Survey: Many Americans Afraid of Investing

More than 1 in 3 Americans surveyed are afraid of investing. 43% of females surveyed are afraid of investing in the stock market compared to 31% of males, according to a new CreditDonkey.com survey.

What Are You Afraid Of? Many Still Spooked by the Stock Market

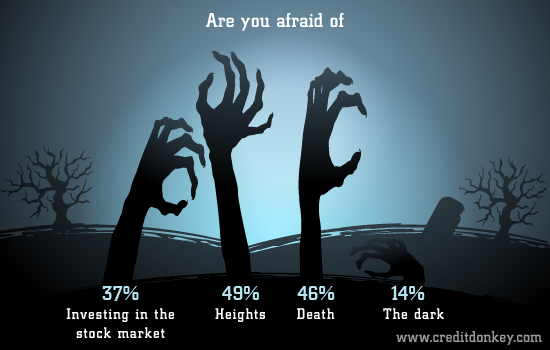

Fear of the unknown will stop most anyone in their tracks, even if a potential reward awaits them. In a new survey of more than 1,200 Americans by CreditDonkey.com, 46% of respondents revealed they are afraid of death and 37% of respondents said they are afraid of investing in the stock market.

|

| Are you afraid of © CreditDonkey |

These fears might stem from the uncertainty over what comes next. Just over half (55%) of the respondents surveyed said they believe in life after death. And many of the respondents who said they are afraid of investing in stocks blamed their wariness on the high risk involved. "I'm afraid of losing the money," one respondent said. "Plus, I don't have time to constantly watch the market."

|

| Do you believe in © CreditDonkey |

Lack of knowledge and lack of money to invest were other reasons mentioned. "I barely have enough money to get by now, and the chance of losing any more to some bad decision-making doesn't appeal to me," said one respondent. On top of those reasons is an overriding sense of skepticism. Many survey respondents are wary of putting their trust in brokers, corporations, and the entire system in general. "Rigged" was a commonly cited word. "Putting my money in the hands of someone else is scary," said one respondent.

Many View Stocks as a Gamble but Think It's a Good Idea Anyway

Some 73% feel investing in the stock market is gambling while 31% think the stock market is rigged. "It's almost never profitable," one respondent wrote. "The chances you'll profit are the same as scratching a lottery ticket." Others were harsher in their criticism, with one respondent suggesting he would lose out while those with "massive influence" would win from his investment over time. Another respondent claimed the market is "rigged to benefit those already in power, the elite 1%." However, 75% of the survey respondents still do believe investing in the stock market is a good idea, and 63% are likely to invest in stocks in the future.

Respondents' viewpoints on where to put their money fell along gender lines. Males are more likely than females to have faith in the stock market while females have a stronger belief in the banking system (78% of males vs 70% of females believe in the stock market, and 69% of males vs 73% of females believe in the banking system).

Another factor influencing respondents' viewpoints is their experience in recent years. Many respondents cited the uncertainty of current economic times and said they knew of people — such as their father, a friend, or simply themselves — who had been burned by investing in stocks. "Given the recent years and the factors affecting the economy, I would rather save my money elsewhere with more guarantee," one respondent wrote.

Among the other findings in the CreditDonkey survey:

- 69% of males plan to invest in stocks in the future vs 57% of females (investing in stocks "seems like a good way to lose money," one female respondent wrote).

- 76% believe investing in mutual funds is a good idea, and 54% are likely to invest in mutual funds in the future (59% of males plan to invest in mutual funds in the future vs 50% of females).

- 75% believe investing in bonds is a good idea, and 51% are likely to invest in bonds in the future (56% of males plan to invest in bonds in the future vs 47% of females).

- 76% believe real estate is a good investment, and 56% are likely to invest in real estate in the future.

- 49% said real estate is a better investment than stocks (52% of females vs 46% of males).

- 31% believe investing in foreign currency is a good idea (38% of males vs 25% of females).

(CreditDonkey conducted the online survey of 1,261 Americans, aged 18 and over, between February 23 and February 26, 2015.)

Sarah Johnson is a senior editor at CreditDonkey, a personal finance comparison and reviews website. Write to Sarah Johnson at sarah@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Read Next: