transaction data to the merchant bank. Your processing provider will set you up with a payment gateway. Some will charge an extra monthly fee, and some include it in the overall cost.

Online payments have higher processing fees because of the higher risk of fraud. But there are ways to reduce fraud by using a billing address verification service at checkout.

Over the Phone Payments

For payments by phone, you need a virtual terminal (also called "cloud POS"). This lets you manually enter card payments directly from your web browser. Your provider may charge an extra fee for this feature.

Keyed-in payments have the highest processing fees, as the risk of fraud is the greatest.

Invoices

If you need to send invoices, most providers let you create and send invoices straight from the app or desktop dashboard. Invoices are considered online payments and have the same processing rate.

Recurring Billing

This is for subscription businesses where your customers are on an automatic billing schedule. This means you need to store their credit card data.

Recurring billing is considered an online payment and has the same processing rate. Some providers may charge an extra monthly fee for this feature.

Bottom Line

It may not seem necessary to know the nitty-gritty of what's going on behind the scenes. But having a basic knowledge of the process lets you understand why you pay processing fees.

Anna G is a research director at CreditDonkey, a credit card processing comparison and reviews website. Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Not sure what is right for your business?

|

|

|

Answer a few short questions in our credit card processing quiz to receive tailored recommendations to help you keep more profits.

|

|

| ||||||

|

|

|