Infographic: College Alcohol Statistics

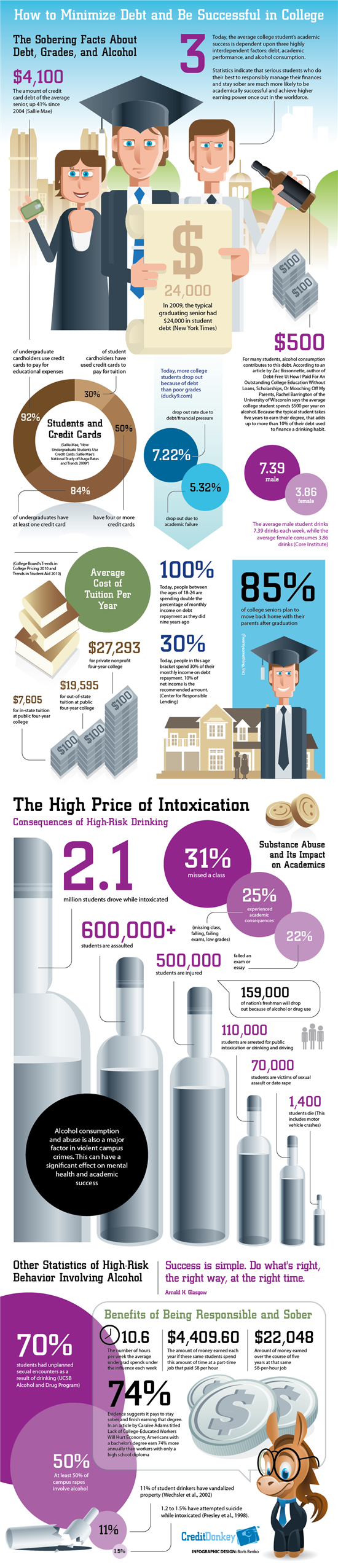

The Sobering Facts about Student Debt, Grades, and Alcohol

The answer to success may be as easy as cutting back on alcohol consumption in college. When you take the time to look at statistics, you can see how alcohol, debt and academic success all work together.

|

| Infographics: College Debt, Grades, and Alcohol © CreditDonkey |

Alcohol consumption adds to debt

As reported by Sallie Mae, college seniors on average have $4,100 in credit card debt. With college students spending an average of $500 per year on alcohol, and the average student taking five years to earn their degree, this adds up to $2,500 invested in alcohol by the end of college.

While $2,500 may not seem like much in the grand scheme of things, consider how many books and other supplies could have been purchased instead.

Alcohol consumption detracts from academic performance

While debt now accounts for more college dropouts than academic performance does, some students do choose to leave college because they have slipped behind in their work. Alcohol contributes to many students’ academic difficulties. In fact, 31% of students have reportedly missed class due to substance abuse, 25% experienced academic consequences like falling behind or receiving poor grades, and 22% failed an exam or essay due to substance abuse.

Debt and poor academic performance decrease success

Studies have shown that having wise spending habits will save students more than just the interest they pay on credit card debt – 7.22% of college students drop out of school due to debt and financial pressure; another 5.32% drop out due to academic failure .

Of course, just because a student has dropped out of college doesn’t mean that individual is going into the working world debt free. They still have their student loans they will need to pay off. And because they do not have a college degree, they will be making less money on average than an employee with a bachelor’s degree.

It pays to abstain

On average, students spend 10.6 hours per week intoxicated. If that time was instead invested in a part-time job that pays just $8 per hour, those students could earn an additional $4,409.60 per year. That’s a large amount of money that could be tucked away in savings, go toward credit card debt or toward a new vehicle.

While it may seem like you’re missing out on fun by abstaining from alcohol, you can see how it can really pay off to be sober. And, really, how much “fun” are you missing out on? The sad reality is that at least 50% of college rapes involve alcohol, 70% of students have unplanned sexual encounters due to drinking and 500,000 students are injured annually due to their high-risk alcohol consumption.

(Reporting by Kelly; Infographics by Boris; Writing by Meghan)

Kelly Teh is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Kelly Teh at kelly@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.