How Much Life Insurance Do I Need?

How much life insurance is enough? Learn how to determine how much you need, including the rule of thumb for calculating your coverage.

|

Life insurance is a useful tool for managing risk if something were to happen to you.

The guarantee of a safety net provides peace of mind for the insured's family. When calculating coverage, you must consider all outstanding debts and expenses.

We cover a couple popular rules of thumb for calculating coverage below. Be sure to not underestimate how much you may need.

What is a Good Rule of Thumb for Life Insurance?

While there is a lot to consider when calculating coverage, you can refer to a popular rule of thumb that should cover all the expenses and needs of the surviving family.

Coverage Amount = (Coverage Years × Annual Income) + (Debt + Expenses) - (Liquid Assets + Savings)

Other Rules of Thumb

- Annual Income × 10: Not considering factors like debt and expenses could leave you underinsured.

- Annual Income × 10 plus $100K/child: This will provide slightly more coverage, but it's still not considering your family's specific needs.

Income Replacement

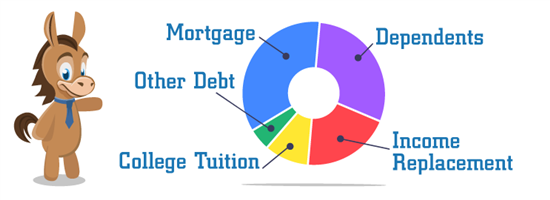

Many widely circulated rules of thumb put the most focus on income replacement. While there is much more to consider, income replacement may account for the largest chunk of your coverage amount.

Here are some things to consider:

- Policyholder's income before and after taxes

- Number of years you want their income replaced

- Anticipated annual raise, if applicable

- Value of a stay-at-home parent's services, if applicable

When taking out a life insurance policy on a stay-at-home parent, do your best to calculate the value of every service they provide for the family. This includes childcare, cooking, cleaning, laundry, carpooling, and more.

Salary.com reports that if a stay-at-home parent were compensated, they would earn nearly $115,00 per year for their duties.

Debt

|

| © CreditDonkey |

Once you've determined your income replacement requirements, consider your debt and expenses. When calculating your debt, don't forget:

- Outstanding mortgage

- Outstanding student loans

- Medical debt

- Credit card debt

It's smart to buy enough life insurance so the policyholder's outstanding debt can be paid off.

This way, the surviving spouse won't have to choose between using the money for living expenses or to pay off debt.

Dependents

People typically factor in any dependents when calculating how much life insurance coverage they'll need. Consider a child's future college tuition or the needs of an aging parent.

When adding these considerations to your total amount, think about:

- Average tuition of private vs public universities

- Full-time care for an older parent

- Lifetime care for special needs children

- Co-signers for loans in your name

Final Expenses & Retirement

In addition to debt and dependents, think about how your partner will be prepared for retirement. The following questions may help you figure out how much to account for it:

- How much will the surviving partner need to retire?

- Will their own income be enough to save for retirement?

- Do you have retirement savings already in place?

- If you are currently saving for retirement, what will the total amount to when you plan to retire?

If the surviving partner plans to continue working and will have enough retirement income from pension, Social Security benefits, and investments, then factoring in retirement may not be necessary.

When the policyholder passes away, the last thing the surviving family wants to worry about is how to pay for a costly funeral or burial. The National Funeral Directors Association reports the average funeral costs as much as $9,000.

Estimate the total of final expenses and add it to the coverage total with the rest of your debt and expenses.

Other Expenses to Consider

Families are unique. The earlier questions are common issues for most families. While the factors above will apply to most families, the following considerations are less common.

Some special situations can have a large influence on the amount of life insurance coverage you need.

Don't forget these factors when tallying up your coverage total:

- Emergency fund

- Estate that you leave behind

- Business(es) that will require management

- Children from another relationship

Savings & Liquid Assets

Figuring out your income replacement, debt, and expenses is the most important part of calculating coverage, but there's still more to consider.

After totaling your financial obligations, subtract the sum of any retirement, savings accounts and liquid assets that you have:

- 401(k) accounts

- Roth and Roth IRA accounts

- College funds

- Employer life insurance

- Other savings

If the policyholder already has some life insurance coverage through their work, factor it into your calculation as an asset, but don't rely on it entirely.

Most policies through an employer only offer 1-3 times your current salary. Plus, in most cases, you lose the policy if you leave the job.

Life Insurance in Your 50s and 60s

Calculating life insurance coverage for policyholders above 50 is similar to the process for younger adults.

However, if you are lucky enough to retire by that time, your coverage amount may put more focus on retirement needs than income replacement.

You may also want to take advantage of the life insurance company's available riders, as many are tailored to older policyholders.

Look into the following riders to add to your policy:

- Waiver of Premium: Waives premium if you become totally disabled

- Critical Illness: Provides a one-time cash benefit for medical expenses

- Long-term Care: Pays for daily living care if you become ill

- Disability Income: Receive income if you become permanently disabled

Term vs. Whole Life Coverage

Term and whole life policies are the most common types of life insurance coverage.

Because term only provides coverage for a specific period of time, there's a common misconception that term life coverage does not need to be as robust as whole life.

It's true that whole life provides a guaranteed death benefit and a term life benefit may not be utilized if you outlive the policy and choose not to renew.

Still, don't go underinsured. If you do pass away during the term, your coverage will need to provide the same support that a whole life policy would.

If your health has changed or you've taken up a dangerous hobby, consider converting to a whole life policy at the end of your term.

If you are not sure about your health, try to buy replacement coverage before your term insurance expires. If you don't qualify for good rates, convert your term insurance to whole life.

Bottom Line

Life insurance can help you manage many of the risks your family would face if you die prematurely.

After you calculate how much income you'll need, add that amount to any immediate cash needs. Some of the lump sum needs may not need to be fully funded because the money has time to grow.

Write to Jeanine G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

| ||||||

|

|

|