Acorns Review: Is It Good?

Acorns automatically invests your spare change. But can it help make you money? Find out if this app is safe and legit.

| |||

Overall Score | 4.1 | ||

Annual Fee | 3.0 | ||

Minimum Deposit | 5.0 | ||

Mobile App | 4.5 | ||

Customer Service | 3.0 | ||

Ease of Use | 5.0 | ||

Pros and Cons

- No minimum to open account

- Invest with spare change

- Cash-back program

- Fees are high for small balances

- No tax benefits

- Limited investment options

Bottom Line

Investment app that automatically invests your spare change. Good for young investors to get into the habit

The two biggest investing myths holding people back:

- You need to be rich

- You need to be a finance expert

Truth is, you can start investing with a few dollars. And you don't need to know stock market lingo.

Many beginners on a small budget are fans of Acorns. This micro investing app lets you get started with spare change. It's completely hands-off and requires no work on your end. You can open a checking account, save for retirement, and even invest for your children.

But there are some fees and other drawbacks to watch out for. Find out if it's worth your hard-earned money below.

Shortcut: Acorns is a user-friendly and convenient option for those looking to start investing with just a few dollars.

Despite the fees, the benefits of the app make it a worthwhile consideration for beginners on a small budget. With Acorns, you can easily build your investment portfolio and work towards your financial goals.

Who Is Acorns Best For?

Acorns is best for:

- Hands-off investors

- People who struggle to save

- Custodial accounts for kids

Small steps add up. If you're ready to finally save and invest your money, visit Acorns to get started.

|

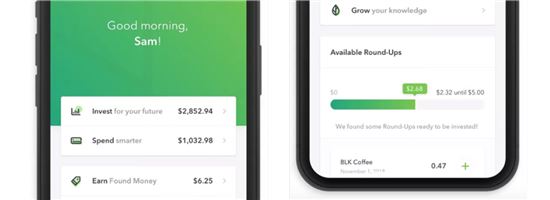

| Screenshot of Acorns |

Acorns truly aims to make investing accessible. If you're new to investing but want to start, check out all of the app's features below.

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

How Does Acorns Work?

Acorns automatically invests your spare change with their Round-Ups feature. Whenever you make a purchase with your linked card, Acorns rounds up the transaction to the next dollar. That change is put in a diversified portfolio based on your age, time until retirement, financial goals, and risk tolerance.

If you buy lunch for $5.25, Acorns rounds it up to $6 and invests the difference (75 cents). Round-ups help your account grow steadily as you go about your daily life.

You also have a Round-Ups Multiplier option. Instead of just rounding up to the next dollar, you can multiply the spare change by 2x, 3x, or 10x. You'll grow your investments a lot faster this way.

Acorns also supports daily, weekly, or monthly recurring deposits. Or, you can manually transfer a lump sum to your account starting with just $5.

Let's take a closer look at all the services Acorns offers.

Invest your spare change—automatically.Choose your state to start saving and investing your money.

1. Acorns Invest

The Acorns Invest account is a taxable account that lets you invest your spare change. You can open the account with $0. And you need just $5 to start investing.

No need to pick and choose your own stocks. Simply answer questions about your risk tolerance and investment goals. Acorns invests in a diversified portfolio of over 7,000 stocks and bonds for you. Plus, it will automatically rebalance your portfolio and reinvest dividends.

Ready to Build a Better Financial Future?

It takes less than 5 minutes to set up an investment account with Acorns. Get started with investing today.

2. Acorns Later

If you want an easy way to save for your golden years, Acorns Later lets you automate it. You can invest in Traditional, Roth, or SEP IRAs starting with just $5.

Over the years, Acorns will change with you. As you get closer to retirement age, your portfolio will shift toward more conservative investments.

IRA accounts don't support round-ups. But you can set up recurring contributions and save automatically.

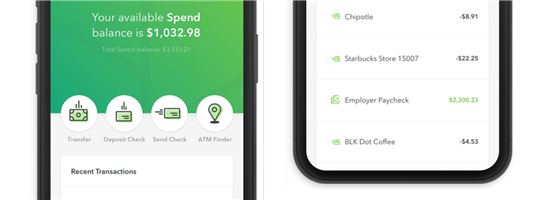

3. Acorns Checking

This is Acorns' checking account, so you can have your banking and investing in the same app. It comes with a cool tungsten metal debit card for your everyday purchases.

It has all the typical features of a checking account including direct deposit, mobile check deposits, and online bill pay. You get access to 55,000+ fee-free ATMs around the world. Plus, there are no overdraft fees.

This account is FDIC insured up to $250,000, so you can trust that your money will be safe.

Acorns Checking

Get a checking account that saves, earns and invests for you.

4. Acorns Earn (Found Money)

This unique feature lets you earn extra money when you shop.

All you have to do is shop with Acorns' 15,000+ brand partners like Chevron, Nike, or Walmart. You'll receive Acorn Earn rewards which will be invested into your investment account. And there's even a Chrome extension and Safari extension for online shopping.

All this takes no effort on your part. You automatically get cash back when you use your linked card to make a purchase. After 60 to 120 days, the rewards will show up in your account.

The list of partners changes frequently, so you'll get more opportunities to earn.

5. Acorns Early Invest

Give your children a head start in investing by setting up UTMA/UGMA custodial investment accounts for them. You can start investing for your kids with $5. The account will be in your child's name.

You can withdraw from the Acorns Early Invest account without penalty. But the funds must be used to benefit the child. You can set up accounts for multiple kids at no additional cost. Acorns Early Invest is available at the $12/month tier.

Acorns is hugely popular with millennials but they're not the only investing app out there. Don't forget to browse the latest promotions.

6. Acorns Later Match

With Acorns Later Match, you can boost your retirement savings for every new contribution you make to your Acorns Later IRA. Unlike an employer 401(k) match, you don't need an employer to earn a match on your contributions.

Acorns will match a percentage of your contributions in your Later account up to the annual contribution limit. If you're an Acorns Silver member, you get a 1% match. If you subscribe to Acorns Gold, you get a 3% match. This match will be automatically paid out and invested in your Later account.[1]

To qualify for the match, Acorns Silver or Acorns Gold customers can make new contributions to their Acorns Later retirement account in three ways: by setting up recurring contributions, making one-time contributions, or splitting their paycheck to direct a portion to their Later account.

Compare Acorns

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Stash: Sign Up and Get $5

- Sign up, add at least $5 to your account and get a $5 bonus.

- Invest with fractional shares

- Get portfolio recommendations

Betterment: Compare Pricing

3 Free Fractional Shares

Open a new Webull individual brokerage account. Make a qualifying single initial deposit of $100 - $499.99 during the promotional period to get 3 fractional shares, each valued between $3 - $3,000. Maintain a balance of $100 - $499.99 in the account for 30 days or more. Terms and conditions apply.

Compared to other apps, Acorns fees are super high for small balances. Keep reading to discover if Acorns' returns are worth the cost.

Reasons We Like Acorns

|

No minimum to open

This can often be a barrier for new investors, as they only have a little money to invest. Acorns doesn't require a minimum to open the investment account, but you'll need just $5 spare change to start investing.

No Minimum Requirement

Takes the complexity out of investing

Investing can be extremely complicated, so some people avoid it altogether. With Acorns' automated tools and hands-off investment practices, it's easy to start investing without knowing a thing about ETFs, stocks, bonds, or real estate.

The savings are automatic

Sometimes the hardest part of saving is actually doing it. If you always find ways to spend your money rather than invest it, Acorns can automate it for you. The money is out of sight and out of mind so you can reach your financial goals without a second thought.

Plenty of options for customization

Acorns lets you fully customize how quickly your "round-ups" accumulate. You can have round-ups apply only to specific purchases, or turn them off altogether. You can even retroactively claim round-ups from purchases you made before signing up.

Set up an IRA using your spare change

Acorns Later lets you set up an IRA with your spare change. While you won't strike it rich quickly, it gets the ball rolling.

|

| Screenshot of Acorns |

No fee for withdrawing funds

You can withdraw your funds from Acorns at any time. However, it can take 3-6 business days to get the funds in your bank account.

Invest with "Acorns Earn"

When you shop with Acorns partners, like Apple, Macy's, and Nike, you can earn money from your investment account. On average, you can expect between 1% - 2% of the purchase price in rewards. Rewards take 60-120 days to get deposited in your account.

Acorns Earn (formerly known as Found Money)

- Earn as you shop with Acorns Earn partners

- Automatically invests cash back to your Acorns Core account

- Brands include Chevron, Nike, Walmart and more

Set up recurring deposits

If spare change deposits are not enough for you, setting up recurring investments is simple in the Acorns app. You can choose to set up weekly or monthly deposits from a bank account that take place automatically to enhance your investments.

Offers matching contribution

Acorns Later Match boosts Acorns Silver or Acorns Gold customers' accounts with a 1% or 3% IRA match, respectively, on new contributions. That could be a big advantage for self-employed or gig workers looking to save for retirement.

When is Acorns a Bad Idea?

Here are some reasons Acorns may not be right for you:

If you only rely on spare change

If you only use the spare change roundups, you're not going to be accumulating much. Investing in micro amounts will also only get you micro returns. To really build wealth, you'll need also contribute larger amounts regularly.

High fees for small balances

$3 a month or $36 per year doesn't sound like a lot. But the percentage can be steep for small balances. If you only have $10 in your account, that's a 30% monthly fee.

In comparison, Betterment, another robo-advisor, charges $4 per month for balances under $20,000, and then 0.25% annual fee for balances of $20,000 or more, or if you set up recurring monthly deposits totaling $250 or more.[2]

No tax benefits

Acorns does not offer tax loss harvesting or any type of tax assistance, for that matter. Some robo-investing apps, like Wealthfront provide tax loss harvesting for all users.

Limited Investment options

You only have approximately 7 asset classes to choose from. While, some investing services, like Betterment, offer 10+ asset classes.

Acorns Fees

Acorns fees range from $3 to $12 per month:[3]

- Acorns Bronze ($3/mo) - includes personal taxable account, IRA, and checking account

- Acorns Silver ($6/mo) - includes everything in Bronze, emergency fund, 25% match on rewards, and 1% IRA match on Acorns Later contributions

- Acorns Gold ($12/mo) - includes everything in Silver, investment accounts for kids, 50% match on rewards, custom portfolio, Trust & Will, $10K Life Insurance, free Acorns Early account, and 3% IRA match on Acorns Later contributions

There are no transaction or withdrawal fees for Acorns.

Acorns Bronze offers convenient investing, retirement savings, and a cash management account for one monthly fee. Of course, you can do all of this on your own for free, if you're a disciplined saver/investor. But most of us aren't.

So if you struggle with investing or saving money, it's probably better to kick Acorns $3-$12 per month to direct your savings. Then, you can save without obsessing over every purchase.

If you're looking for a no-fee alternative, check out Robinhood. It offers commission-free trading so you won't have to deal with pesky monthly charges.

Other Features

|

| © CreditDonkey |

The Acorns app is very user-friendly. You can switch between Past, Present, and Potential tabs for complete control of your account. Here's what each feature covers:

Present

This tab is a quick snapshot of the overall health of your Acorns accounts. You can view the current value of each account. And you can make quick changes to your Round-Ups, set up recurring deposits, and view active offers from Acorns Earn (formerly known as Found Money) partners.

Past

Here, you can see an in-depth breakdown of your past Round-Ups, deposits, Earn, and more. Use this feature to keep tabs on how quickly you accumulate each $5 investment minimum and adjust as necessary.

|

| Screenshot of Acorns |

Potential

Here, you can view the projected value of your account based on your current investments. If you don't like the projection you see, you can select "Change Your Potential" and edit your recurring investments to boost your account value.

Grow

Expand your knowledge of investing and saving with this educational section. Catch up on investing news and learn what to expect from the stock market in the upcoming week.

People love Acorns' 100% automatic, robo-investing service. Now, let's dive deeper into exactly how the app makes you money.

Acorns Portfolios

When you sign up, Acorns recommends the best portfolio for you based on your personal info, risk tolerance, and financial goals. You can accept the recommendation or choose your own.

Your investments through Acorns are based on the Nobel-prize winning modern portfolio theory, or MPT.[4] In general, MPT considers diversification to be more important than individual security selection.

So, Acorns will build you a diversified portfolio of ETFs by investing in seven asset classes:

- Large company stocks

- Small company stocks

- Emerging market stocks

- Government bonds

- Corporate bonds

- Real estate stocks

- International large company stocks

Here are examples of what you may find in the different portfolios:[5]

| Stocks | Bonds | Real Estate | |

|---|---|---|---|

| Aggressive | 90% | 0% | 10% |

| Moderately Aggressive | 72% | 20% | 8% |

| Moderate | 54% | 40% | 6% |

| Moderately Conservative | 36% | 60% | 4% |

| Conservative | 0% | 100% | 0% |

What Does Acorns Invest in?

Acorns mostly invests your money in Vanguard and iShares by Blackrock ETFs. Here are just a few of the ETFs that Acorns invests in:[6]

- Vanguard S&P 500 (VOO)

- iShares Core S&P Mid-Cap (IJH)

- Vanguard Small-Cap (VB)

- Vanguard FTSE Developed Markets (VEA)

- Vanguard Real Estate ETF (VNQ)

- iShares Corporate Bond (LQD)

- iShares 1-3 Year Treasury Bond (SHY)

Of course, you can just invest in these ETFs yourself through a DIY brokerage and save the monthly service fee. But if you usually have trouble saving and don't want to manage your own portfolio, Acorn's service may be worth it for just $3 a month.

How It Compares

Acorns vs Stash: Stash will guide you to choose investments based on your goals and risk level and do the actual investing for you. Unlike an Acorns account, Stash has a $1 minimum requirement.

Acorns | Stash | |

|---|---|---|

| Annual Fee |

|

|

| Minimum Deposit | ||

| Robo Advisor | ||

| IRA Accounts | ||

| Banking | Included in Acorns Bronze ($3/mo). Free metal debit card, no minimum balance, no overdraft fees, and 55,000+ fee-free ATMs nationwide. | All users get a cash account with a debit card. No minimum balance, no overdraft fees, and free ATM access at 55,000+ ATMS. |

| Mobile App | ||

| Visit Site | Learn More | |

Acorns: Pricing information from published website as of 11/29/2024. Stash: Pricing information from published website as of 08/14/2019 | ||

Acorns vs Betterment: Acorns and Betterment are both robo-advisors, but the similarities end there. Betterment is better if you have more than just spare change to put toward retirement. It's for the serious investor who want the help of a robo-advisor.

Acorns | Betterment | |

|---|---|---|

| Annual Fee |

|

|

| Minimum Deposit | ||

| Robo Advisor | ||

| IRA Accounts | ||

| Banking | Included in Acorns Bronze ($3/mo). Free metal debit card, no minimum balance, no overdraft fees, and 55,000+ fee-free ATMs nationwide. | Offers checking account with a free debit card, and a high-yield cash account |

| Mobile App | ||

| Visit Site | Learn More | |

Acorns: Pricing information from published website as of 11/29/2024. Betterment: Pricing information from published website as of 01/12/2025 | ||

Acorns vs Robinhood: Acorns is perfect for beginners and "hands-off" investors, while Robinhood is better for those who want a more active role in choosing their investments. Robinhood offers more customization, and their trading is completely commission-free. Learn more in our full Robinhood app review.

Acorns | Robinhood | |

|---|---|---|

| Annual Fee |

| |

| Minimum Deposit | ||

| Robo Advisor | ||

| IRA Accounts | ||

| Banking | Included in Acorns Bronze ($3/mo). Free metal debit card, no minimum balance, no overdraft fees, and 55,000+ fee-free ATMs nationwide. | Offers Robinhood spending account with Robinhood Cash Card issued by Sutton Bank |

| Mobile App | ||

| Visit Site | Visit Site | |

Acorns: Pricing information from published website as of 11/29/2024. Robinhood: Pricing information from published websites as of 01/25/2025. | ||

What the Experts Say

As part of our series on investing and saving, CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

Should you invest with the Acorns app? The answer really depends on your situation.

Realistically, your spare change isn't going to get you very far. You would still need to deposit larger amounts on your own to change your financial future. Even worse, the monthly fee can also be expensive for smaller balances.

If you're looking for a primary investment account for retirement, a brokerage account is a much better alternative.

But, if you are the type of person who struggles to save or invest, Acorns can be a great way to get started with small amounts of money.

Why not do something with that spare change, right? It can give you a nice little boost to your income in the long run.

References

- ^ Acorns. How does Later Match work?, Retrieved 11/29/2024

- ^ Betterment. Pricing at Betterment, Retrieved 07/23/2024

- ^ Acorns. Acorns Pricing, Retrieved 07/23/2024

- ^ The Nobel Prize, Prize in Economic Sciences 1990, Retrieved 07/23/2024

- ^ Acorns. What's the Difference Between Conservative and Aggressive Investing and Portfolios?, Retrieved 07/23/2024

- ^ Acorns, Where Is My Money Invested?, Retrieved 07/23/2024

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Buy $100 in Crypto and Get $10 Bonus from eToro USA LLC

- Sign up for an eToro account

- Deposit funds

- Invest in $100 worth of crypto

You'll automatically receive $10 directly to your account balance. Offer only applies to US customers. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

$30 Off Seeking Alpha Premium with 7 Day Free Trial

- Premium for $269

- 7-day free trial

- Next Alpha Pick - FREE!

Donna Tang is a content associate at CreditDonkey, a personal finance comparison and reviews website. Write to Donna Tang at donna.tang@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

| Trending | A visitor from California read Wealthfront Review |

| Featured | A visitor from New York read Webull Review |

| Expert Insights | A visitor from California read Best Investment Apps for Beginners |

| Deep Dive | A visitor from Texas read Invest $20 |

|

|

| ||||||

|

|

|

Compare: