Rakuten Review

Rakuten offers cash back and coupons for your everyday purchases. But is it actually legit? Learn more about the benefits and downsides of Rakuten.

Overall Score | 4.2 | ||

Average Savings | 4.5 | ||

Coupon Codes | 3.0 | ||

Ease of Use | 5.0 | ||

Privacy Policy | 3.5 | ||

Rewards | 5.0 | ||

Pros and Cons

- Free to use

- Get paid in cash, not gift cards

- Many ways to earn

- Pays out quarterly

- Limited coupons

- Collects personal data

Bottom Line

Good cash-back tool for online shoppers

Between coupon-clipping and constant price checking, saving money can be a lot of work.

That's why a lot of people just overpay rather than find the best deals.

But sites like Rakuten make it easier to save money. By offering quarterly cash back and free coupons, Rakuten makes it easy to get a deal.

Find out if Rakuten is safe to use, and if it's really worth it for you.

What is Rakuten?

Rakuten, formerly known as Ebates, is a cash-back website that rewards you for shopping through their site. It's also available as a browser extension.

When you buy stuff through Rakuten, you'll get a percentage of your purchase in cash back. This is paid back to you quarterly (more on this later). Customers can earn between 1% and 40% at over 2,500 online stores like Nike, Walmart, Target, Best Buy, and more.

|

Rakuten has more than 15 million members across the U.S. In total, members have earned over $2 billion in cash back.

Rakuten Pros and Cons

|

Interested in scoring deals and saving money? Review these quick pros and cons before signing up with Rakuten.

Pros

- Free to use

- Lots of bonuses to earn more

- Easy way to save money online

- Get paid in cash, not gift cards

- Great for purchases you were already going to make

Cons

- Collects personal data

- More complicated to save in-store

- Infrequent payouts

- Deals can encourage you to spend more than you would normally

How does Rakuten Work?

Still confused about how Rakuten works? Find out the smart way the company makes money with its free cash-back program.

How Rakuten Makes Money

Any site that offers you free money can seem a little suspicious. What's the catch?

The truth is that Rakuten is an affiliate marketing site. It makes money by partnering with retailers. Every time you make a purchase through Rakuten, these partners pay Rakuten a commission.

Rakuten shares part of that commission with its users in the form of cash back. It keeps customers coming back to the site, and helps them earn more commissions in the long run.

All you have to do to get cash back is shop through their links. This lets the partner stores know you're coming from Rakuten.

Security: Is Rakuten Safe?

Like other sites that help you save money on purchases, Rakuten collects some of your data. This includes info like your shopping behavior and other personal behavior.

Because they collect your data, it's important that the company takes privacy seriously. Rakuten won't sell information, and you won't get junk mail from random companies if you set up an account.

Rakuten uses encryption and other security measures to protect your information. Plus, they regularly evaluate their measures to make sure they're all in working order.

Overall, Rakuten is a legit company that takes security seriously. Before you sign up for any account, it's always a good idea to look at their privacy policy. That way, you'll be able to make an informed decision when you do decide to join.

Rakuten Features

Rakuten offers a few different ways for you to earn and save money. Check out how each of them works below.

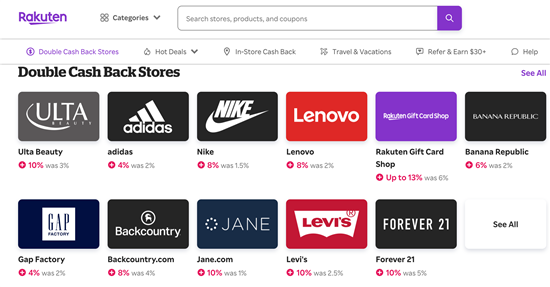

1. Cash-Back Rewards

The main way Rakuten helps you save is through its cash-back rewards. To start earning, you can head over to their website and search for the store you want to shop at. If Rakuten has a cash-back offer, it'll show you how much you can earn.

|

Triple cash-back stores will earn you more than usual. But you can search for any store to see what the current offers are. Some stores will also have coupon codes you can use when you check out.

Once you've racked up more than $5 in cash-back rewards, you can cash out. Up next, learn more about how you'll actually receive your cash rewards.

2. Cash-Back Payouts

If you're hoping to cash out whenever you want, you're out of luck. Rakuten only pays out cash-back rewards once every quarter. Here's their payment schedule according to their website:[1]

| Purchases Made Between | Payment Sent |

|---|---|

| January 1 - March 31 | May 15 |

| April 1 - June 30 | August 15 |

| July 1 - September 30 | November 15 |

| October 1 - December 31 | February 15 |

If you don't hit the more than $5 minimum to cash out by the end of the quarter, your cash back will just roll over to the next quarter so you can keep earning.

Rakuten offers payments by check or PayPal. You even have the option to donate some of your check to nonprofits Rakuten has partnered with.

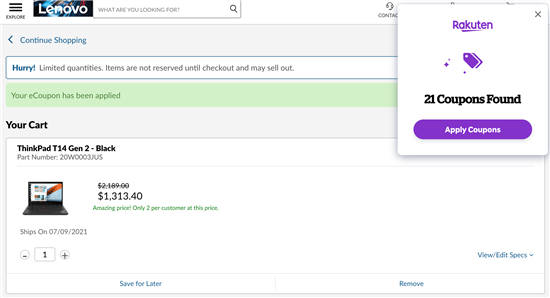

3. Rakuten Browser Extension

Rakuten's browser extension, called the Cash Back Button, offers the same features as the website.

Instead of having to make purchases through Rakuten's website, you can just shop on any site as you would normally. A little pop-up will appear whenever you reach a site that's eligible for rewards.

|

From there, you can activate cash back and try any coupons Rakuten might have. The extension will automatically apply the promo code that saves you the most money. It's a nice choice if you don't want to go through the extra step of visiting the Rakuten website.

4. In-Store Shopping

Although Rakuten is mainly known for their online savings, you can also earn when you shop in person.

To do this, you need to link a credit card to your Rakuten account. Then, you link offers to your card before you hit the shops.

You'll earn your cash back when you use your linked card to pay at the store. Each linked offer works only once per purchase. You have to relink an offer if you want to make another purchase.[2]

This multistep process isn't as convenient as Rakuten's online shopping experience. But it's a good option if you prefer to make most of your purchases in person.

Other Ways to Earn With Rakuten

Welcome Bonus

You can get a $10 bonus when you sign up for Rakuten. All you need to do is spend at least $25 on any partner store that offers cash back within 90 days of becoming a member. This works with both online and in store purchases.[3]

Refer-A-Friend Bonus

With the referral program, you have a unique sign-up link that you can share with your friends. When a friend signs up with your link and spends $30 through Rakuten, you'll get a $30 bonus too. Plus, there's no limit to how many people you can refer. The more, the merrier!

The bonus changes from time to time, so check their website for the latest offer.

Who Should Use Rakuten

If you do any sort of online shopping, Rakuten can be a great way to help you save. The cash back you earn is a nice bonus for purchases you already plan to make.

But good deals can be a slippery slope. You might fall into the trap of buying more than you intended since you know you'll get cash back for it anyway. As long as you're able to resist this temptation, Rakuten could save you a decent amount in the long run.

Rakuten doesn't work as seamlessly in person as it does online. If you only shop in-store and value convenience more than savings, it might not be right for you. The effort it takes to get cash back in person could be more than it's worth.

For most shoppers, though, Rakuten is a great way to earn rewards.

How to Get Started With Rakuten

Joining Rakuten is easy. Just visit their website and click "Join Now" to make an account. All you need to do is just sign in using any of these accounts:[4]

- Google

- Facebook

- Apple

- Email address and password

The browser extension is also simple to download. It's available on Chrome, Safari, Firefox, and Edge. If you've already created an account on their site, you won't need to sign up again for the extension.

And that's it! You're ready to start earning.

Top 3 Rakuten Alternatives

Looking for a different way to save? Check out how these Rakuten competitors stack up.

- Capital One Shopping

Capital One Shopping is a browser extension that offers coupons, shopping rewards, and price comparisons across different stores. It also offers local deals that you can use in-store, but its main focus is on online shopping.In our experience, Capital One Shopping seems to have access to more coupons and offers compatibility with more stores than Rakuten. The Capital One Shopping extension automatically applies coupons when you check out across thousands of sites, so it's a great option.

- PayPal Honey

PayPal Honey is another browser extension that works much like Capital One Shopping. PayPal Honey offers coupons, checks for lower prices, and has a cash-back rewards program called PayPal Rewards.PayPal Honey can be a great tool for Amazon shoppers, especially. It compares prices against all Amazon sellers to look for the best deal. It also has a handy price history tool that shows you the price of an item in the past 6 months.

Generally, PayPal Honey has lower rewards rates than Rakuten. But if you're looking for an extension that has more coupons, it's a solid choice.

- RetailMeNot

RetailMeNot is better known as a coupon site rather than a cash-back site. But it actually offers both.You don't have to download their browser extension to use their offers. But it does save a lot of time to not have to manually try all of the codes yourself. The plugin will automatically activate your cash back rewards and apply the coupon that saves you the most.

RetailMeNot doesn't have other features like price tracking or price comparisons.

Bottom Line

Rakuten works whether you shop online or in-store, although it's more convenient for online shoppers.

It's a good way to save on purchases you were going to make already. Just make sure you don't end up spending more than you had planned just because it seems like a great deal. When used correctly, Rakuten can be a great money-saving tool.

As always, before you download any app or sign up for anything, take a little time to understand their privacy policy. It'll help you make an educated decision about which companies you want to share your data with.

References

- ^ Rakuten. Getting Your Rakuten Cash Back Payments, Retrieved 2/20/2022

- ^ Rakuten. How In-Store Cash Back Works, Retrieved 2/20/2022

- ^ Rakuten. Rakuten Welcome Bonus Terms, Retrieved 2/20/2022

- ^ Rakuten. How to Join Rakuten, Retrieved 2/20/2022

Get Money Back When You Shop Online

- Free to join, free to use.

- Members earn on average $450 cash back a year

- Get paid directly to your bank account, PayPal, or Gift Cards.

Donna Tang is a content associate at CreditDonkey, a personal finance comparison and reviews website. Write to Donna Tang at donna.tang@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|