Infographic: Veteran-Owned Businesses

Why veteran business owners command our attention

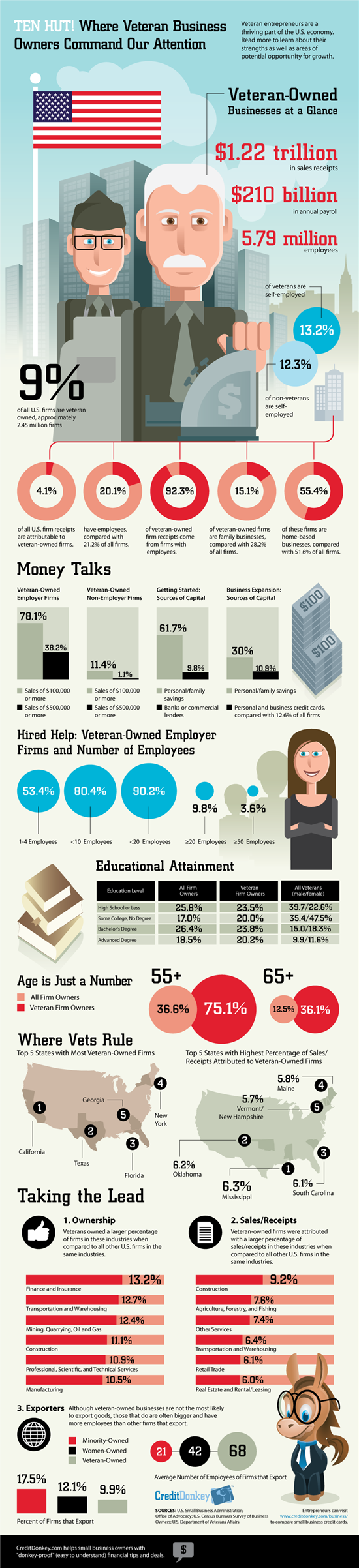

Many veterans have established lucrative and fascinating second careers as entrepreneurs. And they're thriving: They produce $1.22 trillion in annual sales and employ 5.8 million people. In fact, a higher percentage of veterans than non-veterans are self-employed.

Read on to see the degree to which veterans are generating small-business activity, as well as some of the struggles they continue to face.

|

| Infographic: Veteran Business Owners © CreditDonkey |

From accounting to construction, veteran-owned businesses employ millions of people and provide valuable services to millions more. They also fulfill lifelong dreams for many vets who appreciate the freedom of being their own boss.

And they have plenty of inspiring stories to tell. Consider just a few examples:

- Kyle Hansen, an Army veteran, returned from serving in Afghanistan and opened Heal the VET, a software company that helps veterans take care of their own health between doctors’ visits.

- A-Sun Truth served in the Marines and later founded a mobile ticketing and coupon service called Twicketer.

- Mark McCarty, an Air Force and Vietnam veteran, built a social networking site to help families raise money to welcome returning veterans home.

Still, entrepreneurship is not for everyone. Veterans contemplating whether they could bring a new product or service to market should first consider whether they are up to the task. Start with this helpful checklist from the U.S. Small Business Administration, which prods you to think about critical points, including whether you’re comfortable trusting your instincts, whether you’re a good negotiator, and how much you accept risk. Another key question is the support system you have in place, particularly whether there’s a business mentor out there to help you.

Fortunately, this is an area that sets veterans apart from other entrepreneurs. If you don’t have a trusted friend who can help you navigate the process of starting a business, the SBA can offer some help. It works with 16 organizations across the country that serve as Veterans Business Outreach Centers, providing assistance with everything from writing a business plan to training in specific skills.

Other resources for entrepreneurial veterans include the Boots to Business program for transitioning service members out of the military, special financing help through the Patriot Express Pilot Loan Initiative, and the National Veteran-Owned Business Association.

More options are available for veterans who became disabled while in the line of duty and are interested in government contracts. Executive Order 13360 calls for at least 3 percent of all federal agencies’ contracting money to go toward businesses owned by these vets. Some agencies haven’t been able to meet this goal because they haven’t found the small businesses to work with, which means there’s a great opportunity for entrepreneurial service-disabled veterans who can navigate the government contracting system. Many states also have parallel programs, so be sure to check with local veterans’ groups to see what other options may be available.

Of course, despite the special assistance for entrepreneurial veterans, getting together the funds to start a business and keeping cash flow moving in the right direction can be tricky for any startup. Check out the CreditDonkey comparison of credit cards for all types of small businesses to figure out your options for managing some of those financial issues. The right card, used the right way, can help build your business credit, simplify accounting, and earn you rewards.

(Research by Kelly; Graphic Design by Dex; Graphic Editing by Maria; Additional Writing by Livia; Editing by Sarah)

Kelly Teh is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Kelly Teh at kelly@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next: