How Much Does It Cost to Form an LLC?

Forming an LLC can be the next step for your business. But how much will it cost? Read on to learn about the different LLC formation fees.

|

Here are the following costs to consider:

- State Filing Fee: $35 to $3,000

- Operating Agreement Fee: Up to $500+

- Publication Fee: Up to $1,000+

- Annual Taxes: Varies

- Annual Report Fee: Up to $3,000+

- Registered Agent Fee: Up to $399+

- Business Licenses and Permits: Varies

- Other Fees: Up to $200+

Forming an LLC for your business won't be free. And some businesses could pay high costs, depending on their location.

But doing so will give you the liability protection of corporations. Yet, you'll have the flexibility of a sole proprietor or partnership.

Fortunately, for most businesses, it doesn't cost too much to form an LLC.

What are the costs for your business? Let's find out.

Costs to Start an LLC

The initial costs that come with forming an LLC depend on where you're creating yours. Here are the usual fees to consider:

| One-time LLC Fees | Cost |

|---|---|

| State Filing Fee | $35 to $3,000 |

| Operating Agreement Fee | Up to $500+ |

| Publication Fee | Up to $1,000+ |

State Filing Fee

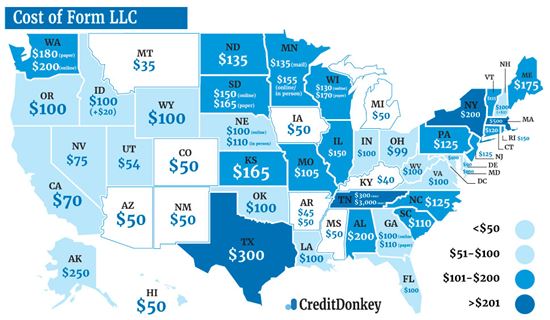

Fee Range: $35 - $3,000

To form an LLC, you'll need to file your Articles of Organization with your Secretary of State's office. You'll also need to pay the one-time state filing fee when you submit the documents to start the formation process.

The exact amount you pay will vary from state to state. It costs around $50 to $150 in most states. But some areas charge as high as $500.

Of course, this only applies if you're filing the documents yourself.

You may have to pay additional fees if you're going to hire a lawyer or a third-party service. They may also charge you extra if you want to shorten the turnaround time (expedited processing).

Here's how much the LLC filing fee costs in each state:

| State | Domestic LLC Filing Fee | Foreign LLC Filing Fee | Annual or Biennial Report Fee |

|---|---|---|---|

| Alabama[1] | $200 | $150 | None |

| Alaska[2] | $250 | $350 | $100 every two years |

| Arizona[3] | $50 | $150 | None |

| Arkansas | $45 (online) $50 (paper)[4] | $270 (online) $300 (paper)[5] | $150 each year[6] |

| California[7] | $70 | $70 | $20 every two years |

| Colorado[8] | $50 | $100 | $10 each year |

| Connecticut[9] | $120 | $120 | $80 each year |

| Delaware[10] | $110 | $200 | None ($300 annual tax)[11] |

| District of Columbia[12] | $99 | $220 | $300 every two years |

| Florida[13] | $125 | $125 | $138.75 each year |

| Georgia[14] | $100 (online) $110 (paper) | $225 (online) $235 (paper) | $50 each year (online) $60 (paper) |

| Hawaii[15] | $50 | $50[16] | $15 each year |

| Idaho[17] | $100 | $100 | $0 each year |

| Illinois[18] | $150 | $150 | $75 each year |

| Indiana[19] | $95 | $105 | $31 every two years |

| Iowa[20] | $50 | $100 | $30 every two years (online) $45 (paper) |

| Kansas[21] | $160 (online) $165 (paper) | $165 | $100 every two years (online) $110 (paper)[22] |

| Kentucky[23] | $40 | $90 | $15 each year |

| Louisiana[24] | $105 (online) $100 (paper) | $155 (online) $150 (paper) | $35 each year (online) $30 (paper) |

| Maine[25] | $175 | $250 | Domestic: $85 each year Foreign: $150 |

| Maryland[26] | $100 | $100 | $300 each year |

| Massachusetts[27] | $500 | $500 | $500 each year |

| Michigan[28] | $50 | $50 | $25 - $75 each year |

| Minnesota[29] | $155 (in person/online) $135 (paper) | $205 (in person/online) $185 (paper) | $0 each year |

