Best Cryptocurrency Exchange

Want to invest in crypto? The right platform can help you start trading. Here are the best exchanges to buy bitcoin and other cryptos.

|

The world of cryptocurrency is constantly changing.

This can be an exciting—but risky—investment. Choosing a cryptocurrency exchange is the first challenge you'll have to overcome.

What's the best way to get into crypto? And which exchanges are actually worth the fees?

Check out the top crypto exchanges to start. Plus, compare the coins supported on each platform.

Here are some of the top cryptocurrency exchanges and platforms:

Top-Rated Crypto Exchanges for 2023

eToro

- Cryptocurrencies Supported: 83 (21 in the US)

- Fiat Currencies Supported: USD, EUR, GBP, AUD, RMB, THB, IDR, MYR, VND, PHP, SEK, DKK, NOK, PLN, CZK, PEN, MXN, QAR, BHD, OMR, AED, SGD. Not available for US customers.

Pros:

| Cons:

|

Our Review: eToro is a stock and crypto exchange known for its CopyTrading feature. Find out if it's worth the fees and how it compares to other platforms...

Robinhood

- Cryptocurrencies Supported: AAVE, AVAX, BTC, BCH, LINK, COMP, DOGE, ETH, ETC, LTC, SHIB, XLM, XTZ, UNI, USDC

- Fiat Currencies Supported: USD

Pros:

| Cons:

|

Our Review: Robinhood lets you trade stocks commission-free and has no account minimums. Is it safe? Are there hidden fees? Read on for the pros and cons...

iTrustCapital

- Cryptocurrencies Supported: 85+

- Fiat Currencies Supported: USD

Pros:

| Cons:

|

Our Review: iTrustCapital lets you invest in cryptocurrencies and precious metals through a self-directed IRA. Is it right for your retirement?...

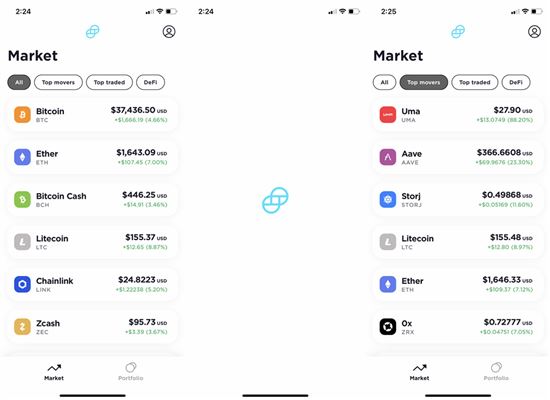

Uphold

- Cryptocurrencies Supported: Over 250

- Fiat Currencies Supported: USD, EUR, GBP, AED, ARS, AUD, BRL, CAD, CHF, CNY CZK, DKK, HKD, HRK, HUF, ILS, INR, JPY, KES, MXN, NOK, NZD, PHP, PLN, RON, SEK, SGD

Pros:

| Cons:

|

Our Review: Uphold's motto is you can trade "Anything to Anything" — from crypto to gold and forex. But are they legit? Read this review to learn more...

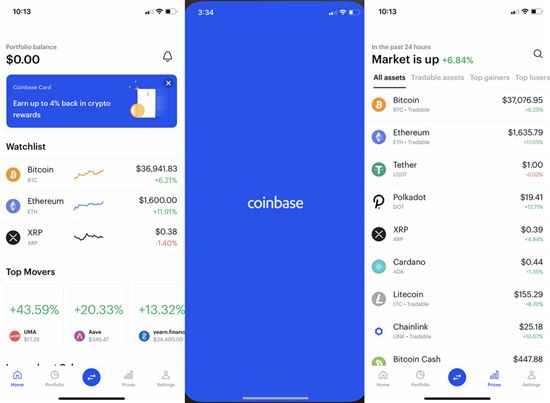

Coinbase: Most Popular

|

| Screenshot of Coinbase |

Coinbase is one of the largest crypto exchanges with over 98 million users. It offers a beginner-friendly interface that allows users to buy and sell crypto, track the market, and manage their portfolios.

But Coinbase's ease-of-use comes at a price. Their trading fees are higher than many other exchanges. Review the fees below to decide if the cost is a fair trade-off for you.

