Butterfly Call Spreads: What You Need to Know

Predicting a stock's future can be a profitable investment. It can also lead to tremendous loss. Wouldn't it be nice if you could limit your losses? It may be possible with the butterfly call spread.

The strategy doesn’t eliminate your losses – there’s still potential for loss. But you might lose a little less than if you only traded a long call.

What Is a Butterfly Spread?

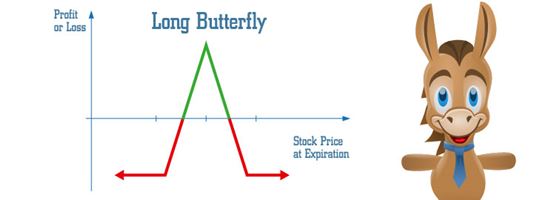

The butterfly spread takes both the bull and bear position. You cover the in-the-money, at-the-money, and out-of-the-money positions. It sounds like a win-win, but you can still lose with this trade. Luckily, the maximum loss is limited. But the maximum profit is also limited. There are no “the sky is the limit” type trades here, unlike the long call position.

The long call butterfly is a strategy for the neutral investor. You think there might be change, but it won’t be anything drastic. The strategy involves 3 legs. You make 2 at-the-money trades, 1 in-the-money trade, and 1 out-of-the-money trade.

The short call butterfly works for investors who think the market is volatile. In this case, little change means loss, while bigger change means profit. You make the same number of trades as the long butterfly. It just uses a different strategy.

In order for either butterfly to work, the “wings” of the butterfly must be equally distant from the middle. Here’s a quick example. If the middle (or at-the-money) strike price is $40, your wings should be $35 and $45. They could be any equal distance. Your butterfly’s body (or middle price) will always equal the stock’s current market price.

The Long Call Butterfly

|

| © CreditDonkey |

The most common butterfly spread is the long call butterfly. You use this strategy when you don’t think the market price will change much. Here’s what it entails:

- Buy (take the long position) 1 in-the-money call with a lower strike price than the current market price

- Write (short) 2 at-the-money call options with a strike price equal to the current market price

- Buy (take the long position) 1 out-of-the-money call with a higher strike price than the current market price

Here’s an example:

ABC stock trades at $30 today. You want to create a long butterfly spread. You’ll trade the following:

- Buy 1 call with a $25 strike price ($6.00 premium)

- Sell 2 calls with a $30 strike price ($3.00 premium)

- Buy 1 call with a $35 strike price ($1.00 premium)

The total cost of the trade is:

$600 (made for 2 short calls) - $600 (paid for long call with lower strike price) - $100 (paid for long call with higher strike price) = ($100), or $100 net premium paid

You reach maximum profit when the market price of the stock doesn’t change. If it remained at $30, the 2 short calls and 1 long call with a $35 strike price expire worthless. You would execute the long call with a strike price of $25, though. This would make you $500 (buy 100 shares at $25 and sell 100 shares at $30).

Your maximum profit then equals $500 (net profit from trade) - $100 (net premium paid) = $400.

A quick calculation to determine your max profit is:

Strike price of short call – strike price of ITM long call – net premium paid = Maximum profit

Your maximum loss is the net premium paid. In this case, your loss would be $100. You realize maximum loss in one of 2 ways:

- When the market price of the stock is lower than the ITM call’s strike price

In the above example, if the market price hit $24, all options would expire worthless. Your maximum loss would be the $100 net premium paid. - When the market price of the stock is higher than the OTM call’s strike price

In the above example, if the market price hit $36, a few trades would occur. You’d be obligated to sell 200 shares at $30/share ($6,000). You’d buy 100 shares at $25/share ($2,500) and 100 shares at $35 ($3,500). You’d break even with the trade, but you are still out the $100 net premium paid.

Now let’s compare this outcome to the outcome of just buying the long call. The long call cost $600 and has a strike price of $25. If the stock ended at $24 at expiration, your maximum loss equals $600. That’s a $500 difference from the long butterfly call spread.

The Short Call Butterfly

You can also create a short call butterfly trade. Investors use this strategy when they think a stock has high volatility. Here’s how you create a short call butterfly:

- Sell (short) 1 in-the-money call with a lower strike price than the current market price

- Buy (take a long position) 2 at-the-money calls with a strike price equal to the current market price

- Sell (short) 1 out-of-the-money call with a higher strike price than the current market price

Here’s an example:

ABC stock trades at $40 today. You think it will move up or down in a drastic manner, so you create a short butterfly trade:

- Sell (short) 1 call with a $35 strike price ($7.00 premium)

- Buy (go long) 2 calls with a $40 strike price ($3.00 premium)

- Sell (short) 1 call with a $45 strike price ($1.00 premium)

The total cost for the trade is:

$700 (made for shorting 1 call with $25 strike price) + $100 (made for shorting 1 call with a $35 strike price) - $600 (paid for buying 2 calls with a $30 strike price) = $200 net premium made

Your maximum profit on this trade is the net premium made. You have limited profit, both above the higher strike price and below the lower strike price.

Here’s an example:

If the market price of the stock ends at $33 upon expiration, all contracts expire worthless. You keep the $200 premium and walk away.

If the market price of the stock ends at $46, the following would occur:

- The short call with a strike price of $35 would be executed, making you $3,500

- You’d execute your 2 long call contracts at $40/share, costing you $8,000

- The short call with a strike price of $45 would be executed, making you $4,500

You’d walk away with $3,500 + $4,500 - $8,000 + $100 (net premium made) = $100

With this strategy, the maximum profit is achieved whenever the stock’s price is:

- Less than the lowest strike price

- Higher than the highest strike price.

Your maximum loss in this strategy is not as simple. You’ll realize maximum loss if the strike price doesn’t change at all. Remember, this is a strategy to use when you think the stock’s volatility is high.

If the market price doesn’t change, only one leg of the strategy is assigned:

Let’s say the market price of the stock is $40 at expiration – it never changed. In this case, the following would happen:

- You’d execute the short call with a strike price of $35, making you $3,500

- The long call with a strike price of $40 expires worthless

- The short call with a strike price of $45 expires worthless

You’d have to buy the stock at the market price of $4,000 and sell it for $3,500, leaving you with a loss of $500. You made a $100 net premium, though, so your net loss equals $400.

A quick calculation to determine your maximum loss is:

Strike price of long call – strike price of short call with lower strike – net premium made = Maximum loss/share

The Bottom Line

You need quite a bit of experience for either butterfly call spread. Once you get the hang of options, you can use the strategy to limit losses. Remember, though, you also limit your profit. It’s all about a little give and take.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Read Next: