Best Chase Ultimate Rewards Transfer Partners

Ad Disclosure: This article contains references to products from our partners. We receive compensation if you apply or shop through links in our content. You help support CreditDonkey by using our links.

Find the best way to use each Chase transfer partner. Maximize the value of your Chase Ultimate Rewards® points.

|

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

The Chase Ultimate Rewards program is one of our favorite credit card travel reward programs. No doubt its most valuable feature is the ability to transfer points on a 1:1 basis to popular airline and hotel partners. This allows you to use your points at a much higher value than other redemption options.

- Airline Partners: Aer Lingus, Air France-KLM, British Airways, Emirates, Iberia, JetBlue, Singapore Airlines, Southwest Airlines, United, Virgin Atlantic

- Hotel Partners: Hyatt, InterContinental Hotel Group, Marriott

- Transfer Points From Chase Cards: Chase Sapphire Reserve®, Chase Sapphire Preferred®, Ink Business Preferred®

Complete List of Chase Transfer Partners

Chase Ultimate Rewards Airline Partners:

- Aer Lingus AerClub

- Air France/KLM Flying Blue

- British Airway Avios

- Emirates Skyward

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

Chase Ultimate Rewards Hotel Partners:

If you use any of the above airlines and hotels, you must check out the latest Chase Sapphire Preferred card promotion.

You're not limited to just these airlines. You can book award flights with any of an airline's partners within its alliance: SkyTeam, oneworld, and Star Alliance. For example, American Airlines is part of the oneworld alliance, so you can book flights on AA through British Airways.

Top Chase Ultimate Rewards Promotion You Should Not Ignore

Not all Chase Ultimate Rewards cards allow you to transfer points. Look into one of these cards if you want to be able to transfer.

| For | Credit Card |

|---|---|

| Consumer Card | Chase Sapphire Preferred® |

| Small Business Card | Ink Business Preferred |

| Premium Travel Perks | Chase Sapphire Reserve® |

All cards offer 1:1 transfer ratio for airline and hotel partners.

For occasional travel and dining, take a look at the Chase Sapphire Preferred card. If you travel often, the Chase Sapphire Reserve credit card offers perks like airport lounge access and Global Entry.

If you have a small business and spend a lot on travel, online advertising, shipping, and/or telecom services, check out Chase Ink Business Preferred.

You can combine your points between your UR cards. If you have one of the cards with no annual fee that earn Chase Ultimate Rewards points (such as the Freedom Unlimited), you can combine your points from that unto one of the premium cards. Then you'll be able to redeem them for travel with the Chase transfer partners.

You can only combine points from cards that belong to you or a spouse/domestic partner. Points can be combined from both personal and business cards.

Overview: Best (and Worst) Ways to Use Chase Transfer Partners

|

| © CreditDonkey |

We analyzed all the Chase transfer partners and came up with the best (and perhaps more important - the worst!) way to use each one.

Our favorite transfers:

- Flying with United as they never charge a fuel surcharge. The Excursionist Perk allows you to visit one extra destination for no additional miles on qualifying multi-city trips.

- Using Southwest and JetBlue to fly within the U.S. and surrounding areas with no blackout dates or seat restrictions.

- Transferring to Hyatt as some redemptions are valued at over 2 cents a point.

- Using Flying Blue to fly from the continental U.S. to Hawaii, Mexico, Central America, and the Caribbean.

- Using British Avios to fly from the West Coast to Hawaii or within Europe.

And here are some of our not-so-favorite uses of Chase transfer partners:

- Using British Avios to fly long-haul international

- Using Singapore KrisFlyer to fly long-haul international

- Transferring to Virgin Atlantic Flying Club

- Transferring to IHG Rewards Club and Marriott Bonvoy

Read on to learn more in detail how to get the most value of out of your UR points.

How to Transfer Your Chase Points

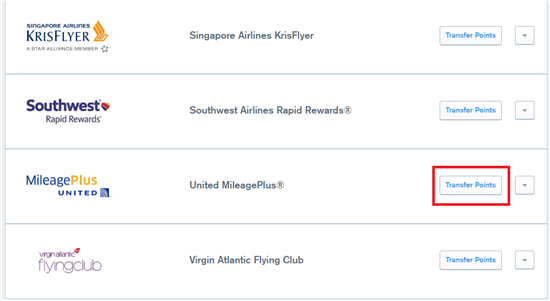

It's easy to transfer your Ultimate Rewards points to airline and hotel partners. Log in to your Ultimate Rewards account. If you have more than one UR card, select the card that allows you to transfer points.

At the top, you'll see a menu of options of ways you can use your points. Click on "Transfer to Travel Partners".

|

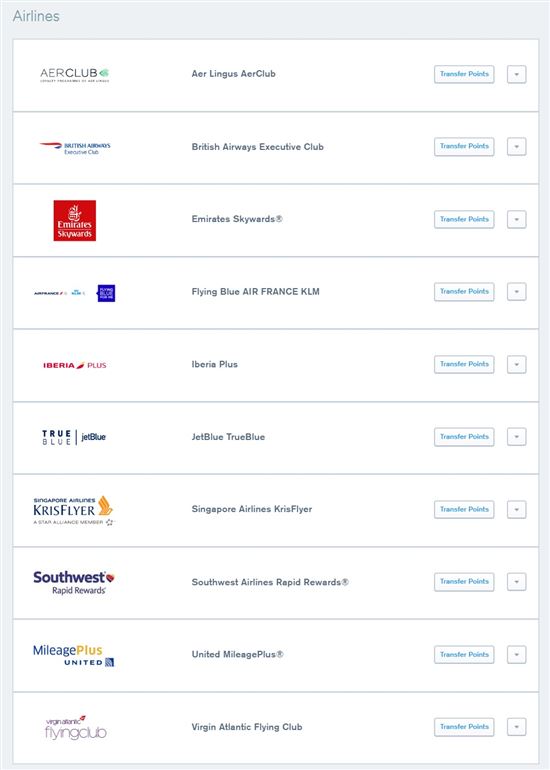

You'll then be taken to a list of the Chase transfer partners. All you need to do is select the airline or hotel you want to transfer points to, enter in your member ID, and how many points to transfer.

|

The transfer ratio is 1:1 for all airlines and hotel partners.

Points Transfer Rules

Here are some things to know about Chase Ultimate Rewards transfer rules:

- Transfers are in increments of 1,000. So if you only need a small number of points for an award ticket, you may have some unused points.

- All transfers all final. If you've completed a transfer and then change your mind, you will not be able to get your points back to your Chase account. Make sure the flight has an award seat available before you perform any transfers.

- Not all transfers are instant. You can receive your points instantaneously for most Chase transfer partners. So as soon as you transfer, you can book your award flight or room. This is the case EXCEPT for Marriott, IHG, and Singapore Krisflyer. Transfers for these partners could take 1-2 days.

If you're worried that the award seat will be gone by the time your transfer completes, you can try calling the airline and asking them to hold the seat for you. Explain that you plan to transfer points from Chase and it may take some time.

- Transfer points to another person. Let's say you want to transfer Chase Ultimate Rewards points to another person's loyalty program (like someone else's MileagePlus account). For personal cards, the person must be an authorized user on your Chase card account and have same address as you.

For the Ink Business Preferred, if you'd like to transfer points to another person's loyalty account, he/she must be a company employee and authorized user on your business card.

Other Ways to Use Chase Points

|

| © CreditDonkey |

Here are some other ways to redeem your Ultimate Rewards points.

- Book travel on the Chase Travel℠ portal. Chase has a travel portal where you can book airfare and hotels with your points. With the Sapphire Preferred card or Ink Business Preferred, your points are worth 25% more value (10,000 points = $125). With the Sapphire Reserve, your points are worth 50% more (10,000 points = $150).

- Get cash back. You can redeem your points for statement credit or direct deposit into your bank account. But the value is only 1 cent each (10,000 points = $100).

- Exchange for a gift card. You can exchange for a gift card to select store or restaurant at the rate of 1 point = 1 cent. This option isn't even as flexible as straight up cash back.

- Buy an experience. Chase offers unique experiences to premium cardholders, like private dining with a chef and concert packages. The redemption rate depends on how much you think the experience is worth.

Is it better to transfer points or to book travel on Chase?

- Transferring points is usually better for expensive flights/hotels or for business/first class seats.

- Using the discount on the Chase Travel℠ portal could be the better option for cheap economy flights.

For example, let's say there's a round-trip ticket from Los Angeles to London during low season for just $500. With the Sapphire Preferred points discount, this would only cost 40,000 points (and 33,334 points with the Reserve). If you transfer, a round-trip flight to Europe would require 60,000 miles with United.

It'a always smart to compare prices on the portal before you transfer points. Another advantage of using the portal is that there are no award fees. When redeeming with airline frequent flyer miles, there may be other taxes and fees in additional to the points.

Read on to see good (and bad) uses of Chase Ultimate Rewards transfer partners.

Chase Ultimate Rewards Airline Partners

|

Chase has 10 partner airlines. We'll do a run-down of each.

Note: Redemption options and values can change at any time.

United MileagePlus Miles

- Do: One good thing about United Airlines is that it never charges a surcharge, not even on partner airlines.

United also has a generous Excursionist Perk to visit more destinations for no additional points on qualifying multi-city trips. Here's how it works:

- Your overall trip starting and end points must be in the same region (for example, United States).

- You must be traveling to an international destination (for example, Europe).

- You get one free leg within that international region (for example, from London to Paris).

- At the end of the trip, you can return to a different city from your starting point, as long as its in the same region.

Essentially, this is giving you one free leg in your destination region and one open-jaw when you return. Terms and conditions apply.

Example: Let's say you want to go from Boston to London, then London to Paris, and then come back and visit New York for a few days. The leg from London to Paris will cost no additional miles. You can also return to a different place within your starting region. The total trip will just be the normal round-trip mileage price to Europe (which is 60,000 miles). - Your overall trip starting and end points must be in the same region (for example, United States).

- Don't: Redeeming points on United for business and first-class award tickets are often higher than other airlines, so that's not the best use of your points.

See United's interactive awards chart.

Find: Best Ways to Use United Miles

Learn: How to Earn United Miles Fast

Southwest Rapid Rewards

- Do: Use this transfer partner to book flights within the U.S. The value is especially good on the Southwest Wanna Get Away flights, with many routes as low as 4,500 points one-way. And you don't pay any taxes or surcharges for domestic flights either, except for the $5.60 Security Fee in each direction.

Southwest also offers very low rates to Mexico, Costa Rica, Puerto Rico, and the Caribbean for a bit more in taxes.

![]()

JetBlue TrueBlue

- Do: Find flights at great value within the U.S. and surrounding areas. You can book any JetBlue flight with TrueBlue points, with no blackout dates or seat restrictions. In general, we estimate each TrueBlue point to be worth about 1.4 to 1.5 cents on average. This means that 10,000 points could be redeemed for a flight that costs around $140 - $150.

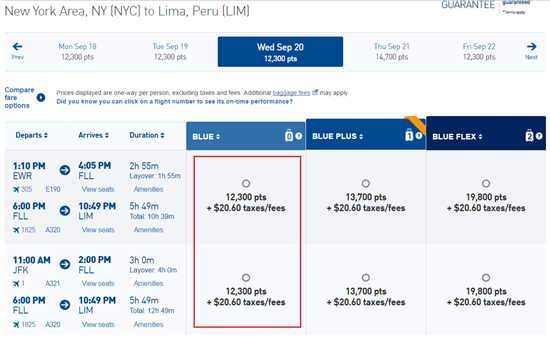

You can find some GREAT travel deals on JetBlue, but it depends on your dates. So it's best to have flexibility. For example, you can find flights to the Caribbean for as low as 7,000 points each way, to Central America for as low as 10,000 points each way, or even to South America for 12,300 points each way.

![]()

In the above search, we found a one-way flight from New York to Lima, Peru, in September. The normal price is $214, or using TrueBlue points will come out to just 12,300 points. Each point is worth over 1.7 cent.

Air France Flying Blue

Flying Blue no longer has a region-based award chart. Now, their award program is cost-based. This may mean good news on some routes.

- Do: You can get cheaper routes to fly to Europe from the East Coast. For example, it can be as low as 21,500 miles to go one-way from JFK to London (instead of the 25,000 miles it used to be).

It's also possible to fly one-way from the U.S. to Hawaii for as low as 17,500 miles. This is as little higher than what you can get with some other airline awards, but still good value. Flights to the Caribbean and Mexico can also be found for around 30,000 miles round-trip.

Flying Blue releases promo awards at the start of each month, where you can snag great deals for certain routes. It offers discounts from 20% - 50% off. For example, in August 2018, there's a promo deal from Paris to New York for just 11,000 miles one-way.

![]()

- Don't: It's hard to say exactly how much miles will cost with the new award system. It only tells you the minimum points required, so it could cost more. It may take you a while to figure out the best day and route that would result in the least miles.

Use the Flying Blue Miles calculator.

British Airway Avios

- Do: If you're on a European vacation where you'll be hopping between countries, British Airways offers short flights within Europe at a great transfer rate. A lot of popular routes only cost 4,500 Avios points one-way with no fuel surcharge.

In general, short nonstop flights with BA won't incur high fuel surcharges. Domestic travel within Japan (on Japan Airlines), Asia (on Cathay Pacific), and Australia (on Qantas) can be great value with very low extra fees.

- Don't: On long-haul international flights, you'll could be hit with potentially hundreds of dollars in fuel surcharges (which negates the whole purpose of using points!), EXCEPT when you fly with American Airlines (within the western hemisphere), LAN, Aer Lingus, and Air Berlin.

Tip: If you want to use Avios to fly from the U.S. to Europe, use Air Berlin as you won't be charged hundreds in fuel surcharges.

Use the British Airway Avios calculator.

If you do want to travel to Europe with less fuel surcharges, Chase recently added a couple of more transfer partners: Iberia Plus and Aer Lingus AerClub. Both also use Avios, though they are all separate programs from British Airways.

You can transfer Avios between the programs. In this sense, these transfer partners aren't really "new," but it does save you the hassle of making the transfer yourself.

Iberia Plus

Iberia, a Spanish carrier, offers better options to get to Europe.

British Airways has very high surcharges for flights to Europe. It likes to route you through London, and you will immediately be subjected to the high airport fees.

You can reduce a lot of this cost by using Iberia instead. With Iberia, you'll route through Madrid and save hundreds on fees and taxes. You can find some great deals going to Spain. For example, the Iberia Avios calculator shows only 34,000 Avios for a round-trip award flight from Madrid to New York.

Use the Iberia Avios calculator.

Aer Lingus AerClub

- Do: Aer Lingus is an Irish airline with flights between major cities in United States and Ireland. You can find some amazing deals during the off-peak travel season.

For example, you can go from Dublin to Chicago for only 13,000 Avios one-way in Economy. Aer Lingus flights does have a fuel surcharge, but it is nothing compared to that of British Airways'.

See the AerClub award chart.

Singapore KrisFlyer

- Do: Singapore Airlines also allows one free stopover on a round-trip Saver flight (or 2 free on a Standard Award ticket), which will allow you to visit a new destination. For example, you can go from Los Angeles to Australia, with a stopover in Tokyo, for 55,000 miles in economy.

