How Much Interest Does $1,000 Earn?

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

How do you calculate interest earned on a savings account? It's actually pretty simple. Find out how much interest $1000 will earn in a year.

|

How much interest will I get on $1,000 a year in a savings account?

If your savings account has an interest rate of 1%, you can earn $10 in interest for one year.

Reduce that interest rate to the national average of 0.07% and you would see $0.70 in interest for the year. You can't even buy a cup of coffee for that. Fortunately, some banks offer higher interest rates.

How Much Interest You Will Earn on $1,000

Here is a table of how much interest $1,000 will earn in 1, 10, and 20 years at different interest rates:

| Rate | 1 Year | 10 Years | 20 Years |

|---|---|---|---|

| 0.00% | $1,000 | $1,000 | $1,000 |

| 0.25% | $1,003 | $1,025 | $1,051 |

| 0.50% | $1,005 | $1,051 | $1,105 |

| 0.75% | $1,008 | $1,078 | $1,161 |

| 1.00% | $1,010 | $1,105 | $1,220 |

| 1.25% | $1,013 | $1,132 | $1,282 |

| 1.50% | $1,015 | $1,161 | $1,347 |

| 1.75% | $1,018 | $1,189 | $1,415 |

| 2.00% | $1,020 | $1,219 | $1,486 |

| 2.25% | $1,023 | $1,249 | $1,561 |

| 2.50% | $1,025 | $1,280 | $1,639 |

| 2.75% | $1,028 | $1,312 | $1,720 |

| 3.00% | $1,030 | $1,344 | $1,806 |

| 3.25% | $1,033 | $1,377 | $1,896 |

| 3.50% | $1,035 | $1,411 | $1,990 |

| 3.75% | $1,038 | $1,445 | $2,088 |

| 4.00% | $1,040 | $1,480 | $2,191 |

| 4.25% | $1,043 | $1,516 | $2,299 |

| 4.50% | $1,045 | $1,553 | $2,412 |

| 4.75% | $1,048 | $1,591 | $2,530 |

| 5.00% | $1,050 | $1,629 | $2,653 |

| 5.25% | $1,053 | $1,668 | $2,783 |

| 5.50% | $1,055 | $1,708 | $2,918 |

| 5.75% | $1,058 | $1,749 | $3,059 |

| 6.00% | $1,060 | $1,791 | $3,207 |

| 6.25% | $1,063 | $1,834 | $3,362 |

| 6.50% | $1,065 | $1,877 | $3,524 |

| 6.75% | $1,068 | $1,922 | $3,693 |

| 7.00% | $1,070 | $1,967 | $3,870 |

| 7.25% | $1,073 | $2,014 | $4,055 |

| 7.50% | $1,075 | $2,061 | $4,248 |

| 7.75% | $1,078 | $2,109 | $4,450 |

| 8.00% | $1,080 | $2,159 | $4,661 |

| 8.25% | $1,083 | $2,209 | $4,882 |

| 8.50% | $1,085 | $2,261 | $5,112 |

| 8.75% | $1,088 | $2,314 | $5,353 |

| 9.00% | $1,090 | $2,367 | $5,604 |

| 9.25% | $1,093 | $2,422 | $5,867 |

| 9.50% | $1,095 | $2,478 | $6,142 |

| 9.75% | $1,098 | $2,535 | $6,428 |

| 10.00% | $1,100 | $2,594 | $6,727 |

| 10.25% | $1,103 | $2,653 | $7,040 |

| 10.50% | $1,105 | $2,714 | $7,366 |

| 10.75% | $1,108 | $2,776 | $7,707 |

| 11.00% | $1,110 | $2,839 | $8,062 |

| 11.25% | $1,113 | $2,904 | $8,433 |

| 11.50% | $1,115 | $2,970 | $8,821 |

| 11.75% | $1,118 | $3,037 | $9,225 |

| 12.00% | $1,120 | $3,106 | $9,646 |

| 12.25% | $1,123 | $3,176 | $10,086 |

| 12.50% | $1,125 | $3,247 | $10,545 |

| 12.75% | $1,128 | $3,320 | $11,024 |

| 13.00% | $1,130 | $3,395 | $11,523 |

| 13.25% | $1,133 | $3,470 | $12,044 |

| 13.50% | $1,135 | $3,548 | $12,587 |

| 13.75% | $1,138 | $3,627 | $13,153 |

| 14.00% | $1,140 | $3,707 | $13,743 |

| 14.25% | $1,143 | $3,789 | $14,359 |

| 14.50% | $1,145 | $3,873 | $15,001 |

| 14.75% | $1,148 | $3,958 | $15,669 |

| 15.00% | $1,150 | $4,046 | $16,367 |

- Axos ONE:

Earn up to 4.21% APY - Valley National Bank:

High-Yield Savings Account - 3.90% APY - Mission Valley Bank:

High Yield Savings Account - 3.86% APY - Western Alliance Bank:

High-Yield Savings Premier - 3.80% APY - Live Oak Bank:

Personal Savings - Earn 3.80% APY - CIT Bank Platinum Savings:

3.75% APY - Quontic:

High Yield Savings - 3.50% APY - UFB Freedom Checking & Savings:

Unlock Up to 3.46% APY

Interest on Savings Accounts

|

| © CreditDonkey |

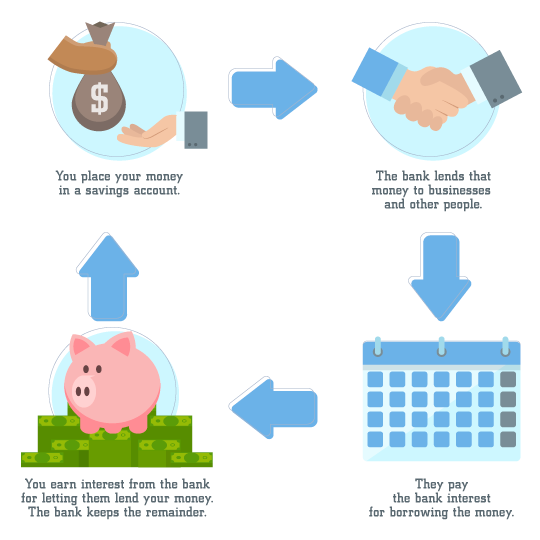

Borrowing money comes at a cost: this is called interest. When the time comes to pay the money back, the interest is paid back in addition to the original amount that was borrowed.

When you deposit your money into a savings account, the bank is essentially borrowing your money. The bank then loans your money to borrowers and, in return, it pays you interest for letting it use your money.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

How Is Interest Calculated?

The formula for calculating the interest you'll earn from a savings account is as follows:

I = P x R x T

Once you get a grasp of the following terms, it's simple to use:

- I = Interest. This is the amount of money paid to you by the bank.

- P = Principal. This represents the sum you deposited into your account.

- R = Rate. This is the annual interest rate offered by the bank.

- T = Time. Since we are considering an annual interest rate, time in this case is the number of years that has passed.

As an example, let's say that you deposit $1,000 into a savings account with an interest rate of 2.0%. If you wanted to figure out how much interest you will earn after one year, you would use the formula as follows:

I = $1,000 x 2% x 1 = $20

Your account balance at the end of the year would then be $1,020.

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

How Much Interest Does $10,000 Earn?

| Rate | 1 Year | 10 Years | 20 Years |

|---|---|---|---|

| 0.00% | $10,000 | $10,000 | $10,000 |

| 0.25% | $10,025 | $10,253 | $10,512 |

| 0.50% | $10,050 | $10,511 | $11,049 |

| 0.75% | $10,075 | $10,776 | $11,612 |

| 1.00% | $10,100 | $11,046 | $12,202 |

| 1.25% | $10,125 | $11,323 | $12,820 |

| 1.50% | $10,150 | $11,605 | $13,469 |

| 1.75% | $10,175 | $11,894 | $14,148 |

| 2.00% | $10,200 | $12,190 | $14,859 |

| 2.25% | $10,225 | $12,492 | $15,605 |

| 2.50% | $10,250 | $12,801 | $16,386 |

| 2.75% | $10,275 | $13,117 | $17,204 |

| 3.00% | $10,300 | $13,439 | $18,061 |

| 3.25% | $10,325 | $13,769 | $18,958 |

| 3.50% | $10,350 | $14,106 | $19,898 |

| 3.75% | $10,375 | $14,450 | $20,882 |

| 4.00% | $10,400 | $14,802 | $21,911 |

| 4.25% | $10,425 | $15,162 | $22,989 |

| 4.50% | $10,450 | $15,530 | $24,117 |

| 4.75% | $10,475 | $15,905 | $25,298 |

| 5.00% | $10,500 | $16,289 | $26,533 |

| 5.25% | $10,525 | $16,681 | $27,825 |

| 5.50% | $10,550 | $17,081 | $29,178 |

| 5.75% | $10,575 | $17,491 | $30,592 |

| 6.00% | $10,600 | $17,908 | $32,071 |

| 6.25% | $10,625 | $18,335 | $33,619 |

| 6.50% | $10,650 | $18,771 | $35,236 |

| 6.75% | $10,675 | $19,217 | $36,928 |

| 7.00% | $10,700 | $19,672 | $38,697 |

| 7.25% | $10,725 | $20,136 | $40,546 |

| 7.50% | $10,750 | $20,610 | $42,479 |

| 7.75% | $10,775 | $21,095 | $44,499 |

| 8.00% | $10,800 | $21,589 | $46,610 |

| 8.25% | $10,825 | $22,094 | $48,816 |

| 8.50% | $10,850 | $22,610 | $51,120 |

| 8.75% | $10,875 | $23,136 | $53,529 |

| 9.00% | $10,900 | $23,674 | $56,044 |

| 9.25% | $10,925 | $24,222 | $58,672 |

| 9.50% | $10,950 | $24,782 | $61,416 |

| 9.75% | $10,975 | $25,354 | $64,282 |

| 10.00% | $11,000 | $25,937 | $67,275 |

| 10.25% | $11,025 | $26,533 | $70,400 |

| 10.50% | $11,050 | $27,141 | $73,662 |

| 10.75% | $11,075 | $27,761 | $77,068 |

| 11.00% | $11,100 | $28,394 | $80,623 |

| 11.25% | $11,125 | $29,040 | $84,334 |

| 11.50% | $11,150 | $29,699 | $88,206 |

| 11.75% | $11,175 | $30,372 | $92,247 |

| 12.00% | $11,200 | $31,058 | $96,463 |

| 12.25% | $11,225 | $31,759 | $100,862 |

| 12.50% | $11,250 | $32,473 | $105,451 |

| 12.75% | $11,275 | $33,202 | $110,238 |

| 13.00% | $11,300 | $33,946 | $115,231 |

| 13.25% | $11,325 | $34,704 | $120,438 |

| 13.50% | $11,350 | $35,478 | $125,869 |

| 13.75% | $11,375 | $36,267 | $131,531 |

| 14.00% | $11,400 | $37,072 | $137,435 |

| 14.25% | $11,425 | $37,893 | $143,590 |

| 14.50% | $11,450 | $38,731 | $150,006 |

| 14.75% | $11,475 | $39,585 | $156,695 |

| 15.00% | $11,500 | $40,456 | $163,665 |

High-Yield Savings Premier - 3.80% APY

- No account fees

- Option to open individual or joint account

- FDIC insured up to $250,000 per depositor

- Only $500 minimum opening deposit

How Simple Interest Works

Put simply, simple interest is the interest paid on the principal you initially deposit. The above formula calculates simple interest.

Some specific accounts, like certificates of deposit (CDs) with specific brokers, pay a simple interest rate. However, when you're considering where to stash your money, consider an account that pays you in compound interest instead.

Below we discuss why compound interest is the way to go.

How Compound Interest Works

With most savings accounts, the interest you earn isn't just on the money you initially deposit. Most savings accounts use compound interest. Basically, you earn interest on the interest that you earned the previous month or day, in addition to the interest you earn on your principal.

For example, let's say you deposit $1,000 into your savings account in January and earn 1% in interest each month. By February, you'd have $1,010. In March, you'd then earn 1% on $1,010, giving you $1,010.10. The power of compounding interest is that the money grows at an exponential rate.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Ben Franklin's Compounding Interest Experiment

When Benjamin Franklin passed away, he famously left the city of Philadelphia and the city of Boston $4,400 each in his will. The money was placed in a trust that was required to sit idle for a period of time before it was utilized. Why? Franklin wanted to harness the power of compounding interest to maximize the funds before the cities could put it to good use.

By 1990, the value of those $4,400 investments had ballooned to $6.5 million!

When researching savings accounts, you may notice that banks list the annual percentage yield (APY). While similar to the interest rate, the APY is different in that it factors in compounding interest. The APY takes into consideration how often your bank compounds interest, whether it be quarterly, monthly, or even daily. The APY, therefore, gives you a more accurate idea of how much interest you will earn than just the flat interest rate.

Savings Accounts

As you might expect, one of the most important things to consider when choosing a savings account is the interest rate and APY. Some online-only banks offer interest rates 10x higher than the national average.

In addition to the interest rate, you'll also want to be mindful of any fees the bank charges and special features they offer. Below we've rounded up some of the best savings accounts available today.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

High-Yield Savings Premier - 3.80% APY

- No account fees

- Option to open individual or joint account

- FDIC insured up to $250,000 per depositor

- Only $500 minimum opening deposit

High Yield Savings Account - 3.80% APY

- No fees

- $1 minimum deposit

- 24/7 online access

- FDIC insured

High Yield Savings Account - 3.86% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- FDIC insured

CIT Bank Savings Connect - 3.65% APY

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

UFB Freedom Checking & Savings - Unlock Up to 3.46% APY

Combine Freedom Checking with Portfolio Savings to boost your savings APY by up to 0.20%.* Fewer fees, faster transactions. Plus, earn 2.00% APY* on your checking account.

Axos ONE - Earn up to 4.21% APY

- Earn up to 4.21% APY* on savings, and 0.51% APY* on checking when you meet requirements.

- Get your money up to 2 days early.

- No monthly maintenance, minimum balance, account opening, or overdraft fees.

High Yield Savings - 3.50% APY

- 3.50% APY

- $100 minimum opening deposit

- No monthly service fees

High-Yield Savings Account - 3.90% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- FDIC insured

Many online-only savings accounts pay anywhere from 1.5 to 2.0%. Brick-and-mortar banks usually only offer interest rates as low as 0.03%. When evaluating a savings account, it's important to find a bank with a high interest rate but that also meets your banking needs.

Bottom Line

Savings accounts play an important role in your financial health. Using the power of interest, you have the opportunity to see your account balance grow in a savings account. Combined with regular deposits, a savings account with a good interest rate will set you up for financial success.

Write to Jeffrey B at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|