Best Stock Advisor Website

Looking for advice on which stocks to buy and sell, but not sure who to ask? Read this guide to the best stock advisor websites.

|

Stock Advisor - $99/year for New Members

*$99 is an introductory price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then-current list price.

So, you want to start investing? That's a smart move. You've probably heard about people making even more money by trading stocks.

Many experts say it's a great idea to put your money in the stock market. But let's be honest, if you're not familiar with all that business and finance stuff, it can feel a bit tricky.

Why You Need Stock Advisor Websites

Certainly, it's gotten easier for the average new investor in recent years. There are a wealth of resources, beginner-friendly investing platforms, learning tools, and more.

But sometimes you just want someone to tell you what to invest in. Someone with a proven track record of success.

That's where stock advisor websites come in.

Their goal is to provide their users with sound investing advice. And equip them for success throughout their investing careers. But there are quite a large number of popular sites.

How do you even choose?

In this guide to the best stock advisor websites, you'll learn everything you need to know. And pick the one that's right for you.

Best Stock Advisor Website

|

If you've never used one before, a stock advisor website does pretty much what it sounds like it does.

It gives you advice on which stocks to buy but leaves the actual trading up to you. That means that while you are equipped with the best information. But you remain in control of your finances.

Every stock advisor site will work a little differently. Focusing on different metrics to measure potential investments. And different sites may be better suited to different types of investors.

That's why it's important to choose the one that suits you best, rather than looking for a one-size-fits-all recommendation.

Here is a head-to-head pricing comparison for the top-performing stock advisor sites out there.

| Motley Fool | $199 per year for Stock Advisor |

| Seeking Alpha | $299/year for Premium; $2,400/year for Pro |

| Zacks Investment Research | $249 to $2,995 per year |

| Morningstar | 7-day free trial; then $249/year |

| Mindful Trader | $47/month |

| Stock Rover | Free; Essentials for $79.99/year; Premium for $179.99/year; Premium Plus for $279.99/year |

| Trade Ideas | Standard for $999/year; Premium for $1,999/year |

| Barron's | $19.99/month for 3 months; $199 for 1 year |

Now let's take a deeper look at these sites.

Motley Fool

Pros

- Consistently outperforms the market

- One of the most respected stock-picking services

- In-depth educational resources for beginners

Cons

- High renewal price after the 1-year promotional rate

- Performance data is lacking

Motley Fool is a well-known name among stock advisors. They have a fairly long history and strong track record. Founded in 1993 by David Gardner, Tom Gardner, and Erik Rydholm, they're based in Alexandria, VA.

Motley Fool Stock Advisor

|

The Motley Fool Stock Advisor makes recommendations for semi-long-term holdings. Based on the principle of investing in 25 stocks or more, and holding them for at least 5 years. This means they'll target stable companies with a history of success.

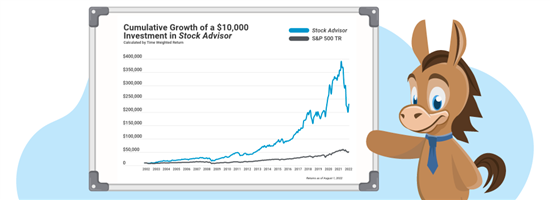

Since its inception 21+ years ago, the Stock Advisor has performed four times better than the S&P 500.

For the annual fee, subscribers get access to both the library of previous picks. As well as two new stock recommendations every month. This means you can keep your portfolio up to date in just a few minutes each month.

Price: $199 per year

Stock Advisor - $99/year for New Members

*$99 is an introductory price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then-current list price.

What you can expect from the plan:

- Two expert-curated stock picks a month

- Detailed reports on each pick

- Instant buy and sell alerts

- News on your favorite stocks

- Historical stock picks: See all their recommended stocks over the years

- Starter stocks to build a portfolio

- Live customer support

- Active message boards

Seeking Alpha

Pros

- Consistently outperforms the market

- Plenty of analysis tools like stock screeners and backtesting

- Active and experienced community

Cons

- Not much mutual fund data

- Could share more performance data

Seeking Alpha is a stock advisor site targeting intermediate and experienced investors. Those interested in choosing their own investments with a wealth of information at their fingertips.

The site has thousands of active contributors providing in-depth analysis and investment advice. Also, there are written articles submitted to the in-house team of editors for approval before they're published.

In addition to content, they have a range of useful tools. They help users understand the fundamentals of every company. They also offer three subscription plans.[1]

The free Basic plan, which has ads, comes with email alerts and financial news, investing newsletters, Wall Street stock ratings, and some analysis.

The Premium plan comes with everything the basic plan does. And it includes Seeking Alpha author ratings and performance reviews, stock quant ratings, stock dividend grades, and fewer ads.

Price: $299/year

The PRO plan further includes their Top Ideas, exclusive content and newsletters, an idea screener, a short ideas portal, and VIP service, with no ads.

Price: $2,400/year

What you can expect from the PRO plan:

- Earnings calls transcriptions

- Ratings and Performance Metrics on each author

- View 10 years of statements

- Easily compare stocks against each other

- Dividend and earnings forecast

- Stock analysis email alerts

- Real-time news updates

- Stock prices and charts

- Wall Street ratings for every stock

- Top ideas for stock picks

- PRO content and newsletters

- Short ideas portal

- Screeners and filters

For those looking to maximize value, there are several opportunities for a discount code that can make their plans more affordable.

Zacks Investment Research

Pros

- Many plans to suit your investing or trading goals

- Huge number of stock analysis tools with screeners, trackers, and reports

- International trading options

Cons

- Vast information can be overwhelming for beginners

- Too many marketing emails

- Higher account minimums & commissions

Zacks Investment Research offers subscribers a range of useful tools for deciding which investments to make. They offer direct recommendations and analytical resources for active investors.

Zacks Earnings Expected Surprise Prediction (ESP) Filter offers suggestions based on predictions of future positive and negative earnings surprises. You also have the ability to filter by your own criteria.

Premium screens help you find the best stocks for your investing style, and you can use their custom stock screener to search for companies that match criteria you consider important.

Zacks Portfolio Tracker lets you monitor your active investments in one place.

Zacks #1 Rank List highlights stocks with the most potential. You can reorder them based on:

- Value

- Growth

- Momentum

- Income Style Score

Their Focus List provides insight into the best stocks for long-term holding. And their Premium Insight provides daily, weekly, and long-term market analysis.

Price: $249 per year[2]

What you can expect from the premium plan:

- Zack's #1 Rank List of stocks to buy now

- Equity Research Reports to understand your investments

- Premium screeners to select the right stocks

- 30-day free trial

Stock Advisor - $99/year for New Members

*$99 is an introductory price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then-current list price.

Morningstar

Pros

- Industry-leading investment picks

- Advisor-grade portfolio management tools

- Vast number of stock analysis tools

Cons

- Better for experienced investors

- Premium service is costly

- Focused mostly on US investments

Morningstar is a stock advisor website designed for active and more experienced traders. Those interested in doing their own investment research. But if you want to avoid it, they also provide access to their top investment strategy and picks.

They offer professional analysis provided by over 150 independent analysts. Subscribers at Morningstar get access to extensive research tools. And data that help you understand companies at a fundamental level.

Morningstar ratings are trusted by a number of brokerages to gauge the quality of investments, such as stocks, ETFs, and mutual funds. This should give you an idea of the perception of quality associated with their site.

Price: [3]

- $34.95 per month

- $249 for 1 year

What you can expect from the premium plan:

- 150+ independent analyst reports, ratings, and picks

- Screeners use comprehensive performance and ratings

- Pre-filtered investment lists to build your portfolio

- Morningstar Portfolio X-Ray evaluates your investments according to important metrics

Mindful Trader

Pros

- Data-driven algorithm picks

- Easy-to-understand strategy for swing traders

- Trade ideas for stocks, options, and futures

- Multiple plans to suit your investment goals

- Respected in the industry

Cons

- Only for active traders

- Only one expert offering picks

- Performance has been below the market since 2020

- No alerts for new trades

Many of the stock advisor sites we've previously mentioned so far cater to buy-and-hold investors. But Mindful Trader is a stock advisor site designed primarily for swing traders.

If you are interested in buying and holding stocks for short to medium term, Mindful Trader might be the right choice for you.

Since speed is a factor, you'll get a larger number of investment recommendations more frequently. On average, users receive about 15 trade alerts each week. You can choose to receive them by either text or email.

Price: $47 per month[4]

What you can expect from the premium plan:

- Education resources for stocks, options, and futures

- Picks based on historical probabilities and price momentum

Stock Advisor - $99/year for New Members

*$99 is an introductory price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then-current list price.

Stock Rover

Pros

- Works for every type of investor

- 650+ powerful screener tools

- 10 years of historical data

- Easy-to-use for beginners

Cons

- No community

- Tools don't suit traders

- No mobile app

- US stocks only

Stock Rover is for active investors interested in a powerful research platform that provides a wealth of real-time information.

They're known for offering a stock screening tool. It helps users rank stocks based on metrics they find important. If you are having trouble deciding between multiple investments, their comparison tool will help you identify the pros and cons of each.

Detailed, comprehensive reports make researching potential investments easy to do in a single place. You can link your brokerage for real-time portfolio updates. And their charts make it easy to see important metrics.

Stock Rover has a free plan which is worth checking out if you're curious. They also have three paid plans, which offer gradually improved research tools and metrics.

Price: [5]

- Essentials - $79.99 per year

- Premium - $179.99 per year

- Premium Plus - $279.99 per year

Stock Rover Free

- Comprehensive information on over 8,500 North American stocks

- Coverage of 4000 ETFs and 40,000 mutual funds

- Portfolio management

- Portfolio Brokerage integration for automated syncing of portfolios

- Portfolio dashboard with detailed portfolio performance information

- Activates a 14-day free trial of Stock Rover Premium Plus

Stock Rover Essentials

- Easy comparison of investment candidates via the Stock Rover dynamic table

- Fully customizable financial views and columns

- 275+ metrics with 5 years of detailed historical data

- Easy to use, fast and flexible stock screening

- Portfolio and watchlist tracking

Stock Rover Premium

- Over 100+ additional metrics, 375+ in total

- 10+ years of detailed financial history

- Data export

- ETF and Fund comparison data

- Powerful Stock and ETF screening

Stock Rover Premium Plus

- Over 300+ additional metrics, 700+ in total

- Custom metrics

- Equation screening

- Historical data screening

- ETF screening with 180+ ETF specific metrics

What you can expect from the Premium Plus plan:

- Powerful screeners use 650+ metrics to select stocks

- Investment comparisons

- Research reports on every stock in your portfolio

- Real-time updates on your portfolio metrics

- Potent stock scoring system

- Rebalancing functionality

Trade Ideas

Pros

- Simulated trading tool is great for beginners

- Can automate your trading

- A.I. trading suggestions

- Free live trading room

- Aimed at day traders

Cons

- No mobile app

- Subscription is costly

- Only for day traders

Most of the stock advisor sites you've seen so far either rely on the advice of investment professionals. Or they provide the tools to do the research yourself. But Trade Ideas takes a different approach.

Trade Ideas employs a proprietary market scanner and an AI called Holly. It identifies stock picks automatically and sends alerts to you if you subscribe.

By offering frequent updates and adaptive recommendations, Trade Ideas provides a valuable tool for both day traders and long-term investors.

You can also make use of Holly's 70+ running algorithms. Also, set your own parameters and tweak the advisor to provide alerts for stocks that match your criteria.

Price: [6]

- Standard - $999 per year

- Premium - $1,999 per year

What you can expect from the premium plans:

- 3 A.I. virtual trading analyst algorithms

- Trading help with entry and exit signals

- Backtesting tool

- Advanced auto trading with interactive brokers

- Charting tools

- Scanners

Stock Advisor - $99/year for New Members

*$99 is an introductory price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then-current list price.

Barron's

Pros

- Easy-to-understand platform & app

- Expert stock picks and analysis

- Strong customer support

- Trusted reputation in stock market news

Cons

- No technical analysis tools

- Not aimed at beginners

If you do much reading about investing, there's a good chance you're already familiar with Barron's. A publication owned by the same company that produces the Wall Street Journal.

With a digital subscription, you get access to market insights and stock picks from Barron's team.

Every week, Barron's will highlight 5 new stocks they think are worth investing in. They typically favor long-term investment opportunities. These are identified by examining the fundamentals of a given company before making a recommendation.

Price: [7] $4.99/month after free trial

What you can expect from the Digital Advisor package:

- Full access to Barron's, WSJ, MarketWatch.com, and the corresponding mobile and table apps.

Stock Advisor - $99/year for New Members

*$99 is an introductory price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then-current list price.

What the Experts Say

CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

Choosing the right stock advisor website is a highly personal choice. And there is no right platform for everyone.

The right site for you will depend on whether you're interested in short, medium, or long-term investing. Also, doing independent stock research or relying on professional advisors. Lastly, what you can afford to spend.

Some of the sites mentioned above offer free trials or unpaid versions. So it's worth experimenting a bit before you decide to pull out your wallet.

References

- ^ Seeking Alpha. Subscription Plan Pricing, Retrieved 09/16/2024

- ^ Zacks Investment Research. Stock Products, Retrieved 6/27/2022

- ^ Morningstar. FAQ: What's the price of a subscription to Morningstar Investor?, Retrieved 6/27/2022

- ^ Mindful Trader. Pricing, Retrieved 6/27/2022

- ^ Stock Rover. Stock Rover Plans, Retrieved 6/27/2022

- ^ Trade Ideas. Pricing and Subscription Plans, Retrieved 6/27/2022

- ^ Barron's. Barron's Advisor Pricing, Retrieved 6/27/2022

Jeremy Harshman is a creative assistant at CreditDonkey, a personal finance comparison and reviews website. Write to Jeremy Harshman at jeremy.harshman@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|