| Mississippi[30] | $50 | $250 | $250 each year (for foreign LLCs only) |

| Missouri[31] | $50 (online) $105 (paper) | $105 (paper) | None |

| Montana[32] | $35 | $70 | $20 each year |

| Nebraska[33] | $100 (online) $110 (in-person) | $100 (online) $110 (in-person) | $25 every two years (online) $30 (paper)[34] |

| Nevada[35] | $75 | $75 | $150 each year |

| New Hampshire[36] | $100 | $100 | $100 each year |

| New Jersey[37] | $125 | $125 | $75 each year |

| New Mexico[38] | $50 | $100[39] | None |

| New York[40] | $200 | $250 | $9 every two years |

| North Carolina | $125[41] | $250[42] | $203 each year (online) $200 (paper)[43] |

| North Dakota[44] | $135 | $135 | $50 each year |

| Ohio[45] | $99 | $99 | None |

| Oklahoma[46] | $104 (online) $100 (paper) | $300 | $25 each year |

| Oregon[47] | $100 | $275 | $100 each year |

| Pennsylvania[48] | $125 | $250 | $7 each year |

| Rhode Island[49] | $150 | $150[50] | $50 each year |

| South Carolina[51] | $110 | $110 | None |

| South Dakota[52] | $150 (online) $165 (paper) | $750 (online) $765 (paper) | $50 each year |

| Tennessee[53] | $300 - $3,000 | $300 - $3,000 | $300 - $3,000 each year[54] |

| Texas[55] | $300 | $750 | None |

| Utah[56] | $54 | $54 | $18 each year |

| Vermont[57] | $125 | $125 | Domestic: $35 each year Foreign: $140 |

| Virginia[58] | $100 | $100 | $0 each year[59] ($50 Annual Registration)[60] |

| Washington[61][62] | $200 (online) $180 (paper) | $200 (online) $180 (paper) | $70 each year |

| West Virginia[63] | $100 | $150 | $25 each year[64] |

| Wisconsin[65] | $130 (online) $170 (paper) | $100+ (online/paper) | Domestic: $25 each year (online/paper) Foreign: $65 (online) $80 (paper) |

| Wyoming[66] | $100 | $150 | At least $60 each year |

|

Unfortunately, there's no way to set up an LLC for free. Whether you do it yourself or hire a service, you still have to pay the filing fee and other costs to form your LLC.

Operating Agreement Fee

Standard Cost: Up to $500+

An operating agreement is a document that details how your company will be run, including its decision-making process and the members' specific roles.

Not all states require LLCs to have one, but it can come in handy, especially when resolving internal conflicts.

If you're unsure how to create an operating agreement, hiring a lawyer or third-party services can be a good idea. They can help you draft an operating agreement for an extra fee.

An LLC formation service, like ZenBusiness, typically charges around $50 to $200,[67] while a lawyer could cost more than $600.

California is one of the few states that require LLCs to have an operating agreement.[68] However, you don't need to file it with the Secretary of State. You just need to keep a copy along with your LLC's important files.

Publication Fee

Standard Cost: Up to $1,000+

Some states also require newly formed LLCs to announce their company's existence in a local publication. But you have to make sure that your chosen publication is part of the state's pre-approved list.

Right now, only 3 states have this requirement: Arizona, Nebraska, and New York. [69][70][71]

| Formation State | How Long It Should Run | When to Publish |

|---|---|---|

| Arizona | 3 consecutive weeks | Within 60 days after approval |

| Nebraska | 3 consecutive weeks | No specified deadline |

| New York | 6 consecutive weeks | Within 120 days after approval |

The exact publishing cost varies from company to company. Depending on the location and requirements (e.g., frequency and run length), it can cost anywhere from $40 to $1,000+.

Aside from the publication costs, you must also pay a separate $50 filing fee in New York to get a Certificate of Publication.

Yes, they are. But the IRS only allows you to deduct a maximum of $5,000 for startup costs not exceeding $50,000. But you can amortize the rest as long as your expenses meet their established criteria.

Annual Ongoing Fees for LLCs

You also have to consider the various annual costs when forming an LLC. Unlike startup fees, which you only pay once, maintenance fees are recurring costs.

Here are the ones you have to remember:

| Annual LLC Fees | Cost |

|---|---|

| Annual Taxes | At least 15.3% (self-employment tax)[72] |

| Annual Report Fee | Up to $3,000 |

| Registered Agent Fee | Up to $399+ |

| Business Licenses and Permits | Up to $1,000+ |

Each of the annual LLC fees is discussed in detail below.

Annual Taxes

Standard Cost: Varies

Like any individual or separate legal entity, LLCs have to pay taxes. But they're unique because they can choose how their income is taxed.

They can choose to file their taxes as sole proprietorships, partnerships, C-corporations, or S-corporations.

Aside from income taxes, LLCs also have to pay the following:

- Payroll taxes (if they have employees)

- Self-employment taxes

- Sales taxes (if they sell any taxable goods or services)

LLC members must pay self-employment taxes on their share of the profits. The current combined self-employment tax rate is 15.3%, with 12.4% going to Social Security and 2.9% to Medicare.[72]

Most states also charge LLCs a separate state income tax. The exceptions are Alaska, Florida, New Hampshire, Nevada, South Dakota, Texas, Tennessee, Wyoming, and Washington.

Some areas, like California and Delaware, also require all LLCs formed in the state to pay a fixed annual franchise tax. This costs $800/yr in California, while it's only $300/yr in Delaware.

Single-member LLCs, also called a "disregarded entity" by the IRS, are taxed as sole proprietorships by default.[73] You have to pay self-employment taxes based on your taxable income.

Annual Report Fee

Standard Cost: Up to $3,000

Most states also require LLCs to file a detailed report of their company's activities with their Secretary of State's office every one to two years.

This is to keep the state's record updated and inform the public of what's happening in the company. It can also give shareholders and interested investors a clearer picture of a company's financial performance in the last year or so.

Depending on where you formed your LLC, the annual report fee can range from $10 to $150 per year. But some areas charge as high as $300 per year.

Note: You might have to pay extra if you want a third party to handle your company's annual report filing.

Filing an annual report with your LLC's formation state is critical to keeping its good standing with the government. Missing the deadline or forgetting to file it can result in penalties for your company. It can also lose its good reputation, affecting your ability to do business in that state.

The exact amount will depend on where you formed your LLC. Annual and renewal fees usually vary from state to state. Most states charge between $50 and $200. New York's annual fees range as high as $4,500, and Tennessee charges as high as $3000. Other states like Texas and Ohio have $0 recurring fees.

Registered Agent Fee

Standard Cost: Up to $399+

All LLCs must have a registered agent on file when they submit their Articles of Organization to their Secretary of State's office.

In fact, you can only proceed with your LLC's formation if you have one.

Registered agents serve as a company's primary point of contact. They're responsible for receiving legal documents like lawsuits and tax notices and forwarding them to the appropriate person in the company.

There are several options available regarding who can be your registered agent. You can act as your own registered agent, assign the role to someone else, or hire a third-party service.

Third-party companies, like Northwest Registered Agent, usually charge an annual fee for registered agent services.

You can learn more about their responsibilities, the requirements, and more in this article.

Some states require a written statement from the appointed agent confirming their willingness to serve in that role. Even if it's not required, it's always best to appoint someone who understands the full responsibility of receiving sensitive legal and tax documents.

Business Licenses and Permits

Standard Cost: Varies

You don't need a license to form an LLC. But depending on your type of business, you may need a license or permit (or both) to operate within the state.

Depending on your industry, you may need federal, state, city, and/or county licenses. It's best to check with your state and local offices about what licenses you need.[74]

For example, a wine shop or a moving company will need a federal license. Restaurants, salons, and house painters typically need state and local licenses.

Applying for a business license or permit can cost anywhere from $25 to $1,000+, depending on your specific industry and location.

You also need to consider the renewal fees, which can cost $20 to $100+ per year.

It makes more sense to form your LLC first because you need to provide your business name and other information when applying for a business license.

Other Fees

When forming an LLC, you mostly only have to worry about the startup and maintenance fees. But there are other expenses you will want to consider, namely:

Business Name Reservation Fee

Part of the requirements of forming an LLC includes having a unique business name. While you don't have to pay anything to register your business name, you need to pay a small fee if you want to reserve it beforehand.

Like the other fees, the exact amount will vary from state to state. But it generally costs around $10 to $50 to reserve a business name.

Note that your reservation will only last a few weeks, typically around 30 to 60 days. Some states allow reservations for up to 180 days, so check beforehand.

You must form your LLC and register your business name before the reservation expires or extend the reservation by paying the fee again.

DBA Name Filing Fee

Getting a DBA can be the best alternative if you can't use your preferred business name or simply want a different name.

A DBA will allow your LLC to operate legally under another business name. It also offers several other benefits, which you can read more about in this article.

Like forming an LLC, you also need to register your DBA name with the state. The filing fees can cost around $5 to $150, depending on your location.

Note that DBA registrations also expire after several years (around five years). After this, you must pay the renewal fee to keep using your DBA name. The exact price will vary from state to state.

- Fictitious Name

- Trade Name

- Assumed Name

Form an LLC: Do It Yourself or Hire Someone?

If you want to form an LLC, you typically can do it in one of two ways: do it yourself or hire a formation service. Both options have their advantages and disadvantages.

Let's take a look at them.

Doing It Yourself

If you choose to do it yourself, the main advantage is you won't have to pay additional costs. You only have to worry about paying the necessary fees (e.g., state filing fee, business license/permit, taxes, etc.).

That's why this option is best if you have a tight budget or want to cut down on unnecessary expenses.

But the main downside is that you have to do everything yourself. Forming an LLC can be a tedious and time-consuming process. This leaves you with little time for other aspects of your business until the process is over.

Aside from that, you also have to keep track of the annual requirements, like:

- Filing your annual reports

- Paying taxes

- Renewing your business licenses/permits

You also must pay close attention to what you include in the documents. All details must be accurate and correct. Even a tiny mistake can cost your business thousands of dollars later to fix.

Hiring a LLC Formation Service

On the other hand, the main upside of hiring a third-party formation service is convenience.

An LLC formation company will handle all aspects of the process, often including filing annual reports and complying with other requirements (e.g., getting an EIN).

Many also offer in-house registered agent services (usually free for the first year). You no longer have to look for or hire a separate service provider.

They also typically have in-house experts who can go over your documents. They can spot and correct any errors before you submit them. Not only will this save you the time and effort needed to understand complex legal terms, but it will also save you money by avoiding penalty fees.

Of course, the main drawback is the cost. You have to pay for their services on top of the filing fees and other expenses related to forming an LLC.

Handling the formation process yourself is the cheapest way to start an LLC. You only have to worry about paying the fees and complying with the requirements. States like Kentucky only charge $40 for the initial fees to start your LLC.[75] On the other hand, states like Massachusetts will charge $500 per LLC.[76]

| DIY vs. Hired Services | ||

|---|---|---|

| DIY | Hired Services | |

| Cost | Low | High |

| Processing time | Slow | Fast |

| Proneness to error | High | Low |

| Difficulty | High | Low |

That said, if you are a first-time entrepreneur, it's recommended to hire an LLC formation service to reduce the risk of making a mistake.

LLC Formation: Start Your LLC for $0 - Just Pay State Fees

- Get step-by-step guidance to form your LLC

- Check business name availability

- LLC formation processing within 14 business days

- Business coaching program (tax, compliance, marketing)

- Invoicing and bookkeeping (30-day trial)

LLC Formation Service Fees

You'll find many LLC formation services online. But only a few enjoy thousands of 5-star customer reviews and a reliable reputation.

Here are the three best LLC formation services for first-time entrepreneurs.

Northwest Registered Agent

LLC Filing Service Fee: $39 + state fees[77]

Northwest has built a solid reputation as one of the country's best LLC services.

Aside from filing your LLC formation documents, Northwest offers the use of its registered agent name and address throughout the Articles of Organization. This adds a layer of privacy because you don't have to put your details on a public record.

One drawback about Northwest is, unlike the alternative below it doesn't offer free formation services.

ZenBusiness

LLC Filing Service Fee: From $0 + State fees

ZenBusiness receives positive reviews because of its easy-to-use platform and wide range of additional LLC services. But perhaps the cherry on top is its free LLC formation services. You only have to pay the state filing fee.

And unlike Northwest, you're not required to pay for a registered agent. It's offered as an a la carte for $199 per year so you only pay for the services you need.[78]

How to Form an LLC

If you want to form an LLC on your own, you usually just need to follow these 5 steps:

- Select a business name

Your business name should be unique and follow your formation state's naming guidelines. For example, it shouldn't contain obscene words or promote illegal activities.You can check your state's online business name database to see if it's available. Reserving it is also possible if you aren't ready to register it yet.

