Infographic: Home Business Statistics

Start a Home Business: Where Businesses Go for Startup Dough

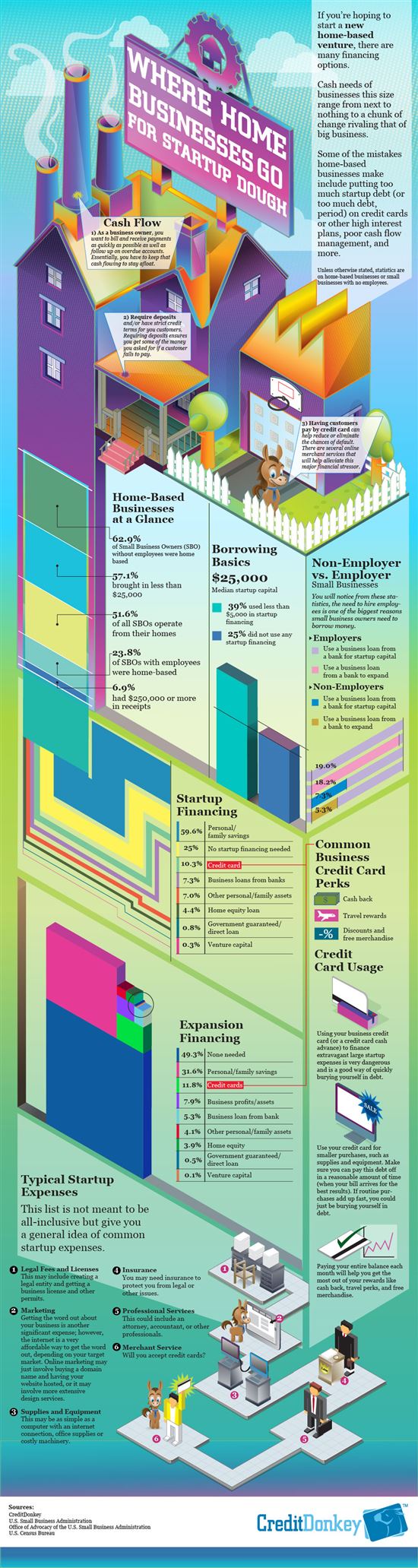

39% of business owners with no employees started their business with less than $5000 in startup capital, according to the U.S. Small Business Administration. Our research infographic illustrates where home business owners go for startup capital.

|

| Infographic: Home Business Startup © CreditDonkey |

Aspiring entrepreneurs can minimize the cost of their business venture by operating from home. In fact, according to the U.S. Census Bureau, over half of all small business owners operate from their home.

While the majority utilizes personal and family savings, 10.3% of small business owners use credit cards to help with startup financing. Using a business credit card responsibly helps entrepreneurs manage cash flow while earning rewards.

The experts at CreditDonkey.com recommend the following tips for aspiring home business owners:

Cash Flow

- As a business owner, you want to bill and receive payments as quickly as possible as well as follow up on overdue accounts. Essentially, you have to keep that cash flowing to stay afloat.

- Require deposits and/or have strict credit terms for your customers. Requiring deposits ensures you get some of the money you asked for if a customer fails to pay.

- Having customers pay by credit card can help reduce or eliminate the chances of default. There are several online merchant services that will help alleviate this major financial stressor.

Credit Card Usage

- Using your home business credit card (or a credit card cash advance) to finance extravagant large startup expenses is very dangerous and is a good way of quickly burying yourself in debt.

- Use your credit card for smaller purchases, such as supplies and equipment. Make sure you can pay this debt off in a reasonable amount of time (when your bill arrives, for the best results). If routine purchases add up fast, you could just be burying yourself in debt.

- Paying your entire balance each month will help you get the most out of your rewards like cash back, travel perks, and free merchandise.

You may also consider

- Purchase supplies and equipment that are critical for delivering the products and services you currently offer and for which there is a current and sustained demand. Buying things just because they would be "neat to have" or because some of the "big guys use them" is not a good business strategy. You always have to weigh big purchase decisions with profitability in both the short- and long-term. How many of your current customers are demanding products or services where this "new thing" would be needed? How often? How long do you think the demand will last?

- Growing too fast, or buying items to meet short-term growth or fads, is often another way to get yourself in over your head. Is this growth truly sustainable with the right financing and business strategy?

- Focus is key. Don't be too eager to offer a ton of products and services too fast. For example, buying software and equipment for products and services you might offer or you think would be nice to offer someday is a good way of getting in the habit of overspending. Diversify slowly (or at least conscientiously) after weighing your ability to grow (new hires, your time, training, etc.) in order to meet new demands. Also, ask yourself how many things you and your company can do well.

- From the beginning, make sure you're setting enough money aside for all your tax obligations. Talk to your accountant or other tax professional.

- It's usually best to consolidate your debt. It's easier to keep track of payments and interest accruals if most or all your debt is in one place. Put your debt into a plan with the lowest interest rate and best terms.

- Many small businesses use personal funds, but there are risks here too. Are you spending a good portion of your retirement? Your emergency fund or general savings? Money you live on?

(Writing by Kelly; Graphic Design by Estefan)

Kelly Teh is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Kelly Teh at kelly@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.