Apps Like Tilt (formerly Empower)

Tilt (formerly Empower) is a fintech company which counts cash advances as its flagship service. Sounds good? Well, there are other apps like it.

|

These apps are like Tilt (formerly Empower) but may be better depending on your needs:

Wondering if other cash advance apps like Tilt (formerly Empower) exist? Good news—there are lots!

Just like Tilt (formerly Empower), they don't charge interest or require credit checks. And some may even be a better fit for you.

Let's dive in and see what's out there.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

The SMART rule helps individuals remember the key aspects to consider when choosing an app like Empower:

- Speed: Look for apps that offer fast access to funds.

- Minimal fees: Ensure the app has low or no fees.

- Accessibility: The app should be easy to use and accessible on multiple devices.

- Reliability: Choose a reputable app with positive reviews.

- Transparency: The app should have clear and transparent terms.

8 Best Cash Advance Apps like Tilt (formerly Empower)

There could be plenty of reasons you're looking for Tilt (formerly Empower) alternatives. One of these top cash advance apps might be it.

Kicking things off, here's an app that lets you borrow a higher amount.

EarnIn: Up to $1,000 with Cash Out

|

| credit earnin |

| Timing and Repayment | |

|---|---|

| Get Money | Within 1-3 business days via ACH |

| Repay | Upcoming payday |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | $2.99 to $5.99/Cash Out transfer[1] |

| App Rating | |

| Google Play | 4.7 out of 5 ✰ from 274K+ reviews on Google Play[2] |

| App Store | 4.7 out of 5 ✰ from 346K+ reviews on App Store[3] |

EarnIn is a finance app providing early access to your unpaid income for up to $150/day, and up to $1,000/pay period. Because of the daily limit, getting larger sums may require multiple consecutive withdrawals over several days.

Compared to Tilt (formerly Empower), EarnIn doesn't have borrowing costs, which can be very helpful for those living paycheck-to-paycheck. You can tip the service, though. The wait time for a standard transfer is pretty decent so you may not have to resort to paying extra for Lightning Speed

.

In addition, it has Balance Shield. It sends alerts when your balance falls below your set threshold. And when it reaches overdraft range, you'll automatically get $100 to protect your balance.

EarnIn will deduct from your incoming paycheck any Cash Out withdrawal made plus Lightning Speed fees, if applicable.

EarnIn Cash Out requirements:

- Sign up for an EarnIn account if you're at least 18 and with a valid U.S. mobile number.

- A linked checking account with consistent paychecks.

- Employment details.

- Minimum $320 per pay period.[4]

Pros + Cons

|

|

What if you aren't employed? Like Tilt cash advance, this next tool can be more accommodating.

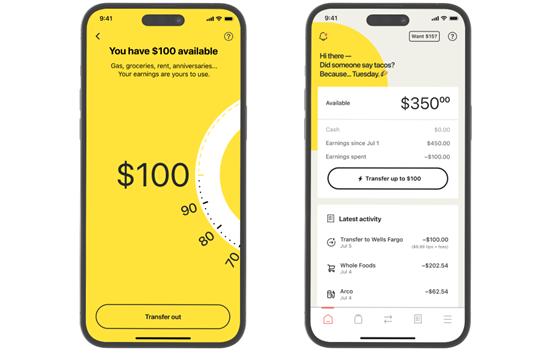

Brigit: Up to $250 with Instant Cash

|

| CREDIT hellobrigit |

| Timing and Repayment | |

|---|---|

| Get Money | 20 minutes (with fee) or at least one business day |

| Repay | Next payday or preferred date using an extension. |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $8.99/mo. Plus plan or $15.99/mo. Premium plan[5] |

| Instant Transfer Fee | Starts at $0.99/transfer;[6] free for Premium members[7] |

| App Rating | |

| Google Play | 4.8 out of 5 ✰ from 294K+ reviews on Google Play[8] |

| App Store | 4.8 out of 5 ✰ from 412K+ reviews on App Store[9] |

Brigit is similar to Tilt (formerly Empower) in more ways than one. With Instant Cash, you have a slightly lower cash advance amount of $250, but it doesn't require you to be employed.

While employment helps your chances of being approved, you can still qualify with regular direct deposits from another source, like a government benefits provider. Brigit also looks into your bank account health and spending behavior.

Make sure your financial markers are good to get the highest possible cash advance limit. Because, unlike Tilt (formerly Empower), this amount is fixed once it's assigned to you.

Brigit Instant Cash requirements:

- Sign up for a paid Brigit subscription.

- A linked external bank account with a minimum 60-day history, three recurring deposits from the same source, and a positive balance.

- A minimum average end-of-day balance on scheduled paydays.

Pros + Cons

|

|

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

If you need a higher cash advance, this next app can deliver—with conditions of course.

MoneyLion®: Up to $1,000 w/ Instacash℠

| Timing and Repayment | |

|---|---|

| Get Money | Minutes (with fee) or at least one business day |

| Repay | On scheduled repayment date (usually next paycheck) |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | Tiered fee starts at $0.49/transfer[10] |

| App Rating | |

| Google Play | 4.5/5 ✰ (193K+ reviews)[11] |

| App Store | 4.8/5 ✰ (270K+ reviews)[12] |

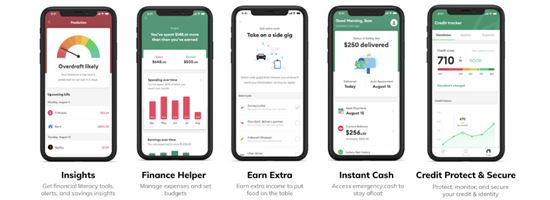

With MoneyLion®, you can keep your finances in a single platform. It is an all-in-one app that has banking, budgeting, credit-building, borrowing, earning, and investing products.

Instacash℠ lets you advance up to $1,000. But this calls for a recurring direct deposit into a RoarMoney℠ account. Otherwise, the ceiling amount drops to $500.[13]

More importantly, MoneyLion® has other personal finance tools that encourage you to make more money. This way, you don't have to rely too much on its cash advance feature whenever you're in a pickle.

Signing up for a MoneyLion account would benefit anyone using a personal finance tool. You can keep one without paying for a monthly subscription while taking advantage of what it offers.

MoneyLion® Instacash℠ requirements:

- Sign up for a MoneyLion® account.

- A linked checking account with a minimum 60-day history and a positive balance.

- At least three direct deposits from the same source or payroll provider into the linked account.

Pros + Cons

|

|

What if you don't have a steady income? There's still hope.

Cleo: Up to $500 cash advance

| Timing and Repayment | |

|---|---|

| Get Money | Within 24 hours for a fee, or four business days via standard transfer |

| Repay | On your set repayment date, usually within 14 days |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | Starts at $3.99/transfer[14] |

| App Rating | |

| Google Play | 4.5 out of 5 ✰ from 98K+ reviews on Google Play[15] |

| App Store | 4.6 out of 5 ✰ from 171K+ reviews on App Store[16] |

There's practically nothing that can stop you from qualifying for a Cleo cash advance, even if you have poor credit, or so it says.

However, most cash advance apps don't have credit checks to begin with, so this isn't something to jump about.

What makes it worth a second look is its wider eligibility, which includes part-time employees. You could be a freelance personal finance writer and still qualify for a cash advance, which is very helpful. You can access up to $250 or $500 max with a Cleo direct deposit setup.[14]

There is one catch: As a new user, you start with a much lower amount. Nevertheless, it may be enough to cover expenses or the usual cash emergencies.

As a new Cleo user, you can get anywhere from $20 to $100 cash advance,[17] up to $140[18] with a Cleo Builder subscription.

Cleo cash advance requirements:[19]

- Sign up for a Cleo account.

- Choose between a Cleo Plus and a Cleo Builder subscription, or request by emailing team@meetcleo.com.

Favorable bank transaction histories and spending patterns still remain crucial factors in determining your eligibility and advance amount.

Pros + Cons

|

|

Up next—an app that helps you borrow responsibly.

Dave®: Up to $500 with ExtraCash™

|

| CREDIT DAVE |

| Timing and Repayment | |

|---|---|

| Get Money | Seconds to a Dave® checking account (no fee) or within three business days to an external bank account |

| Repay | Next payday or nearest Friday |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | up to $5/mo membership fee |

| Instant Transfer Fee | 1.5% of the transfer amount for external debit card transfers[20] |

| App Rating | |

| Google Play | 4.4 out of 5 ✰ from 564K+ reviews on Google Play[21] |

| App Store | 4.8 out of 5 ✰ from 742K+ reviews on App Store[22] |

Dave® is a multipurpose financial app just like Tilt (formerly Empower) but with some differences.

With ExtraCash™, you can get an advance of up to $500, which is treated as an overdraft. So, if you get it, you may notice a negative bank account balance.

Don't worry—even if you're technically overdrawing your account, you won't be penalized with overdraft fees. Besides, it serves as a clear reminder, showing exactly how much you owe.

You can transfer your advance to a Dave Checking account right away, with no fee. If you need the money sooner on a different debit card, you'll have to pay a small fee of 1.5% of the amount.

Dave® ExtraCash™ eligibility contributing factors:

- Sign up for a Dave® account.

- Linked bank account details or Dave® checking account with a minimum 60-day history and a positive balance.

- At least three recurring verified bank deposits.

- Minimum $1,000 total monthly deposit.

- Pay a monthly membership fee.

Yes, you must repay Dave® ExtraCash™ in full and on time. If for whatever reason you are unable to, partial amounts may be deducted until the overdraft is brought to $0.

Pros + Cons

|

|

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Unlike Tilt (formerly Empower), this next option almost entirely removes fees from the equation.

Chime®: Up to $200 with SpotMe®

|

| credit chime |

| Timing and Repayment | |

|---|---|

| Get Money | Immediately after initiating a SpotMe® transaction |

| Repay | On your next direct deposit or fund transfer, whichever comes first |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | $0 |

| App Rating | |

| Google Play | 4.7 out of 5 ✰ from 900K+ reviews on Google Play[23] |

| App Store | 4.8 out of 5 ✰ from 1.2M+ reviews on App Store[24] |

Chime® is a mobile banking app users love for its no-fee approach. This applies even to their SpotMe® feature. After all, you want to save money, especially when you actually need it.

SpotMe® has a fee-free overdraft protection of up to $200. When used via debit card purchase, you'll receive a notification that says, "SpotMe has you covered. Your debit purchase at (Store Name) was taken care of by SpotMe."

Alternatively, you can go to any of its 47,000+ ATMs if you prefer withdrawing your SpotMe® limit.

Chime® SpotMe® requirements:

- Apply for a Chime® debit card or Credit Builder card.

- SpotMe® must be activated in your app settings.

- At least a $200 qualifying direct deposit from an employer or benefits provider sent regularly.[25]

Pros + Cons

|

|

Here's another option where overdrawing your account isn't necessarily a bad thing.

Albert: Up to $1,000 with Instant

| Timing and Repayment | |

|---|---|

| Get Money | Immediately into Albert Cash account (no additional fee) or within minutes to an external account for a fee |

| Repay | Within a six-day grace period |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0[26] |

| Instant Transfer Fee | $5.99-$19.99/transfer to an external bank account[27] |

| App Rating | |

| Google Play | 4.5 out of 5 ✰ from 136K+ reviews on Google Play[28] |

| App Store | 4.6 out of 5 ✰ from 267K+ reviews on App Store[29] |

Albert's Instant provides cash advance of up to $1,000. There are no credit checks, and no late fees or interest.

Unlike Tilt Cash Advance, it does not require a paid subscription. You can access your Instant limit immediately without additional charge using your Albert Cash account. Otherwise, you'll pay $5.99-$19.99 based on the amount of your transfer.

Cash advances must be covered in six days, with a seven-day extension available. You can't request additional advances until you pay.

Albert Instant requirements:

- Sign up for a paid Albert membership.

- Maintain an Albert Cash account in good standing and link an active bank account.

- An activated Smart Money, which is found under Profile tab.

- Set up qualifying direct deposits to potentially raise your limit.

Direct deposits aren't required when signing up for an Albert account. However, having a qualifying direct deposit with Albert Cash

Pros + Cons

|

|

We're near the end of the list. If you qualify, your only choice in this next app is to get your funds fast.

Varo: Up to $500 with Varo Advance

| Timing and Repayment | |

|---|---|

| Get Money | Instantly |

| Repay | Within 30 days |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | Tiered cash advance fee starts at $1.60[30] |

| Instant Transfer Fee | $0 |

| App Rating | |

| Google Play | 4.6 out of 5 ✰ from 243K+ reviews on Google Play[31] |

| App Store | 4.9 out of 5 ✰ from 233K+ reviews on App Store[32] |

Varo can spot you cash when you need it most. This means no waiting times and no expedited fees, which is a huge relief during unexpected expenses.

Like Tilt (formerly Empower), you don't have to be employed to be eligible for Varo Advance. You may qualify as long as you have consistent recurring deposits from the same source to a Varo bank account.

However, there's a catch. It has a mandatory cash advance fee. But that's it. Unlike a fixed monthly fee that other cash advance apps ask from you, you'll only pay it when you get an advance.

With an online bank account, Varo offers other banking services you can use conveniently like early paydays, 40,000+ fee-free ATMs, and cash-back perks.

Varo Advance requirements:

- Sign up for a Varo account. If you already have one, it must be active and in positive standing.

- At least $800[33] in total qualifying direct deposits

to either your Varo Bank Account or Savings Account or combined.

Pros + Cons

|

|

Paycheck advance apps are usually more flexible when it comes to late payments. Some provide up to 30 days extension, others allow you to repay whenever you can. In exchange, your cash advance access may be restricted if not suspended until full repayment.

Now that you've learned about apps like Tilt (formerly Empower), here's an overview for a more informed comparison.

What does the Tilt (formerly Empower) app do?

Aside from offering small cash advances of up to $400, Tilt (formerly Empower) provides easy-to-use savings and budgeting tools to give you more control over your money.

With a Tilt Card account, you can get your paycheck 2 days early and earn some APY on your balances.

Other things you can do with Tilt (formerly Empower) include monitoring credit and proactively receiving smart money advice.

How to Choose Tilt (formerly Empower) Alternatives

Getting an advance from Tilt (formerly Empower) alternatives can be the best solution to your financial hurdle.

But before you sign up for one, here are things to consider:

- Processing time

When you're in a rush, the processing time is a top priority. It will determine how fast you can get the money. Most cash advance apps take less than 24 hours to process and have express delivery options. - Cash advance amount

Determine how much cash you need. Many apps cap their cash advance anywhere from $250 to $500. So before signing up, check if the app can cover your target amount. - Repayment date

Paycheck advance apps on this list set an automatic repayment on your next payday. But there are other repayment options, too. Some let you pay in installments, while others let you choose your repayment date. - Fees

Check for any possible cash advance charges, such as monthly subscriptions and instant delivery fees.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

Reputable instant cash advance apps like Tilt (formerly Empower), EarnIn, and Brigit are generally safe. It also helps to use strong, unique passwords and a two-factor authentication setup to secure your account information.

How to get out of a cash advance cycle

Repayment can sometimes be its own challenge. Budgeting your next salary to pay bills alongside your cash advance can be difficult.