If you want the ultimate first-class experience, you can't ask for better than flying on Singapore Airline's luxurious A380 Suites (the first double-bed in the sky!). A favorite route for travelers is from New York to Frankfurt (8 hours of airtime) for 76,000 points. Or you can go from Singapore to Tokyo to Los Angeles (18.5 hours of airtime) for 118,000 miles.

Note: Note: Krisflyer made some changes to its frequent flyer program recently. There was an award devaluation where many routes saw increased award prices. It also discontinued the 15% discount for booking online. However, the surcharges for all Singapore Airlines and SilkAir operated flights have been removed, which helps to offset some of these negative changes. - Don't: In most cases, there are still high surcharges on partner flights. In general, you'll be hit with high surcharges on international long haul flights, EXCEPT for flights with Air New Zealand, Copa, Avianca, and TACA.

See Singapore Airline's award chart.

Virgin Atlantic Flying Club

- Do: Booking domestic partner flights could be a good value. For example, you can fly domestic within Japan (on All Nippon Airways), Australia (on Virgin Australia), New Zealand (on Air New Zealand), and South Africa (on South African Airways) for 15,000 or 20,000 points round-trip.

- Don't: Aside from that, in general, Virgin Atlantic is not the best transfer program. Virgin Atlantic itself pretty much only flies to/from the UK, and they tack on heavy fuel surcharges to their award flights. So we don't recommend using it for international travel. Stick to their partners.

See Virgin Atlantic's award chart.

Emirates Skywards

Emirates (a carrier based in Dubai) is known for superior aircrafts and service. However, it's not our favorite airline transfer partner. Its award chart is not well priced, and they levee heavy surcharges as well.

- Do: If you want to experience the ultimate luxury in air travel, you may be enticed by Emirates' A380 first class cabin (which has an onboard shower spa!). You can go round-trip on their New York to Milan route for only 135,000 miles in First Class (or 45,000 in economy and 90,000 in Business class).

- Don't: Any routes not part Emirate's regular routes will cost an exorbitant number of miles and heavy surcharges. For example, trying to go from the U.S. to Australia will cost a whopping 130,000 miles in economy.

Trying to redeem your points on a partner airline is a headache too. You can't unless you fill out a request form and wait for an agent to contact you. It's not hard to find a lot of frustrated people on forums who said that an agent never contacted them or couldn't help them book a partner flight.

Use the Emirate's Miles Calculator.

Chase Ultimate Rewards Hotel Partners

Chase also has 3 hotel transfer partners:

|

We'll say this now: In general, using hotel transfer partners is not a good way to spend your points. The EXCEPTION is Hyatt, which is one of the best uses of UR points.

Let's go over each of the hotel transfer partners:

World of Hyatt

Room redemptions at Hyatt start at just 5,000 points/night for a Category 1 Standard Room, while a Category 7 hotel will cost you 30,000 points. You also have the option to pay in points and cash, which is great if you want to save some points. You can also redeem points to upgrade to a Club room (for 3,000 points/night) or a Suite (for 6,000 points/night).

- Do: Hyatt is the most valuable Ultimate Rewards transfer partner for free nights and offers great value. Their awards are well priced and the transfer makes for a great points conversion most of the time. For example, a room in the Andaz 5th Avenue in New York (a Category 6 hotel) costs $525/night, or 25,000 points (each point is worth over 2 cents).

Tip: Oftentimes, the cash and points options offers the most bang for your buck if you don't mind fronting a little in cash. In the above example, you can pay $125 in cash + 12,500 in points per night. This is an awesome value to snag this $500+ room for just a little bit of cash and points. If you stay for 3 nights, the normal cost would be $1,575. Subtract the $375 cash upfront, and the value of your points would come out to 3.2 cents per point.

- Don't: Hyatt also lets you redeem points on their dining, spa, and resort activities, but these options will only be worth about 0.5 - 0.8 cents per point. We only recommend redeeming your points for free nights and save your cash for the hotel extras.

See Hyatt's award chart.

IHG Rewards Club

Point redemption starts at 10,000 points/night for a Category 1 hotel and up to 60,000 points for a Category 11 hotel. IHG also lets you combine cash + points. For example, for a Category 5 hotel, you can pay 30,000 points, or 25,000 points + $40, or 20,000 points + $70.

- Do: Keep your eye out on BreakPoints® deals, a bimonthly deal where IHG releases rooms in certain hotels at only 5,000 points/night. But if you see something you're interested in, you'll have to act fast, as the availability is limited and they go quick. For example, for October 2016, there are deals available in Brazil, Honduras, and Mexico.

- Don't: Aside from lucking out with a BreakPoints® deal, we don't think IHG is a great transfer partner. The points conversion is not great and is often valued at far less than 1 cent per point. For example: the Crowne Plaza at Times Square Manhattan goes for $274.40/night for a random date in April 2017, but costs 50,000 points. That puts the value at only 0.55 cents per point.

Marriott Bonvoy

Marriott, Ritz Carlton, and Starwood programs have all merged into one single program as of August 2018 - for a total of over 7,000 hotels worldwide. Under this new program, properties go from Category 1 (7,500 points/night) to Category 8 (85,000 points/night). Most hotels are available for 35,000 points or less.

- Do: The new program now offers discounted rates for off-peak travel. You can save some points while avoiding crowds. Marriott also occasionally offers PointSavers rates, which is discounted even more when you travel off-peak.

Marriott offers the 5th night free if you use points to book 4 consecutive nights. This will get you the best value.

- Don't: Marriott is not our favorite way to spend Chase UR points either. In our opinion, Marriott points are only valuable if you have the Marriott Bonvoy Boundless card from Chase, as you rack up the Marriott points a LOT faster, thus making each point worth more. 1:1 transfer from Chase will rarely get you a value of over 0.8 cents per point, unless you're looking at Category 1 & 2 hotels.

See the Marriott rewards chart.

Bottom Line

The Chase Ultimate Rewards program is one of the most valuable travel programs. Though it doesn't have a huge list of travel partners, the selection is excellent.

Transferring points to airline partners is almost always the best value, especially if you can take advantage of stopover and open-jaw policies. Just watch out for high fuel surcharges on certain transfer partners.

In general, aside from Hyatt (which is a great value when redeeming for free nights), we don't recommend using the other hotel partners as the value of the points are relatively low.

Featured Chase Credit Card with Ultimate Rewards

![]() Chase Sapphire Preferred lets you earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 Annual Chase Travel Hotel Credit, plus more.

Chase Sapphire Preferred lets you earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 Annual Chase Travel Hotel Credit, plus more.

Points can be transferred 1:1 to leading frequent travel programs including airline transfer partners. The card has no foreign transaction fees. The card also comes with premium travel and purchase protection benefits (including trip cancellation/trip interruption insurance and auto rental collision damage waiver). There is a $95 annual fee.

Wait, how about other carriers?

- Do you like to fly American? Book award travel on American Airlines using a OneWorld alliance member such as British Airways. Remember, you don't pay fuel surcharges if you stay within the western hemisphere (essentially traveling in the Americas).

- Do you like to fly Delta? Book award travel on Delta using a SkyTeam alliance member such as Air France.

- Or if you have the Chase Sapphire Preferred, you can book travel, on any airline, by redeeming your points on Chase Travel℠ (Chase's online travel portal). You'll receive a 20% discount when you redeem points toward travel through Chase Travel℠. For example, if you book a $500 airfare using Chase Travel℠, it would only require 40,000 points.

Want to get started?

It's easy. First apply for the

Once you have the card, log on to your account and select Transfer Points to Transfer Partners. For most partners, transfers will complete instantly.

|

Enjoy your next vacation!

Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. This site may be compensated through the Advertiser's affiliate programs.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by Chase. This site may be compensated through the Advertiser's affiliate programs.

Read Next: