American Express Platinum Credit Score

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

The Platinum Card® from American Express average cardholder has a great credit score. But credit requirements may not be as tough as you think. Find out how to improve your odds.

How to Get Approved for AMEX Platinum

|

The American Express Platinum has long been the premium travel reward card.

Surprisingly, for a luxury card with a $695 annual fee , the average cardholder credit score isn't quite as high as you would expect.

Read on to learn about Amex Platinum and what it takes to get approved.

We'll explain more below. But first, let's highlight the current American Express Platinum promotions.

Credit Score Needed for AMEX Platinum

There are multiple "credit scores" available. But in general, 720 is considered a good credit score. The AMEX Platinum usually requires a good to excellent credit score.

The credit score is not the only thing that AMEX considers when reviewing your application. They will look at other factors as well.

Factors That American Express Considers

Many things are taken into account during the decision process. Consider these factors to help improve your AMEX Platinum approval odds:

- Your credit score: Banks will usually pull your credit report from a couple of the three credit bureaus (Equifax, Experian, and TransUnion), as your scores may be different across each bureau. AMEX usually pulls from Experian, so know your score from this report before applying.

- Your payment history: Your payment history will tell AMEX whether you'll be capable of making your payments on time.

- Your total open cards: AMEX doesn't have a 5/24 rule like Chase, but a lot of open cards could mean that you're not good at handling your money. Or that you open a lot of cards for the bonuses. Your chances may be lower if you've opened a lot of new cards recently.

Note: American Express has a maximum limit as to the number of AMEX cards you can owe. Though AMEX says that approval really depends on your credit.

- Average age of your accounts: This is a card for experienced users. If your other card accounts are still pretty new, this doesn't give AMEX much info on whether you can handle your personal finances responsibly.

- Your credit utilization: This means how much of a balance you're carrying compared to your total limit. Ideally, you should never go over 30%. A high percentage is a signal that your income does not support your spending. It's best if you apply for this card after you have paid off your balance on your other cards.

- Your income: With an annual fee of $695, the Platinum is a luxury card targeted towards heavy spenders. AMEX may also look at your income to make sure it can support it, particularly if your credit score is lower. Most Platinum cardholders have higher incomes in the six digits. But your spending limit is determined based on your usual spending patterns, so people with lower salaries may get approved for this card too.

- Prior relationship with AMEX: If you already own one of the AMEX cards, you could win some extra points. It could show AMEX that you can responsibly handle credit, which may make them more willing to issue you a card.

If you think you may not meet any of these factors, it doesn't mean you can't get approved. Read on.

What Can You Do If You Don't Get Approved?

If you get a rejection, it may not be the end. Here are a couple of things you can do:

- Work on building your credit: If you still get denied, or you know you're not quite there yet, then just work on building your credit.

- Work on paying off the balances on your other credit cards. Don't miss or be late with any payments.

- You can ask for credit limit increases on your other cards, which will help with the credit utilization ratio.

- Consider applying for another AMEX card first. A prior relationship may help your odds.

- Work on paying off the balances on your other credit cards. Don't miss or be late with any payments.

Remember, you don't have just one chance. You can apply again after your credit has improved. Terms and conditions apply.

That's the great thing about working on building a good credit history. If you don't qualify the first time, once you fix your credit, you have another shot at getting your American Express Platinum card. It pays to keep trying after you've improved your credit history.

| ||||||||||||

Disclaimer: The information for the The Platinum Card® from American Express has been collected independently by CreditDonkey. The card details on this page have not been reviewed or provided by the card issuer.

How Credit Score is Determined

|

| © CreditDonkey |

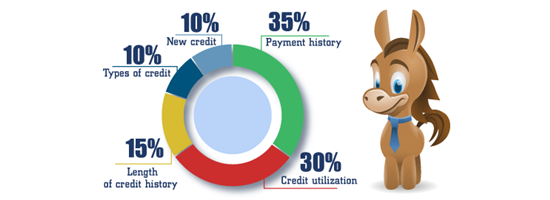

Your credit score is made up of five factors:

- Payment history (35%): Do you pay your bills on time and do you have a balance?

- Credit utilization (30%): How much credit you're using compared to what you've been given

- Length of your credit history (15%): Length of time you've had credit accounts and activity

- Types of credit (10%): What kind of credit you have (credit cards, car loan, student loan, etc.)

- New credit (10%): # of new applications for credit or inquiries

Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by American Express.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. This site may be compensated through the Advertiser's affiliate programs.

Disclaimer: The information for the The Platinum Card® from American Express has been collected independently by CreditDonkey. The card details on this page have not been reviewed or provided by the card issuer.

Read Next: