Best Debit Cards for Kids

Top debit cards for kids. Teach your child money matters and enjoy benefits only parents can get.

|

Here are the top 9 debit card for kids:

- Greenlight for investing

- BusyKid for young kids

- Acorns Early for educational content

- Capital One MONEY Teen Checking for teens

- Alliant Teen Checking to earn interest

- Chase First Banking for Chase customers

- Step Banking for Teens to build credit

- Jassby Virtual Debit Card for rewards

- FamZoo for teaching interest

Acorns Early Kids' Debit Card

- Real-time spend notifications.

- Block and unblock cards easily.

- Teach financial independence safely.

Step Visa Card for Teens

- Building credit is safe and easy with the Step secured Visa card

- Step Black members earn 3.00% on savings and up to 10% cashback on purchases

- No interest, no security deposit and no credit check

As kids grow up, it's important for them to have good financial habits.

With these cards, they'll learn the importance of money management, saving money, and giving back.

Below, review the best debit cards for kids based on these factors:

- Low fees

- Great parental controls

- Data security

- Attractive card design options

- App technology

Laws vary from state to state, but signing any contract under 18 is complicated. To get around this, parents can give their kids and teens experience with banking via prepaid cards or by opening a joint checking account[1] (more on this below).

For the best picks, check out the following table. Then, get an in-depth comparison of each debit card below for more details.

| Debit Card | Monthly Fee | Interest Paid | Notable Features |

|---|---|---|---|

| Greenlight | Starts at $5.99/month | 2%-6% Savings Reward | Kid-friendly investing |

| BusyKid | $4 per month (billed annually at $48) | None | Kid-friendly investing |

| Acorns Early | $5/Child; $10/Family | None | Customizable debit card |

| Capital One Money Teen Checking | None | 0.10% APY | Blacklist retailers |

| Alliant Teen Checking | None | 0.25% APY | ATM access |

| Chase First Banking | None | None | Financial education tools |

| Step Banking for Teens | None | None | Allows kids to build credit |

| Jassby | $5.95/month | None | Rewards program |

| FamZoo | $5.99/month | Custom rate paid by parents | No withdrawal fees |

9 Best Debit Cards for Kids

|

Review the debit cards and apps below to pick the right fit for your child. Consider which features you want to prioritize (financial literacy, chore management, etc.) and any fees involved.

The KIDS CARD rule helps parents remember the key aspects to consider when choosing a debit card for their kids:

- Knowledge: Look for cards that offer educational tools to teach kids about money management.

- Independence: Ensure the card allows kids some financial independence while still being monitored.

- Daily limits: Set daily spending limits to manage and control spending.

- Security: Choose a card with strong security features to protect your child's information.

- Control: Ensure parents can control and monitor the card's usage.

- Accessibility: Make sure the card is easy to use for both kids and parents.

- Rewards: Look for cards that offer rewards or savings opportunities.

- Education: The card should provide resources to educate kids about budgeting and saving.

Greenlight: Best for Investing

Greenlight offers a prepaid debit card for kids and parents. Using Greenlight, parents can instantly transfer funds to kids, manage their chores checklist and automate their allowance.

Where Greenlight stands out is their Max, Infinity, and Family Shield plans, which are the upgraded version of their basic prepaid debit plan.

Greenlight Max, Infinity, and Family Shield open a connected brokerage account for kids and parents where they can buy and sell real stocks and ETFs on the stock market.

Of course, parental approval is required for every trade.

Greenlight Pros + Cons

|

|

Fees[2]

- Greenlight Core: $5.99 per month

- Greenlight Max: $10.98 per month

- Greenlight Infinity: $15.98 per month

- Greenlight Family Shield: $24.98 per month

Features

- Custom prepaid debit card

- Deposits for chores and allowance setting

- Spending and savings accounts

- Charity donations

- Stock investing for beginners

Got young kids eager to learn about money? This next card is designed just for them.

BusyKid: Best for Young Kids

|

BusyKid, a prepaid card and chores app, is a great option for parents of younger kids. This app has it all — and for a very affordable price tag compared to its top competitors.

Parents can set an automated allowance for their kid, assign chores and payments for each completed chore, and can choose from 10 attractive card designs.

One great thing about BusyKid is that it offers kid-friendly investment features at no additional cost.

Kids can look at stocks inside an easy-to-navigate tile format with full-color logos of each company — instead of the usual block of text and statistics found on adult investing apps like Robinhood.

BusyKid Pros + Cons

|

|

Fees[3]

$4 per month (billed annually at $48)

Features

- Custom debit card

- Deposits for chores and allowance

- Kid-friendly investing education tools

Yes. Deposits into your BusyKid account are handled by MVB Bank, Inc., which is confirmed to be FDIC insured here.

Seeking a card with educational content for your child? The following option is worth exploring.

Acorns Early: Best for Educational Content

Acorns Early (formerly GoHenry) is a fun prepaid card option geared towards kids ages 6-18. They offer a 30-day free trial.

Parents can set custom weekly spending limits, single-purchase spending limits, and ATM withdrawal limits for the account. Acorns Early also has similar chores and allowance features as BusyKid.

The Acorns Early debit card shines for its custom card designs, including a custom logo using your child's name.

Acorns Early Pros + Cons

|

|

Fees

$5/mo per kid; $10/mo per family (up to 4 kids)[4]

Features

- Personalized debit cards ($5)

- Weekly and per-purchase spend limits

- ATM withdrawal limits

- Payments for chores and allowance

Acorns Early Kids' Debit Card

- Real-time spend notifications.

- Block and unblock cards easily.

- Teach financial independence safely.

For teens ready for more financial independence, here's a checking account that stands out.

Capital One MONEY Teen Checking: Best for Teens

Capital One's MONEY Teen Checking is a joint checking account for older kids and teenagers.

With Capital One MONEY, your teen can get APY on all balances, a free debit card that can be used at a large network of over 70,000 ATMs, and parents don't even need to have a Capital One account; any bank can be used for funding.

Capital One Teen Checking Pros + Cons

|

|

Fees

No monthly fee

Features

- $500 daily purchase/ATM withdrawal limits

- No monthly fee or minimum balance requirement

- Automatic blacklist of kid-unfriendly retailers (prescription drug sites, bars, nightclubs, and tobacco/cigar stores)

For interest-earning potential in a teen account, check out what this next option offers.

Alliant Teen Checking: Best to Earn Interest

Alliant Teen Checking is a joint checking account for teens 13 to 17. The parent or guardian must be an Alliant Credit Union member.

If you meet these qualifications, Alliant offers the best APY of any of the options on this list. Accounts earn 0.25% APY, and you have the option to open a Kids Savings Account, which carries an impressive 3.01% APY on savings balances.

With a free Alliant debit card, teens have access to a nationwide network of over 80,000 credit union network ATMs. The parent is responsible for setting ATM withdrawal and spending limits for their child.

Alliant Teen Checking Pros + Cons

|

|

Fees[5]

No monthly fee

Features

- Debit card

- 0.25% APY[6]

- Option to open savings account with 3.01% APY

- Parental spending limits

- ATM withdrawal limits

Already a Chase customer? Their tailored option for kids could be a perfect fit.

Chase First Banking: Best for Chase Customers

If you're a Chase checking account holder and your child is between 6 and 17, you can open up a Chase First Banking account for your kid(s).

Parents can set limits on where and how much kids can spend money using their free debit card. Kids can easily manage money and keep track of how much they're spending.

To withdraw cash from your checking account with no fees, just visit any of the 15,000 Chase ATMs.

Chase First Banking Pros + Cons

|

|

Fees

No monthly fee

Features

- Debit card

- Financial education tools

- Deposits for chores and allowance

- Teens can send money requests to parent

- Parents can limit where teens spend money

- Account alerts

- Spending limits, ATM limits

Want to help your teen build credit early? This next card is designed just for that.

Step Banking for Teens: Best to Build Credit

For no monthly fee, Step offers an interesting product that is great for helping teens aged 13 to 17 build a positive credit history.

With the Smart Pay feature, teens can build good credit without the potential to overdraw their accounts and negatively impact their score.

However, because the Step card acts like a credit card, ATM withdrawals are considered "cash advances," which may trigger fees or interest charges.

Teens can connect their card to Google Pay and Apple Pay for contactless payments.

Step Banking Pros + Cons

|

|

Fees

No monthly fee

Features

- Customizable card

- Secure way to help teens to build credit

- Ability to send and receive money to family or friends

- Link Step account to other apps and cards

Step Visa Card for Teens

- Building credit is safe and easy with the Step secured Visa card

- Step Black members earn 3.00% on savings and up to 10% cashback on purchases

- No interest, no security deposit and no credit check

Interested in a card that offers rewards for kids? This next one has a unique approach.

Jassby Virtual Debit Card: Best for Rewards

Jassby is a debit card and an app that lets kids and teens earn rewards. Your kid can redeem rewards on the Jassby shop for gift cards and products. The Jassby debit card can be used online and in-store anywhere Mastercard is accepted.

You can choose between a digital and physical card or both. The card is a little less versatile than some competitors since there's no ATM access for cash withdrawals or deposits. But if you want a card with the ability to earn rewards, Jassby is a solid choice.

Jassby Pros + Cons

|

|

Fees[7]

$5.95 per month

Features

- Digital and physical debit card

- Earn points to redeem gift cards and products

- Full parental control and spending limits

- Manage chores and allowance

Looking for a card that teaches about interest in a practical way? Here's one that does it creatively.

FamZoo: Best for Teaching Interest

FamZoo offers another prepaid debit card option for kids that costs $5.99 monthly with the option to pay in advance for a discount. The least expensive option is the 24-month plan, which costs $59.99.

Because FamZoo is a prepaid card, it doesn't pay any interest on balances.

However, it does offer a fun "parent paid interest" feature that allows parents to set an interest rate and payment frequency (such as weekly or monthly). The interest is withdrawn from the funding account and deposited into the child's account.

FamZoo does not belong to an ATM network, but they will not charge an additional fee for ATM withdrawals on top of the operator's fee.

FamZoo Pros + Cons

|

|

Fees[8]

$5.99/monthly fee

Features

- Comprehensive financial literacy tools

- Parents can set up a custom interest rate

- Lots of customizable alerts

No, FamZoo does not report to any major credit reporting agencies, so it will have no impact on your credit score or your child's credit history (positive or negative).

For a more detailed look at how FamZoo compares to Greenlight and Acorns Early, read our comprehensive review of Greenlight vs Acorns Early vs FamZoo.

Why Get a Debit Card for Kids?

Opening a checking account or prepaid debit card for your child is a big first step. It's a financial rite of passage that helps kids feel more confident with money.

Here are a few important lessons your kid can learn with a debit card:

- Money management. With their own checking account, kids get hands-on experience with depositing and spending money. Once your kid gets their first job, a checking account makes it much easier to handle paychecks. Plus, it's easier to keep track of transactions compared to using cash.

- Financial responsibility. A debit card reduces the risk of spending more than you have. Kids can only spend the amount that's currently in their account. Getting in the habit of not spending above your means is good training for future credit card use.

- Savings goals. Many prepaid debit cards and checking accounts for kids allow kids to set their own savings goals. This encourages kids to set aside money instead of designating all of it for spending.

If you don't want to spend extra money on fees while teaching your kids how to save money, here are free debit cards for kids.

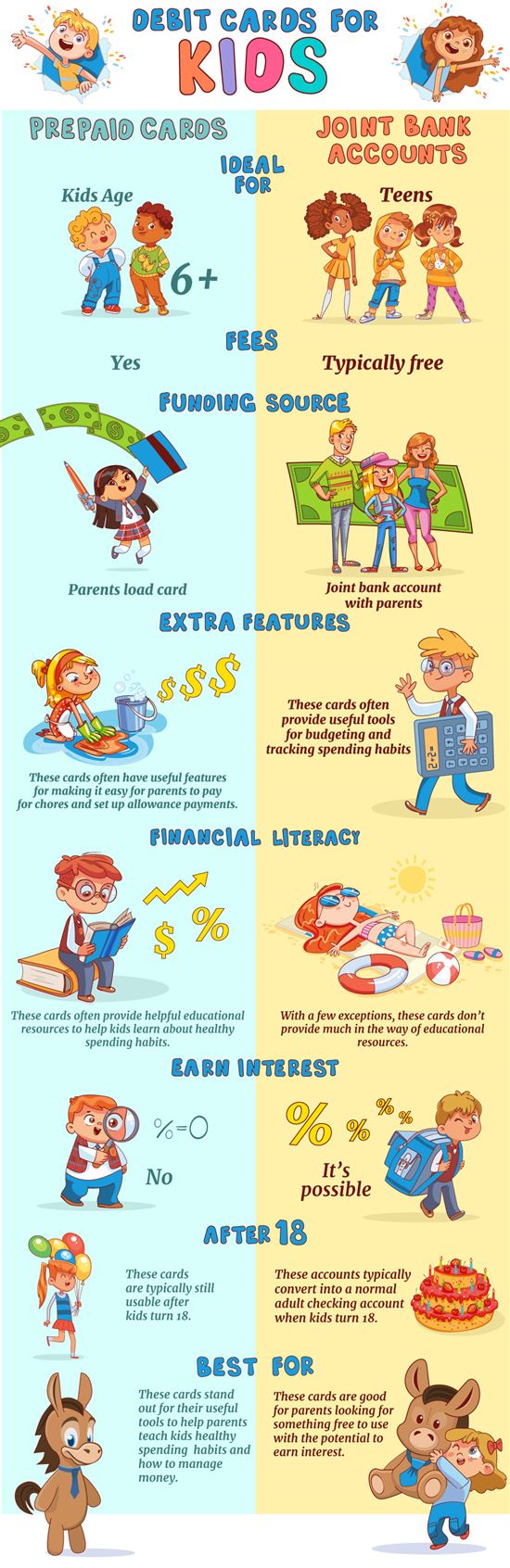

Checking Accounts vs. Prepaid Debit Cards

If you're looking for a debit card for your child, you actually have two different options. One is to go with a checking account that comes with a debit card. The other is to opt for a prepaid debit card.

You can open a joint checking account at a bank like Chase or Capital One. The age limit for a checking account is typically 13 years old, but there are some exceptions. Chase First Banking, for example, is open to children as young as 6.

In general, if you're looking for a card for a child under 13 you'll have to go with a prepaid debit card. These are typically offered by fin-tech companies that partner with a bank. Companies like BusyKid, Copper, and Acorns Early fall under this category.

Practically, the differences are pretty minimal. The main difference is that you have to load a prepaid debit card before you use it. A debit card that's linked to a checking account simply pulls money from the account. You don't have to load the card before use.

How to Choose the Best Debit Card for Kids

When it comes to your child's first debit card, parents have two options: kids' prepaid cards and joint bank accounts.

Kids' prepaid cards usually come with a monthly or annual fee, but will offer a lot of features focused on financial literacy, along with chores and allowance features. Another perk of prepaid cards is that they cannot be overdrawn, so kids and parents can avoid overdraft fees.

With a prepaid card, the parent acts as the banker while the child acts as the account owner.

Joint bank accounts often don't have a monthly fee and may even pay interest on balances. However, the financial education features and allowance features are usually lacking. These accounts can also be overdrawn and often come with steep overdraft penalties.

When you're trying to make a final choice, here are a number of questions you should keep in mind:

- Does it have a monthly fee?

- Does it offer interest payments?

- Can parents set spending limits and restrictions?

- Does it provide spending notifications?

- Does it support regular allowances?

- Does it offer ATM access?

- Does it help build credit?

- Does it have educational options?

|

Pros and Cons of a Kids' Debit Card

Deciding whether or not to get your kids a debit card is an important choice, and before you decide for or against it, you should consider both the benefits and the potential costs. Here are the pros and cons of getting your kids their own debit cards.

Pros

- Learn to budget: By giving kids access to regular allowances and limited funds, parents can teach them budgeting skills that will last a lifetime.

- Safer than cash: Carrying a debit card that can be canceled is safer than carrying around cash, especially when kids are planning large purchases.

- Secure: Most of these cards come with security features that protect them in case the card is lost or stolen, and parents often have the ability to confirm or deny transactions.

- Parental controls: Knowing how your kids spend their money can provide peace of mind as a parent, so you can be sure they aren't going out and buying things that are unwelcome in your home.

- Bill sharing: By sharing the load of recurring payments such as cellphone bills, kids will get a better idea of just where adults' money is going, and they'll realize that many of the products and services they take for granted aren't free.

- Parental loans: When kids want to make large purchases, parents have the option of setting up loans through some of the apps, allowing them to teach kids about credit and responsible repayment.

- Build an emergency fund: Having access to an emergency fund is both a great tool for parents and a powerful life lesson that will serve kids well into adulthood.

- Open a retirement account: For kids who are working, these cards can make it possible to set up retirement and other savings accounts to put money away for the long term.

Cons

- Easy spending: Having a loaded card in their pocket may make kids tempted to spend more. This can be avoided by separating savings and spending money, or setting up parental controls.

- Fees: There may be fees associated with the cards. These include monthly or annual fees, ATM fees for withdrawing cash, and reloading fees charged when parents put money on the cards.

- Other expenses: Some of the cards may incur other expenses, such as account fees for custodial and investing services.

Are Kids' Debit Cards Safe?

Obviously safety is a major concern for every parent, regardless of the topic, and that's as true for kids' debit cards as it is for anything else. In order to alleviate your worries, here are some reasons you ought to rest assured you're safe trusting a debit card to your kids.

- FDIC Insurance: FDIC Insurance means that your kids debit cards are insured for up to $250,000 in case the partnering bank fails. That means they're a safe place to put your money.

- COPPA Compliance: If you're worried about the collection and disclosure of your kids personal data, know that COPPA (the Children's Online Privacy Protection Act) requires providers to disclose to parents what data is being collected, and try to ensure confidentiality and security; they can however share it with third parties.

- Parental Controls: A range of parental controls offer protection against unwanted purchases, overspending, and more. Parents can control which businesses their kids aren't allowed to shop at, and lock the cards remotely if necessary. Many also allow for the confirmation or denial of individual purchases.

- Security Features: Some of the cards go the extra distance to protect against identity theft, fraudulent transactions if the card is lost or stolen, purchasing protection, and more.

- Budgeting Tools: By separating the accounts used for saving and those used for spending, parents can worry less that their kids are going to run through their emergency fund on frivolous purchases.

- Virtual Cards: Virtual cards protect cardholders in the event of a hack in which the card info is exposed. These are easy to create for one-time uses when shopping online.

7 Tips for Teaching Kids About Personal Finance

- Discuss the value of money: Teach responsibility by introducing your kids to the relationship between work and compensation.

Read more: Best Online Jobs for Teens

- Emphasize saving: Introduce the idea of savings by having your child save up for a video game console or amusement park trip they want.

- Introduce them to credit: Allow them to borrow money with the promise to pay it back later to teach them how credit works.

- Talk about wants vs. needs: For example, they need sneakers for gym, but might want to buy the latest Nikes. Teach them how to distinguish needs and wants (and when it's ok to buy a "want").

- Discuss money often: Be consistent about discussing money and be open to answering any questions they have. This will help them be fiscally responsible later in life.

- Offer incentives for savings: Similar to employer-matching retirement contributions, offer to pay your child a small "bonus" for achieving savings goals.

- Be a good example: Kids mirror their parents' behavior, especially at a young age. Be a good example by spending within your limits and saving for the future.

What Experts Say

Having the money talk with your kid is hard. But you don't have to go it alone.

CreditDonkey asked a panel of experts about teaching kids money management skills from a young age. Here's what they had to say:

Bottom Line

Teaching kids and teens about financial literacy has never been more important — with a vast majority of young adults today (76%) lacking even a basic understanding of financial concepts (Source: PWC).

Teaching your children about finances, good spending and savings habits, and investing can help set them up for future success, alleviate stress, and generally improve their quality of life.

Any of the 9 options above provide great tools and resources to help your children succeed, but our top three choices would have to be Greenlight, BusyKid, and Acorns Early.

Acorns Early Kids' Debit Card

- Real-time spend notifications.

- Block and unblock cards easily.

- Teach financial independence safely.

Chase High School Checking℠ - $125 Bonus

- Your teen gets $125 when you open a new Chase High School Checking℠ account together with qualifying activities within 60 days of coupon enrollment

- As a co-owner of the account, you must be present at account opening.

- $0 Monthly Service Fee

- Help your teen build good money habits with their own debit card. Plus, they can add their debit card to their digital wallet.

- With Zelle®, pay and get paid back from friends and family who have an eligible account at a participating U.S. bank. No fees and no waiting for days for money to hit their account.

- You and your teen can stay on top of their account activity by choosing which Account Alerts you both want to sign up for — such as low balance, posted payments, and more.

- Chase makes it easy for your teen to access their money from anywhere with the Chase Mobile® app, plus thousands of ATMs and branches.

- JPMorgan Chase Bank, N.A. Member FDIC

Additional Resources

References

- ^ Office of the Comptroller of the Currency. Guidance to Encourage Financial Institutions' Youth Savings Programs and Address Related FAQ, Retrieved 4/9/2022

- ^ Greenlight. Plans, Retrieved 10/19/2025

- ^ BusyKid. Features & Pricing, Retrieved 1/11/2023

- ^ Acorns. Acorns Early: Pricing, Retrieved 11/30/2024

- ^ Alliant Credit Union. Teen Checking Account Fees, Retrieved 1/27/2024

- ^ Alliant. Teen Checking Rates, Retrieved 1/18/2022

- ^ Jassby. Pricing, Retrieved 1/20/2023

- ^ FamZoo. Pricing, Retrieved 1/18/2022

- ^ FamZoo. Credit History, Retrieved 1/18/2022

Write to Justin Barnard at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|