How to Transfer Money from One Bank to Another

Looking to transfer funds between banks? You've got several ways to move your money. But fees and speed may vary. Keep reading to learn more.

|

| © CreditDonkey |

With so many banking options available, you may be saving your money in more than one place. So how can you transfer funds between accounts at different banks?

Here are your choices.

Online External Transfer

|

| © CreditDonkey |

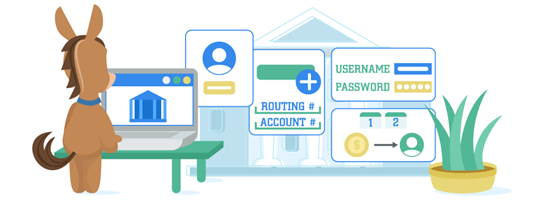

Transfers between banks are easy to handle online once you've linked your accounts. This kind of electronic transfer is called an ACH transfer.

To make ACH transfers, follow these steps.

- Log onto the website of one of your banks.

- Select ADD EXTERNAL ACCOUNT.

- Add the information for your other bank account, including the routing and account numbers.

- Complete the process to verify the second account. You can typically do this a couple different ways:

- Instantly by sharing the username and password of your second bank.

- Within a Day or Two by receiving and verifying two micro deposits (usually less than 50¢) into your second bank account.

- Instantly by sharing the username and password of your second bank.

As soon as your banks have been successfully linked, find the option for TRANSFER (or sometimes EXTERNAL TRANSFER) on the site.

Follow directions by entering how much and when you want to move the money.

Online external transfers between banks are typically free, though they may be subject to limitations. Federal law restricts savings and market accounts to 6 withdrawals and transfers a month.

You can also make ACH transfers in person or over the phone. But you may be charged a small fee.

ACH transfers usually take 3-5 business days to clear before that money appears in your other account.

Need to move between accounts fast? You can, but it'll cost you.

Wire Transfers

|

| © CreditDonkey |

Most banks offer wire transfer services, which is faster than ACH transfer. You can also use a wire transfer company like Walmart and Western Union. Depending on how early you do the transfer, your funds will arrive the same day or early the next.

But that speed comes at a price. Banks charge anywhere from $15 to $40 for wire transfers.

You'll need to fill out a form with basic information, including the routing and account numbers. This can usually be done online. But you can also call or visit a branch if you need in-person assistance.

Transfer Money to Another Person

There are several person-to-person payment services. They are fast and convenient for sending money to another person's bank account.

Zelle®

Zelle is integrated with just about all major banks. You can enroll in it through your mobile banking app. Then you can easily send money to anyone else with a US bank account for free. It's a direct transfer between bank accounts.

The great thing is that you only need the recipient's email address or mobile number. You don't need to ask for their account number. Transfers are instant.

Popmoney

Popmoney also lets you send money just by entering the recipient's email or mobile number. But it does charge a $0.95 fee to send or request money. It also works with most major US banks.

Transfers are usually processed within 1-3 business days

Venmo

Venmo works a bit differently. It's an account where you can hold money. You can use your Venmo balance to send money (and if you don't have enough, then Venmo will take from your linked bank account).

There's no fee to send money and transfers are instant. But both parties need to have a Venmo account to send/receive money.

Transfer Money Internationally

If you need to transfer money to a foreign bank account, one way is to send an international wire transfer. But the fee can be quite expensive. And banks also aren't likely to give you the best exchange rate.

Instead of using your bank, the cheapest option is to use an online money transfer service, like TransferWise.

TransferWise always gives you the real, mid-market exchange rate. You pay a low fixed fee plus a tiny percentage of your transfer amount. TransferWise always tells you the exact fee you pay and exchange rate.

You can make the transfer through a card or your bank account. Depending on what you choose and the country you're sending to, transfers can be almost instant or take up to 2 days.

Other Ways to Transfer Money

|

| © CreditDonkey |

Finally, here are some other options to move money between different banks.

- Write a Check: If you have a checking account, write yourself a check and then deposit it directly into your other account.

Depending on your bank, these checks can be deposited using your mobile device (with the camera on your phone). Or deposit it at an ATM or branch location.

Whichever way you choose, it'll take a couple days for the funds to clear in your other account.

Related: Chase Checking Account Coupon - Use a Cashier's Check: You can also request a cashier's check from your bank. Since these funds are guaranteed, your money will be available shortly after deposit into the other account.

NOTE: Many banks charge a small fee when you order a cashier's checks.

- Use PayPal: This one gets a little complicated. If you have a PayPal account, you can transfer money to PayPal using one of your accounts. When the money clears, use your other account to withdraw that money.

This process only works if BOTH accounts are already linked to your PayPal. Otherwise, you'll have to wait until one or both is verified. And it'll still take a couple days for the money to clear into your account.

Make important transfers in advance. Unless you're willing to pay extra, transferring money between different banks will take a few days.If you know a bill or purchase is coming, complete the transfer the week before to avoid stress (and unwanted overdraw fees).

- Visit Your Bank or an ATM: Again, this isn't exactly the most convenient option. But in a pinch, you could withdraw cash from one bank or ATM and deposit it INTO the other.

Make sure your destination bank allows for cash deposits—many online banks don't.

Bottom Line

You have some options when transferring money between accounts at different banks. But expect a few days' delay before that money is available - unless you're willing to pay extra.

Your best bet is to link your accounts online to allow for convenient (and usually free) transfers between banks.

Write to Kevin L at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|