- Assign a registered agent

Again, you can only form an LLC if you have a registered agent. Make sure you have one listed before you file your Articles of Organization with the state. - Draft your operating agreement

Not all states require businesses to include this when filing their formation documents. But creating one is still a good idea, especially for potential internal conflicts. - File your Articles of Organization

Filing these with your Secretary of State's office will start the formation process. Make sure all the listed information is correct and accurate. During this step, you also have to pay the state filing fees. - Comply with the other requirements

Once your LLC registration has been approved, you must comply with the other requirements before doing business. Some examples include getting your business license/permit and EIN (employer identification number).

What the Experts Say

CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

Forming an LLC can be the next best step for your growing business. It'll give you liability protection without sacrificing flexibility and simplicity.

But even though it's not as expensive as forming a corporation, turning your business into an LLC will still cost you money.

If you've come this far, though, you're now aware of the various fees involved before you take this next step for your business. This should help make the entire process as smooth and seamless as possible, so you can get back to focusing on your customers.

References

- ^ Alabama Secretary of State. Fee Schedule, Retrieved 02/18/2024

- ^ State of Alaska. Forms by Entity Type, Retrieved 02/18/2024

- ^ Arizona Corporation Commission. Schedule of Fees Limited Liability Companies, Retrieved 02/18/2024

- ^ Arkansas Secretary of State. Domestic Limited Liability Company, Retrieved 02/18/2024

- ^ Arkansas Secretary of State. Foreign Limited Liability Company, Retrieved 02/18/2024

- ^ Arkansas Secretary of State. Franchise Tax / Annual Report Forms, Retrieved 02/18/2024

- ^ California Secretary of State. Business Entities Fee Schedule, Retrieved 02/18/2024

- ^ Colorado Secretary of State. Business FAQs: Q2. Can anyone be a registered agent?, Retrieved 02/18/2024

- ^ CT.GOV. Forms and Fees, Retrieved 02/18/2024

- ^ Delaware.gov. Corporate Fee Schedule, Retrieved 02/18/2024

- ^ Delaware.gov. LLC/LP/GP Franchise Tax Instructions, Retrieved 02/18/2024

- ^ DLCP. Corporations Division Fees - Limited Liability Company, Retrieved 02/18/2024

- ^ Florida Department of State. Limited Liability Company Fees, Retrieved 02/18/2024

- ^ Georgia Secretary of State. Corporations Division Filing Fees Schedule, Retrieved 02/18/2024

- ^ DCCA Hawaii. Domestic Limited Liability Company Fees, Retrieved 02/18/2024

- ^ DCCA Hawaii. Foreign Limited Liability Company Fees, Retrieved 02/18/2024

- ^ Idaho Secretary of State. Business Forms, Retrieved 02/18/2024

- ^ The Office of the Illinois Secretary of State. Limited Liability Company Publications/Forms, Retrieved 02/18/2024

- ^ Indiana Secretary of State Diego Morales. Fee Calculator, Retrieved 02/18/2024

- ^ Iowa Secretary of State. Business Entity Forms and Fees, Retrieved 02/18/2024

- ^ Kansas Secretary of State. Register a Business, Retrieved 02/18/2024

- ^ Kansas Secretary of State. Instructions for Filing an Information Report, Retrieved 03/24/2024

- ^ Office of the Kentucky Secretary of State. Business Filings Fees, Retrieved 02/18/2024

- ^ Louisiana Secretary of State. Get Forms & Fee Schedule, Retrieved 02/18/2024

- ^ Maine.gov. Limited Liability Companies, Retrieved 02/18/2024

- ^ Maryland.gov. Fee Schedule, Retrieved 02/18/2024

- ^ Massachusetts Secretary of State. Corporations Division Filing Fees, Retrieved 02/18/2024

- ^ Michigan Department of Licensing and Regulatory Affairs. Filing Fees, Retrieved 02/18/2024

- ^ Office of the Minnesota Secretary of State. Business Filing & Certification Fee Schedule, Retrieved 02/18/2024

- ^ Mississippi Secretary of State. Business Documents Filing Fees, Retrieved 02/18/2024

- ^ Missouri Secretary of State. Schedule of Fees and Charges, Retrieved 02/18/2024

- ^ Montana Secretary of State. Business Services Filing Fees, Retrieved 02/18/2024

- ^ Nebraska Secretary of State. Forms and Fee Information, Retrieved 02/18/2024

- ^ Nebraska Legislature. Nebraska Revised Statute 21-192, Retrieved 02/18/2024

- ^ Nevada Secretary of State. Forms & Fees, Retrieved 02/18/2024

- ^ New Hampshire Secretary of State. Domestic and Foreign Limited Liability Company, Retrieved 02/18/2024

- ^ State of New Jersey Department of the Treasury. Registry Fee Schedules, Retrieved 02/18/2024

- ^ New Mexico Secretary of State. Domestic NM LLC, Retrieved 02/18/2024

- ^ New Mexico Secretary of State. Foreign Limited Liability Company, Retrieved 02/18/2024

- ^ New York Department of State. Fee Schedules, Retrieved 02/18/2024

- ^ North Carolina Department of the Secretary of State. Business Registration Fees - Limited Liability Companies, Retrieved 02/18/2024

- ^ North Carolina Department of the Secretary of State. Register a Foreign Business Requirements, Retrieved 02/18/2024

- ^ North Carolina Department of the Secretary of State. Annual Report Due Dates, Retrieved 02/18/2024

- ^ North Dakota Secretary of State. LLC Fees, Retrieved 02/18/2024

- ^ Ohio Secretary of State. Filing Forms & Fee Schedule, Retrieved 02/18/2024

- ^ Oklahoma Secretary of State. Business Forms, Retrieved 02/18/2024

- ^ Oregon Secretary of State. Business Registry Fee Schedule, Retrieved 02/18/2024

- ^ Pennsylvania Department of State. Fees and Payments, Retrieved 02/18/2024

- ^ Rhode Island Department of State. Costs & Fees, Retrieved 02/18/2024

- ^ Rhode Island Department of State. Foreign Business Costs & Fees, Retrieved 02/18/2024

- ^ South Carolina Secretary of State. Downloadable Paper Forms, Retrieved 02/18/2024

- ^ South Dakota Secretary of State. Filing Fees, Retrieved 02/18/2024

- ^ Tennessee Secretary of State. Business Forms & Fees, Retrieved 02/18/2024

- ^ Tennessee Secretary of State. FAQ: Limited Liability Companies, Retrieved 02/18/2024

- ^ Texas Secretary of State. Business Filings & Trademarks Fee Schedule, Retrieved 02/18/2024

- ^ Utah Division of Corporations & Commercial Code. Fee Schedule, Retrieved 02/18/2024

- ^ Vermont Secretary of State. Fees, Retrieved 02/18/2024

- ^ Virginia State Corporation Commission. Forms and Fees, Retrieved 02/18/2024

- ^ Virginia State Corporation Commission. Annual Reports: How much does it cost to file an Annual Report?, Retrieved 02/18/2024

- ^ Virginia State Corporation Commission. Annual Registration Fees, Retrieved 02/18/2024

- ^ Washington Secretary of State. Download Forms / Online Filing Instructions, Retrieved 02/18/2024

- ^ Washington Secretary of State. Limited Liability Companies (LLC), Online and Paper Registrations, Retrieved 02/18/2024

- ^ West Virginia Secretary of State. Fee Schedule for Services and Registration, Retrieved 02/18/2024

- ^ WV One Stop Business Portal. Annual Reporting, Retrieved 02/18/2024

- ^ State of Wisconsin Department of Financial Institutions. Corporation Fees: Limited Liability Company, Retrieved 02/18/2024

- ^ Wyoming Secretary of State. Business Division Filing Fee Schedule, Retrieved 02/18/2024

- ^ ZenBusiness. Operating Agreement, Retrieved 03/05/2024

- ^ California Secretary of State. Starting a Business - Entity Types, Retrieved 03/01/2024

- ^ Arizona State Legislature. Arizona Revised Statutes 29-3201, Retrieved 03/05/2024

- ^ Nebraska Legislature. Nebraska Revised Statute 21-193, Retrieved 03/05/2024

- ^ The New York State Senate. Section 206 Affidavits of publication, Retrieved 03/05/2024

- ^ IRS. Self-Employment Tax (Social Security and Medicare Taxes), Retrieved 03/01/2024

- ^ Internal Revenue Service. Single Member Limited Liability Companies, Retrieved 03/05/2024

- ^ U.S. Small Business Administration. Apply for licenses and permits, Retrieved 03/05/2024

- ^ Office of the Kentucky Secretary of State. Business Filings Fees, Retrieved 03/05/2024

- ^ Massachusetts Secretary of State. Corporations: Limited Liability Company Information, Retrieved 03/05/2024

- ^ Northwest Registered Agent. LLC FAQ: How much does it cost to start an LLC?, Retrieved 03/05/2024

- ^ ZenBusiness. Compare LLC Packages, Retrieved 03/05/2024

Write to Alyssa Supetran at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|