Fabric Life Insurance

Fabric offers term life insurance with affordable premiums and a fast application process. Find out if Fabric is good for you.

| |||

Overall Score | 4.5 | ||

Price | 4.0 | ||

Financial Strength | 5.0 | ||

Customer Service | 5.0 | ||

Ease of Use | 4.0 | ||

Pros and Cons

- Affordable rates

- Create a will for free

- Convert term to whole life

- Some applicants require exam

Bottom Line

Low-cost online term policies with robust app and quick approval times

With Fabric, you can apply online in as little as ten minutes. This means you could get approval without a medical exam.

If the automated system doesn't approve you instantly, a human reviews your application. During the underwriting process, they decide if you need to undergo a medical exam.

- What is Fabric Life Insurance

- What Fabric Offers

- Fabric Policy Cost

- How to Apply

- Pros

- Cons

- How Fabric Compares

What is Fabric Life Insurance?

Fabric is a life insurance company offering term life policies. As an exclusively-online company, they provide an easy application process that takes minutes.

Plus, healthy, low-risk applicants may even qualify for coverage without needing a medical exam.

While it's a relatively new company, Fabric's policies are issued and financially secured by Vantis Life, which is owned by life insurance giant Penn Mutual.

Keep reading to see how Fabric demystifies the health-grading process, prices their term life policies, and more.

Fabric has an A+ rating with the Better Business Bureau and policies are issued by Vantis Life. This collaboration gives you the benefit of a modern tech startup with the security of an established insurance company. Vantis Life is owned by Penn Mutual, which has been in business since 1847 and has an A+ rating from A.M. Best.

What Fabric Offers

|

| © CreditDonkey |

Buying life insurance can be overwhelming. Fabric keeps it simple by offering just term life insurance.

Fabric's term life insurance covers most natural causes of death, including by:

- Accident

- Illness

- Fire

- Homicide

- Vehicle accidents

- Health issues, including heart attack, stroke, diabetes, and cancer

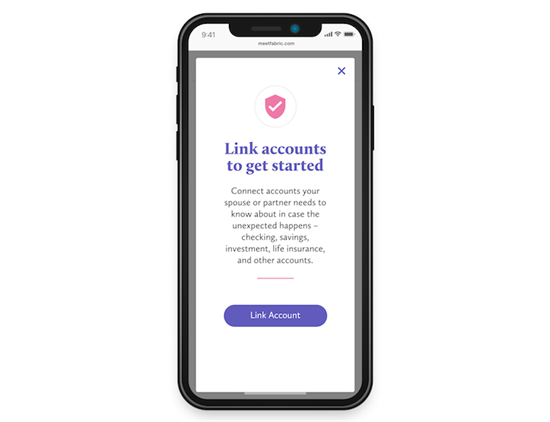

|

| Screenshot from Fabric |

Fabric Premium is term life insurance.

- Available in terms of 10, 15, and 20 years (but some states only allow a 20-year term)

- Keep the policy after the level term ends until age 85.

- Coverage available up to $5 million (no-exam coverage available up to $1M for those who qualify).

Fabric excludes death by suicide within two years of starting a new policy. You may also face exclusions if you weren't honest about your health on your application.

Fabric Policy Cost Samples

To give you an idea of what you might pay, Fabric provides real coverage offers they've made to customers. All prices are for a 20-year term policy and are quoted to those in excellent health.

| Age and Gender | Coverage Amount | Cost |

|---|---|---|

| 29-year-old Female | $250,000 | $14.61 per month |

| 35-year-old Male | $750,000 | $34.17 per month |

| 42-year-old Female | $500,000 | $41.61 per month |

Fabric also shares their grading rubric to shed light on how health and lifestyle influence your monthly rates. Here's each health level, from lowest to highest risk:

- Ultra Select: Excellent health and family history, no tobacco in 5 years, low-risk lifestyle

- Select Plus: Very good health and family history, no tobacco in 3 years, low-risk lifestyle

- Select: Good health and family history, no tobacco in 2 years, low-risk lifestyle

- Standard: Acceptable health and family history, no tobacco in 1 year, moderate-risk lifestyle

- Tobacco User: Acceptable health and family history, tobacco use within the year, moderate-risk lifestyle

Fabric's health-rating transparency is a definite plus; stick around to see what other benefits and perks they offer.

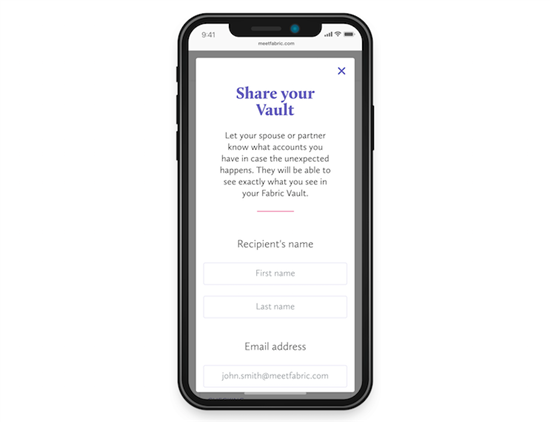

Your info is plenty safe with Fabric. They use 256-bit encryption to secure any information you transmit, store, or share. Should you decide to share your information with a family member or beneficiary via the app, that information is encrypted and secure, as well.

How to Apply

|

| © CreditDonkey |

You apply for life insurance through Fabric online. The application asks questions about your:

- Age, gender, birthdate, and state of residence

- Height and weight

- Employment, living situation, debts, and current life insurance policies

- Lifestyle and hobbies

- Plans for future living arrangements outside the U.S.

- Tobacco, drug, and alcohol use

- Criminal and driving history

As a final step, you'll provide your name, driver's license number, and Social Security number. Many applicants receive instant approval. In some cases, more information will be required.

That means an underwriter will contact you with additional questions. Sometimes they'll also request a health exam. Fabric sends the health professional to you—at home or work at your convenience. The exam typically includes blood pressure and pulse measurements, and sometimes blood work.

In some cases, the underwriters may also need a copy of your medical records or a signed note from your doctor.

Pros

|

| © CreditDonkey |

Medical Exam Not Always Required

Each situation is different, but Fabric tries to keep medical exams to a minimum. If you do need one, they make it convenient by bringing the health professional to you.

Online Claim Process

Your beneficiary can contact Fabric support online to make a claim. The agents will walk them through the process. Vantis will also reach out to complete the claim.

Premium Payment By Credit Card

Fabric accepts all major credit cards. You can store the payment information in your account for easy monthly payment.

Short Underwriting Periods

Many applicants are approved within minutes. Even if you need a medical exam, Fabric will often make a decision within 5–7 business days.

Non-commission Brokers

You don't have to deal with an agent trying to upsell you and offer several confusing options. All you need to do is choose the term and the amount.

Option to Convert to a Whole Life Policy

All term life insurance policies can be converted into permanent ones at any time—as long as you're under 65 at the time of the conversion.

Excellent Customer Service

In addition to their A+ rating from the BBB, Fabric Life also boasts an impressive 4.8 out of 5 rating from Trustpilot[1] which is based on the experience of Fabric policyholders.

31-day Grace Period

If you miss a payment, you have 31 days to make it. Your policy will lapse on the 32nd day after the due date. However, you have 29 days to get your policy reinstated.

Coverage Starts Immediately

The final step in the application process is to make your first month's premium. Once you pay online, your coverage begins.

Free Tools on the app

Connect all your financial accounts, manage your policy, safely share info with beneficiaries, and create a last will and testament for free.

|

| Screenshot from Fabric |

Cons

Some applicants require medical exam

How Fabric Compares

Vs Ladder

Like Fabric, Ladder offers an online application for life insurance. In as little as five minutes, you can have insurance coverage, if approved.

Ladder offers terms of 10, 15, 20, 25, or 30 years. You can also decrease your life insurance amount at any time or apply for more.

Ladder distributes term life insurance products issued by multiple highly rated insurers, available in all 50 states plus Washington, D.C.

Vs Haven Life

Haven Life offers an online application process for term life insurance. You may get instant coverage, but they do require medical exams in certain cases. You have 90 days to complete the process.

The company offers terms of 10, 20, or 30 years. Applicants up to age 60 can apply for up to $3 million in coverage and applicants ages 60 to 64 can apply for up to $1 million in coverage.

Vs Quotacy

If you need more than term life insurance, Quotacy is a good place to start. It offers comparison shopping for insurance. You can apply online and receive multiple quotes and plans from various companies.

You'll also have more options including whole life and final expense insurance.

- First, ensure that the policyholder's cause of death is covered.

- Then, notify Fabric that you wish to file a claim.

- Complete the initial death claim questionnaire provided by Fabric.

- Finally, Vantis Life, Fabric's insurance partner, mails any remaining forms and guide you through the finishing steps of the claims process.

Important: Claims must be filed within 20 days of the policyholder's death.

Bottom Line

So, is Fabric Life Insurance worth it?

If you're in the market for an affordable term policy, Fabric is more than worth it. Ideal for parents and busy professionals, they offer a seamless life insurance experience that features:

- A simple online interface

- Free tools for creating a will, and

- A handy smartphone app

Even better, Fabric is one of the few life insurance companies to accept payment with credit card, which can be a good way to maximize credit card points.

However, if you need more complex coverage or have a complicated health history, you may want to look elsewhere.

References

- ^ "Fabric Life Insurance: Trustpilot Review." Trustpilot, 2020.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|