Gemini Review

Gemini is a cryptocurrency exchange for investors who prioritize security. Find out if it's as safe as they claim and how it stacks up to other exchanges.

Overall Score | 4.6 | ||

Cryptocurrency Trading | 3.5 | ||

Mobile App | 5.0 | ||

Commissions and Fees | 4.5 | ||

Ease of Use | 5.0 | ||

Research | 5.0 | ||

Safety | 5.0 | ||

Pros and Cons

- Beginner friendly

- Security-focused

- Competitive fees

- Moderate selection of coins

- No margin trading

Bottom Line

Strong all-around crypto exchange. But without as many coins as other exchanges

In the world of crypto, security is always a concern.

Which is why Gemini, a growing crypto exchange, adopted a "security first" mindset.

But is it really safe? And how does it compare to other crypto exchanges like Coinbase or Kraken? Read our full review to find out.

What is Gemini?

Gemini is a digital currency exchange and custodian founded in 2014 by Tyler and Cameron Winklevoss in New York City.

The platform aims to give users a secure platform to buy, sell, and store cryptocurrencies. While it started as a platform for the secure trading of Bitcoin, it now supports over 120 cryptocurrencies.

With an emphasis on security and compliance (their motto: ask permission, not forgiveness) they became the first licensed Ethereum exchange in the U.S. in 2016, and the first licensed Zcash exchange in 2018.

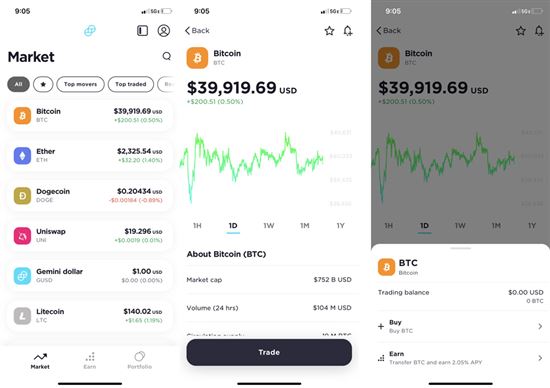

|

| Screenshot of Gemini |

Gemini is regulated by the New York State Department of Financial Services (NYSDFS) - one of the few exchanges to be U.S.-regulated. As of writing, Gemini has never been hacked.

Yes. Gemini is a New York trust company regulated by the New York State Department of Financial Services (NYSDFS).

According to Gemini: "We are subject to capital reserve requirements, cybersecurity requirements, and banking compliance standards set forth by the NYSDFS and the New York Banking Law. Gemini is also a fiduciary and Qualified Custodian." Additionally, Gemini uses NASDAQ's SMARTS technology to track trades and fight fraudulent activity and price manipulation.

How Does Gemini Work?

|

The Gemini business model is relatively straightforward and similar to other cryptocurrency exchanges like Coinbase.

They offer a platform to buy and sell cryptocurrencies to all levels of users, from retail investors to public and private companies. They make money by charging fees for each transaction (more info on fees later).

There are currently over 120 cryptocurrencies available for trade on the Gemini platform:

- 0x, 1inch, Aave, Amp, Balancer, Bancor Network, Basic Attention Token, Bitcoin, Bitcoin Cash, Chainlink, Compound, Curve, Dai, Decentraland, Enjin Coin, Ethereum, Filecoin, Gemini Dollar, Kyber Network, Litecoin, Loopring, Maker, Orchid, PAX Gold, Ren, Skale, Storj, Synthetix, The Graph, The Sandbox, Uma, Uniswap, Yearn.finance, Zcash

- Gemini is currently supported in over 50 countries.

- North America: United States, Canada, British Virgin Islands, Cayman Islands

- South America: Argentina, Brazil, Chile, Peru

- Europe: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, Greece, Guernsey, Hungary, Iceland, Italy, Jersey, Latvia, Lichtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom

- Asia: Hong Kong, India, Israel, Myanmar, Philippines, Singapore, South Korea, Taiwan, Turkey, Vietnam

- Oceania: Australia, New Zealand

- Africa: Egypt, Nigeria, South Africa

- North America: United States, Canada, British Virgin Islands, Cayman Islands

Investing in cryptocurrency is far from risk-free, and while the historical profits have been extraordinary, that is no guarantee that they will continue to be so. Cryptocurrency is a highly volatile investment vehicle, with extreme price fluctuations. Generally speaking, you should never invest more than you're willing to lose. That said, as adoption of cryptocurrencies becomes increasingly widespread, they may gradually become a safer option.

If you're looking to invest in crypto, but worried about volatility, consider "Stablecoins," like Gemini's Gemini Dollar, which is tied to the price of the USD.

Pros and cons

|

Pros

- Focus on security and compliance

- Easy to use and get started, even for beginners

- Available on mobile and desktop

- Advanced features like Gemini Pay and ActiveTrader

- Supports most major cryptocurrencies

Cons

- Relatively high fees compared to some other exchanges

- Offers fewer currencies than Coinbase

- May be slow to respond to customer complaints; some customers report trouble accessing Bitcoin holdings

App Download: Apple, Google Play

Buy and Sell Cryptocurrency

Features

You can buy, sell, trade, and store cryptocurrencies from your computer or mobile device, track market fluctuations, and monitor your portfolio. It's simple, straightforward, and easy to set up in a few clicks.

Below, some of Gemini's stand-out features.

Gemini Wallet

Gemini offers a secure way to store your cryptocurrency with Gemini Wallet. You can have your crypto stored in a "hot wallet" or offline in a cold wallet that they manage.

They have insurance against theft of digital assets, which means if your cryptocurrency is lost in a hack or breach, it should be covered.

Gemini Custody

Store your digital assets safely offline in geographically distributed, controlled facilities with Gemini Custody.

It's insured for $200 million, the highest insurance coverage awarded to any crypto custodian. And trade instantly from cold storage with Gemini Instant Trade. Pricing depends on account size.

SPEDN

In partnership with Flexa, Gemini offers SPEDN, a standalone app that lets users spend their cryptocurrency at popular retailers by converting it to fiat currency in real time. It can be used at businesses like Barnes and Noble, Gamestop, Nordstroms, and more, and currently supports Bitcoin, Bitcoin Cash, Celo, Dogecoin, Ethereum, Gemini Dollar, Litecoin, and Zcash.

Nifty Gateway

Nifty is Gemini's answer for NFT (non-fungible token) trading. Their marketplace allows investors to buy, sell, store, and display NFTs, and cash out earnings directly to the Gemini Exchange.

|

| Screenshot of Gemini |

Gemini Credit Card

The waitlist is open for the Gemini Credit Card, offered in partnership with Mastercard and expected to debut summer 2021.

Available in all fifty states and accepted wherever Mastercard is, the Gemini Credit Card will offer up to 3% cash back on purchases, 2% on dining, and 1% on groceries--paid in Bitcoin or any other cryptocurrency offered on Gemini.

Rewards will be paid in real time, meaning you won't miss out on price changes, and you'll be able to access your card through the Gemini app, including the ability to freeze it instantly if it's lost or stolen. The metal cards. which come in a range of colors, are compatible with Apple Pay and Google Pay.

Other featured products include:

- Gemini Clearing: Settle off-exchange crypto trades securely and safely

- Gemini Dollar: A Stablecoin, tied to the price of the USD

- ActiveTrader: An advanced version of their trading platform, for serious users

Withdrawing your money from Gemini is easy. Just login to your Gemini account and find the transfer icon in the navigation toolbar. Choose "Withdraw from Gemini." From there, select USD from the dropdown menu, select the bank you want to transfer your money to under "Bank Transfer," enter the amount you'd like to withdraw, and once you've reviewed your request and clicked submit, you're all done.

Fees to look out for

When you trade cryptocurrency on Gemini via mobile and web, they charge two fees: a convenience fee and a transaction fee.

These fees vary based on country and amount of the given trade:

- Convenience Fee (U.S.): 0.50% above the prevailing Gemini market price, included in your quoted price

- Transaction Fee (U.S.): Between $0.99 and 1.49% added to the cost of your transaction, depending on the amount

There are two kinds of transfer fees (for deposits and withdrawals), and they are charged differently.

- Deposits

- Cryptocurrency deposits: Free

- Wire transfers: Free

- Debit deposits: 3.49% of purchase

- Cryptocurrency deposits: Free

- Withdrawals

- These vary depending on the cryptocurrency. If the number of the coins the user withdraws in a calendar month is ≤10, the withdrawal is free.

- If the number of coins withdrawn is >10, the price varies depending on currency.

- These vary depending on the cryptocurrency. If the number of the coins the user withdraws in a calendar month is ≤10, the withdrawal is free.

Security Measures and User Privacy

Gemini has made security the number one priority of their exchange. Below we highlight the security measures that Gemini uses throughout the entire platform.

Crypto Security

- Gemini Cold Storage: Gemini keeps the majority of their crypto stored offline, in an inaccessible, air-gapped system, which is geographically distributed and requires multiple employees to operate.

- Gemini Hot Wallet: The small amount of crypto they do keep online has protection of a FIPS 140-2 Level 3 rating or higher, and is insured.

Account Security

- Two-factor authentication is required to log in or make withdrawals

- They support WebAuthn hardware security keys

- Offers an Approved Addresses list to limit where withdrawals are allowed

- Account operations are rate-limited to prevent brute force attacks

- Personal information is encrypted

Infrastructure Security

- Website data is transmitted over encrypted Transport Layer Security connections like HTTPS

- They partner with third-party vendors to protect against distributed-denial-of-service attacks

- Internal-only portions of the site are not connected to the public internet

Internal Controls

- Transferring crypto out of cold storage requires multiple signatories

- Tyler and Cameron Winklevoss cannot transfer crypto out of cold storage

- Employees undergo criminal background checks

- Objects of value, such as private keys, are not stored in company offices, but in controlled facilities

- Public-key authentication from credentials stored on hardware tokens are required for remote access

They also offer a bug bounty to security researchers who find and disclose flaws in their system.

Common Complaints

According to the Better Business Bureau (BBB), Gemini has received some volume of complaints from users stating that the Bitcoin in their accounts is inaccessible to them.

These users "allege that the company's verification process for withdrawals or transfers is holding up the transactions." They further claim that they failed to receive a response from the company after reaching out for support.

Create an Account

Creating an account with Gemini is quick and straightforward:

- Visit their desktop site or download their mobile app to get started. They'll ask for your name, date of birth, and Social Security number.

- You'll need access to a mobile device, as they require two-factor authentication to sign in and withdraw funds.

- In order to start trading, you'll need to verify your identity with either a state-issued photo ID or passport.

- From there, link a payment method, either bank account or debit card, and you'll be ready to go.

Contact Customer Service

If you need to get in touch with customer service at Gemini, visit support.Gemini.com to submit a ticket via your computer.

You can find the same support access through the app, under the Account drop-down.

Both take you to a page where you have the option of accessing their knowledge base if you want to try solving any problems yourself or submitting a request directly. Gemini will only call you at a time and date that has previously been established via email.

- Gemini is currently not accredited by the BBB and has no rating (NR).

- They have a rating of 1.5 with Trustpilot.

Gemini Alternatives

There are a number of factors to take into account when deciding which crypto exchange is right for you. Let's see how Gemini stacks up against popular competitors.

Gemini vs Coinbase

Gemini | Coinbase | |

|---|---|---|

Buy and Sell Cryptocurrency - | Earn $5 in bitcoin on your first trade on Coinbase - | |

Benefits and Features | ||

| Stock Trading | ||

| Options Trading | ||

| Cryptocurrency Trading | ||

| Minimum Deposit | ||

| Cryptocurrencies Supported | ||

| Countries Supported | ||

| Fiat Currencies Supported | USD, AUD, CAD, EUR, GBP, SGD, HKD | |

| Digital Wallet | ||

| Transaction Fee | Greater of Minimum Flat Fees or Variable Fees (1.49%+) by Location and Payment Method. Minimum Flat Fees:

| |

| Copy Trading | ||

| Limit Orders | ||

| Margin Trading | ||

| Spread | ||

| Crypto Loans | ||

| Bank Account Purchase Fee | ||

| Debit Card Purchase Fee | ||

| Wallet Purchase Fee | ||

| Mobile App | ||

| ACH Transfer Fee | ||

| Wire Transfer Fee | ||

| Crypto Conversion Fee | ||

| SEPA Bank Transfer Fee | ||

| Address Allowlisting | ||

| Anonymity | ||

| Biometric Login | ||

| Cold Storage | ||

| Maximum Trading Amount | ACH: $5,000 / day, $30,000 / month; Debit Card: $1,000 / day; Wire Transfer: Unlimited; Digital Assets: Unlimited | |

| Two-Factor Authentication | ||

| Withdrawal Limit | ACH: $10,000 / day; $30,000 / month; Wire Transfer: $100 min; Digital Assets: for less than 10 free / month; more than 10/month incurs a fee | |

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Gemini: Pricing information from published website as of 08/16/2022. Coinbase: Pricing information from published website as of 04/13/2021. | ||

Most traders interested in crypto are familiar with Coinbase. It's one of the most well-known mainstream exchanges out there.

Coinbase may compare slightly favorably to Gemini in terms of ease of use, which is where Coinbase shines; it is more widely available, and offers a wider range of cryptocurrencies for trade. However, Gemini outperforms Coinbase when it comes to security, privacy, fees, and advanced features.

If you're interested in a beginner's platform, consider Coinbase. Otherwise, Gemini is a stronger choice.

Gemini vs Kraken:

Gemini | Kraken | |

|---|---|---|

Buy and Sell Cryptocurrency - | Buy and Sell Cryptocurrencies - | |

Benefits and Features | ||

| Minimum Deposit | ||

| Cryptocurrencies Supported | ||

| Countries Supported | ||

| Fiat Currencies Supported | USD, AUD, CAD, EUR, GBP, SGD, HKD | USD, EUR, CAD, AUD, GBP, CHF, JPY |

| Digital Wallet | ||

| Transaction Fee | ||

| Copy Trading | ||

| Limit Orders | ||

| Margin Trading | ||

| Crypto Loans | ||

| Bank Account Purchase Fee | ||

| Debit Card Purchase Fee | ||

| Wallet Purchase Fee | 1.5% or 0.9% for stablecoins & FX pairs | |

| Mobile App | ||

| Wire Transfer Fee | ||

| Crypto Conversion Fee | ||

| SEPA Bank Transfer Fee | ||

| Withdrawal Fee | Cryptocurrency withdrawals are free for up to 10 coins / month; further withdrawals vary by currency | |

| Address Allowlisting | ||

| Anonymity | ||

| Biometric Login | ||

| Cold Storage | ||

| Two-Factor Authentication | Google Authenticator or Yubikey | |

| Withdrawal Limit | ACH: $10,000 / day; $30,000 / month; Wire Transfer: $100 min; Digital Assets: for less than 10 free / month; more than 10/month incurs a fee | Depends on verification level. Cryptocurrencies - Beginner: $5,000 / day; Intermediate: $500,000 / day; Pro: $10,000,000 / day; Fiat Currencies - Express: $9,000 / day; Intermediate: $100,000 / day; Pro: $10,000,000 / day |

Gemini: Pricing information from published website as of 08/16/2022. Kraken: Pricing information from published website as of 04/13/2021. | ||

One of Kraken's strong points is security, but as a platform that puts security first, Gemini shines there too.

While Gemini offers fewer currencies, it's only because they are determined to vet every currency they platform. Gemini also puts a lot of emphasis on regulatory compliance, which may prove beneficial in the long term.

Gemini's fees are higher, but not by much. Kraken may be a little more user-friendly, but it wouldn't take much time to get used to either platform.

Overall, both platforms are viable choices. If you're interested in trading a wider range of more obscure currencies, Kraken may be right for you. If security is your prime concern, you can't go wrong with Gemini.

Bottom Line: Should You Use Gemini?

Gemini is an all-around solid cryptocurrency exchange with an emphasis on security as yet unmatched in the crypto sphere.

Other than keeping your crypto on a wallet that you personally control—which you should absolutely do—there probably isn't much more you could do in terms of keeping your assets safe than trading on Gemini.

They don't offer the lowest fees, and they aren't the easiest to use, but they are far from the most difficult or most expensive. If security is what drives you, then Gemini is right for you.

Deposit $100 and Get $10 from eToro USA LLC

- Sign up for an eToro account

- Deposit $100

Jeremy Harshman is a creative assistant at CreditDonkey, a crypto comparison and reviews website. Write to Jeremy Harshman at jeremy.harshman@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: