How to Fill Out a Check

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Learn the proper way to write a check. Read this step-by-step guide on how to fill out a check.

|

| © CreditDonkey |

You probably don't write checks very often. In the digital age, you might think they've become obsolete. Still, they haven't disappeared completely.

If you haven't busted out the old checkbook recently, it can be a little confusing knowing how to fill it out. Follow these simple steps to correctly write a check. Plus, learn how to void a check down below.

- Write the date in the top right corner

- Fill out the payee (recipient name)

- Write the amount in numbers

- Write the amount in words

- Complete the memo/for line

- Sign the check in the bottom right corner

- Record information in your check register

Writing a Check Example

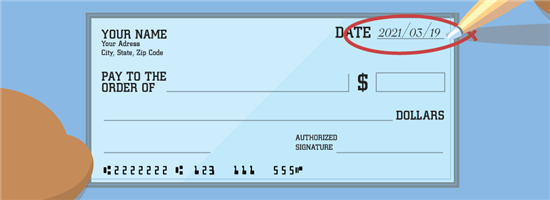

Step 1: Write the Date

|

In most cases, the date you write is today's date. There's a variety of ways you can write the date, but make sure the month, day, and year are clear.

One thing to note is that you should write the full year. For example, instead of writing "2/18/20," write "2/18/2020."

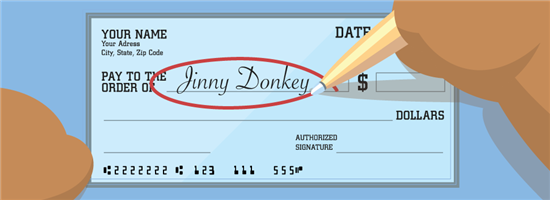

Step 2: Fill Out the Payee

|

In the Pay to the Order of line, write the full name of person or business you are paying. This person or business is known as the "payee."

Make sure to use an individual's full name and not a nickname. Also, don't use any abbreviations for business names. An improper name might prevent the payee from cashing the check.

Yes, you can pay more than one person with a single check. Keep in mind, however, what word you use to separate the names. If you write "and," then both people will have to endorse the back of the check. Using "or" allows the check to be deposited with only one signature on the back.

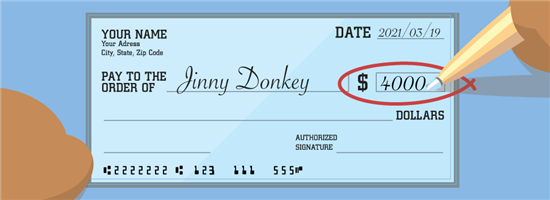

Step 3: Write the Amount in Numbers

|

On the right-hand side, there's a box or line where you'll write how much the check is for. Write the amount of the check in numbers, using commas if the number is greater than three digits, and a decimal point if your check includes cents (for example, $2,345.67).

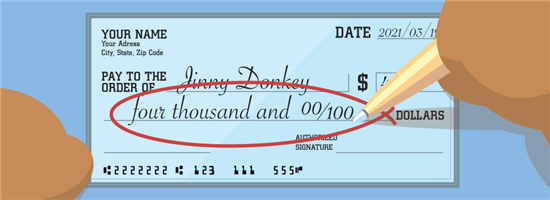

Step 4: Write the Amount in Words

|

After writing the check amount in numbers, you'll also write the amount in words. This goes on the line below the Pay to the Order of line.

If you're dealing with a whole number (meaning, no cents), simply write it how you would say it.

$2,345 would be written as "two thousand three hundred forty-five." There's no need to write "dollars."

If your check amount includes cents, you'll skip the decimal point entirely. Instead, the word "and" just after the whole dollar amount acts as the decimal.

Then, use a fraction of 100 to describe how many cents are in the check amount. For example, 67 cents would be written as "67/100"

Altogether, $2,345.67 would be written as "two thousand three hundred forty-five and 67/100."

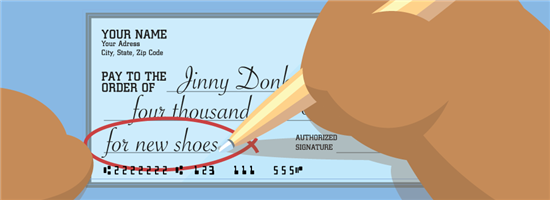

Step 5: Complete the Memo/For Line

|

In the bottom left-hand corner, there is a line for you to specify what the check is for. This is completely optional. What you write here can be as minimal as you'd like.

If you're writing a check to a business, they may want you to add specific information here to help them process the payment, such as an account number. Be sure to double-check with the payee to see if they need specific information in the memo line.

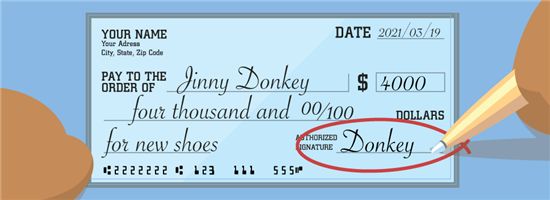

Step 6: Sign the Check

|

Finally, the check must be signed by you on the signature line in the lower right-hand corner. Sign your name in cursive. Without your signature, the check cannot be deposited by the payee.

Most businesses that receive an unsigned check will return it and consider it as a "non-payment."

Step 7: Record Information in Your Check Register

After you've completed the check and removed it from your checkbook, record the information in your check register, whether it's paper or electronic. There, you'll include the check number, date, memo, amount, and running balance for your checking account.

Adding a check to your check register right away prevents the unfortunate situation where you may have overdrawn your account because a check cleared that you forgot you wrote.

Check Writing FAQs

How do I void a check?

Writing "void" in large letters across the face of the check is usually the best way to handle this. Doing so prevents someone from cashing the check if it falls into the wrong hands. If you have to void a check but don't need to keep it for any reason, it's usually a good idea to shred the check.

What part of a check must be filled out?

Technically, the only field that doesn't need to be completed is the Memo/For line. You should never leave any of the other fields blank, especially if you have already signed the check. Doing so allows someone to fraudulently complete your check.

Who signs the back of a check?

The payee signs the back of the check when they deposit the check with their bank. Most checks have a field for the payee's signature. Nothing should be written outside of this field on the back of the check since it is reserved for the use of the bank.

Can I use pencil to write a check?

Only use ink pens when filling out a check. Pencil creates the opportunity for someone to alter your check.

Also, only use black or blue ink pens whenever possible. Some bank hardware has a difficult time reading different ink colors.

How do I postdate a check?

Postdating refers to the practice of writing a future date on a check. In theory, people do this in order to prevent a check from being deposited right away.

However, most banks and credit unions will honor postdated checks before the date written on the check. You shouldn't count on postdating to prevent a check from being deposited.

Bottom Line

Most of the time we can get by without having to write a check. It's simple to pull out your debit card or open an app to pay someone. However, some individuals and businesses, such as landlords, still expect to be paid via check. Now that you know how to properly fill out a check, you'll be better prepared for when the time comes.

Write to Jeffrey B at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|