Fees[1]

- Spread: 0.50%

- Transactions: $0.99 - $2.99 (for $200 or less)

- Minimum Deposit: $2

- Payment with U.S. bank account: 1.49%

- Purchase with Coinbase USD Wallet: 1.49%

- Purchase with debit cards: 3.99%

- Conversions: up to 2%

Supported Coins

Coinbase supports over 150 different types of cryptocurrencies.[2] The minimum trading amount is $2.[3]

- 0x

- Aave

- Ankr

- Augur

- Balancer

- Bancor Network Token

- Band Protocol

- Basic Attention Token

- Bitcoin

- Bitcoin Cash

- Celo

- Chainlink

- Civic

- Compound

- Cosmos

- Curve DAO Token

- Dai

- district0x

- EOS

- Ethereum

- Ethereum Classic

- Filecoin

- Kyber Network

- Litecoin

- Loopring

- Maker

- NuCypher

- Numeraire

- OMG Network

- Orchid

- Ren

- SKALE

- Stellar Lumens

- Storj

- SushiSwap

- Synthetix Network Token

- Tezos

- The Graph

- UMA

- USD Coin

- Uniswap

- Wrapped Bitcoin

- yearn.finance

- Zcash

Why choose Coinbase?

The simple user interface won't overwhelm newbies. It also has a learning program that lets you earn pieces of cryptos as you complete mini-lessons. You can earn up to $167 worth of crypto.

Coinbase Pros & Cons

|

|

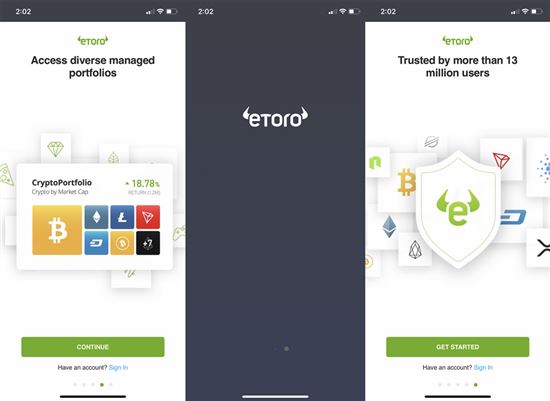

eToro: Social Trading / Copy Top Investors

|

| Screenshot of Etoro |

eToro is popular exchange best known for their focus on "social trading." On eToro's platform, you can view other users' portfolios, collaborate, and discuss strategy.

Their standout feature is the CopyTrader tool, which allows you to copy the actions of top-performing traders. If you like their performance metrics, you can choose to automatically copy their exact trades.

Fees

- Trade fee: 1% fee for buying or selling crypto.

0% commission for buying or selling stocks and ETFs.[4] - Minimum Deposit: $100 ($200 to start copy trading)

- Purchases: None

- Conversions: 0.10%

Supported Coins

eToro supports roughly 24 of the most popular coins.[5]

- Aave

- Bitcoin

- Bitcoin Cash

- Chainlink

- Compound

- Dogecoin

- EOS

- Ethereum

- Ethereum Classic

- Iota

- Litecoin

- NEO

- Stellar

- Tezos

- Tron

- Uniswap

- Yearn.finance

- ZCash

Why choose eToro?

Like Coinbase, eToro is great for beginners and is fairly user-friendly. But eToro stands out for offering more opportunities to learn about trading strategy with their CopyTrading feature.

You can also get a $100,000 fake portfolio to practice your strategy before committing real money.

eToro Pros & Cons

|

|

Get $100,000 Virtual Portfolio to Experiment

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Gemini: All-in-One Exchange and Wallet

|

| Screenshot of Gemini |

Gemini's #1 priority is security. Self-described as the "safest crypto exchange", they offer an all-in-one platform to buy and sell, manage your portfolio, store, and pay with your digital coins.

Gemini offers a basic platform for beginners, as well as an ActiveTrader platform for advanced investors.

Besides buying and selling crypto on the exchange, you can also negotiate trades off the exchange with other Gemini accounts. Gemini helps broker the exchange to mitigate risk.

Fees[6]

- Spread: 0.50%

- Transactions: $0.99 - 1.49%

- Minimum Deposit: $0

- Purchase by debit card: 3.49%[7]

- Conversions: ($0.99 - 1.49%)

- Withdrawals: Cryptocurrency withdrawals are free for up to 10 coins / month; further withdrawals vary by currency[8]

Supported Coins

Gemini supports over 120 cryptocurrencies and stablecoins, including the most popular coins.[9]

- 0x

- 1inch

- Aave

- Amp

- Balancer

- Bancor Network

- Barnbridge

- Basic Attention Token

- Bitcoin

- Bitcoin Cash

- Chainlink

- Compound

- Curve

- Dai

- Dogecoin

- Enjin Coin

- Ethereum

- Filecoin

- Gemini Dollar

- Injective Protocol

- Kyber Network

- Litecoin

- Livepeer

- Loopring

- Maker

- Orchid

- PAX Gold

- Ren

- Skale

- Somnium Space

- Storj

- Sushiswap

- Synthetix

- The Graph

- The Sandbox

- Uma

- Uniswap

- Yearn.finance

- Zcash

Why choose Gemini?

If security is your #1 concern, there are few (if any) choices better than Gemini. You'll pay slightly higher fees but, for some, that may be worth it. U.S. traders can also take advantage of Gemini's features than international traders.

Gemini Pros & Cons

|

|

Robinhood: Stock and Crypto Investing App with No Trading Fees

|

| Screenshot of Robinhood |

Robinhood, the popular micro-investment app, also allows you to trade crypto with no trading fees. This is a big pro since crypto exchanges usually charge a fee.

One important downside: Currently, Robinhood does not support coin withdrawals. You can buy and sell your coins, but you don't actually get access to your wallet. According to Robinhood, this feature is in the works.

Fees[10]

- Spread: Undisclosed

- Transactions: None

- Minimum Deposit: $0

- Purchases: None

- Conversions: None

- Withdrawals: Not supported for crypto

Supported Coins

There are 15 cryptocurrencies available for trading on Robinhood: Aave, Avalanche, Bitcoin, Bitcoin Cash, Chainlink, Compound, Dogecoin, Ethereum, Ethereum Classic, Litecoin, Shiba Inu, Stellar Lumens, Tezos, Uniswap, USD Coin

Why choose Robinhood?

If you already have an account with Robinhood and are still unsure about crypto, this may be a decent option. It's simple app makes it good for beginners.

Robinhood Pros & Cons

|

|

Buy and Sell Cryptocurrency

Robinhood Crypto offers commission-free cryptocurrency investments 24/7. Some of the cryptocurrencies available are Bitcoin, Dogecoin, Ethereum, and Litecoin. This offer is currently available to selected states.

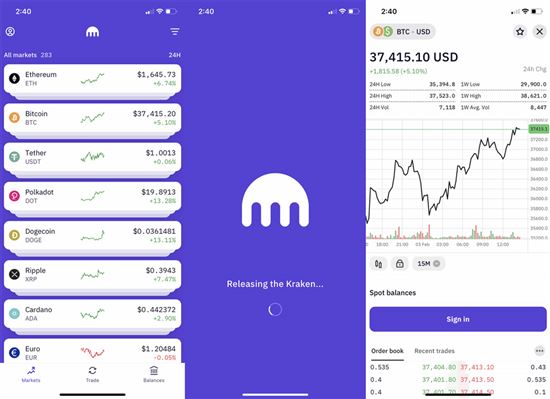

Kraken: Strong Security / Leveraged Crypto Trading

|

| Screenshot of Kraken |

The Kraken is a cryptocurrency exchange with a reputation for reasonable fees and high security. It's also intuitive enough to get started trading pretty quickly.

But where Kraken really shines is the leveraged trading options for advanced traders. They offer up to 5x margin trading and futures investing up to 50x leverage. [11]You can even short cryptos. Just beware that these are riskier strategies, but have higher reward potential.

Fees[12]

- Transactions: 0.00% - 0.26%

- Minimum Deposit: $10

- Purchase by debit card: 3.75% + €0.25

- Purchase by bank account: 0.5% + $0.10

- Conversions: 1.5% or 0.9% for stablecoins

- Withdrawals: Varies by coin

Supported Coins

Kraken supports over 160 different cryptocurrencies.[13]

- Aave

- Aragon

- Augur

- Augur v2

- Balancer

- Basic Attention Token

- Bitcoin

- Bitcoin Cash

- Chainlink

- Compound

- Cosmos

- Curve

- DAI

- Dogecoin

- EOS

- Energy Web Token

- Enzyme Finance

- Ethereum

- Ethereum 2

- Ethereum Classic

- Filecoin

- Flow

- Gnosis

- ICON

- Kava

- Keep Network

- Kusama

- Kyber Network

- Lisk

- Litecoin

- Monero

- Nano

- OMG Network

- Ocean Protocol

- Orchid

- PAX Gold

- Polkadot

- Qtum

- Ripple

- Siacoin

- Stellar

- Storj

- Synthetix Network Token

- tBTC

- Tether

- Tezos

- The Graph

- Tron

- USD Coin

- Uniswap

- Waves

- yearn.finance

- Zcash

Why choose Kraken?

Kraken is probably best for investors who aren't completely new to crypto. There may be too much of a learning curve for true newbies. If you're ready to dive deep into crypto and want a good selection of coins, Kraken's a good choice.

Kraken Pros & Cons

|

|

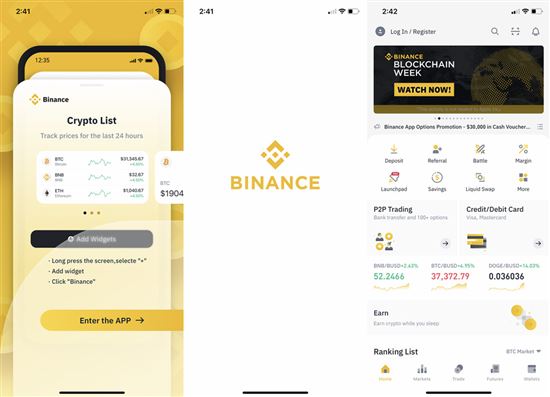

Binance: Most Number of Coins

|

| Screenshot of Binance |

Binance.US supports over 100 different cryptos. It's especially good if you want to trade altcoins and cryptocurrency pairs.

It offers basic and advanced platforms based on your experience. But newbies may find that even the basic platform is not as beginner-friendly.

Fees[14]

- Spread: 0.01 - 0.92%, depending on the coin

- Transactions: 0.10% - 0.50%

- Minimum Deposit:

- Purchase by debit card: 3.75% or $10 - $15

- Conversions: Free for USDC to BUSD

- Withdrawals: Vary by coin

Supported Coins

Binance.US (the American arm of Binance) has fewer coins than regular Binance, but they still offer over 100 coins to choose from.

- 0x

- Augur v2

- Band Protocol

- Basic Attention Token

- Bitcoin

- Bitcoin Cash

- BNB

- BUSD

- Chainlink

- Compound

- Cosmos

- DAI

- Dogecoin

- Elrond

- Enjin Coin

- EOS

- Ethereum

- Ethereum Classic

- Harmony

- Hedera Hashgraph

- Helium

- Horizen

- ICON

- KyberNetwork

- Litecoin

- Maker

- MIOTA

- NANO

- NEO

- OMG Network

- Ontology

- Orchid

- PAX Gold

- QTUM

- Ravencoin

- Stellar Lumens

- Storj

- TetherUS

- Tezos

- Uniswap

- USD Coin

- VeChain

- VeThor Token

- Waves

- Zcash

- Zilliqa

Why choose Binance?

Binance fees are much lower than some other crypto exchanges, making it a good option for those trading often. However, it's best to look at other options if you're very new to crypto as this platform is geared towards traders with more experience.

Binance Pros & Cons

|

|

Binance

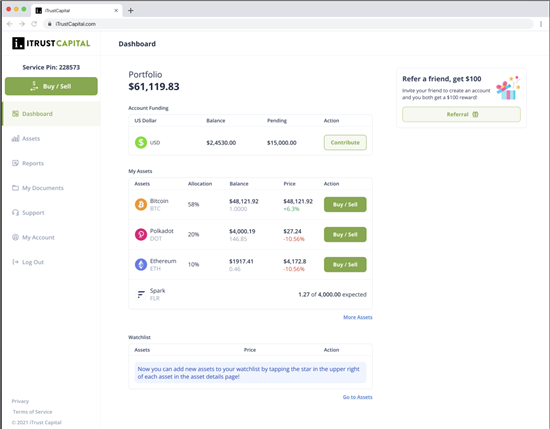

iTrustCapital: Invest in Cryptos in an IRA

|

| Screenshot of iTrustCapital |

iTrustCapital lets you trade and invest in cryptos for your retirement in an IRA account. This lets your gains grow tax-deferred or tax-free (depending on which type of IRA you choose).

The minimum opening deposit is $1,000.

Fees[16]

- Spread: None

- Transactions: 1% per trade

- Minimum Deposit: $1,000

- Purchases: None

- Conversions: None

- Withdrawals: Standard IRA withdrawal fees apply

Supported Coins

iTrustCapital offers 85+ of the most popular cryptocurrencies.[17]

- Bitcoin

- XRP

- Solana

- Sui

- Ethereum

- Hedera

- Cardano

- Dogecoin

- Stellar

- Ondo

- Chainlink

- Curve DAO Token

- Bittensor

- Avalanche

- Algorand

- Render Network

- Sonic

- Pepe

- Gigachad

- The Graph

- Orca

- Sei

- NEAR Protocol

- VeChain

- Dogwifhat

- Echelon Prime

- Fetch.ai

- Bonk

- Flare

- Quant

- Internet Computer

- Cosmos

- Aave

- Shiba Inu

- Polkadot

- AIOZ Network

- Aptos

- Injective

- Gala

- Litecoin

- Official Trump

- Berachain

- Polygon Ecosystem Token

- MooDeng

- Maker

- Toncoin

- Filecoin

- Immutable

- Uniswap

- SushiSwap

- Bitcoin Cash

- Helium

- Optimism

- Decentraland

- Axelar

- Arbitrum

- The Sandbox

- Floki Inu

- Stacks

- Compound

- yearn.finance

- Flow

- EOS

- Internet Computer

- ApeCoin

- Axie Infinity

- Tezos

- MetisDAO

- Celestia

- Lido DAO

- Chiliz

- Jito

- 1inch

- Basic Attention Token

Why choose iTrustCapital?

If you are considering adding cryptocurrency to your retirement portfolio, iTrustCapital is a good place to do it, compared with similar self-directed IRA providers. Just be aware of the risks involved in doing this. iTrustCapital is also best for those interested in investing in popular coins long-term.

iTrustCapital Pros & Cons

|

|

Coinmama: Many Payment Options

Coinmama is aimed toward beginner crypto investors. The buying process is made simple. And there's a support team to help at any time.

The biggest pro about Coinmama is the many payment options. You can buy coins with bank transfer, credit card, debit card, or Apple pay.

However, the fees are expensive. Review the fees below to see if it's worth it for you.

Fees[18]

- Spread: 2%

- Transactions: 2.93% - 3.90%

- Minimum Deposit: $100 to Buy or Sell

- Purchase by debit card: 5% added express fee

- Purchase by bank account: Free

Supported Coins

Coinmama only supports over 10 cryptocurrencies:[19] Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ethereum Classic, Tezos, and Eos.

Why choose Coinmama?

Coinmama is easy to use, easy to sign up for, and widely available internationally. They are a non-custodial exchange, meaning you don't have to worry about them running off with your money.

However, their fees are high and their features are few. Weigh your priorities to decide if Coinmama is right for you.

Coinmama Pros & Cons

|

|

What is a cryptocurrency exchange?

A cryptocurrency exchange is a digital platform where people buy, sell and trade cryptocurrencies.

Crypto exchanges are like online brokerages: both let you fund your account with fiat currency and use it to buy assets. You can also trade one cryptocurrency for another.

Exchanges make money by charging you fees when you make a deposit or withdrawal. Many also charge commissions on your trades, but some are known for being commission-free.

You can usually "store" your crypto with the exchange, which gives the exchange full custody of your assets. This comes with some security concerns and makes the withdrawal process longer. For that reason, many people transfer their crypto off the exchange and onto a wallet.

How Do Cryptocurrency Exchanges Work

A cryptocurrency exchange is a platform where users can buy, sell, and trade cryptocurrencies. Users can deposit fiat currencies (USD, EUR, CNY, etc.) from their banks, and use them to buy crypto.

They can also trade cryptocurrencies between one another, like from Bitcoin to Ethereum. Users can sell their cryptocurrencies and be paid in fiat, or withdraw them into crypto wallets.

Exchanges typically earn money by taking the difference between the bid and the asking price, a cost which is not normally visible to the user, and from fees, which vary widely from one exchange to another.

Types of Cryptocurrency Exchanges

Not all cryptocurrency exchanges work the same way. Here are the different types:

- Centralized exchanges

Centralized exchanges are regulated by a middleman that conducts the transactions. The exchange holds your coins and keep them safe (just like how a bank holds your money). These sites will require identity verification.This is the most common way to trade cryptos. These exchanges have high activity and liquidity.

Examples of centralized exchanges include Coinbase, Gemini, and Kraken.

- Decentralized exchange

These exchanges are not regulated by any official authority, thus often called a "trustless environment." Users get full control of their coins. Users can directly trade coins with each other without a middleman. They focus more on anonymity.We don't have any of these exchanges on our list, as they're better suited for more experienced traders.

- Brokerages

You can now even trade crypto coins with some online stock brokerages like Robinhood. This is a great option if you want to have your stock trading and crypto trading under one broker.But the downside is that they're not digital wallets and you usually cannot withdraw coins to use.

What to Look for in a Crypto Exchange

| Cryptocurrencies Supported | Transaction Fee | |

|---|---|---|

| 83 (21 in the US) | 1% fee for buying or selling crypto. 0% commission for buying or selling stocks and ETFs. |

| AAVE, AVAX, BTC, BCH, LINK, COMP, DOGE, ETH, ETC, LTC, SHIB, XLM, XTZ, UNI, USDC | No |

| 85+ |

|

| 10+ | 2.93% - 3.90% |

- Security

Make sure the site has strong security features to keep your money and information safe. See how your coins are stored. Cold storage means your coins are stored offline, which prevents hackers from being able to get to them. - Types of coins

Do you already know what coins you want to trade/invest in? Make sure the platform you choose supports that currency. Popular crypto like Bitcoin, Ethereum, and Litecoin are available on just about all sites. But the smaller coins won't be available everywhere. - Fees

Most crypto exchanges charge a fee per trade. If you plan to actively trade, you may want to pick a site with lower fees. If you're just buying and holding, it won't matter as much. - Ability to withdraw

This is important if you want to be able to withdraw your coins and actually use them. If so, look for an exchange combined with crypto wallet. If you're investing through a broker like Robinhood, you won't be able to withdraw into a coin wallet. - Ease of use

Beginners will want to look for a platform with a simple user interface. More experienced investors will want a more advanced platform and extra features.

How to Invest in Bitcoin

Investing in Bitcoin for the first time may seem daunting, but the process is actually very simple.

The first step is to choose a cryptocurrency exchange. Beginners may want to go with an easy to use option like Coinbase, even if it's a little more expensive. Gemini and eToro are also good options for new investors.

Once you've signed up and verified your identity, a process that varies slightly between exchanges, you'll be able to fund your account with fiat currency. Then all that's left is to buy Bitcoin, which can usually be done via a simple 'buy' or 'order' button.

The Bitcoin will be transferred to your account, and you'll be a successful Bitcoin investor.

How to Deposit USD to Buy Bitcoin

When it comes to funding your account for Bitcoin purchases, you have a number of options. Not all of them are available on every exchange, and the fees they charge may vary.

- ACH Transfer: Before you can transfer funds, you'll need to verify your bank account, which can be done through exchange apps or desktop websites. Once your account is connected, you can deposit USD to purchase Bitcoin. It may take 3-5 business days for your funds to become available.

- Wire Transfer: The process for wire transfers is nearly the same as ACH transfers. You connect a bank account to your exchange, then select wire transfer to initiate a deposit. Funds wired before 1:00pm PT will be available the same day; funds wired afterwards will become available the next business day.

- Debit or Credit Card: Some exchanges will allow you to deposit via debit or credit card. Those that do will request your card and personal information to initiate a deposit. It's worth noting that some banks may charge additional fees for credit card deposits.

Cryptocurrency Exchanges vs Cryptocurrency Wallets

If you've been learning about investing in crypto, chances are you've come across the terms 'cryptocurrency exchange' and 'cryptocurrency wallet,' and you may have wondered how they differ.

- Exchanges are platforms to buy, sell, and trade cryptocurrency. They may offer a storage service to users who trade on them, but storage isn't their main function.

- Wallets, on the other hand, typically offer storage only. Their whole purpose is to keep your crypto safe. And since there is no such thing as a crypto bank account, your only real choices are putting it in a wallet or leaving it on the exchange.

While some exchanges are insured, unless you are staking, best practices dictate that users keep their crypto in a wallet they personally control, because exchanges are very appealing targets for hackers and thieves.

There are two main kinds of wallets: 'hot,' or digital wallets, and 'cold,' physical wallets.

- Hot wallets are widely available online, and are connected to the internet. They generally accept more cryptocurrencies, but are less secure.

- Cold wallets, which typically resemble USBs, are not connected to the internet, are more secure, but typically support fewer currencies.

Cryptocurrency Survey: What Americans Want

|

Americans are more likely to own crypto than stocks, according to a May 2021 survey of over 1,000 Americans by CreditDonkey. 72.5% of respondents reported owning some form of cryptocurrency, but only 63.89% owned stocks.

Stocks were the most popular traditional investment by a fair margin. 42.87% of people reported owning bonds, while 40% had investments in real estate.

Easy, Safe, and on the Exchange

There's even more good news for cryptocurrency exchanges. Despite the common wisdom in the crypto sphere of personally holding your coins, respondents said they'd prefer to keep them on the exchange more than anywhere else:

- 32.96% of respondents wanted to keep their crypto on the exchange

- 22.69% of respondents had no preference

- 17.59% of respondents wanted to keep it in a traditional bank

- 17.59% of respondents wanted to keep it in a digital wallet

- 9.17% of respondents wanted to keep it in a hardware wallet

There's an opportunity for banks as well as exchanges. People are used to trusting banks with their money. If banks gave them the same convenience and security for their crypto as they did with their cash, more than a few would be interested in keeping their coins there.

The news may be less good for makers of popular hardware wallets like Ledger and Trezor. Fewer than 1 in 10 respondents favored using hardware wallets.

The message seems clear. Americans are interested in crypto, but without the hassle or the stress of transferring it to a cold wallet, managing private keys, and potentially losing it all forever.

Americans Anticipate Financial Revolution

The majority of Americans (73.24%) believed that crypto would replace the U.S. dollar, and 20.93% expected it to happen in the next 10 years.

A further 23.43% believed it would happen in the relatively near term, between 10 - 50 years from now, while 28.89% expected it to happen in the distant future, more than 50 years out.

And it's not just crypto itself that Americans are in favor of. Nearly half (46.57%) supported the idea of decentralized finance (DeFi), while only 5.37% strongly opposed it.

The widespread adoption of blockchain technology could have big implications for banks, brokerages, exchanges, and other central financial intermediaries, who may find themselves increasingly left out of the equation.

That isn't to say that people are interested in going back to the Wild West. The majority of respondents (52.59%) were interested in stronger cryptocurrency regulation, while fewer than 1 in 5 (17.31%) opposed it.

Overall, the results indicate that Americans are very interested in crypto and the freedoms and opportunities it represents, as long as it's tempered with the safety that government oversight can provide.

CreditDonkey conducted an online survey of 1,080 Americans, age 18 and over, on May 24, 2021.

FAQ

What is the best crypto exchange?

The best crypto exchange will depend on your preferences. Are you looking for one that is simple to use? One that can minimize your fees? Or maybe one with unique features like the ability to copy trade? Well, there's an exchange for most everyone's preferences.

Here's a quick take on some of the best exchanges:

- Coinbase is great for beginners since it's so easy to use with many ways to add money.

- eToro is the only exchange that lets you copy the trades of professionals.

- Gemini is great at securing your crypto from hackers.

- Robinhood lets you invest in stocks, in addition to your crypto, so that you can track your investments in one place.

- Binance has the most coins and trading pairs, as well as lower fees than most exchanges.

- Kraken offers the most advanced features letting you margin trade and short sell.

Which crypto exchange has the lowest fees?

Binance has some of the lowest fees, charging spreads from 0.01% to 0.92% and transaction fees from 0.10% to 0.50%. Traders and short-term investors who trade regularly can significantly benefit from exchanges with lower fees.

Kraken also has low fees, charging transaction fees from 0.00% to 0.26%.

Cryptocurrency exchanges that make it easier to buy crypto, like Coinbase and Coinmama, tend to charge higher fees.

Robinhood doesn't charge any commissions to trade, but they don't disclose their spreads like Binance.

Fees structures can be complex and vary widely based on the exchange, or even by coin. But the types of fees tend to be:

- Transaction fees: These are often called the maker and taker fees. These are charged above the market price. You pay for every purchase or sale.

- Deposit fees: When you add fiat money to your account, you could be charged based on the method you use. Debit card deposits cost more than bank or wire transfers.

- Withdrawal fees: When you exchange crypto back to fiat currency, then remove it from your account, you may be charged a fee.

The most common fees on cryptocurrency exchanges are transaction fees. This can be a bit complex, but essentially: the more crypto you buy, the more you'll pay in fees. So the exchanges with the lowest transaction fees could save you a significant amount of money if you trade regularly.

What is the most secure crypto exchange?

Gemini was the first cryptocurrency exchange to earn an ISO 27001 certification and complete a SOC 1 & 2 Type 2 exam. Companies often use these reports to verify that they are safeguarding customer data.

In addition, most of Gemini's cryptocurrency is held in offline cold storage systems. This is generally considered the most secure storage option.

Coinbase has a strong reputation for security and keeps almost 99% of its digital assets in offline cold storage.

Kraken complies with financial regulations in the US, UK, Canada, Australia, and more. They have never been hacked since they were founded in 2011. They keep 95% of their assets in offline cold storage.

Most crypto exchanges offer various ways to secure your account with two-factor authentication. You could also withdraw your crypto to a cold wallet to store it online, however you would be subject to more deposit and withdrawal fees.

How do you buy crypto?

The most popular way to buy cryptocurrency is through a centralized exchange like Coinbase.

You can buy cryptocurrency by following a few steps. To start, you'd:

- Open an account at one of the top exchanges.

- Provide some personal information, although not all exchanges require id verification (commonly called KYC or Know Your Customer).

- Open a wallet to store your crypto. The cryptocurrency exchanges above will provide one for you.

- Transfer fiat currencies like U.S. dollars into your account using an ACH or wire transfer. Some exchanges offer debit card purchases for larger fees.

- You can now buy stablecoins like USDT, USDC, or branded stablecoins like Binance Coin (BNB).

- You then buy Bitcoin or other cryptocurrencies with your stablecoins.

But you could also buy crypto through decentralized exchanges (DEX). A DEX is a cryptocurrency marketplace allowing you to buy or sell crypto without a centralized custodian like Coinbase. These tend to be more complex than centralized exchanges, and are not recommended for beginners.

How much money do you need to buy crypto?

You can buy crypto for as little as $1 on Robinhood and Kraken. But the minimum trade to buy crypto varies based on the exchange and even by coin.

| Cryptocurrency exchange | Minimum trade |

|---|---|

| Coinbase | $2 |

| eToro | $10 |

| Gemini | Varies by coin |

| Robinhood | $1 |

| Binance | $10 |

| Kraken | $1 |

| Coinmama | $30 |

Methodology

To come up with our list, we reviewed the top 25 cryptocurrency exchanges and choose our favorites, based on these 9 factors.

- Security: We only considered exchanges that had a great reputation for security, especially exchanges that kept the majority of their assets in cold storage.

- Availability by location: Laws about cryptocurrency exchanges vary widely. We prioritized exchanges there were legal in most of the United States.

- User friendliness: Getting started buying cryptocurrency can be complicated, so we prioritized an intuitive interface that would appeal to beginners versus those with advanced trading tools that only experienced traders would understand.

- Fees: You can't predict your returns, but you're guaranteed to pay a certain number of fees. The higher the fees, the lower your returns. We weighed trading fees as a top consideration.

- Minimums: If you're just starting to invest in crypto, it's smart to take it slow. Exchanges with lower minimums were ranked more highly than those that required large deposits.

- Number of users: The exchanges with the most users tend to be popular for a reason. These exchanges are the most trusted and easy to use. They also have the largest trading volumes, leading to more liquidity. We only considered exchanges with large numbers of users.

- Number of coins: Beginners may only be interested in the most popular coins like Bitcoin and Ethereum. But you may eventually want to invest in altcoins, so we factored in an exchange's coin selection.

- Withdrawal options: Some exchanges don't allow withdrawals, such as Robinhood. We ranked these lower than exchanges that make withdrawing your returns easier and cheaper.

- Miscellaneous features: Coinbase offers free coins to learn about crypto. eToro offers copy trading. We rated exchanges with a range of financial services above those with fewer features.

What Experts Say

CreditDonkey asked industry experts to answer readers' most pressing questions on the future of cryptocurrency.

Here's what they said:

Bottom Line

Investing in cryptocurrency may be all the rage right now, but make sure it's the right investment for you. Cryptos tend to be extremely volatile, so understand the risks.

To have a happy investment experience, pick the right platform for your needs. Don't only consider the fee. Pick a platform with features you want and an interface you're comfortable with.

References

- ^ Coinbase pricing and fees disclosures, Retrieved 2/1/2021

- ^ Coinbase. Asset Directory, Retrieved 5/22/2022

- ^ Coinbase. What is the minimum amount of cryptocurrency that I can purchase?, Retrieved 5/22/2022

- ^ eToro USA LLC. Trading Fees, Retrieved 3/30/2022

- ^ eToro USA LLC. Trade Markets on eToro, Retrieved 5/22/2022

- ^ Gemini Mobile Fee Schedule, Retrieved 2/1/2021

- ^ Gemini. Transfer Fee Schedule: Deposit Fees, Retrieved 5/22/2022

- ^ Gemini. Transfer Fee Schedule: Withdrawal Fees, Retrieved 5/22/2022

- ^ Gemini. Cryptocurrency Prices, Retrieved 5/22/2022

- ^ "Commission Free Cryptocurrency Investing": Robinhood, 2021.

- ^ Kraken. Features, Retrieved 5/22/2022

- ^ How trading fees work on Kraken, Retrieved 2/1/2021

- ^ Kraken. Cryptocurrencies available on Kraken, Retrieved 5/22/2022

- ^ Binance Fee Structure, Retrieved 2/1/2021

- ^ Binance.US List of Unsupported States, Retrieved 5/22/2022

- ^ iTrustCapital. Pricing, Retrieved 06/03/2025

- ^ iTrust Capital. Assets, Retrieved 06/03/2025

- ^ Coinmama Fees & Charges, Retrieved 2/1/2021

- ^ Coinmama. Cryptocurrencies we offer, Retrieved 5/22/2022

Jeremy Harshman is a creative assistant at CreditDonkey, a crypto comparison and reviews website. Write to Jeremy Harshman at jeremy.harshman@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Uphold Disclaimer: Assets available on Uphold are different per region. All investments and trading are risky and may result in the loss of capital. Cryptoassets are largely unregulated and are therefore not subject to protection. Terms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

|

|

|