Acorns Early (formerly GoHenry) vs Greenlight

Acorns Early vs Greenlight: Which is the best debit card for kids? Find out the pros, cons, and differences between Acorns Early and Greenlight.

Which is Better: Acorns Early or Greenlight?

|

Acorns Early (formerly GoHenry) and Greenlight both offer an educational app and debit card for kids and teenagers. The biggest difference between the two is that Greenlight packs a lot more features in its app. But, as you might expect, Greenlight also comes with a bigger price tag.

In this comparison review, Acorns Early and Greenlight battle it out for the title of best debit card for kids. Find out which kid's banking app is worth it for your family.

Acorns Early | Greenlight | |

|---|---|---|

| Minimum Age | ||

| Savings | Create savings goals; No APY (parent-paid interest only) | 2% savings reward (3% for Greenlight Max, 5% for Greenlight Infinity, 6% for Greenlight Family Shield) on an average daily savings balance of up to $5,000 per family |

| Checking | Debit card up to 4 kids (Family Plan); 1 debit card (Individual Child) | Debit card up to 5 kids. Greenlight Max, Infinity, and Family Shield plans also earn 1% cashback on purchases |

| Monthly Fee | Individual Child - $5 per month Family Plan - $10 per month |

|

| Kids Debit Card | ||

| Minimum Deposit to Open | ||

| Mobile App | ||

| ATMs | No fee for either domestic (US) or international ATM use. ATM owners may charge a fee. | Any ATM with a Mastercard, Visa Interlink or Maestro name or logo. But the ATM owner may charge a withdrawal fee. |

| Visit Site | Visit Site | |

Acorns Early: Pricing information from published website as of 11/30/2024. | ||

Pros and Cons

First, let's take a quick look at the pros, cons, and similarities of Acorns Early and Greenlight.

With both platforms, you'll get:

- Mastercard debit card

- Easy money transfers

- Educational app

- Savings goals

- Chore assignment and allowance

- Customizable spending limits

- Direct deposit

- Charity donations

Acorns Early Pros & Cons

|

|

Greenlight Pros & Cons

|

|

For a more in-depth breakdown of each app, check out our Acorns Early review and Greenlight review.

Acorns Early vs Greenlight: Head to Head Comparison

|

The right app for your kids will depend on which features you value the most. Review the comparisons below to see which app comes out on top for best debit card, fees, security, and more.

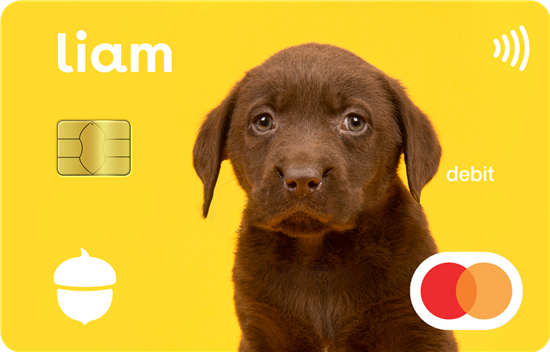

Best Debit Card for Kids

Winner: Greenlight

Greenlight and Acorns Early are both solid options for a prepaid debit card for kids. It can be difficult to find cards for kids under 13, and you can't go wrong with either of these options.

But, if you want the card with the most perks, Greenlight wins. With the Greenlight Max plan, your kid can earn 1% cash back each time they use the card. The cash-back rewards automatically go to your kid's savings.[1]

Greenlight is one of the few kid's banking products that offers this kind of reward. It's a great introduction to how rewards cards work in the real world. Plus, you can customize the card with a photo of your choice.

With that said, the Acorns Early card is also a strong contender. The card supports contactless payments, and there are more than 35 fun designs to choose from. But since the card doesn't offer any rewards, Greenlight wins out.

Best Features

Winner: Greenlight

You might notice a trend here. Greenlight wins for being the kid's banking app with the most unique and helpful features.

Greenlight offers a wide range of features, including:

- Investing platform for parents and kids

- High savings reward

- Cash-back rewards

- Identity theft protection

- Cell phone protection

- Purchase protection

- Charity donations

All these features can give your kid a head start in learning important financial concepts. It's rare to find a children's app that offers investing, money management, and educational content all in one.

In comparison, Acorns Early is more stripped down. Its features include:

- Gamified money lessons

- Chore assignment and allowances

- Savings goals

- Give to charity

Many of these features are also found in the Greenlight app. But Acorns Early does take a bit of a unique approach to its educational content.

Acorns Early's Money Missions take your kid on a fun financial journey. Kids can earn experience points and level up by completing short money lessons. If your kid already likes to play mobile games, this could be a good way to connect the dots.

Best Pricing and Fees

Winner: Greenlight

When it comes to cost, Greenlight wins. Greenlight starts at $5.99/per month. However, Greenlight's pricing plans cover up to 5 children per family even at the base plan. Acorns Early base account which is $5 per month is only for the individual child, and the family pricing of $10 per month only covers up to four kids.[2]

If you need a debit card for several children, Greenlight could be cheaper.

Acorns Early also charges a few other fees:

- Custom card upgrade: $5

- Replacement card with a different design: $5

Greenlight offers several pricing plans:[3]

- Greenlight Core: $5.99 per month

- Greenlight Max: $10.98 per month

- Greenlight Infinity: $15.98 per month

- Greenlight Family Shield: $24.98 per month

Features like cash back and higher savings rewards are only available with Greenlight Max, Infinity, and Family Shield.

Greenlight also charges fees for:[4]

- Custom card upgrade: $9.99

- Card replacements (first replacement is free): $3.50

- Express delivery: $24.99

Acorns Early Kids' Debit Card

- Real-time spend notifications.

- Block and unblock cards easily.

- Teach financial independence safely.

Best Safety and Security

Winner: Tie

With any app geared toward minors, safety and security should be top priorities. Greenlight and Acorns Early use similar security features to keep you and your child's account safe. Both apps offer:

- FDIC insurance. Money in your account is protected up to $250,000 by the FDIC through a partner bank.

- Data encryption. Bank-level data encryption keeps your private information private.

- Mastercard Zero Liability Protection. You are not responsible for any fraud or unauthorized transactions on your debit card.

- Real-time notifications. Catch suspicious activity when it happens, before more damage is done.

- Easily freeze/unfreeze card. Quickly lock and unlock your kid's debit cards from the parent app.

- Unsafe spending categories are automatically blocked. Your kid's card can't be used at places like casinos and massage parlors.

Greenlight offers additional security features—but they're only available with higher-tier plans. These include phone protection, purchase protection, and identity protection. Safety protection features like location sharing, crash detection, and SOS alert are only available with the most expensive Greenlight Infinity option.

Although these are great perks, the security features that come with all Greenlight tiers are pretty much the same as Acorns Early's.

Best Parental Controls

Winner: Greenlight

Acorns Early and Greenlight both offer flexible parental limits. But Greenlight offers a bit more control over your child's spending.

Greenlight lets you set limits for specific spending categories and stores. For instance, if your kid eats out too frequently, you could set a limit on restaurant spending. Acorns Early doesn't offer this level of control, but you can still set a general spending limit.

Both apps give you complete insight into your child's spending. Parents get a comprehensive view of all transactions, savings goals, and balances. You can also set up real-time spending notifications with both apps.

In terms of parental transparency and controls, you really can't go wrong with either app. But if you want to be able to set store-specific limits, Greenlight is the way to go.

Customer Complaints

Acorns Early and Greenlight are both trustworthy banking platforms for teenagers and kids. Still, no app is perfect. Customers of both platforms have complaints about the app.

Acorns Early and Greenlight have issues with syncing funds and bank accounts. These issues aren't extremely common. But it's pretty inconvenient for apps that are meant to streamline money management.

Acorns Early has slightly better reviews on Trustpilot. Greenlight has a rating of 3.6 on Trustpilot vs. Acorns Early's rating of 4.3.

Greenlight also has a B rating from the Better Business Bureau. GoHenry (Now Acorns Early) isn't accredited with the BBB at this time.

How to Pick the Best Prepaid Debit Card for Your Kids

Acorns Early and Greenlight are both great banking apps for children. The best one for you depends on your family's needs.

Here are a few factors to consider before you pick a prepaid debit card for your kid:

Number of Children

Think about how many cards you need for your kids. Greenlight allows up to 5 kids per family, while Acorns Early allows up to 4. Also, Greenlight's monthly fee covers all 5 kids. Acorns Early's base account fee covers just one child, and the family plan fee only covers up to 4 kids.

Pricing

Greenlight and Acorns Early fees are quite high, especially with the Greenlight Max plan and Acorns Early's Family plan. But if you have many children, the price isn't too bad.

Investing and Other Features

Greenlight offers helpful features you won't find in Acorns Early. If you want an app that offers investing, cash-back rewards, and high savings rewards, you'll want to go with Greenlight.

Security

Ensure the app you choose will protect your account. Look for features like FDIC insurance, data encryption, and an easy way to lock/unlock your card. Greenlight also offers identity theft protection (but at a higher price).

Parental Controls

Setting limits and monitoring your kid's spending can give you peace of mind while your kid spends their money. Choose the app that offers enough flexibility for you to set healthy boundaries with your child.

Educational Content

Understand which type of educational content is best for your kid's learning style. Check out Acorns Early if you think your kid would benefit most from game-like lessons. Greenlight offers a range of lesson styles, including quizzes, videos, and short articles.

Bottom Line

Acorns Early and Greenlight offer many of the same features. Both offer chores, allowances, savings goals, and educational content. The biggest difference is that Greenlight offers many more features with its higher pricing tiers.

Overall, Greenlight is one of the best choices for a debit card for kids. It offers a lot of perks you won't find in other banking apps for teens and kids. Greenlight offers investing services, high savings rewards, and identity theft protection, all in one app.

These features come with a high monthly fee, but the price covers up to 5 children per family. If you want to open an account for several children, the fee becomes much more reasonable.

References

- ^ Greenlight. Cash Back & Savings, Retrieved 04/07/2025

- ^ Acorns. Acorns Early: Pricing, Retrieved 04/07/2025

- ^ Greenlight. Compare Plans, Retrieved 10/20/2025

- ^ Greenlight. Fee Disclosures, Retrieved 10/19/2025

Acorns Early Kids' Debit Card

- Real-time spend notifications.

- Block and unblock cards easily.

- Teach financial independence safely.

Step Visa Card for Teens

- Building credit is safe and easy with the Step secured Visa card

- Step Black members earn 3.00% on savings and up to 10% cashback on purchases

- No interest, no security deposit and no credit check

Build Credit While You Bank

- Get Paid Up to 2 Days Faster

- Build credit and earn points with every swipe

- 40,000 fee-free Allpoint ATMs in the U.S.

- No credit check, minimum balance or hidden fees

Donna Tang is a content associate at CreditDonkey, a credit card comparison and reviews website. Write to Donna Tang at donna.tang@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: