Survey: Mobile Wallet Statistics

Most Americans aren’t ready to substitute mobile payment apps for paper and plastic

When it comes to the shopping preferences of U.S. consumers, reports on the deaths of PCs and brick & mortar stores have been greatly exaggerated, says a new survey by CreditDonkey.com.

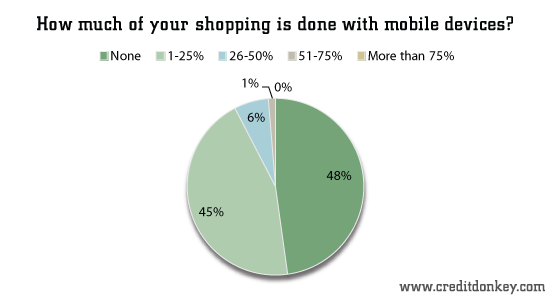

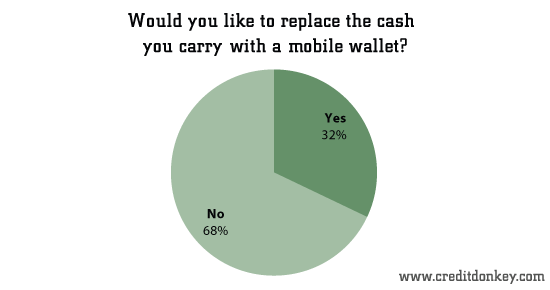

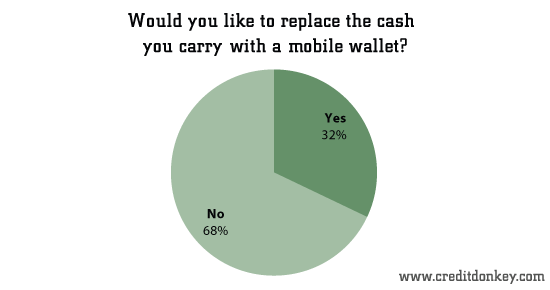

Out of the 69.3 percent of the 1,200-plus respondents who said they owned a smartphone, nearly half (47.8 percent) said they’d never used the devices for shopping, and nearly 68 percent said they did not want to replace their cash and credit cards with mobile payment apps (a.k.a., “mobile wallets”).

|

| How much of your shopping is done with mobile devices? © CreditDonkey |

|

| Would you like to replace the cash you carry with a mobile wallet? © CreditDonkey |

Given all the media hype about mobile shopping and payment apps, you might think consumers had already stowed their wallets in the attic for a future episode of Antiques Road Show. In truth, the survey results aren’t that surprising. Mobile apps and payment options are very new. Since most consumers are not “early adopters,” they still prefer to shop from PCs and at physical stores instead of from Androids, iPhones and Blackberries.

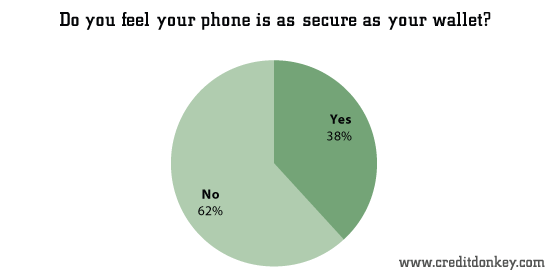

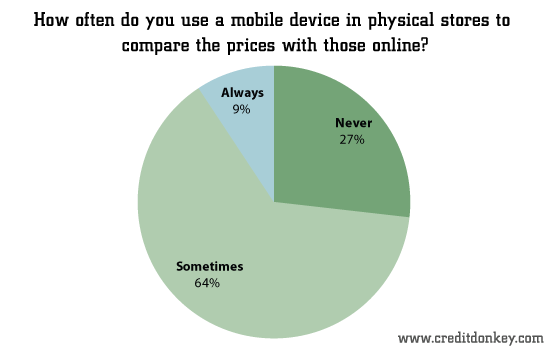

Security concerns appear to be one factor depressing adoption of mobile devices for shopping. When asked if mobile phones were as secure as their wallets, 61.8 percent said no. At the same time, 73.2 percent said they “sometimes” or “always” use mobile devices inside stores to conduct price comparisons.

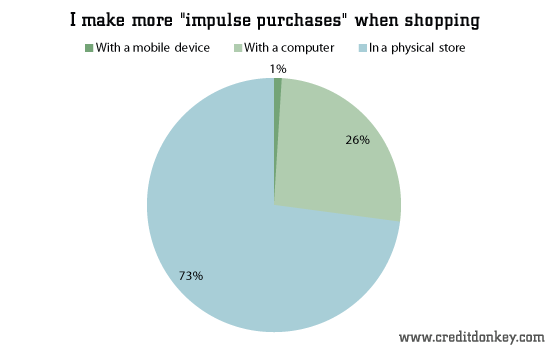

Nearly 73 percent of consumers said they made more “impulse purchases” when shopping at physical stores while; 26.1 percent said they made more impulse purchases when shopping online via a computer. Only 1 percent succumbed to impulse shopping from a mobile device.

|

| Do you feel your phone is as secure as your wallet? © CreditDonkey |

|

| Do you use a mobile device in physical stores to compare the prices with those online? © CreditDonkey |

|

| I make more impulse purchases when shopping © CreditDonkey |

Some other results from the survey

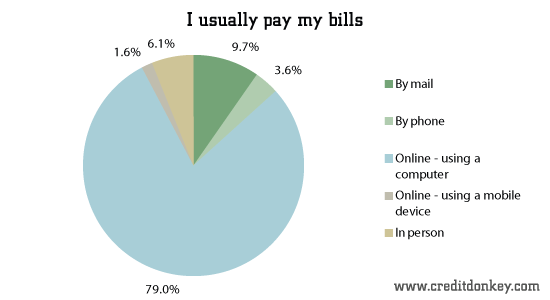

79 percent of respondents usually pay their bills online, versus 9.7 percent by mail, 6.1 percent in person, 3.6 percent by phone and 1.6 percent from mobile devices.

|

| I usually pay my bills © CreditDonkey |

67.9 percent said they would not like to replace cash with a mobile wallet.

|

| Would you like to replace the cash you carry with a mobile wallet? © CreditDonkey |

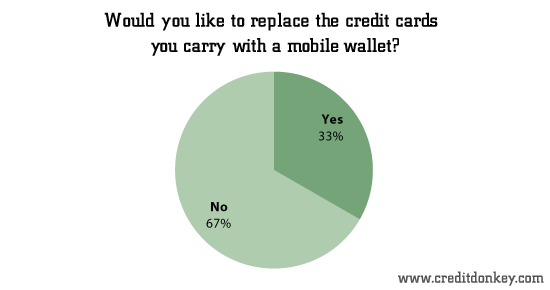

66.7 percent said they would not like to replace credit cards with a mobile wallet.

|

| Would you like to replace the credit cards you carry with a mobile wallet? © CreditDonkey |

65.2 percent said they never negotiate with physical retailers – even after finding better prices online. Another 28.7 percent said they occasionally negotiate, and 6.2 percent claim that they “regularly” or “always” negotiate prices.

|

| How often do you negotiate with the store after finding better prices on your mobile device? © CreditDonkey |

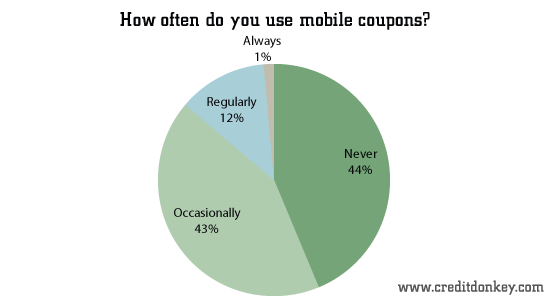

43.7 percent said they have never used a mobile coupon; 42.5 percent said they occasionally use mobile coupons; 12.4 percent use them regularly, and 1.4 percent said they always use mobile coupons.

|

| How often do you use mobile coupons? © CreditDonkey |

Although the media hype is currently outpacing actual use of mobile devices for shopping and price comparison, mobile wallets will undoubtedly become more common in the years ahead. It will probably take longer than some experts expect, but these tools will eventually become a retail force to be reckoned with.

From August 20 to September 2, 2012 CreditDonkey.com polled 1,246 Americans about their shopping and payment preferences using a multiple-choice and short-answer questionnaire.

Charles Tran is the founder of CreditDonkey, a credit card comparison and reviews website. Write to Charles Tran at charles@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.