Avoid the Minimum Payment Trap

Every month, when you get your credit card bill, you've probably noticed a “minimum payment” amount prominently displayed next to your outstanding balance. This amount always seems way too low to even begin to cover all the charges you accumulated during the month, never mind the balance you carried forward from the last statement. Why would your credit card issuer be satisfied with a payment of $40 on a $1,000+ bill?

|

This scenario is the setup for the minimum payment trap that many consumers fall into; and, it’s how many people find themselves buried in debt that will take years and thousands of additional dollars to erase.

In fact, paying the minimum amount each month while continually carrying over an interest-accumulating balance – and probably adding additional charges to the card each month – can ruin your finances.

The Upside of the Minimum Payment

It is important to note that despite how it’s often portrayed, the concept of a minimum payment isn’t inherently evil. And it wasn’t established by credit card companies to trap people into accumulating debt.

The purpose of a credit card is to let you make purchases without immediately having to pay for them in cash. Beyond being a convenient alternative to carrying cash, credit cards are also supposed to provide consumers with budget flexibility by giving them additional time to secure money to cover purchases or other expenses. That means if an unexpected emergency expense comes up (like your car or house needs sudden repairs), you can postpone paying off your credit card balance for a month or two to free up funds that can cover the more-pressing issue.

The Trap - Why You Need to Avoid the Minimum Payment Trap

The problem begins when people treat the minimum payment more as a monthly fee than as an option.

It’s tempting to pay the smaller amount of your bill; your credit card company will be satisfied with the smaller payment, and you can fool yourself into thinking you got to charge hundreds or thousands of dollars of purchases almost for free. But it’s not free. Eventually you will have to pay off all that debt. And if you’re only paying the minimum each month, it could take decades for you to be debt free.

Consider the following scenario: You have a balance of $2,000 on a card with 15% APR. If you make only the minimum payments (initial monthly payment of $40), it would take over 14 years and cost over $2,200 in interest to pay off – and that assumes you don’t add any additional charges to the card before you pay it off. In other words, you’ll pay more in interest alone than the original balance amount.

Instead, you should pay a fixed monthly payment of $80 and you’ll see the time period to pay off the balance cut down to under three years. In addition, your interest cost will fall to about $400, less than a quarter of what it was under the minimum-payment scenario.

Minimum payments serve a very definite purpose for both credit card companies and consumers. They provide added flexibility for credit card users while giving some assurance to credit card issuers that the cardholder hasn’t defaulted on their debt.

In short-term or emergency situations, they can be tremendously useful. But it’s important to understand that the existence of the minimum payment is not a license to regularly spend more than you can afford. Unless you’re facing unusual circumstances or major, unexpected expenses, stay within your budget and pay most if not all of your outstanding credit card balance each month. It’s the best way to ensure that you won’t fall into the minimum payment trap.

|

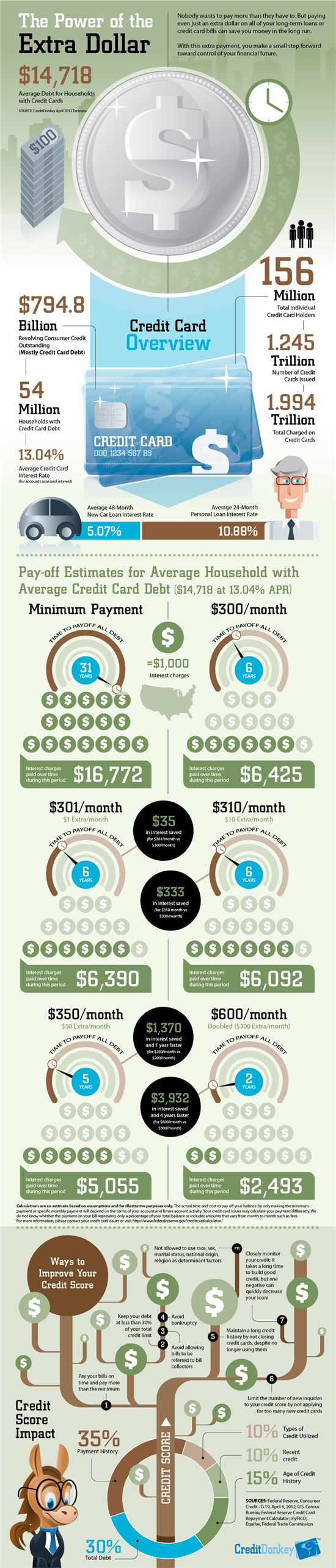

| Infographics: The Power of the Extra Dollar © CreditDonkey |

Leah Norris is a research analyst at CreditDonkey, a credit card comparison and reviews website. Write to Leah Norris at leah@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.