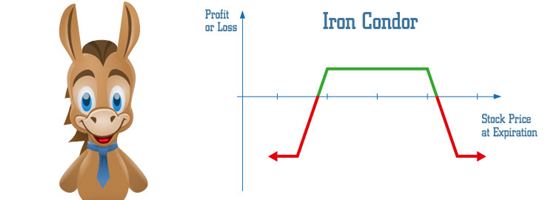

Iron Condor: How It Works

Imagine being able to limit your losses while predicting your profits. Sound too good to be true? It's possible with the iron condor. Read on to learn more.

What Is an Iron Condor?

|

| © CreditDonkey |

The iron condor is a trade for the experienced trader who wants limited risk. You do best with the trade when the underlying stock has low volatility.

Once you understand both sides, you can try your luck at the iron condor. This trade gives you protection on both sides of the equation.

The iron condor has 4-legs:

- Buy a put

- Write a put

- Buy a call

- Write a call

Each option has the same expiration for this trade. How you structure the strike prices determines your profit/loss.

You'll buy an out-of-the money call with a higher strike price than the out-of-the-money call you sell. You'll also buy an out-of-the-money put with a lower strike price than the out-of-the-money put you sell.

The combination of trades leaves you with a net credit or profit.

Let's say XYZ stock currently trades for $40 and you want to trade an iron condor. You'd do the following:

- Sell a call with a strike price of $45 ($1.00 premium)

- Buy a call with a strike price of $50 ($0.50 premium)

- Sell a put with a strike price of $35 ($1.00 premium)

- Buy a put with a strike price of $30 ($0.50 premium)

You'd spend $100 on the call and put. Each option is worth 100 shares. The premium is $0.50 per share x 100 shares = $50. You buy a put and a call option, costing you $100.

You'd make $200 on the call and put you wrote. The premium is $1.00 per share x 100 shares = $100. You wrote a call and a put, making you $200.

Your net premium made is then $100 ($200 - $100).

Maximum Profit Potential

The maximum profit you make on an iron condor is the net premium made. In the above example, this means $100.

If the market price of the underlying stock lands between $35 and $45, all options expire worthless. You walk away with the net premium.

If the stock's price lands outside of the narrow $35-$45 range, you'll experience a loss. But your net premium helps to offset the loss.

Maximum Loss Risked

Although you cap your profit with this trade, you also cap your losses. Your maximum loss occurs when the stock's market price is outside of the outer legs of the iron condor.

In our example, the outer legs are $30 and $50. You can figure your max loss with the following equation:

Max loss = Strike price of the long call - Strike price of the short call - Net premium received

This means, your max loss =

$50 - $45 - $1 = $4, or $400.

The market price of XYZ stock ends at $30 at expiration. All options would expire worthless except the $35 written put. The buyer of the put would exercise the right to sell to you at $35.

You'd have to pay $3,500. If you turned around and sold the stock in the open market, you'd get $30/share, or $3,000. This is a loss of $500. But you have a net premium of $100; this offsets the loss, making it $400.

Even if the stock dipped below the outer leg of the iron condor, you'd still cap your loss at $400. Let's say the price fell to $28. The two left-sided options would be exercised.

You'd exercise your bought put. This allows you to sell your stock for $30 per share. You'd buy 100 shares for $28 and sell them for $30. That gives you a $200 profit.

Your buyer would also exercise their put, forcing you to buy their shares at $35/share. You'd then sell them on the open market for $28. You'd suffer a loss of $700.

This loss is offset by your $200 profit on the bought put and the $100 net credit received. You walk away with a maximum $400 loss.

The same scenario occurs on the right side options of the condor. If the price exceeds the long call's strike price of $50, your maximum loss is still $400.

Figuring Out Your Break-Even Point

It's always important to determine your break-even point before entering a trade. In this case, there are two break-even points:

- Upper break-even point = Strike price of the short call + Net premium paid

- Lower break-even point = Strike price of the short put - Net premium paid

$45 + $1 = $46.

If the stock landed at $46 at expiration, the only option that would be exercised is the short call. The buyer of the call would want to buy the stock from you for the strike price of $45.

You would have to buy the stock in the open market for $46. This is a loss of $100. But that loss is offset by the $100 net premium received. You walk away without a gain or a loss.

$35 - $1 = $34.

If the stock landed at $34 at expiration, the only option that gets exercised is the short put. This option has a strike price of $35.

You'd have to buy the stock at the strike price of $35. You could then sell it in the open market for $34.

That's a loss of $100, but again, you offset the loss with the net premium received of $100.

The Bottom Line

The iron condor is a good neutral strategy. You don't think the stock will move wildly one way or the other. You limit your profits while maximizing your losses.

It's a way to make a little bit of quick money while trading options. You don't have a large capital outlay and you don't put your entire portfolio at risk.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Read Next: