Net Present Value Calculator

How profitable is a project or investment opportunity? Use this net present value calculator to find out.

|

As a rule of thumb, a positive NPV results in profits and a negative NPV results in a loss. Any project or investment with a negative NPV should be avoided.

Money is worth more today than in the future. That's due to inflation and the alternative investments that could have been made in that same time period.

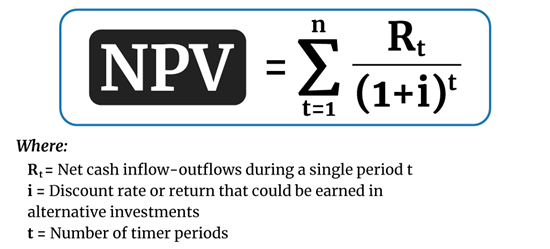

The NPV formula is one way to account for this. To learn about an investment's profitability and opportunity costs, check out how NPV works.

What is Net Present Value (NPV)?

Net Present Value evaluates the value of a potential investment opportunity. NPV projects all of the future cash inflows and outflows of an investment and subtracts them with the present-day value.

- With this equation, you'll get a positive or negative number. In a nutshell, a positive NPV means you'll make more money if you proceed with the investment.

- It factors in the time value of money that could've been spent on other investments - also known as the opportunity cost.

NPV relies on the discount rate (derived from the capital needed to make an investment). One major flaw about calculating NPV is that it makes assumptions about future events. These future events may not be 100% reliable.

How do you calculate NPV manually (without a calculator)?

Due to inflation, a dollar in the future will not be worth the same as that dollar today. You can, however, invest that dollar and earn a return. Simple calculators, like ours, compute the total value today of a future stream of payments. You'll quickly learn just how attractive a project is.

To figure out NPV by hand, you need to estimate future cash flows for each period and determine the correct discount rate.

|

Let's put it this way: If you could receive $1,000 today or in a year, you'd probably choose to receive the money right away. But what if you could choose to receive $1,000 today or $1,100 a year from now?

The 10% rate of return could make the wait worthwhile unless another investment yields a higher rate than 10% over the same period.

However, if you knew you could earn 20% from a safe investment over the next year, you'd choose to receive $1,000 today and not $1,100 in a year, with a 10% return. Here, the 20% would be the discount rate.

Here's an easier and quicker way to remember the concept of NPV:

NPV = TVECF -TVIC

TVECF = Today's value of the expected cash flows

TVIC = Today's value of invested cash

Net Present Value Example

Imagine your company has two investment options:

- Invest in equipment that will cost $100,000. This equipment is expected to generate $2,500 per month in revenue for three years.

- Invest this capital into the stock market for an expected return of 8% per year.

In this scenario, buying the equipment and investing in the stock market has similar risk levels.

Step 1: Identify the Number of Periods and Discount Rate

Since the equipment is paid for upfront, you do not need to factor elapsed time. The $100,000 is the first cash flow included in the calculation and doesn't need to be discounted.

- Identify the number of periods (t) - There are 60 periods (i.e., months) because the equipment is expected to generate monthly cash flow for 5 years.

- Identify the discount rate (i) - The discount rate is what the alternative investment is expected to pay each year vs the equipment's monthly cash flows - in this case, it's 8%.

Because the equipment produces a monthly stream of cash flows, the annual discount rate needs to be turned into a periodic or monthly rate.

Periodic Rate = ((1 + 0.08) 1/12) - 1 = 0.64%

Step 2: Calculate the Adjusted Monthly Payments

If cash flows are earned at the end of the month, then the first payment will arrive exactly one month after you purchase the equipment. Future payments need to be adjusted for the time value of money.

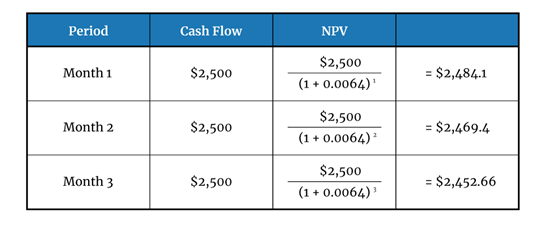

First, calculate the first three payments as shown below:

|

Step 3: Calculate Net Present Value

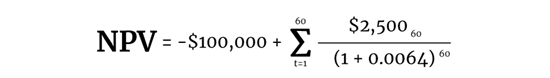

Next, perform the full calculation with the initial investment.

This calculation sums up the total of all adjusted cash flows (accounting for inflow and outflow) for the number of periods you define and the cost of the initial investment.

|

Your output is -$93,636.65. So in this case, your net present value is negative. You shouldn't purchase the equipment. Instead, go for the stock investments.

- Business Loan Calculator: Calculate interest, total amount paid and amortization of a business loan

- Burn Rate Calculator: Calculate runway for your business to see how long your current cash reserves will last

- Credit Card Processing Quiz: Find out if you're overpaying for credit card processing fees

Net Present Value FAQs

What's a good NPV?

In a nutshell, a positive-number NPV is good. This means you'll make more money if you proceed with the investment. However, the exact number can be helpful, too.

For example, many investors rely on certain NPV thresholds, oftentimes $10,000 or more, to give themselves a margin of safety.

What are the advantages and disadvantages of NPV?

The advantage of NPV is that it can give you today's value of a future stream of cash flows. It also factors in the time value of money that could've been spent on other investments, or the opportunity cost.

One major disadvantage of calculating NPV is that it makes assumptions about future events. These future events may not be 100% reliable.

Why are future cash flows adjusted/discounted?

Future cash flows are discounted because of something called the time value of money. This principle basically says that a dollar you have now is worth more than that same dollar in the future.

This is because any money you invest now has the potential to earn compounded interest over time; more people would rather invest money they have today than wait.

Bottom line

This financial metric aims to capture the total value of a potential investment opportunity. By factoring in the opportunity cost of capital and risk tolerance (via discount rate), it lets you know whether or not you should proceed with an investment.

Just remember that an NPV is good if it's a positive number.

Amber Kong is a content specialist at CreditDonkey, a personal finance comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

| ||||||

|

|

|