Infographic: Household Spending Statistics

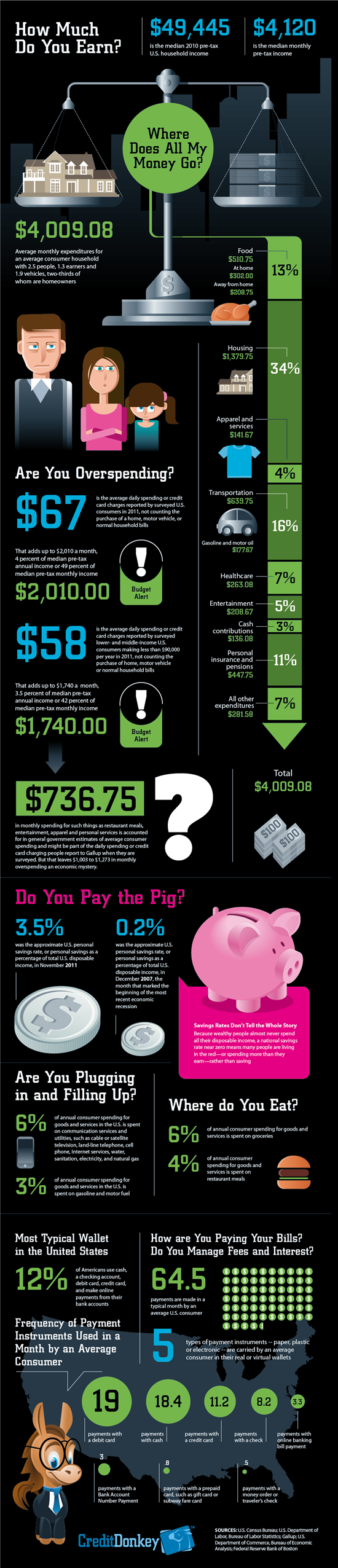

Where does all the money go? See what typical Americans make and spend in a month.

Our analysis suggests that many people are likely spending more than they earn each month. It also shows steady movement away from cash and checks toward plastic and electronic payment instruments, which can result in unfamiliar or unchecked fees and interest charges that can increase overspending and indebtedness. Managing your spending and payments will help track those expenditures.

|

| Infographics: Where Does All My Money Go © CreditDonkey |

The analysis shows:

- The median American monthly income in recent years is about $4,000, 80 percent of which is usually needed to cover regular monthly expenses for groceries, housing, gasoline, insurance and the like for average families, according to the U.S. Department of Labor's Bureau of Labor Statistics estimates.

- Nearly 6 percent of all consumer spending in the U.S. is presently used to pay for communication services such as cell phone charges, Internet hookups, cable or satellite television and basic utilities such as water, electricity and natural gas.

- Even though more than 80 percent of typical household income can be roughly accounted for by regular expenses and communication services, lower- to middle-income Americans say they also use their credit cards to charge about $58 a day for things other than regular bills or major purchases, which adds up to $1,740 a month - or more than 40 percent of monthly income - according to Gallup's daily survey of consumer spending.

- The overall U.S. personal savings rate - total savings as a percentage of total disposable income - was above 3 percent at the end of 2011. This is a significant increase from a rate of .2 percent in December 2007 at the start of the economic recession, but still a low figure. These figures include savings data from the wealthy, middle-class, and poor. Because the wealthy rarely spend all of their disposable income, a low overall savings rate means many people are spending more than they earn and are living in debt.

- The average consumer makes about 64.5 payments a month, with only 28.1 percent of those made for regular bills and 64.1 percent of them for in-person retail or service transactions.

- Thirty of those monthly payments are made with plastic - debit or credit cards - compared to 27 made with cash or paper checks. The remaining payments are made with electronic payment instruments (such as online banking and electronic transfer) and prepaid cards (such as subway cards and money orders).

Manage Your Spending and Payments

Although it may seem overwhelming, it is possible to track how you are spending your money and to manage your payments. These guidelines will help you do that:

- Make a budget for regular spending on food, housing, utilities, telecommunications (cell phone, cable and wireless service) and gasoline.

- Never use the category "credit card payment" or "PayPal" in your monthly budget. Instead, identify the expenses (for example, use groceries, gasoline, rent, clothing) and their costs per month.

- Review all credit card and bank statements when you receive them and compare interest rates and fees from month to month. If you tend to carry a balance, consider using [low interest credit cards].

- Many people just pay the minimum monthly credit card payment. Instead, pay the minimum payment plus the full payment for items such as restaurant meals, groceries, gasoline and clothing. Never allow the cost for these items to increase your balance month-to-month. Look for credit cards that help you do this and consider the benefits of using your credit card statements for your budgeting.

- If you use credit cards for gasoline, groceries, and cable bills, investigate and monitor rewards programs that offer cash back on purchases at gas stations, supermarkets, drugstores, convenience stores and utilities. If you tend to pay your balance off in full each billing cycle, consider using [credit card rewards] to save money.

(Writing by Annette; Graphic Design by Boris Benko)

Do you know where all your money is going?

Annette O'Connor is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Annette O'Connor at annette@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

|