How Much Should I Save?

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

How much of my income should I save? Depends if it's for retirement, a house, college, a car or other goals. Find out how the 50/20/30 rule can help you.

|

| © CreditDonkey |

What you save is much more important than how much you make. You can make millions, but if you don't save, you won't come out ahead. But how much should you save?

We answer these questions and more below.

A good rule of thumb is to save 20% of every paycheck. For example, if you earn $1,500 each paycheck, you would save $300. This is a good start, but it may not be right for you. We explain below.

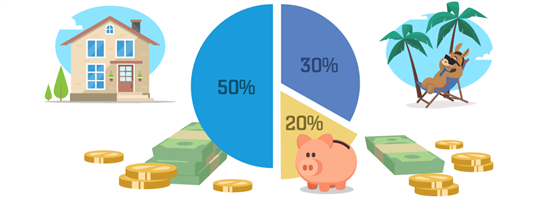

How Much to Save Each Month: 50/30/20 Rule

|

The basic rule of thumb is to save 20% of your take-home income each month. This is called the 50/30/20 Rule.

This means your budget should look like this:

- 50% for necessities: things like housing, car costs, electricity, and basic food

- 30% for fun spending: this is your wants, such as eating out, movies, shopping, gym membership, etc.

- 20% for savings: to be split up between retirement savings and other goals. We'll go into more detail below.

Remember that this is to be calculated with your after-tax (take-home) income.

Now let's go over different savings goals and how to split that 20%.

What to Save For

So now you know you should save 20% of your income. How do you divide that 20%, though? You must prioritize the funds.

Your personal strategy will depend on your financial situation. We recommend that you prioritize your savings as follows:

- Emergency fund

- High interest debt

- Retirement funds

- Large purchases

This doesn't mean work on them one by one. Instead, tackle all issues at the same time, giving priority according to the list.

If you have no emergency fund, don't just put your entire 20% into that. You still need to pay off debt too. So maybe you want to save 10% for emergencies, 5% on debt, and 5% on retirement.

After your emergency fund is done, you can shift to 10% on debt, 5% for retirement, and 5% for large purchases.

It also depends on the timeline. For example, if you're older, you may want to save more aggressively for retirement. If you want to buy a house in the next 2 years, you may want to prioritize that.

How Much to Save for Common Savings Goals

|

Now, we'll go over the common savings goals. We'll discuss more in detail about exactly how much to save for each.

How Much to Save for Emergencies

Emergency savings are crucial. They help keep you afloat if you lose your job. They also help during car, home, or medical emergencies.

An ideal emergency fund should cover 3 to 6 months of living expenses. To calculate that, look closely at your monthly expenses and determine your "must-pays". This would be stuff like:

- Housing (rent/mortgage, insurance, utilities, etc.)

- Transportation (car payment, insurance, gas, etc.)

- Food

- Healthcare

- Personal debt payments

Then aim to save 3 to 6 months of that cost. Keep this fund in a separate savings account that you won't touch.

Certain types of people may want to save more than 6 months of expenses. They include:

- People with irregular income (freelancers, small business owners, seasonal business employees)

- People who work in an industry with frequent layoffs

If you fall into either category, try saving closer to 12 months of expenses.

Ideal Savings for Retirement at Every Age

|

| © CreditDonkey |

Saving for retirement is a long-term plan. It's smart to start as early as possible.

Financial experts advise to save 10x your annual salary by the time you retire. This is a good benchmark so you can live comfortably for the rest of your life.

To reach that goal, here's how much you should have saved by each age:

- By age 30: 0.5x - 1x your annual salary

- By age 35: 1.5 - 2x your annual salary

- By age 40: 2.5x - 3x your annual salary

- By age 45: 3.5 - 4.5x your annual salary

- By age 50: 5x - 6x your annual salary

- By age 55: 6x - 7x your annual salary

- By age 60: 8x - 9x your annual salary

- By age 67: 10x your annual salary

To reach these benchmarks, it's advised to save 15% of your income each month (including employer contributions), starting from your mid-20s.

However, in your 20s and early 30s, you're likely still starting your career and paying off student loans. Focus on paying down debts first and save however much you can for retirement.

As you get older, your earning power should increase. Your expenses should also lower as you pay off the mortgage and your kids have grown. In these years (50's and above), you should be saving more aggressively for retirement.

How Much to Save for a House Down Payment

|

| © CreditDonkey |

Buying a house requires a very large amount of cash up front. You want to aim for a 20% down payment in order to avoid paying Private Mortgage Insurance.

So how much do you need to save? Here are a few things you need to figure out.

- How much housing payments you can afford. First, you need to know how much you can afford in housing payments each month. The best rule of thumb is that housing expenses don't exceed 28% of your gross monthly income. This includes the mortgage, property taxes, homeowner's insurance, and HOA fees (if any).

- How much down payment you should save. After you have an idea of how much mortgage you can afford to take out, work backwards to figure out the down payment you'd need. Remember, you want at least 20%.

Here's how you'd figure that out:

For example, let's say you make $75,000 per year ($6,256/month). 28% of that is $1,752. That is your maximum total monthly housing payment.Let's say property taxes for your area is around $5,000 ($417/month) and annual homeowner's insurance is $950 ($79/month). You want to subtract those from the total monthly housing payment.

$1,752 - $417 (taxes) - $79 (insurance) = $1,256 per month for your mortgage payment

Assuming a 5% interest rate, you can estimate your mortgage payment to be $550 for every $100,000 you borrow.

$1,256/$550 = 2.28

$100,000 x 2.28 = $228,000 mortgageFor a $228,000 mortgage with a 20% down payment, you would calculate the following:

$228,000 / 0.80 = $285,000 (total house cost)

$285,000 - $228,000 (mortgage) = $57,000 down payment - When you want to buy. This determines how aggressively you have to save. If you want to buy a house in 5 years, that means you need to save $11,400 a year, or $950 a month. Is that reasonable for you? If not, adjust your timeframe.

We've got a more detailed guide on how to save for a house.

How Much to Save for a Car

|

| © CreditDonkey |

Cars can be emotional purchases. You may be tempted to get your dream car. But if you're not careful, you may stretch your budget too thin and have trouble paying it off.

So how much should you spend? There is a good rule of thumb. It's called the 20/4/10 rule:

- Save up 20% down payment for the car

- Finance no longer than 4 years

- Spend no more than 10% of your gross monthly income on car expenses. This includes car loan (principal and interest) and car insurance.

If you make $60,000 a year, that means your gross monthly income is $5,000. 10% of that is $500/month on car expenses.

Let's say insurance each month costs $100. So that leave you with $400/month on your auto loan payment. With a 4% interest rate, you can take out a loan of $17,716 (search for a car calculator).

Working backwards, if you save 20%, you can purchase a $22,145 car, with a $4,429 down payment.

How Much to Save for a Vacation

|

| © CreditDonkey |

A vacation is categorized under "fun spending." Remember the 50/30/20 rule we talked about earlier? 30% of your take-home income can be used on wants.

If you want to save for vacation, then it needs to come out of that 30% "fun spending." This means you need to prioritize and cut down on other wants.

Open a separate vacation fund. Every month, deposit some money into it and try not to touch it.

Here are a few things to consider when deciding how much to save for your vacation.

- Where do you want to travel? Certain destinations will be a lot more expensive than others (like Norway vs. Costa Rica). Research food and sightseeing costs in your destination.

- How much are flights? If your dates are flexible, you'll have a better chance of finding the cheapest flights. See our list of best sites to look for cheap airfare.

- What kind of accommodation? You have a huge range of options here. Hotels will usually cost the most, while Airbnbs can save you money.

After you estimate the trip cost, you will get a better idea of how much you need to save each month. Or how long you will need to save to reach your goal.

But you have to spend first in order to get the bonus. So make sure it makes sense for you and that you can pay if off.

Effective Strategies to Reach 20%

|

| © CreditDonkey |

Does it sound impossible to save 20% each month? Don't fret. We'll show you how you can do it.

- Max out your employer's 401k:

This is one of the most important things you can do. Most employers will match 401k contributions. That's free money they're offering towards your retirement.Let's say your employer matches up to 5%. Automatically send 5% of your monthly income to your 401k. Your employer will match that 5%. So already, you have saved 10% of your income even before you get that paycheck.

And that's pre-tax. So in reality, you're saving even more. But for simplicity's sake, we'll just call that 10%. Now, you just need to save 10% of your take-home paycheck.

- Automate your savings:

Set up auto-deposit from your bank account into a savings or investment account. This way, you pay yourself first and won't accidentally spend that money.For example, you can auto transfer 5% into a high-yield savings account and another 5% into a robo-advisor. Then watch your money grow with the magic of compound interest.

- Save bonuses, raises, tax refunds:

If you get a bonus or raise at work, save that instead of spend it. For example, if you get a 5% raise, maintain your current lifestyle and save that extra money. That's automatically 5% more you're saving and you won't even feel the difference. - Invest to grow your money faster:

Investing will help grow your money the fastest. Your earnings compound, so even one small deposit will grow into something more. Try to invest something even if it's just a small amount per month.Investing as a beginner can feel overwhelming. If you're unsure where to begin, read our guides on investing for different budgets: - Use cash back credit cards:

Use a cash back credit card for all your expenses. Then save the cash back you get each month. For example, if you charge $1,000 every month and you get an average of 2% cash back, that's $20 savings per month without even trying. However, make sure you pay your balance in full each month. - Cut down on fixed expenses:

See where you can cut down and save the difference. For example, cancel the cable package and subscribe to Netflix for $10/month instead. Cancel the gym membership and do at-home workouts on YouTube. Search for a cheaper car insurance.

Where to Save Money

|

| © CreditDonkey |

You know what you are saving for, but where do you put it? You need an account that will help your money grow. Different savings goals will require different accounts.

Then, depending on the account and how far off the goal is (i.e. buying a house may be 5 or 10 years down the road), invest that money in a CD or another high interest yielding account.

Sarah Moe, business and crowdfunding coach, iFundWomen

Here's what we recommend:

Online savings account:

Online savings accounts offer much higher interest rates than traditional banks. This will allow your money to grow a little. You can still access your money when you need it.

This is ideal for emergency savings and short-term goals (within 2-5 years).

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

High-Yield Savings Premier - 3.80% APY

- No account fees

- Option to open individual or joint account

- FDIC insured up to $250,000 per depositor

- Only $500 minimum opening deposit

Online brokerage or robo-advisor:

Investing your money will have more growth than a savings account. A taxable account will still allow you to withdraw funds as needed.

If you're a confident investor, you can invest on your own with an online brokerage. If you're not sure, then start with a robo-advisor. For a small annual fee, a computer will invest and manage your portfolio for you.

Because of the ups and downs of the market, this is best for longer-term goals (over 5 years) and supplemental retirement savings.

Traditional IRA or Roth IRA:

IRAs are special retirement accounts. You cannot withdraw the funds early or you'll face a penalty. There are two types of IRAs:

- Traditional IRA contributions are tax deductible, but you pay taxes when you withdraw the funds.

- Roth IRA contributions are made with after-tax dollars, however, your withdrawals are tax-free.

The IRS sets limits for how much you can contribute each year for both. So these are used for supplemental retirement savings (or as your primary retirement account if you don't have a 401k).

529 Plan:

This is a college savings plan for your children's education. Some states allow tax deductions for your contributions. The greatest benefit is that you don't pay taxes on your earnings or when you withdraw for qualified education expenses.

Is It Better to Save or Pay off Debt?

So what if you have debt? Should you focus on paying it off or on saving that 20%?

This goes back to our discussion on priorities. Ideally, you want to find a balance between paying off debt and saving money. Here is what we recommend:

- Max out your 401k employer match.

No matter your income or personal financial situation, always contribute at least up to your employer match in your 401k. It's silly to give up free money. This way, you are getting started saving for retirement. And this money is taken out before you receive your paycheck, so you won't even miss it. - Pay off high-interest debt.

If you have credit card debt or personal loans, make paying off that your highest priority. This is because the interest on your credit card debt can far outweigh anything you earn in savings. By paying that off, you are saving money.For example, if you put $1,000 into a savings account with 2% APY, you'll only earn $20 after a year.On the other hand, if you have $1,000 in credit card debt with an interest rate of 20%, that's an additional $200 in interest by the end of a year. You're losing more money than you can earn in savings.

- Build an emergency fund if you don't have one.

If you have no emergency fund, give higher priority to building one. This way, if something happens, you have money to fall back on. This keeps you from racking up even more credit card debt and continuing the debt cycle.

If you have both high-interest debt and no emergency fund, then maybe you want to split between paying off debt and building your savings. This way, you continue to pay off debt while building yourself a safety net.

What to Do When You Hit Your Goals

|

| © CreditDonkey |

Maybe you get lucky enough to hit your goals. Then what? Just keep going.

Don't give up! If you are comfortable with it, increase what you save. No one says you can't go above the traditional 20% savings. If you have an emergency fund already, save for retirement. You can't predict inflation. You may need more than you think.

Don't make the mistake of getting too comfortable. You'd probably rather have too much money than not enough!

Bottom Line

Strive to save 20% of your take-home income each money.

However, don't worry if you can't hit that goal right away. Any savings is better than not doing anything. Hopefully, we gave you some good tips and you can see it's not impossible. Set your priorities and then don't give up. Eventually you'll have a nice nest egg for emergencies, retirement, and more.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|