Tips to breaking the cash advance and repayment cycle include:

Use budgeting and spending tools.

Many apps on this list offer budgeting assistance and saving tools. Use them to help improve your financial health.

Earn extra income.

Instead of payday loans, why not go for apps that can make you some money first? Or try a few side hustles to capitalize on your other skills.

Take note of your due dates.

Needless to say, you must be responsible for the cash advance you make. Set reminders of your repayment dates to help you prepare and pay on time.

Cash advances from a financial technology company (not a bank) like Tilt (formerly Empower) and EarnIn won't impact your credit because it doesn't get reported to credit bureaus. However, credit card cash advances may impact your credit. That's because the amount is deducted from your card limit, which increases your credit utilization ratio

Alternatives to Cash Advance/Loan Apps

Other than cash advance apps, here are a few more ways to access cash for emergencies:

- Borrowing money from a friend

Accessing money from someone close to you with extra cash is an option. Family loans may be even better, if possible. - Use your credit card

Especially if you're running short on groceries before your paycheck arrives, a credit card can be a lifesaver. And then, pay it in full on the due date to avoid interest. - Personal loan

For emergencies that call for more than a thousand dollars, taking out a loan could be your best bet. Try nearby credit unions, some of which offer small-dollar loans with lower fees and more manageable repayment terms.

Methodology

Tilt (formerly Empower) is a reliable cash advance app. So when making this list, we looked for other apps that you can count on during emergencies.

We also made sure that they could offer you a range of loan amounts. Need only a couple hundred? No problem. Want your full pay right away? We got an app for that, too.

Furthermore, we looked into other features like having financial tools that help you manage your money. That way, we know you're in good hands every time you get strapped for cash.

Bottom Line

The Tilt app is a convenient solution for fast cash advances. However, it isn't the only option you have.

Consider similar apps like EarnIn, Brigit, and MoneyLion®. Like Tilt (formerly Empower), these providers let you borrow money at zero interest. They also offer other personal finance tools to help you with money management.

However, their differences in loan amounts, fees, and eligibility requirements may dictate which one would suit you best.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

References

- ^ EarnIn. Lightning Speed fees and details, Retrieved 10/13/2025

- ^ Google Play. EarnIn: Why Wait for Payday?, Retrieved 10/13/2025

- ^ App Store. EarnIn: Beyond Cash Advance, Retrieved 10/13/2025

- ^ EarnIn. Frequently Asked Questions, Retrieved 10/13/2025

- ^ Brigit. How much does Brigit cost?, Retrieved 10/13/2025

- ^ Brigit. Brigit Terms of Service, Retrieved 10/13/2025

- ^ Brigit. Our pricing, Retrieved 10/13/2025

- ^ Google Play. Brigit: Borrow & Build Credit, Retrieved 10/13/2025

- ^ App Store. Brigit: Fast Cash Advance, Retrieved 10/13/2025

- ^ MoneyLion®. MoneyLion fee schedule, Retrieved 10/13/2025

- ^ Google Play. MoneyLion: Bank & Earn Rewards, Retrieved 10/13/2025

- ^ App Store. MoneyLion: Banking & Rewards, Retrieved 10/13/2025

- ^ MoneyLion®. Instacash, Retrieved 10/13/2025

- ^ Cleo. Terms & Conditions, Retrieved 10/13/2025

- ^ Google Play. Cleo: Budget & Cash Advance, Retrieved 10/13/2025

- ^ App Store. Cleo: Cash advance & Credit, Retrieved 10/13/2025

- ^ Cleo. Cash Advance, Retrieved 10/13/2025

- ^ Cleo. What's a cash advance boost and how do I request one?, Retrieved 10/13/2025

- ^ Cleo. How do I request a cash advance?, Retrieved 10/13/2025

- ^ Dave®. What are ExtraCash Fees?, Retrieved 10/13/2025

- ^ Google Play. Dave: Fast Cash & Banking, Retrieved 10/13/2025

- ^ App Store. Dave: Fast Cash & Banking, Retrieved 10/13/2025

- ^ Google Play. Chime - Mobile Banking, Retrieved 10/13/2025

- ^ App Store. Chime - Mobile Banking, Retrieved 10/13/2025

- ^ Chime®. How to Use SpotMe, Retrieved 10/13/2025

- ^ Albert. What is the difference between advances and loans?, Retrieved 10/13/2025

- ^ Albert. How do I advance with Instant?, Retrieved 10/13/2025

- ^ Google Play. Albert: Budgeting and Banking, Retrieved 10/13/2025

- ^ App Store. Albert: Budgeting and Banking, Retrieved 10/13/2025

- ^ Varo. Varo Advance Fees, Retrieved 10/13/2025

- ^ Google Play. Varo Bank: Mobile Banking, Retrieved 10/13/2025

- ^ App Store. Varo Bank: Mobile Banking, Retrieved 10/13/2025

- ^ Varo. Varo Advance Overview, Retrieved 10/13/2025

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Chase Total Checking® - $400 Bonus

- New Chase checking customers can receive $400 when you open a Chase Total Checking® account and make direct deposits totaling $1,000 or more within 90 days of coupon enrollment.

- Unlock more offers with Chase. Get up to $500 per calendar year by referring friends and family. Plus, get cash back from top brands with Chase Offers when you use your debit card.

- Chase Total Checking® has a $15 monthly service fee, you can easily avoid the fee with direct deposits totaling $500 or more, or a minimum average daily balance each statement period.

- Chase Overdraft Assist℠ – no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*

- Chase Mobile® app makes banking simple. Manage accounts, pay bills, send money to friends with Zelle® and deposit checks on the go with Chase Quick Deposit℠.

- Chase has the largest branch network in the U.S. with thousands of ATMs and branches. Use the Chase locator tool to find a branch or ATM near you.

- Chase helps keep your money protected with features like Zero Liability Protection, fraud monitoring and card lock.

- Chase Total Checking includes FDIC insurance up to the maximum amount allowed by law.

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

U.S. Bank Business Essentials - $400 Bonus

Promo code Q1AFL26 MUST be used when opening a U.S. Bank Business Essentials® or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

To earn a business checking bonus, open a qualifying U.S. Bank business checking account between 1/15/2026 and 3/31/2026. Make the required deposit(s) in new money within 30 days of account opening, maintain the same required daily balance through the 60th day, and complete 6 qualifying transactions based on posted date within 60 days of account opening.

Business Essentials: $400 bonus with $5,000 new money deposits, daily balance, and 6 qualifying transactions.

Qualifying transactions include debit card purchases, ACH and wire credits or debits, Zelle credits or debits, U.S. Bank Mobile Check Deposit, electronic or paper checks, Bill Pay (excluding payments made by credit card), and payment received via U.S. Bank Payment Solutions. Other transactions, such as person-to-person payments, credit card transfers, or transfers between U.S. Bank accounts, are not eligible.

New money is defined as funds from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees may reduce the required daily balance during the qualifying period.

Bonus will be deposited into your new eligible U.S. Bank business checking account within 30 days after the month-end in which all offer requirements are met, provided the account remains open with a positive available balance.

Offer may not be combined with other business checking bonus offers. Existing businesses with a business checking account or had one closed within the past 12 months, do not qualify.

All regular account-opening procedures apply. For full checking account pricing, terms and policies, refer to your Business Pricing Information, Business Essentials Pricing Information, and YDAA disclosure. These documents are available at any U.S. Bank branch or by calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice.

Member FDIC

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Write to Penny Besana at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Empower Personal Wealth, LLC (“EPW”) compensates CREDITDONKEY INC for new leads. CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

|

|

|