Why Credit Card Processing Fees Are High

Are credit card processing fees killing your bottom line? Here's a look at why processing fees are so high. And what you can do to lower them.

|

It's almost impossible to succeed in today's world without accepting plastic. But why is it so expensive to process credit cards? Is it just a cost of doing business?

There are some legit reasons for the high fees, though they may not seem fair to the small business owner just trying to make a living. Let's break it down.

What Is the Average Credit Card Processing Fee?

The average credit card processing fees are 1.5% - 2.9% for swiped transactions and 3.5% for online transactions (due to the higher risk of fraud).

Here are the average credit card processing fees for the 4 major credit card networks:

- Visa: 1.4% - 2.5%

- Mastercard: 1.5% - 2.6%

- Discover: 1.55% - 2.5%

- American Express: 2.3% - 3.5%

The processing rates depend on many factors, like the type of card and processing method. We'll explain why some variables drive up the processing costs.

Who Gets the Credit Card Processing Fees?

|

| © CreditDonkey |

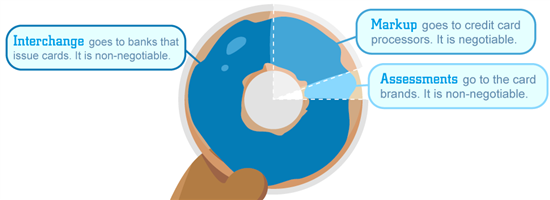

To understand why it costs so much to process credit card transactions, first it's important to know just what goes into processing.

Swiping a card or clicking "checkout" takes just one second. But a lot goes on behind the scenes. There are many parties involved, and each one gets a piece of the processing fee.

This includes:

- Card issuer: This is the bank that issues the credit cards to consumers, such as Chase, Bank of America, Capital One, etc. The interchange fees are paid to these banks to cover operation costs and risk.

Interchange fees account for most of your processing costs. The average interchange fee for credit cards is around 1.7% - 2%. They're non-negotiable, so unfortunately, there's nothing you can do about them.

- Credit card network: This is the brand of the card (Visa, Mastercard, Discover, and Amex). They take a small assessment fee for using their card brands. This fee is just 0.13-0.14%.

- Credit card processor: This is the provider that helps you process credit cards (like Square). They also earn a commission with each purchase, along with other fees they charge for their service.

Now that you have a basic understanding of where your fees go, let's have a deeper look into 5 reasons why it costs so much to process cards.

1. Risk of Fraud

Credit card fraud is a huge deal. When that happens, someone has to pay the tab. This responsibility falls to either the merchant - which is usually the case - or the bank. (Sadly, the criminal never pays.)

It takes a lot of energy for banks to investigate fraud disputes. The risk of fraud is accounted for in the processing fee and passed down to merchants.

Card-not-present (CNP) transactions have higher chances of fraud. This includes online or phone orders, invoices, and manually keyed-in transactions. Since the customer isn't physically there, the merchant can't verify their identity.

Because of the higher fraud risk, CNP transactions have higher processing costs. The average processing fee for in-store transactions is 1.5% - 2.9%. But the average for CNP transactions is 3.5%.

2. Debit vs. Credit

Debit cards with PIN are the cheapest to process because of the low risk to the bank. The typical interchange rate for debit cards is just 0.5%, while credit cards are around 1.7% - 2%. Big difference.

When someone makes a debit card purchase, the approval only depends on if the customer has enough money in their bank account.

But when someone uses a credit card, the bank is first covering the purchase. The customer pays back later (and not all do). This is another reason why credit cards have higher processing rates.

And plus, it's much easier to commit fraud with a stolen credit card. This is also factored in the higher fee.

3. Credit Card Rewards

You know those fancy credit cards with cash back rewards and travel miles? They're great! But someone has to pay for these awesome rewards. And that's right - you, as the merchant, get to pay for them.

Premium cards and business cards have much higher interchange fees to make up for the rewards. For example, a regular Visa credit card could have an interchange rate of 1.43% + $0.05. But a Visa Signature rewards card could have a rate of 2.40% + $0.10 .

So next time someone shows off their fancy metal credit card, know that you're actually the one paying for their exclusive travel perks.

4. Equipment and Software

Card purchases run through a lot of channels to get from the customer's hand to money in your account.

In-person purchases require equipment to accept the card. Online purchases require a payment gateway to authorize credit cards and transfer payment data. All this technology doesn't come free.

Plus, merchant account companies usually provide a POS app with other functions. You can also do things like set discounts, issue refunds, manage customer database, and see reporting.

Whether your provider charges separately for equipment and software or not, you pay for all that one way or another.

5. Service

Credit card processing companies have a lot of people working for you to keep things running smoothly. People who help set up your account, answer questions, fix issues, maintain PCI compliance, and more.

All that service is also factored into the merchant account markup fees.

6. Competition in the Credit Card Market

As people increasingly use credit cards to pay for purchases, the interchange fees have also risen over time.

With so many credit card options out there, banks compete to attract consumers by offering all sorts of incentives and rewards. This in turn, means higher interchange rates to make up for those rewards (as mentioned before).

The card networks also attract banks to issue their cards by offering higher interchange rates. The revenue from interchange fees is one of the biggest ways banks make money - especially for smaller local banks and credit unions.

Can You Lower Credit Card Processing Fees?

It is possible to reduce your processing costs by negotiating with your provider. But you need to know which fees are open for discussion.

The interchange rates and assessment fees are not negotiable. Those are set by the card networks. BUT you can negotiate the processor markup.

The more sales you have, the more negotiation power. Here is the general rule of thumb:

- If your business has small average ticket size, negotiate the fixed fee.

For example, if your processing rate is Interchange + 0.2% + $0.10, getting it down to + 0.2% + $0.05 will save you 5 cents each purchase. That can add up to a lot of savings if you're processing thousands a month.

- If your business has large average ticket size, negotiate the percentage markup. For instance, you can cut it down to 0.15% + $0.10.

If you're unable to negotiate right now, don't worry. See our 8 ways to lower credit card processing fees for more practical tips.

High Risk Processing

If your business is in the "high-risk" category, it's certain that you will have higher processing rates. If a processing company thinks you may lose them money, they'll charge you more to offset the risk.

High-risk businesses can include:

- Industries with a high risk of chargebacks and fraud

- Industries with high rate of failure

- Industries that require a lot of legal regulation

- If you have a history of bad credit

- Companies with large transaction amounts

Some common high-risk businesses are: travel companies, auto parts and accessories, financial services, construction, and adult entertainment.

In general, a high-risk business can expect processing rates to be 3.5% - 5%, depending on what end of the risk spectrum you are.

Bottom Line

In exchange for reaching more customers by accepting plastic, you have to pay processing costs. And that will eat into your profits.

The ugly truth is that you, as the merchant, end up paying for the risk and rewards. Unfortunately, interchange fees can't be avoided and are just a cost of doing business. But you can negotiate with your merchant account provider to get a lower processor markup.

Anna G is a research director at CreditDonkey, a credit card processing comparison and reviews website. Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Not sure what is right for your business?

|

|

|

Answer a few short questions in our credit card processing quiz to receive tailored recommendations to help you keep more profits.

|

|

| ||||||

|

|

|