Ask These Money Questions and You'll Stay Out of Debt

It's easy to make a decision when you don't put much thought into it. But you may not be pleased with the results, especially when money is involved. Quick thinking can lead to unmanageable debt and missed investment opportunities.

That "oooh, yes" you said in the three seconds it took you to choose your latest iTunes rental — your 30th of the month — can bite you when you see the final tally on your credit card bill. The impulse purchase that made you feel as light as air will weigh you down hard when the interest charges add up months and months from now.

|

The only way around such regrets is to come up with a game plan. With the help of personal finance expert Syble Solomon, who has created Money Habitudes (fun tools for people to get a handle on their money), we came up with questions you should ask yourself every time you are about to part with your money.

When Making a Purchase

How long will I have to work to pay for this? Think about how much sweat equity you will have to put into the item you are about to buy. "If you earn $20 per hour, are you willing to work five hours to pay for a $100 pair of shoes?" Solomon asks. "That doesn't even include the taxes taken out of your paycheck."

If I hadn't seen this today, would I have gone out looking for it? Just because something is on sale doesn't mean it's a good deal. If you buy something you don't actually need or want, you didn't get a bargain, despite what the retailer's signs will have you believe.

Related: Impulse Buying Statistics

When Choosing an Investment

If I lose this money, can I live without it? This question applies when you put money toward a risky investment - such as if you invest in the stock market directly - as well as if you sit on your money and do nothing with it. When you let all of your money languish in a low-earning savings account, that's what you're doing. You can't keep up with inflation with today's very low yields. Are you giving up money you could be earning? This is a question you should be asking on a regular basis.

Do I know anything about this business, product or service? Don't invest on gut feel alone. Make sure you know the ins and outs of a company's financials before investing in a specific stock or a crowdfunding venture. Most of us are better off letting the pros go after individual companies while we stick to investing in index funds.

Related: Smart Ways to Invest $1,000

When Deciding How to Pay

Will I remember what I have spent? Before you go on a spending spree or a trip, come up with a way to recall where the money goes. "I almost always use my credit card because it's an easy way to keep track of my money," Solomon says. When used wisely, credit cards can give you a clearer picture of your cash flow over time, which can come in handy if you're on vacation and you have a mobile app to look at your accounts daily. Or set aside a pocket in your wallet for receipts and notes, and do some self-reflection as your trip progresses.

Does one method make me spend more than another? Although some experts recommend paying for things in cash because it limits the total amount you can spend, the right answer truly depends on your individual habits. "I tend to spend more money if it's right there in my wallet," Solomon says. Yet, when times were tough for her, she used cash and an envelope budgeting system. Think realistically about what works best for you based on where your finances are today.

Related: Household Spending Statistics

When Buying a Home

Am I making the decision for me and my family or someone else? We're often influenced by those around us, and although we want them to approve of our lifestyle (and our home), it's important to ask yourself whether "you're looking for the size, location or features that really matter to you, or are you automatically assuming it has to have certain options so it will win the approval of a parent, sibling or friend?" Solomon notes. If there's anyone you should be trying to impress, it should be yourself.

Can I afford this much house? The real estate crash of a few years ago has taught us the value of buying no more house than we can afford. Ideally, you want to be able to put 20 percent toward a down payment. And you should spend less than 30 percent of your monthly income toward your monthly payments. The exact figures depend on your financial situation, including other debts you already have. Use an online calculator to figure out how much house you can afford.

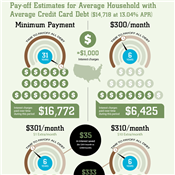

Related: How to Get Out of Debt

When Deciding What to Do With Extra Money

Where is the money from? When you get a surprise bonus, Solomon says, celebrate with a portion of your windfall. Set aside 10 percent to do something that's pure enjoyment before thinking about what to do with the rest. By rewarding yourself first, you are more likely to be frugal with the rest of the extra money.

What works best given my values and circumstances? Maybe it makes the most sense for you to put this extra cash against your credit card debt or student loans, or use it to beef up your emergency fund. Or split it among several accounts.

The answer may depend on what will make you feel more secure and accomplished so that you can continue down the right savings and investing path. Don't put the money aside and think that you suddenly have the freedom to just spend more. "Some people always carry credit card debt or car loan debt. As soon as they pay it off, it's like they are driven to buy more or get a new car," Solomon says. "Paying off the debt won't necessarily change their debt status unless they overcome their emotional tie to debt."

Related: Best Time to Buy a New Car

When you ask the right questions, your relationship with debt — and any money issues for that matter — will be more clear.

Allison Kade is a contributing writer at CreditDonkey, a credit card comparison and reviews website. Write to Allison Kade at allisonk@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

|