Infographic: LGBT Consumer Statistics

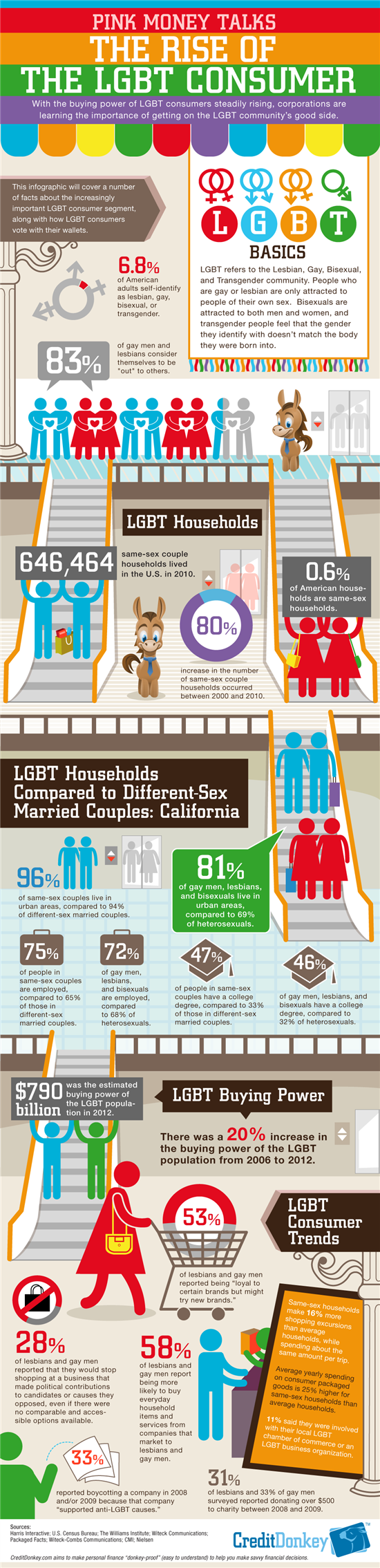

Pink Money Talks: The rise of the LGBT consumer

With the buying power of LGBT consumers steadily rising, businesses that have underestimated the size of this group may want to revisit their marketing strategies.

By putting facts and figures about the buying power of the Lesbian, Gay, Bisexual, and Transgender (LGBT) community in one infographic, we highlight the growing proportion of this consumer group’s spending power.

|

| Infographic: LGBT Statistics © CreditDonkey |

In “Pink Money Talk: The Rise of the LGBT Consumer,” we illustrate the rise in same-sex couple households over the past decade, the LGBT community’s preference to live in urban areas more than its heterosexual peers, and the rise in its buying power.

As acceptance and awareness of the LGBT community in recent years has led to an increase in this group’s willingness to come forward and be counted in publicly available databases, companies can benefit from gaining a better understanding of this group. Depending on their type of business, companies may want to make changes to their products or marketing campaigns to reach this group. Otherwise, they could be leaving money on the table.

In fact, same-sex households tend to make more shopping trips than other households. In addition, the majority reported they are more likely to make purchases of everyday items from companies that specifically market to the LGBT community.

Astrid Martinez is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Astrid Martinez at astrid@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.