Best Ways to Redeem Southwest Points

Ad Disclosure: This article contains references to products from our partners. We receive compensation if you apply or shop through links in our content. You help support CreditDonkey by using our links.

Redeem Southwest Rapid Rewards points for the most value. This guide highlights some of the best award redemption opportunities with Rapid Rewards points.

|

| © tomasdelcoro (CC BY-SA 2.0) via Flickr |

Southwest is the most popular budget airline in the US, and for good reason. Free checked bags, no change fees, and regularly gifted drink coupons make for happy customers.

Their Rapid Rewards program is equally generous. Use our tips to figure out the best ways to use those Rapid Rewards points.

1:1 point transfer to leading airline and hotel loyalty programs, including Southwest Airlines

What to Know About Rapid Reward Points

- Southwest splits their fares into three categories:

- Wanna Get Away: The cheapest option. Flights are refundable, but only as credit to be used on a future flight. If you booked with points, your points will be refunded back into your account. You can also change your flights.

- Anytime: Middle of the road option. Flights are refundable and changeable.

- Business Select: This option costs the most. Southwest doesn't have first class seating, but you do get some extra perks like priority boarding and free drinks.

When we talk about flight deals in this article, we'll be looking at Wanna Get Away fares. - Wanna Get Away: The cheapest option. Flights are refundable, but only as credit to be used on a future flight. If you booked with points, your points will be refunded back into your account. You can also change your flights.

- Southwest Rapid Rewards is cost-based. That means the number of points you need for an awards flight depends on the price of the flight. This is very different from region-based awards systems like American or United.

- There isn't a set dollar-to-point conversion. On average, a Southwest point is worth 1.5 - 1.8 cents. Anything lower is not a great deal, so do the math to make sure your flight falls within this range.

- There are no black-out dates or seat restrictions on award flights. As long as the flight has a seat available, you can book it with points.

- You always want to book award travel early, but this is especially important with Southwest.

The earlier you book, the lower prices you'll find, which means fewer points required. Generally, Tuesdays and Wednesdays are the cheapest days to fly.

- Southwest doesn't impose fuel surcharges. For domestic flights, you only have to pay a $5.60 Security Fee each way. However, taxes and fees for international flights vary.

Earning Southwest Points

Before you redeem Southwest points, you have to earn them. Luckily, Southwest makes it easy for you to earn points.

The fastest way to earn a ton of Southwest points is through credit cards. The welcome bonuses offer a lot of points as long as you meet the minimum spend requirement.

Chase Ultimate Rewards Credit Cards (best strategy):

Chase Ultimate Rewards points transfer on a 1:1 basis with Southwest Rapid Rewards. Check out our reviews on the Chase Sapphire Preferred®, Chase Sapphire Reserve®, and Chase Ink Business Preferred® card to see which one is right for you.

-

Chase Sapphire Preferred lets you earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 Annual Chase Travel Hotel Credit, plus more.Points can be transferred 1:1 to leading frequent travel programs including airline transfer partners. The card has no foreign transaction fees. The card also comes with premium travel and purchase protection benefits (including trip cancellation/trip interruption insurance and auto rental collision damage waiver). There is a $95 annual fee.

-

Chase Sapphire Reserve lets you earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠. This card offers a $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.This card earns 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases. The points can be transferred 1:1 to leading frequent travel programs including airline transfer partners. The card has $0 foreign transaction fees. The card comes with access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select. There is a $550 annual fee.

-

Ink Business Preferred lets you earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. 100,000 points is worth $1,000 cash back or $1,250 toward travel when you redeem through Chase Travel. Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year. Earn 1 point per $1 on all other purchases. There are no foreign transaction fees. There is a $95 annual fee.

If you fly Southwest often, check out one of Southwest's co-branded cards:

Besides through credit cards, here are other ways to earn points doing everyday things:

- Eat out with Southwest. The Southwest Dining program gives you points for eating out at partner restaurants. Just register a credit card and when you pay at a participating restaurant with that card, you'll earn 1-3X the number of points.

- Shop online. Southwest also has an impressive online shopping portal. Depending on the store, you can earn 2-6x points per dollar spent.

How to Book Southwest Flights with Points

First, you need to be a Rapid Rewards member. It's free to join.

Head to Southwest's website to get started. Input your departure and destination cities and your travel dates. Let's search for a one-way award flight from Los Angeles to Portland in October.

Make sure to select "Points" instead of "Dollars."

|

You'll see all the flight options on that date and the points needed. Non-stop flights with the lowest points will always show up first.

|

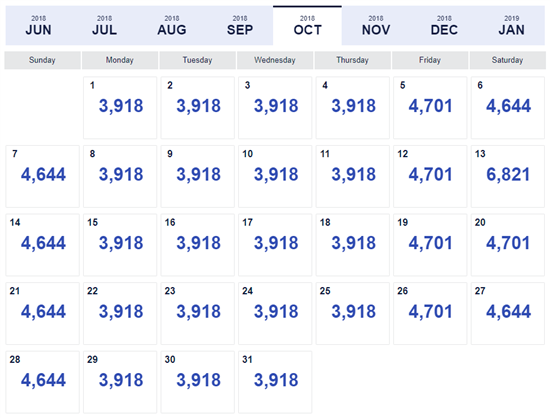

If your dates are flexible, choose the "Low Fare Calendar" option in the bottom left-hand corner. This will give you a calendar of the lowest prices each day during your travel month.

|

From this screen you can click on the dates that look best to you. Next you'll choose the time of your flight and checkout using your Rapid Rewards information.

All you will pay is the $5.60 Security Fee for one-way domestic flights.

Redeem Rapid Rewards Points for Best Value

Because Southwest has a cost-based program, it's tricky to determine which deals are good and which aren't. We have gathered all of the tips and tricks that you can use to make sure you're getting the biggest bang for your Southwest buck.

Because Southwest is cost-based, the point amounts are subject to change. But you can use our examples to get an overall idea.

Keep reading for how to get the best value for your Rapid Rewards points.

Fly with the Companion Pass

The Companion Pass is the gold standard of travel perks. Once you earn 110,000 points (or take 100 one-way flights in a year), Southwest will gift you a Companion Pass.

This pass lets you name one partner to fly with you for free on unlimited Southwest flights for the rest of the year PLUS the entire next year. This basically doubles the value of all of your Rapid Rewards points.

To add your companion, do NOT book their flight when you book yours.

Instead, book only your flight. And then go to the "My Trips" tab in your Southwest account. Click on your upcoming flight and you'll see "Add Companion" under your flight details. You'll need to pay the taxes and fees for their flight, but that's all.

Your companion does have to have the exact same flight itinerary. You cannot, for example, fly from Boston to Orlando and have your partner fly from Dallas to Orlando. You must fly together on the same flight.

Book and Rebook a Flight

One of Southwest's greatest features is that their award flights are refundable. If you booked with points, they will refund you points if the cost of your flight goes down.

Let's say you find a flight from Orlando to San Francisco for 14,000 points, but then Southwest has a sale and the cost goes down to 11,000 points. You can change the flight online or by calling Southwest and they will reimburse you those 3,000 points.

Flight Sales

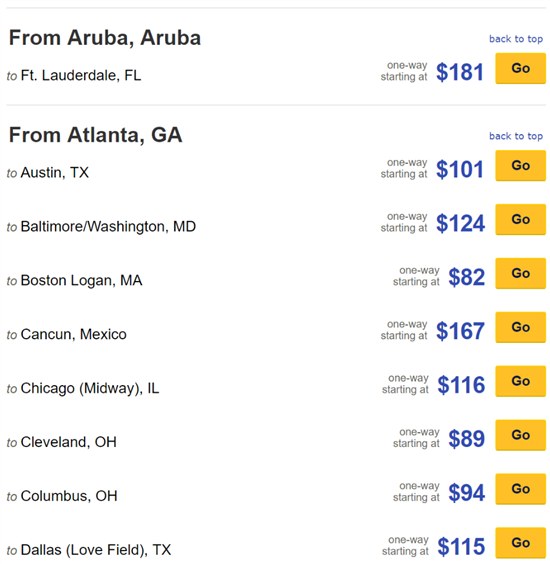

Southwest is also known for some killer sales. Look on their "Special Offers" page to see what their current deals are. Once you're on the page, just look for your departure city. Underneath the departure city, you'll find all of your destination options along with prices.

|

The page won't show you the cost of flights in points. When you see a low fare in dollars, click the "Go" button. You can then choose to see the price in points.

You can just go off of the prices in the sale. With a little research, however, you can really understand if the deals are worth it or not. If you have flights that you take often, like flying to see your family, check the site every couple weeks to see how much those flights go for on average. That will give you a good idea of how much those flights generally cost. With that information, you can see if the Southwest sale is really a good deal.

Any longer-distance flights for less than 3,500 points are a steal.

Fly between US Cities for as Low as 4,000 Points

Southwest can get you some great deals on flights throughout the US. Even without Special Offers sales, you can find flights between US cities for as low as 4,000 points. To make sure you're getting a good deal, do a little math. Again, Southwest points should be worth 1.5 - 1.8 cents per point.

If you find a flight from Dallas to Denver for $107 that costs 6,095 points, each of those points is worth 1.8 cents ($107 ÷ 6,095). That makes it a good deal in terms of points.

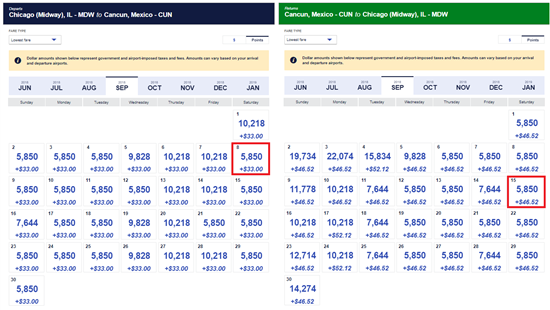

Trips to Mexico for under 10,000 Points

Southwest can help you find some sun and beaches by sending you to Mexico for less than 10,000 points each way. This is especially possible if you go in the off-season from September - December. With four different destinations in Mexico, you can really explore the country.

In this example, you can go from Chicago to Cancun in September for just 5,850 points each way. In comparison, United's region-based award chart requires 17,500 points to fly to Mexico.

|

Trips to the Bahamas and Belize for under 15,000 Points

If you are looking to go somewhere even further out than Mexico, look to the Bahamas or Belize. Great beaches, relaxed living, and delicious food make these places worth visiting. They're even more worth visiting when it only costs you 15,000 points (or less) to get there with Southwest.

Positioning Flights

In simple terms, this is a "pre-flight" in order to get yourself to the main starting point.

Let's say you find an amazing deal to fly to Europe from New York City on a different airline. But you don't live near NYC. In this case, you can use a cheap Southwest flight as a "positioning flight." You can use some Rapid Rewards points to grab a quick flight from a smaller airport to a major international airport (for example, from Columbus, Ohio, to JFK airport).

You can then use points from other airlines, or from credit card travel programs like Chase Ultimate Rewards, to catch your flight to Europe.

Don't be afraid of positioning flights. They allow you to take advantage of a ton of great deals, especially if your home airport isn't a major hub. Just make sure to plan it all out.

You can also redeem your Rapid Reward points for hotel stays and car rentals. However, you will not get the same redemption value. The value is poor, at just about 0.2 - 1 cent per point. It's not the best way to use your points, unless you happen to have more points than what you know to do with.

You do need to have a Southwest co-branded credit card in order to book hotels and car rentals with points. Redeem in the "Redeem More Rewards" section on the Southwest website.

Bottom Line

Southwest has lots of opportunities to use all of those hard-earned points. With the tips we gave above, you'll be flying Southwest all the time, with only a few dollars out of pocket.

Write to Shawna Taets at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. This site may be compensated through the Advertiser's affiliate programs.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by Chase. This site may be compensated through the Advertiser's affiliate programs.

Disclaimer: The information for the Southwest Rapid Rewards Premier Credit Card and Southwest Rapid Rewards Plus Credit Card has been collected independently by CreditDonkey. The card details on this page have not been reviewed or provided by the card issuer.

Read Next: